Key Takeaways

- Bitcoin has risen by almost 13% over the last week.

- A spike in network improve and launch ardour stamp additional beneficial properties.

- Breaching the $42,100 resistance level would validate the optimistic outlook.

Several on-chain metrics counsel that Bitcoin is gaining strength for a critical bullish impulse. Silent, the high crypto has a huge hurdle to beat first.

Bitcoin On-Chain Metrics Preserve shut Up

Bitcoin looks admire it’s gaining strength again.

The main cryptocurrency has loved a mettlesome uptrend over the last week. It’s won almost 5,000 factors in market price, rising from a low of $37,600 on Mar. 14 to a excessive of $42,400 on Mar. 19.

Even supposing costs comprise retraced by roughly 5% in the last 48 hours, Bitcoin’s uptrend appears to be like to be gaining strength.

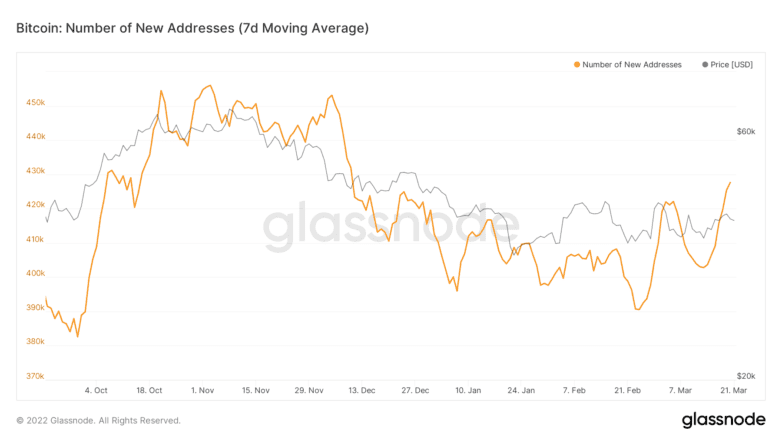

The selection of newest addresses becoming a member of the Bitcoin network has vastly increased since Feb. 21, making a series of increased highs and increased lows. The uptrend on this on-chain metric suggests rising ardour from sidelined traders who seem like re-getting into the market.

More than 480,000 Bitcoin addresses had been created in Mar. 17 alone, which is a stable obvious signal for additional upward imprint action.

Community improve is normally regarded as belief to be one of primarily the most appropriate imprint predictors for cryptocurrencies. A sincere uptrend in the selection of newest addresses created on a given blockchain normally outcomes in rising costs over time.

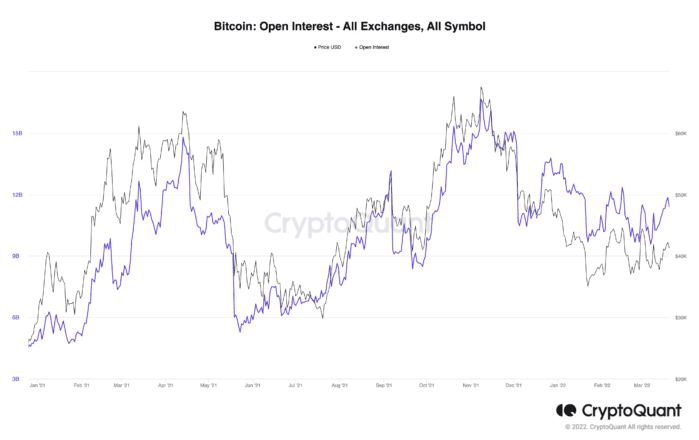

A the same uptrend can even be viewed in the futures markets, where the selection of launch positions, including every long and short positions, has been incessantly rising since Mar. 7. As launch ardour will improve, it signifies more liquidity, volatility, and a spotlight is coming into the derivatives markets. A sincere improve in launch ardour to surpass 12.36 million can even improve Bitcoin’s newest imprint improve.

Silent, transaction historic past displays that Bitcoin has one gargantuan resistance wall to spoil so as to come additional.

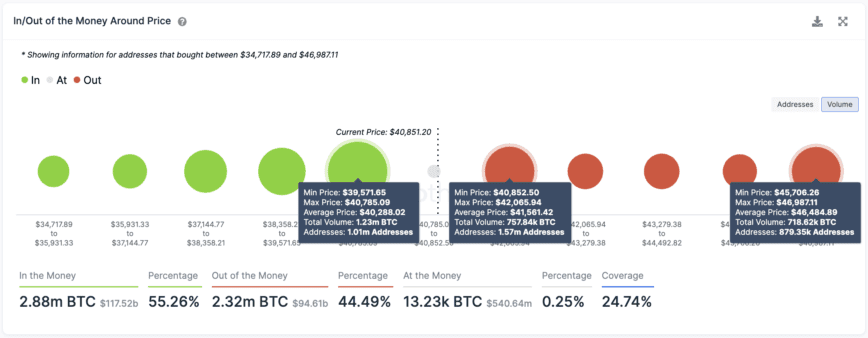

IntoTheBlock’s In/Out of the Cash Spherical Impress model displays that 1.57 million addresses comprise beforehand purchased almost 760,000 BTC between $40,900 and $42,100. A decisive each day candlestick shut above this hurdle can even give Bitcoin the strength to spoil the next significant barrier, which is sitting at $46,500.

The IOMAP furthermore displays that the high-ranked cryptocurrency is retaining above stable improve as over 1 million addresses comprise beforehand purchased 1.23 million BTC at a median imprint of $40,300. As long as Bitcoin stays shopping and selling above this foothold, it has a possibility at advancing additional. Alternatively, failing to plot so can even consequence in a downswing to $37,500.

Disclosure: At the time of writing, the author of this portion owned BTC and ETH.

The certain wager on or accessed through this net pages is purchased from self reliant sources we mediate to be appropriate and official, nevertheless Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed through this net pages. Decentral Media, Inc. is no longer an investment advisor. We plot no longer give personalized investment advice or other financial advice. The certain wager on this net pages is topic to commerce with out detect. Some or all of the certain wager on this net pages can even merely change into outdated, or it’ll be or change into incomplete or wrong. We can even merely, nevertheless are no longer obligated to, update any outdated, incomplete, or wrong data.

That you might even merely aloof never make an investment decision on an ICO, IEO, or other investment in retaining with the certain wager on this net pages, and in addition you might perchance presumably also merely aloof never elaborate or otherwise depend on any of the certain wager on this net pages as investment advice. We strongly imply that you simply consult a licensed investment advisor or other qualified financial legit whereas you are searching for investment advice on an ICO, IEO, or other investment. We plot no longer rep compensation in any invent for inspecting or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

Delight in fat phrases and prerequisites.

Ukraine Signs Digital Sources Bill to Legalize Bitcoin

The update comes after cryptocurrency donations to Ukraine’s war efforts comprise broken $100 million. Ukraine Signs Crypto Bill Into Law Ukraine merely legalized crypto. The Ukrainian Authorities’s Ministry of Digital…

Bitcoin Exhibiting Dinky Place of Well-known Resistance Forward

Bitcoin appears to be like to be making ready for a bullish impulse as on-chain metrics show signs of accelerating demand and itsy-bitsy to no resistance ahead. Bitcoin Has the Doubtless to Surge Bitcoin…

Wasabi’s Bitcoin Mixer to Open Censoring Transactions

Wasabi, a Bitcoin-totally wallet with belief to be one of primarily the most well-most approved transaction mixing implementations, has announced that it’ll launch censoring obvious transactions to its CoinJoin mixer. Wasabi’s CoinJoin to Open…