“We prefer to switch NFTs onto the Layer 2 ecosystem to carve costs. Nonetheless, doing that *magnificentrequires correct defective-rollup portability standards, so the ecosystem can eradicate away from getting locked into one particular L2.” – Vitalik Buterin, Creator of Ethereum

Many people are mindful of presumably the most novel none-fungible token (NFT) craze that has took place over most novel months, with digital images of rocks and pixelated characters selling for thousands and thousands of bucks. Bubble, fad, or the starting up up of something mighty bigger? That, we is no longer going to perceive, and we aren’t going to discuss the validity of NFTs as an investment (study: hypothesis) in this present day’s Each day Dive, nonetheless moderately we will dive into the comparability of Bitcoin versus Ethereum as monetary settlement networks, as Ethereum proponents safe tried to frame ETH as “ultrasound money” increasingly extra over the route of 2021.

This day, we are in a position to see assorted metrics comparing the quantity and efficiency of settlement on the atrocious layer of the Bitcoin and Ethereum networks.

The first part that is needed to distinguish is the distinction between switch quantity and trade-adjusted switch quantity.

For an in-depth description of how trade outputs work, click here.

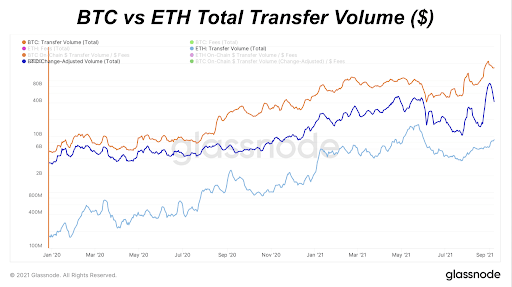

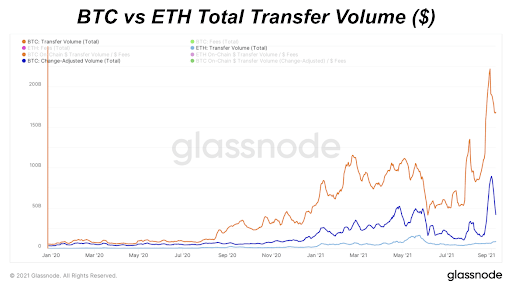

When taking a peep at total switch quantity across the atrocious layer of the Bitcoin and Ethereum networks, the seven-day life like for switch volumes are as follows:

BTC: $168.5 billion

BTC (trade adjusted): $41.8 billion

ETH: $8.7 billion

Below are the charts in both linear and logarithmic scale:

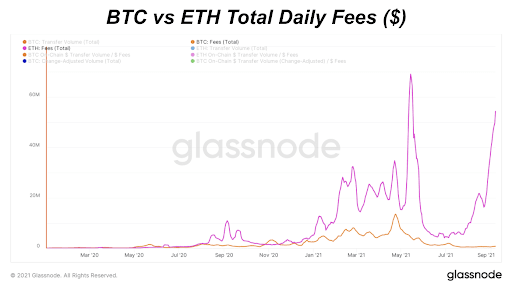

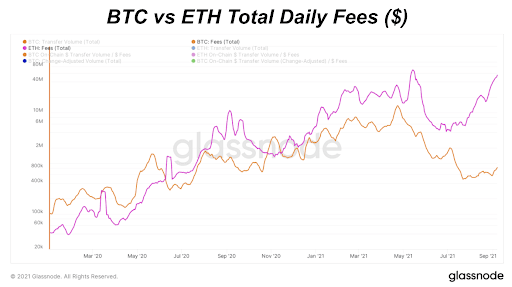

Here is the comparability of the life like each day costs on the atrocious layer of both blockchains over the closing week:

BTC: $0.8 million

ETH: $54.3 million

When comparing the efficiency of settlement (total each day save switch divided by each day costs) of the 2 blockchains, the comparability couldn’t be extra definite.

Bitcoin is cause constructed for one part: save storage and settlement. It is miles the realm’s first and supreme perfected monetary settlement community, and it’s actively scaling to wait to your whole globe.

Below is the comparability of settlement efficiency (total each day save switch divided by each day costs) between the 2 blockchains:

BTC: 206,989

BTC (trade adjusted): 51,428

ETH: 160