The Bitcoin (BTC) tag has been trading in a range between $27,000 and $28,000 since Friday closing week, with $27,800 currently being the largest resistance stage to kick off a transfer to the upside. As fair currently as closing Tuesday, BTC used to be trading above $30,000 sooner than plunging better than 10%.

On the opposite hand, Wyckoff and Elliott Wave analysts agree that the transfer is no longer a motive for issue. Consistent with trader and market psychology coach Christopher Inks, a minimum target of $42,350 is expected for Bitcoin as fragment of its next jump.

Right here’s What Wyckoff Evaluation Says About The Speak Of Bitcoin

The Wyckoff manner used to be invented by Richard Wyckoff in the early 1930s and proposes to read the market the use of causal fundamentals that truly predict market movements. The buildup and distribution schemes are potentially essentially the most up-tp-date fragment of Wyckoff’s work in the crypto and Bitcoin community.

The models ruin down the accumulation and distribution phases into 5 phases (A by E), alongside with plenty of Wyckoff events. Inks writes in his prognosis that Bitcoin is probably going in an accumulation in accordance with the Wyckoff manner.

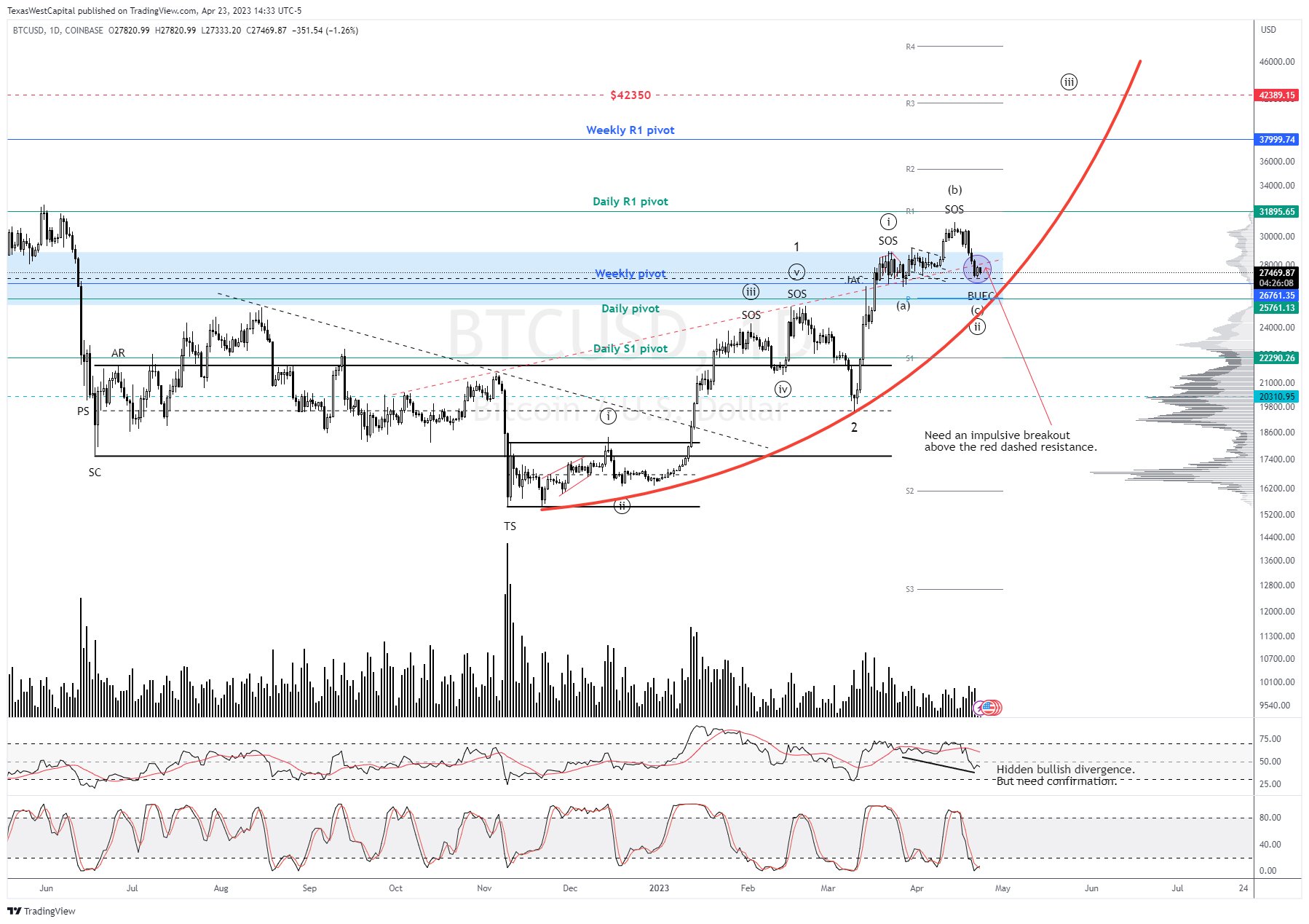

“The Elliott Wave depend would possibly maybe maybe well or would possibly maybe maybe well no longer be upright in the community. We are seeking to search for an impulsive breakout above that ascending crimson dashed resistance to signal that the wave ((ii)) flat bid would possibly maybe maybe well well also be whole, but a breakout above wave (b) is required to add self belief to that depend,” writes Inks, who shared the chart below.

If Inks’ depend is upright, then another breakout has the day-to-day pivot as its target. This kind that the wave ((iii)) of three from right here has a minimum target of $42,350 per Bitcoin. Consistent with the analyst, this view is furthermore supported by the truth that the RSI on the day-to-day chart is currently showing a hidden bullish divergence, with confirmation that it’s whole tranquil pending.

As effectively as, the Stoch RSI on the day-to-day chart has moved aid into the oversold space, so a breakout from the oversold space would extra strengthen the view the wave ((ii)) is whole, the analyst says and concludes:

We are in a position to furthermore picture the crimson parabola. While tag stays above that curved line we would possibly maybe maybe well tranquil continue to demand elevated, overall, fairly than a elevated pullback. Let’s search for if we can rating that rally from someplace spherical this space.

Todd Butterfield of the Wyckoff Stock Market Institute is of the same opinion with Inks. In his latest prognosis, Butterfield writes that Bitcoin skilled a spicy sell-off on low quantity closing week – as expected.

Right here’s “another low-trouble procuring replacement,” in accordance with the dear analyst. The technometer is at 38.5 for BTC/USD and 40.4 for BTC/USDT. By strategy of Twitter, he commented:

Bitcoin has no longer reached oversold and the price action had me staying on the sidelines for a moment. An oversold Technometer is no longer a shut your eyes and aquire, but a sign that we could be forming a bottom, or due for some sideways/elevated.

At press time, the BTC tag stood at $27,236, moving once more closer to the lower cease of the vary, potentially for but another sweep of the low.

Featured image from iStock, chart from TradingView.com

Jake Simmons

Jake Simmons has been a Bitcoin fanatic since 2016. Ever since he heard about Bitcoin, he has been discovering out the sphere each and each single day and attempting to half his files with others. His arrangement is to contribute to Bitcoin’s monetary revolution, which is willing to interchange the fiat money system. Besides BTC and crypto, Jake studied Industrial Informatics at a college. After graduation in 2017, he has been working in the blockchain and crypto sector. You would possibly maybe maybe maybe well be ready to put collectively Jake on Twitter at @realJakeSimmons.