The day that bitcoin becomes less unstable is the day that mass adoption will begin up. Or is it that mass adoption will minimize volatility on bitcoin?

This is one amongst basically the most well liked debates in our condominium as market contributors are attempting to make investments when the unstable designate stagger of bitcoin will get smoother. Those that know me are aware of my stance on the subject: Mass adoption must restful lastly gentle the volatility curve and worth swings on bitcoin, but this adoption could per chance furthermore lift volatility very much in the shut to term, because the expanding ecosystem continues to adjust to the influx of most contemporary market contributors.

Because the Bitcoin ecosystem grows and evolves, unique players proceed to enter with diverse traits from every other, something that can bring disruption or even stress in an ecosystem that has been broken-the entire manner down to a undeniable actuality for such a truly lengthy time.

The Chase Of Bitcoin Stamp Volatility

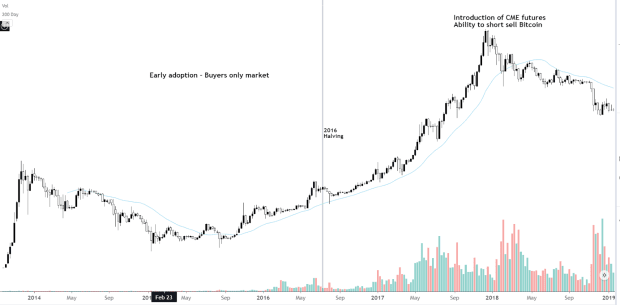

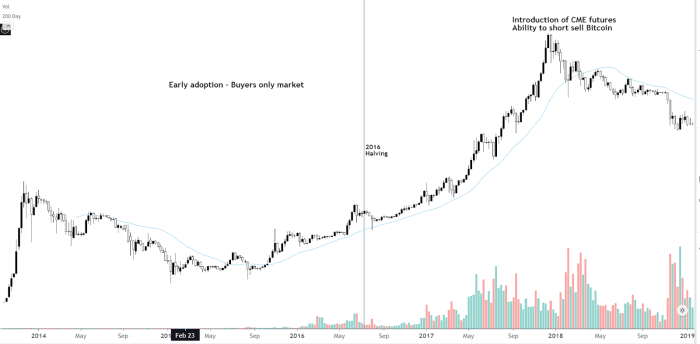

A couple of of the bottom levels of volatility, basically, occurred all over the early adoption stage (2013 to 2017) of bitcoin, when the market cap was as soon as under $20 billion and the network was as soon as dominated by early believers in a merchants-handiest market. Then with out warning, volatility struck with a huge dump that shook the enviornment in 2018 and took many folks “out of the market.”

Nonetheless what took rep 22 situation sooner than the dump that precipitated that event? Many issues were stated about this, but few approaches bear acknowledged a key event that took rep 22 situation moderately earlier, in December 2017: the introduction of the main bitcoin futures product, which started trading on the Chicago Mercantile Alternate.

This was as soon as an event that for the main time created a brand unique actuality. The capacity to short-promote bitcoin on a colossal scale. In diverse phrases, the capacity to promote bitcoin that you just had never beforehand owned (even supposing that bitcoin was as soon as never valid, but rather excellent a designate tracker).

That consisted of the main enlargement of the Bitcoin ecosystem, which came to counter the prior actuality of a merchants-handiest market.

The rising recognition of bitcoin as an asset class on its scheme to mass adoption precipitated the advent of the futures market and the advent of a brand unique form of market participant, the short seller, something that resulted in a dump we all rep into story.

Titillating ahead, as bitcoin entered a brand unique market cycle, the bother of 2018’s dump took most momentum players out of the procedure and allowed the maximalists to salvage the bulk composition of the network.

Something that resulted in the unhurried rejuvenation of costs the entire scheme by mid-2020, when bitcoin became, for the main time, the coolest kid in town and mass adoption began to appear like a doable actuality.

A Deeper Dive Into The Causes Of Bitcoin Stamp Volatility

Nonetheless, ahead of we take care of the show camouflage, let’s rep a leer at how unstable bitcoin was as soon as as it headed in opposition to the CME itemizing, the designate ease and the return to relativity for folks begin air the network.

