Motive to belief

Strict editorial coverage that specializes in accuracy, relevance, and impartiality

Created by alternate consultants and meticulously reviewed

The easiest requirements in reporting and publishing

How Our News is Made

Strict editorial coverage that specializes in accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper european odio.

Bitcoin is changing arms at costs almost 40% below its modeled “energy price,” yet an odd confluence of technical, most major and coverage signals suggests the market may well doubtless be turning, per Charles Edwards, founding father of the quantitative crypto hedge fund Capriole Investments. In his most up to date e-newsletter, Edwards argues that a newly-formed “Triple Place”—simultaneous backstops from the White Home, the Federal Reserve and the US Treasury—has altered the grief profile for all grief resources apt as on-chain and macro indicators for Bitcoin flip decisively greater.

Bitcoin Flips Bullish

Edwards begins with sentiment, describing it as “in the pits.” The American Association of Individual Shoppers’ bull–bear unfold, he notes, is “as bearish as 2009 and the 2022 lows, and critically worse than the 2020 Covid fracture,” even supposing every Bitcoin and the S&P 500 bear fallen no longer up to fifteen percent from their fresh peaks.

The CNN Apprehension & Greed Index has registered its bleakest studying “in years,” while Capriole’s possess Active Supervisor Sentiment gauge reveals fairness managers at advance-story beneath-publicity. “Simply establish, merchants are panicking this day,” he writes, warning that such unsuitable readings “most steadily coincide on the mid-unhurried stage of a major ticket bottom.” The aggregate leaves what Edwards calls “blood (and fear) on the avenue,” echoing the Rothschild maxim he cites in beefy: “the time to buy is ‘when there’s blood on the streets, even if the blood is your possess.’”

Technically, Bitcoin staged a pointy reversal apt days ago. A breakout candle to $94,000 reclaimed the full $91,000–$100,000 fluctuate that had capped the market since February. Edwards classifies the transfer as a “principal fluctuate reclaim,” along side that “for Bitcoin, such bullish fluctuate reclaims hardly search ticket search support.”

Unless the market delivers “a day-to-day shut beneath $91K,” he writes, “it’s laborious to fetch a technical chart more bullish than this.” The breakout coincides along with his company’s machine-studying fundamentals model, the Bitcoin Macro Index, turning obvious after months in neutral territory. The index blends bigger than seventy on-chain, macro-financial and fairness-market variables; ticket is deliberately excluded to handle a ways from solutions effects. Last week the model “reset to ‘stunning price’ after which resumed a bullish pattern,” a shift Edwards calls “a actually promising most major files studying.”

The ‘Triple Place’

Coverage trends provide the third leg of the story. On April 2—the so-called “Liberation Day”—the US imposed sweeping global tariffs, handiest to halve them and add a 90-day stay as soon as equities sold off by roughly fifteen percent, the VIX jumped above 30, and credit ranking spreads widened.

Edwards describes the like a flash reversal because the inaugural “Trump Place,” evidence that “if markets decline too remarkable, Trump will step in, stay coverage and backstop them.” Within the future earlier, on April 1, the Federal Reserve started slashing the glide of quantitative tightening by 95% (the “Fed Place”), successfully ending a four-yr steadiness-sheet contraction; derivatives merchants on the CME FedWatch instrument now establish the imperfect-case to three rate cuts forward of yr-kill.

Meanwhile, Treasury Secretary Scott Bessent urged reporters that the swoon in Treasuries used to be driven by deleveraging in device of international selling and that the division “had instruments to mitigate the topic, along side scaling up buybacks if compulsory” (“Treasury Place”).

Edwards concludes that “now we bear three major financial market places in device, all ready to backstop financial markets. Collectively the US President, Federal Reserve and US Treasury signify the Triple Place,” a volatility backstop remarkable in its breadth.

Is BTC Undervalued?

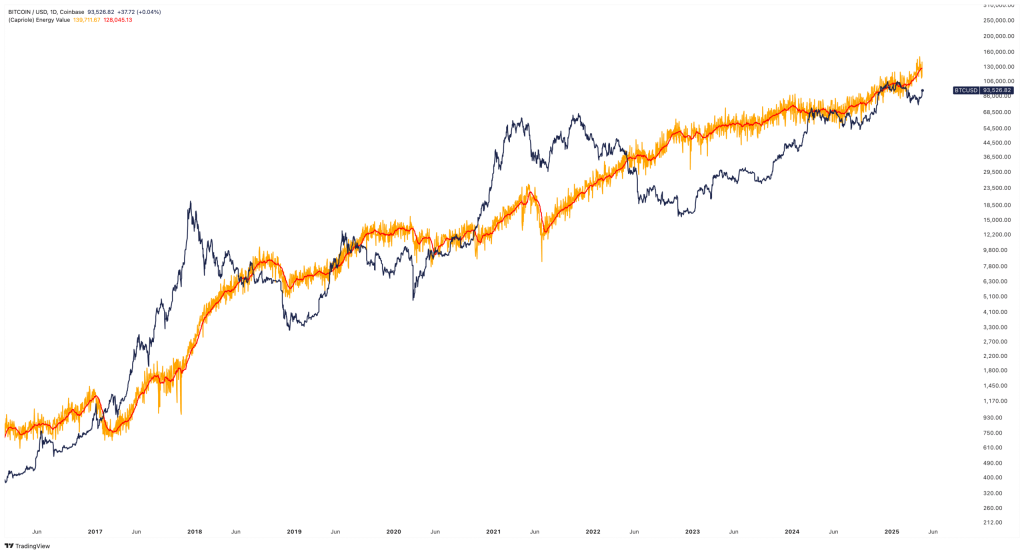

Capriole’s possess “Chart of the Week” underscores the valuation argument. The Bitcoin Energy Value—an in-condo metric that costs the network utilizing aggregate miner electrical energy consumption—surged above $130,000 for the first time this month.

With the region market shopping and selling advance $94,000, Bitcoin therefore sits at an “almost 40% cut again ticket to stunning price,” a depth of undervaluation that Edwards calls “fairly uncommon” in the first yr after a halving and “a actually welcome undercover agent.” Historically, the energy price has acted as a gravitational pull on ticket; gaps of this size bear narrowed in every prior cycle.

Edwards tempers the bullish picture with caveats. “Political and volatility grief remain, and unique coverage changes are the easiest grief to derailing markets at novel,” he writes, along side that Capriole will peek for Bitcoin to shield $91,000 on a weekly shut and for the Macro Index to remain in growth.

Yet his overall tone is unmistakably optimistic: “As it sits this day, the outlook for Bitcoin is awfully bullish with confluence all the device thru technicals, fundamentals and sentiment,” he concludes. If the week ends above novel ranges, Edwards “suspect[s] we are capable of be pushing unique all-time highs on Bitcoin fairly soon.”

At press time, BTC traded at $93,723.

Featured image created with DALL.E, chart from TradingView.com