Home » Bitcoin » Bitcoin’s delayed breakout indicators a healthy bull market, suggests analyst

Jun. 14, 2024

No subject environment a document excessive of $73,000 in mid-March, Bitcoin has yet to explore a valuable save rally.

Allotment this article

Bitcoin’s prolonged duration of save consolidation is probably to be environment the stage for a sturdy bull market, essentially essentially based on technical analyst Rekt Capital.

“The indisputable truth that Bitcoin is struggling to interrupt out is efficacious for the general cycle,” Rekt Capital explained in a present submit on X.

“This persevered consolidation is enabling save to resynchronize with historical [halving] cycles in disclose that we can receive a identical old, frequent [bull run],” he added.

Rekt Capital immediate that present market habits is according to historical halving cycles. He moreover worthy that Bitcoin’s fight to interrupt out early submit-halving is conventional and prevents an accelerated cycle that will perhaps perhaps lead to a shorter bull market.

In a separate submit, he identified that Bitcoin has entered the re-accumulation half, with consolidation doubtlessly extending for any other three months essentially essentially based on past patterns.

“It shouldn’t be glowing for that reason truth if save rejects from the fluctuate excessive resistance,” acknowledged Rekt Capital.

No subject reaching a singular excessive of $73,000 in mid-March sooner than the halving, Bitcoin has no longer seen a gigantic rally since. Consistent with Crypto Quant, the truth that Bitcoin has yet to explore a valuable save rally is probably to be linked to the slowdown in USDT’s market capitalization.

Closing puzzles

With Bitcoin halving and the utter Bitcoin ETF resolution within the aid of us, the US presidential election and macroeconomic factors are seen as ability constructive catalysts for Bitcoin.

The upcoming US presidential election in November has brought crypto to the forefront of some political discussions. Fashioned Chartered means that a ability return of Donald Trump to office could perhaps perhaps positively impact the save of Bitcoin. The bank moreover believes a Trump victory could perhaps perhaps profit the general US crypto panorama.

One other ingredient that will perhaps perhaps profit the Bitcoin market is the Federal Reserve’s (Fed) timeline for passion price cuts. The long scamper price cuts are expected to carry elevated liquidity to markets, doubtlessly benefiting Bitcoin and diversified crypto resources.

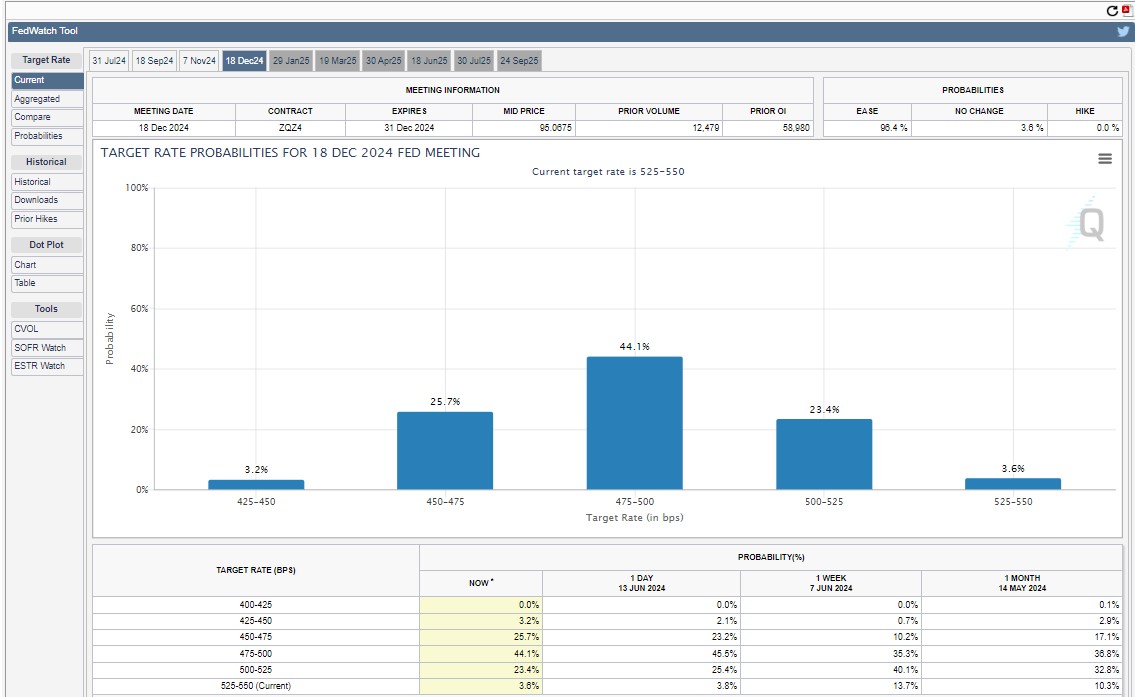

The Fed held rates regular at its June FOMC assembly. Fed Chair Powell, citing persevered excessive inflation, indicated a cautious approach with the possible for one lower this year and four in 2025.

CME FedWatch Tool suggests a detailed to easy job of a price lower expected in December, rising from spherical 85% closing week to almost 97%.

Bitcoin surged on Wednesday after cooler-than-expected inflation data. Also can’s CPI confirmed inflation at 3.3% year-over-year, beating estimates of three.4%. Core inflation moreover came in lower at 3.4%, in comparison to the predicted 3.5%.

Nonetheless, the bullish momentum became as soon as immediate-lived. In immediate after inching nearer to $70,000, BTC dipped to $67,500 on Wednesday and prolonged its correction on Thursday, hitting as little as $66,400, essentially essentially based on data from CoinGecko.

On the time of writing, BTC is shopping and selling at spherical $66,800, down 6% over the closing seven days.

Allotment this article