Bitcoin has been on a outstanding upward trajectory, pushing above the $96,000 be aware for several days after consolidating below the psychological $100,000 stage. As the leading cryptocurrency, Bitcoin has constantly broken all-time highs all over the last three weeks, with the day earlier than on the present time marking a milestone weekly shut at $98,000—the superb in its history.

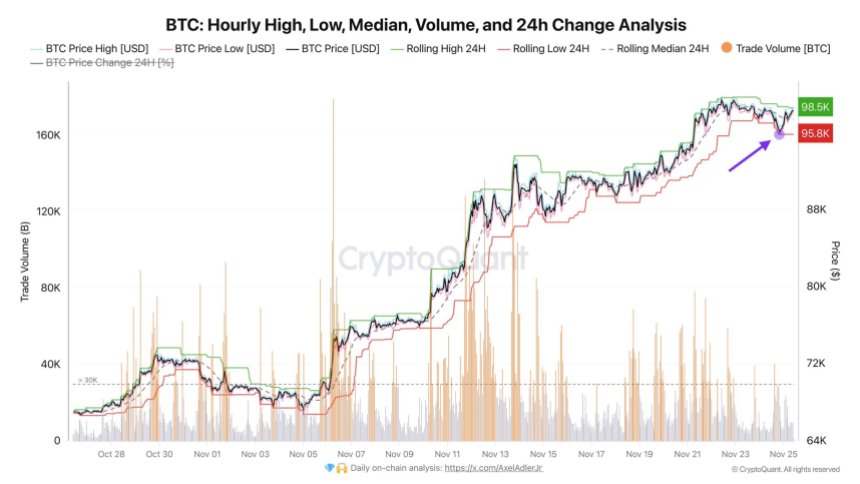

CryptoQuant analyst Axel Adler shared an insightful diagnosis on X, emphasizing that Bitcoin’s recent are attempting to dip below $95,000 met with essential resistance, reinforcing the energy of present toughen ranges. In accordance to Adler, the market is now poised for a severe take a look at of the $100,000 be aware, a barrier that would catalyze extra bullish momentum or stamp a short-time frame consolidation segment.

With Bitcoin’s bullish trajectory exhibiting no indicators of slowing, merchants and merchants are closely anticipating a breakout above $100,000. The kind of transfer would possibly maybe ignite broader market optimism and drive renewed curiosity in altcoins, potentially shaping the subsequent segment of the crypto market’s increase. On the different hand, failure to interrupt above this key stage would possibly maybe plight off a healthy correction, setting the stage for a extra sustainable rally.

Bitcoin Stamp Action Stays Stable

Bitcoin’s mark action has remained exceptionally bullish despite a recent retrace from $Ninety nine,800 to $95,800—a minor dip of decrease than 4%. Traders widely accept as true with this pullback as a transient consolidation segment earlier than a doable breakout above the pivotal $100,000 be aware.

The resilience demonstrated all over this retrace has bolstered self belief among market participants, with many viewing it as a healthy halt in an ongoing uptrend.

Effectively-known CryptoQuant analyst Axel Adler weighed in on the recent market actions via X, sharing a technical diagnosis that reinforces Bitcoin’s mighty bullish building. Adler highlighted that pushing BTC to diminish search recordsdata from ranges used to be unsuccessful, extra solidifying present toughen zones.

In retaining along with his insights, the stage is now plight for Bitcoin to indirectly take a look at the severe $100,000 space and gauge the market’s reaction at this psychological threshold. As BTC approaches this milestone, investor sentiment looks divided. Many merchants peep the $100,000 stage as a superb mark to commence taking profits, citing historical patterns of pullbacks after essential spherical-quantity milestones.

On the different hand, others remain optimistic about Bitcoin’s continued energy, forecasting a doable surge past $100,000. Predictions for the rally’s height vary between $105,000 and $120,000, reflecting a broader perception within the cryptocurrency’s long-time frame capability. Whether Bitcoin consolidates or continues climbing, all eyes remain on its next strikes.

Bullish Weekly Close Would possibly perchance maybe also Ship BTC Elevated

Bitcoin has executed its highest weekly shut in history, recording an outstanding $98,000. This milestone is a technical success and a severe psychological enhance for market participants. It signals a mighty bullish atmosphere that would soon propel Bitcoin above the coveted $100,000 be aware.

The $98,000 stage now serves as a mighty toughen zone, and declaring this mark—or no longer decrease than staying above $95,000—within the coming days would possibly be pivotal. A breakout above these ranges would possibly maybe propel Bitcoin towards $100,000 with essential momentum. The kind of transfer would solidify Bitcoin’s uptrend and entice extra curiosity from retail and institutional merchants.

On the different hand, continued consolidation below $100,000 remains a possibility. Bitcoin would possibly maybe rob several weeks of sideways motion to procure the energy essential for the subsequent leg up. While potentially frustrating for transient-time frame merchants, this consolidation segment would provide a healthy foundation for sustainable increase.

Featured image from Dall-E, chart from TradingView