Bitcoin was as soon as reasonably unstable, some could per chance grunt, because the network was as soon as making exciting itself for mass adoption. Nonetheless how does this compare to the designate stagger of mid-2020 to the show camouflage, when a file influx of market contributors joined our network and mass adoption began to begin up getting precipitated?

The file influx of most contemporary market contributors resulted in file volatility in the network, a volatility that would no longer seem exciting to race away the procedure yet. “Why?” you’d quiz. “Did we no longer continuously assume that mass adoption will bring steadiness in the procedure?” “How come bitcoin, at a $100 billion, $300 billion or even $1 trillion market cap, is more unstable than bitcoin at a $20 billion market cap?”

The acknowledge is easy: The market contributors now bear diverse utilities and applications than they did in the early adoption stage, and the network is having a diminutive shock as it is searching for to rep in the enlargement, the same to acne on a teen’s face as their physique grows into that of an grownup.

Bitcoin with a market cap in the a entire bunch of billions of bucks has many unique players. Gamers with diverse roles and beliefs, with the maximalists accounting now for an awfully much smaller share of the pie. The ecosystem has improved from a merchants-handiest market that welcomed at the delivery lengthy-term merchants, to welcome momentum merchants and speculators, proprietary desks and liquidity suppliers, lenders and a chain of diverse unique roles that are basically very noteworthy wished for the lengthy-term cause of mass adoption, but who bear introduced indecent volatility in the shut to term because the network tries to adjust to the unique, continuously-evolving actuality.

The Importance Of Likelihood Management

All of that, as one request continues to dominate the market: How can we minimize volatility on a network that has grown from an toddler into moderately one, but restful has a lengthy scheme to race till it’s fully developed?

The acknowledge is easy: possibility administration.

Likelihood administration from a individual perspective is the biggest assistance that every of us can offer to bitcoin in describe for it to proceed to grow and accept unique participants below lower volatility and smoother designate swings.

Via possibility administration, the amount-one rule is thought your risks. Nonetheless ahead of we be aware them, we in actuality desire to acknowledge them.

“Denial of possibility refers to cognitive ways to design adaption to bad behaviors by rejecting the replace of suffering any loss.” –Peretti-Watel

“It ain’t what you don’t know that gets you into disaster. It’s what for obvious that excellent ain’t so.” -Stamp Twain

What if the accrued total of the bitcoin positions on the earth were no longer in step with random outcomes, but in its put on scenarios identified ahead of the rep 22 situation establishment?

What if the liquidation of that leveraged rep 22 situation could per chance furthermore were averted?

What if the income of a miner was as soon as locked one yr out ,or 70% of the worth of your portfolio was as soon as secured?

Then self belief would dominate the market and the following dump put no longer need been as flawed because the prior one.

Likelihood administration is a vote of self belief in bitcoin.

Why? Because self belief is derived by identified outcomes and identified outcomes are an output of possibility administration.

Likelihood administration is the acknowledge to indecent unstable swings and lesser promote offs. The moment the design back is no longer detrimental to our portfolios or lives’ financial savings, is the moment that liquidations will be refrained from and jumpy promoting will lift.

The moment all individuals individually manages their possibility is the moment that designate normalization will be attained and self belief will be carried out in the broader market.

Nonetheless how can we even come possibility administration?

For starters, possibility administration begins with rep 22 situation placement and change execution. Or by simply fending off an overleveraged subject that you just bear fully no alter over.

Likelihood administration occurs by making obvious that we stop no longer absorb a change that, if long gone unfriendly, will threaten the financial wellbeing of ourselves and our households.

Likelihood administration occurs in the event you put aside a stop loss to your leveraged rep 22 situation in its put of doubling down or hoping that costs will return assist to the put they were.

Likelihood administration occurs in the event you fleet realize that you just are the one who’s unfriendly, no longer the market, and accordingly adjust your exposure.

In a more moderate come, possibility administration could per chance even be carried out by the derivatives markets, in the event you place a put aside option in describe to set a maximum loss subject or a minimum accomplish. Or simply in the event you promote some futures contracts for share of your physical rep 22 situation in describe to shield your portfolio against internal reach volatility and doable adverse market conditions.

Good just like the leisure in lifestyles, possibility administration must restful work as a injury-aversion mechanism, no longer as an aftermath resolution. Our aim must restful continuously be to guide clear of our condominium catching on fireplace, no longer inserting the fireplace out as soon as it’s too unhurried.