Bitcoin has been experiencing some volatility over this day’s trading session as the associated fee of BTC touches serious resistance ranges. The quantity one crypto by market cap positively reacted to macroeconomic components, but as the weekend approaches, low ranges would possibly well well lead to unexpected brand drag.

At the time of writing, Bitcoin (BTC) trades at $19,800 with a 1% profit within the final 24 hours and an 8% loss over the last week. The cryptocurrency saw bullish brand action after the U.S. posted predominant metrics about their economy, however the rally used to be brief lived as BTC stumble below a cluster of promoting orders at round $20,400.

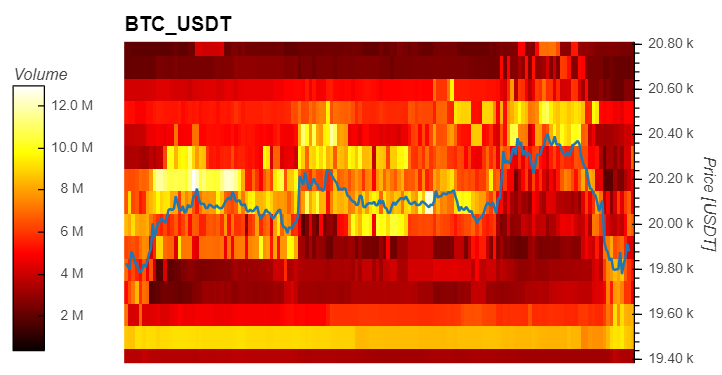

Recordsdata from Arena topic Indicators presentations how the liquidity within the Binance remark books has been following the associated fee of Bitcoin. Sizable gamers hang been environment select and promote orders as BTC approaches serious ranges.

As seen within the chart below, this day’s rejection used to be brought about by a stack of round $20 million in asks orders as Bitcoin trended to the upside. The cost has seen a an analogous sample throughout this week with BTC’s brand trending upwards most nice looking to skills overhead resistance brought about by a spike in quiz liquidity.

On the reverse route, select (convey) orders hang remained relatively more loyal with $19,500, $19,000, and $18,000 displaying essentially the most liquidity. These ranges will doubtless be serious as they’ll feature as toughen and prevent BTC’s brand from reaching a brand unique yearly low if the market makes an try to constructing decrease.

In that sense, Arena topic Indicators also recount an develop in promoting stress from noteworthy gamers. Asks orders of over $100,000 and $1 million hang been growing on decrease timeframes and would possibly well well feature as a non permanent hurdle for any skill upside.

Within the U.S., the weekend will doubtless be prolonged till Tuesday attributable to a vacation. This continuously leads to spikes in volatility as low volume have an effect on the associated fee action.

What Could well Play In Favor Of Bitcoin?

Additional data supplied by analyst Justin Bennett signifies a skill rejection of the U.S. buck as the forex makes an try to break above a mandatory flat atrocious. This can lead to reclaim of ranges final seen in 2003.

Nonetheless, the forex has been unable to particular the dwelling above 109, as measured by the DXY Index, and a “fakeout” would possibly well well also just be in play. Bitcoin and the crypto market hang been negatively correlated with the U.S. buck. Attributable to this reality, a rejection would possibly well well play in favor of the nascent asset class. Bennett said:

To this point, it looks just like the $DXY used to be “scandalous”. Presumably a pullback to 107 subsequent week if this constructing line breaks. That would be bullish for crypto within the brief time period. Nonetheless within the slay, I comprise the USD index heads to 112-113 and doubtless even greater.