The below is an excerpt from a fresh version of Bitcoin Magazine Pro, Bitcoin Magazine’s top charge markets e-newsletter. To be amongst the first to fetch these insights and other on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

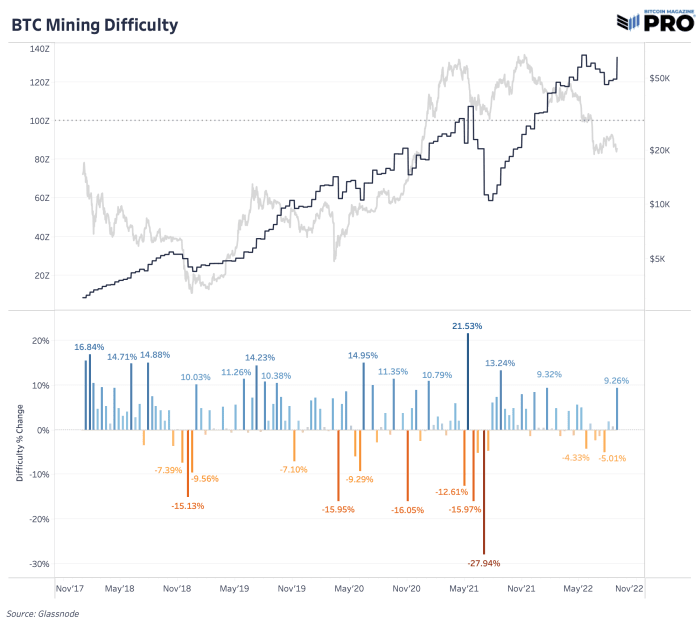

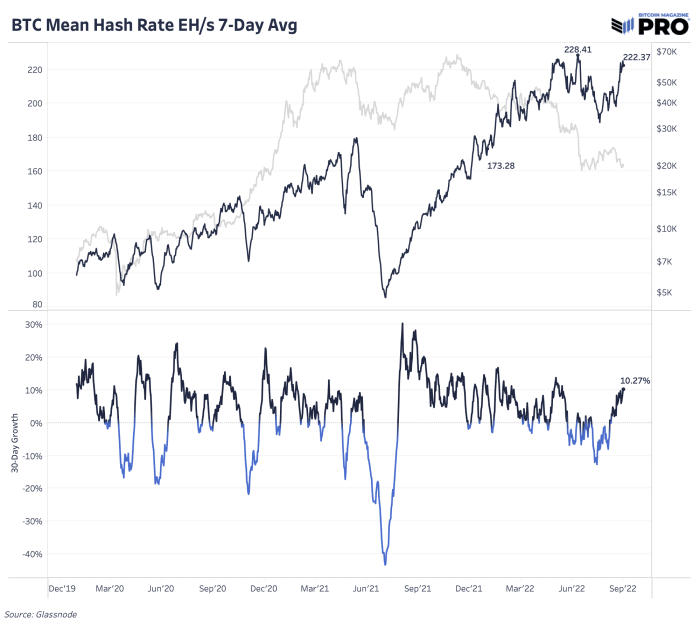

Bitcoin’s most up-to-date scenario adjustment came in at 9.26% earlier as of late, its 2nd largest develop this 365 days in the lend a hand of 9.32% lend a hand in January. As per trendy, the develop is a consequence of a surge in hash charge trusty throughout the last two weeks driving faster block production instances. Now both hash charge and scenario sit genuine below all-time excessive values. Hash charge is up 10.27% trusty throughout the last 30 days.

What looks to be the driving forces in the lend a hand of the hash charge will improve trusty throughout the last of couple weeks are about a factors: better public miners are getting extra rigs plugged in which shall be in alignment with their 2022 expansion plans; we’re getting previous the hotter summer months, significantly in Texas where miners beget been rapid shutting down rigs per incentives from their lift energy agreements; label rallying to $25,000 will drive extra hash online and not more environment pleasant rigs shift arms to extra environment pleasant, aggressive operations. It’s difficult to quantify which is basically the most impactful force, but all appear to be taking half in a feature in hash charge improve.

The Bitcoin mining scenario develop is a consequence of a surge in hash charge trusty throughout the last two weeks

More than one factors beget seemingly been driving the Bitcoin hash charge in the previous few weeks.

To position a matter to this stage of rise in scenario this rapid is a rare occasion and looks less sustainable than slack rises in hash charge and scenario we’ve seen in the previous. If one thing else, basically the most up-to-date scenario rise brings extra pressures to miners’ profit margins at a time where we mediate bitcoin label has further to tumble.

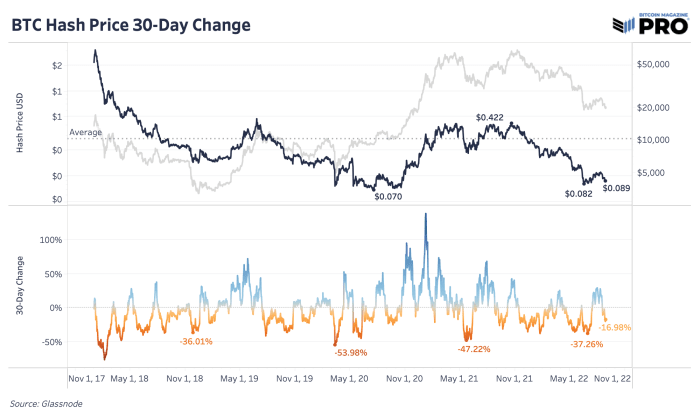

Hash label continues its tumble from its golden duration, down virtually 17% trusty throughout the last 30 days. If the develop in hash charge is most frequently pushed by prefinanced expansion plans by main public miners, the hash charge develop is no longer reflective of a sustained develop in hash charge coming online on the margin.

As you would also stare by the charts above, even a reversal in the quick duration of time doesn’t swap the long-duration of time pattern of an ever-increasing hash charge and rising community scenario.

Hash label continues its tumble from its golden duration, down virtually 17% trusty throughout the last 30 days.

We’ve beforehand highlighted some diagnosis from Arcane Study that showed main public miners’ baseline bitcoin production payment (based fully on electrical energy costs) beget been around $6,000 to $10,000. That that you can perchance presumably be taught extra on that research by clicking the above link or learning “Bitcoin Hash Fee Plummets 17% From All-Time Excessive.” Even if we haven’t performed this diagnosis ourselves or triangulated the guidelines, there’s one estimate that points to an “all-in” bitcoin production payment trusty through public miners to be nearer to $27,600 in Q2 of this 365 days. This payment would contain general costs, upkeep, payroll, ardour costs on notorious loans and other costs exterior of electrical energy.

Even assuming that estimate might perchance perchance well also be heavily overstated due to we don’t beget insight into the quality or methodology of the diagnosis, a bitcoin label hovering around $20,000 composed places main public miners on the ropes to assign profitability on every bitcoin mined.