The below is an excerpt from a most up-to-the-minute edition of Bitcoin Magazine PRO, Bitcoin Magazine’s top fee markets e-newsletter. To be among the predominant to get these insights and various on-chain bitcoin market prognosis straight to your inbox, subscribe now.

Analyzing On-Chain Bottom Indicators

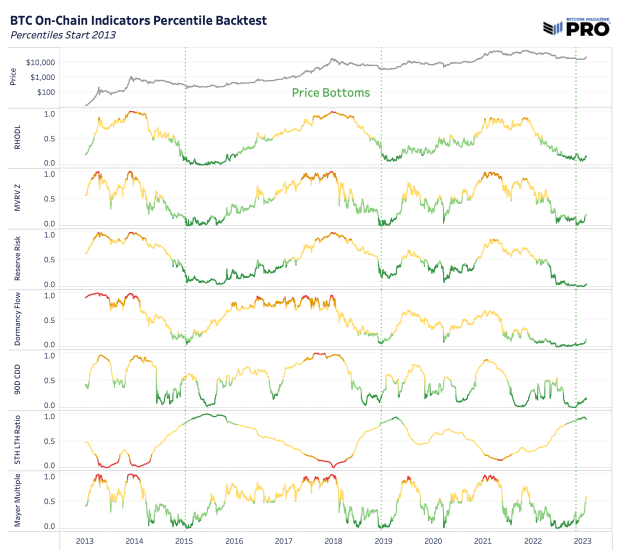

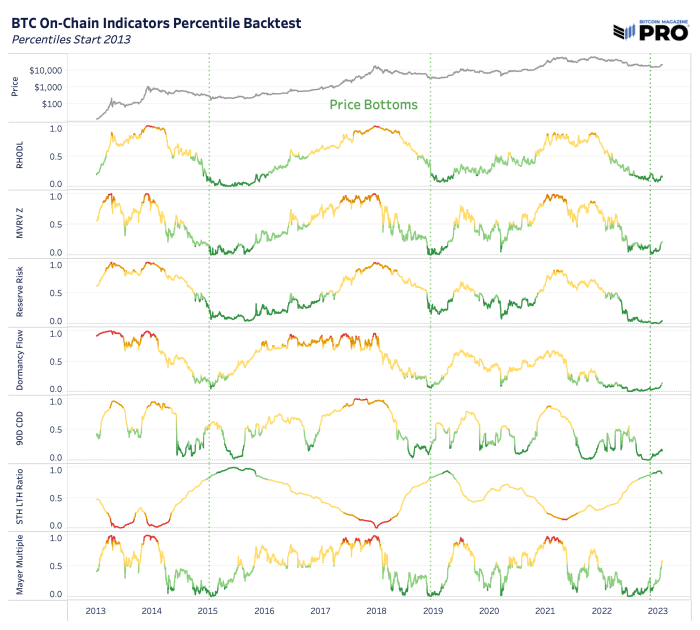

In this week’s dashboard liberate, we highlighted some key on-chain metrics we prefer to song. Listed right here, we’re looking out to high-tail thru extra of those intimately. Across bitcoin’s short historical previous, many on-chain cyclical indicators are currently pointing to what looks to be a classic bottom in bitcoin tag. Market extremes — doubtless tops and bottoms — are where these indicators acquire proven to be the most dear.

Alternatively, these indicators must be plot to be alongside many completely different macroeconomic factors and readers must peaceable relief in thoughts the likelihood that this is able to perchance also be one more endure market rally — as we peaceable sit below the 200-week transferring life like tag of round $24,600. That being stated, if tag can maintain above $20,000 in the transient, the bullish metrics paint a compelling label for added long-term accumulation right here.

A predominant tail difficulty is a probable market-huge selloff in difficulty resources which would possibly be currently pricing a “gentle touchdown” kind scenario in conjunction with the perchance incorrect expectations of a Federal Reserve policy pivot in the 2d half of this year. Many financial indicators and details peaceable blow their personal horns the likelihood that we’re in the course of a endure market identical to 2000-2002 or 2007-2008 and the worst has but to unfold. This secular endure market is what’s assorted about this bitcoin cycle when when compared with any assorted in the previous and what makes it that grand more sturdy to utilize historical bitcoin cycles after 2012 as ideal analogues for at the sleek time.

All that being stated, from a bitcoin-native perspective, the myth is definite: Capitulation has clearly unfolded, and HODLers held the motorway.

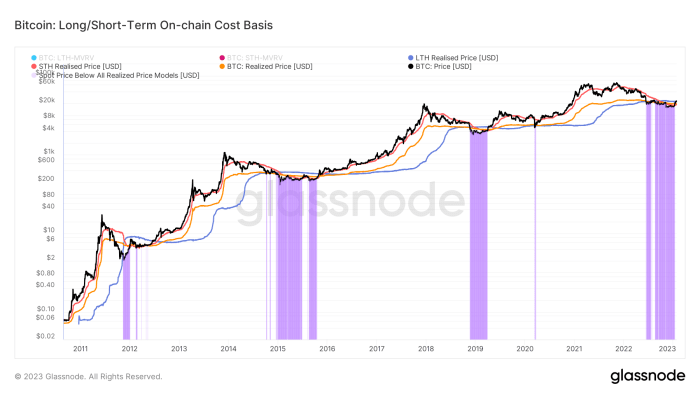

Given the clear nature of bitcoin possession, we are able to be conscious assorted cohorts of bitcoin holders with crude clarity. In this case, we’re viewing the realized tag for the life like bitcoin holder to boot to the identical metric for both long-term holders (LTH) and transient holders (STH).

The realized tag, STH realized tag and LTH realized tag would possibly give us an belief of where assorted cohorts of the market are in profit or underwater.

On a month-to-month basis, realized losses acquire flipped to realized profits for the predominant time since ideal April.

Capitulation and loss taking has flipped to merit realization across the network, which is a in actuality healthy label of thorough capitulation.

There is a sturdy case to be made that given the contemporary elasticity of bitcoin’s offer — as evidenced by the historically runt desire of transient holders or somewhat the trim desire of long-term holders — this is able to perchance also be tense to shake out contemporary market members. Especially eager about the gauntlet endured over the old 365 days.

Statistically, long-term bitcoin holders are in most cases unfazed in the face of bitcoin tag volatility. The guidelines presentations a healthy amount of accumulation accurate thru 2022, despite a huge difficulty-off tournament in both the bitcoin and legacy market.

While liquidity dynamics in legacy markets must be renowned, the provision-facet dynamics for bitcoin seek to be as strong as ever. All this is able to furthermore grasp for a necessary tag appreciation will be a runt influx of newfound question.

Esteem this assert? Subscribe now to get PRO articles on to your inbox.

Related Past Articles:

- BM Expert Market Dashboard Free up!

- On-Chain Data Presentations ‘Attainable Bottom’ For Bitcoin But Macro Headwinds Remain

- The All the pieces Bubble: Markets At A Crossroads

- No longer Your Practical Recession: Unwinding The Very most sensible Financial Bubble In History

- Key Bitcoin And Fairness Dynamics To Worth Right Now

- Rob A Hike: Fed Lags Miles In the motivate of The Curve On FOMC Eve