The below is an excerpt from a contemporary version of Bitcoin Journal Pro, Bitcoin Journal’s top fee markets publication. To be among the many predominant to gather these insights and diversified on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

Retail Holds 14% Of Provide

Belief to be one of presumably the most frequent Bitcoin apprehension, uncertainty and doubt (FUD) opinions is that most of offer is carefully concentrated in the fingers of the few. Worship every financial contrivance or asset class that exists nowadays, there is some truth to that kind of distribution but it’s nearly repeatedly exaggerated in Bitcoin’s case.

Bitcoin’s fragment of offer held by estimated retail folks has been taking more fragment of the network yearly. It’s one of many ideal sources on this planet the put anyone with an web connection and a smartphone can develop, having extremely low adoption friction for the overall person.

Many critics cite an address chart fancy this one and name it truth. The fact is that monitoring offer distributions across addresses is extremely nuanced and it’s a key motive why Glassnode has aged a suite of heuristics and clustering algorithms to estimate entities, rather then addresses, on the network.

What Glassnode found of their diagnosis a Three hundred and sixty five days in the past, is that:

“We are in a position to get that spherical 2% of network entities defend an eye fixed on 71.5% of all Bitcoin. Display that this figure is seriously diversified from the on the overall propagated ‘2% defend an eye fixed on 95% of the availability.’”

And that 71.5% became once an upper toddle, i.e., a high estimate of the availability distribution concentration. There are many the clarification why the retail fragment is probably going increased attributable to bitcoin with custodians, offer on exchanges, misplaced money, and a conservative methodology to title entities.

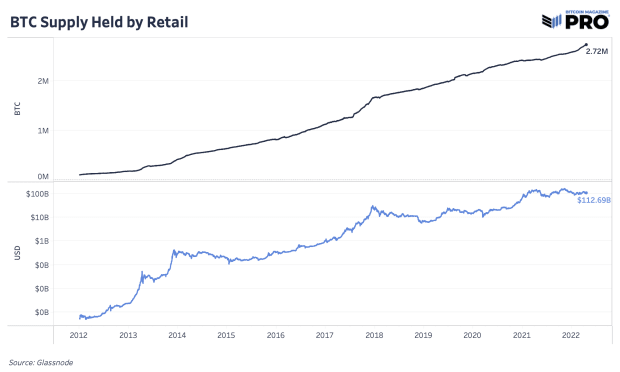

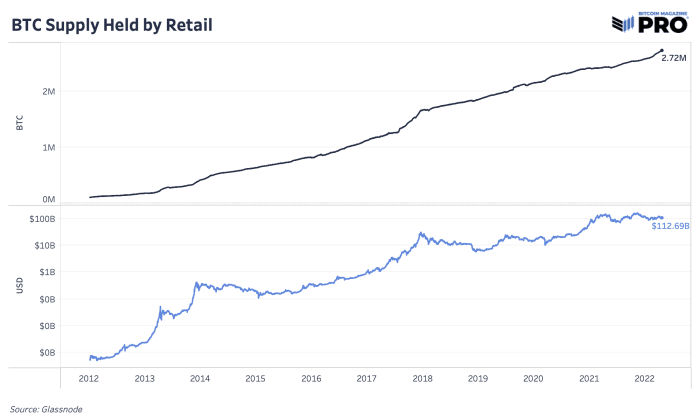

When digging into the entities offer distribution recordsdata nowadays, we uncover an even trend of retail (entities preserving no longer up to 10 BTC) increasing their fragment of circulating offer from 1.51% in 2012 to 13.90% in 2022 on practical. The largest fragment growth of offer comes from entities preserving 1-10 BTC and zero.1 – 1 BTC.

Closing Display

The recordsdata contributes to the case that Bitcoin is a money designed for and accessible to the overall world person. Though institutions and institutional capital flowing into the network is probably going the following significant sign catalyst and ought to aloof affect offer fragment, we proceed to glimpse the network fragment of retail rise as anyone on this planet can build and store bitcoin themselves.

It’s been a predominant-of-its-kind case leer the put for once, retail and folks are in a put to access sources and economic wealth earlier than institutions.