Per onchain recordsdata, Bitcoin can also be coming into into a particular phase of market participation in space of merely hitting a fundamental cycle top or bottom.

New, great entrants are paying increased costs and keeping on, and that trade is reshaping where the network’s price harmful sits. Here is no longer valid a brief blip; the pattern has lots of particular recordsdata sides within the motivate of it.

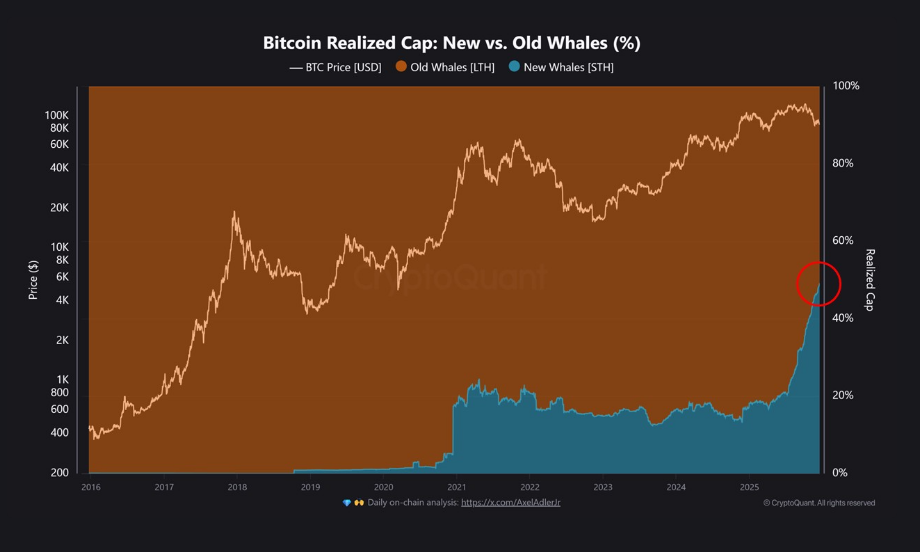

New Whales Rewrite The Network Set up Contaminated

Per CryptoQuant figures, addresses classified as original whales now legend for nearly 50% of Bitcoin’s realized cap. Before 2025, that fragment no longer normally rose above 22%.

Realized cap tracks the cost of BTC at the cost every coin last moved, so this shift displays where capital entered the machine, no longer valid who presently holds the most money.

Studies dispute the realized cap fragment from original whales continued to climb even within the course of pullbacks, which ability the network’s combination price basis is being re-anchored at increased ranges.

Short-Time interval Request Surges As Higher Gamers Purchase Dips

Temporary holder provide expanded by roughly 100,000 BTC over a 30-day span, reaching an all-time high, per analysts. That soar in STH provide sides to intense request at the arrive-time frame degree.

In step with substitute flows, about 37% of BTC despatched to Binance came from whale-measurement wallets, outlined within the knowledge space as holdings between 1,000–10,000 BTC.

Studies from Hyblock show the cumulative volume delta for whale wallets — those within the $100,000–$10 million fluctuate — posted a sure $135 million delta this week.

In distinction, retail wallets ($0–$10,000) and mid-measurement traders ($10,000–$100,000) logged destructive deltas of $84 million and $172 million, respectively. In short: bigger gamers absorbed promoting stress while smaller holders diminished their exposure.

Derivatives Level To Short-Time interval Threat

Set up tear used to be engaging. Bitcoin rose to $88,000 from $85,100 in about five hours after the Bank of Japan raised charges, a tear that many buyers had tracked as a doable macro trigger.

Initiate hobby climbed faster than the cost, and funding charges turned sure, which signifies original margin-pushed long positions had been being added in space of a straightforward quilt of shorts. That extra or less flows pattern raises the likelihood of unstable reversals if sentiment shifts, even when space request appears to be like to be like healthy.

Featured image from Unsplash, chart from TradingView