Residence » Markets » BlackRock holds $78 million in IBIT shares all the draw in which by two funding funds, fresh filings direct

Nov. 28, 2024

Leading financial institutions and command pension funds maintain invested in the command Bitcoin ETF.

Tell: Angus Mordant/Bloomberg

Key Takeaways

- Two funds managed by BlackRock collectively retain $78 million price of IBIT shares.

- IBIT has grown to $forty eight billion in sources below administration since January.

Part this article

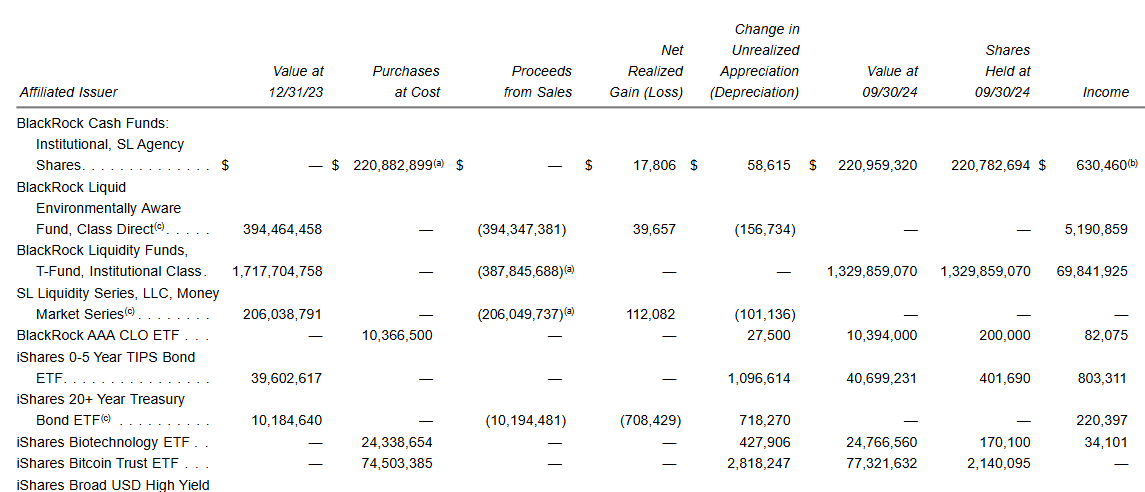

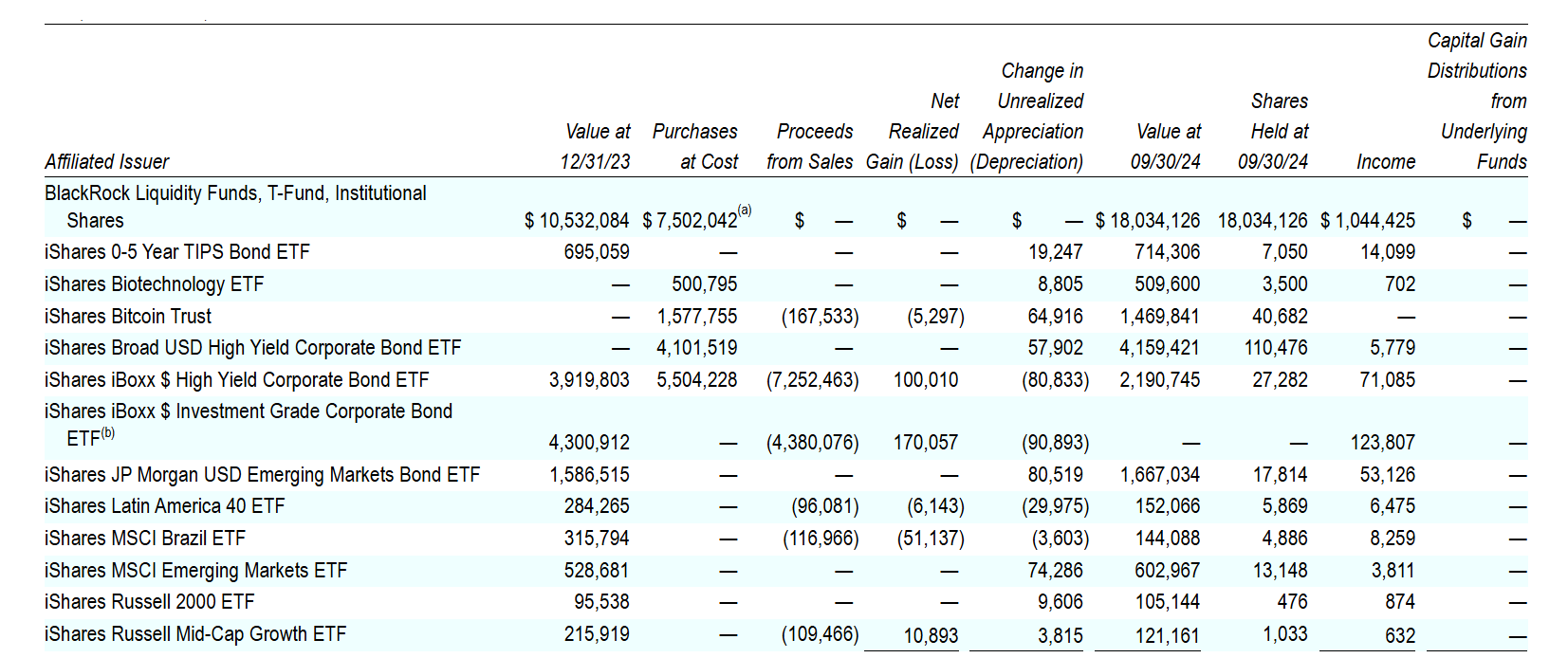

BlackRock has added extra shares of the iShares Bitcoin Belief (IBIT) to 2 of its funds, totaling $78 million as of September 30, in accordance to most popular SEC filings first shared by MacroScope.

BlackRock Strategic Earnings Alternatives (BSIIX), managing $39 billion in sources, disclosed in conjunction with over 2 million shares of IBIT to its portfolio in the length ending September 30. It now holds round 2,1 million IBIT shares, valued at round $77 million.

Per a separate filing, BlackRock Strategic Worldwide Bond (MAWIX), overseeing $816 million price of sources, offered over 24,000 shares of IBIT, rising its total holdings to 40,682, price round $1.4 million.

Each and each funds are managed by Rick Rieder, BlackRock’s chief funding officer (CIO) of global mounted earnings.

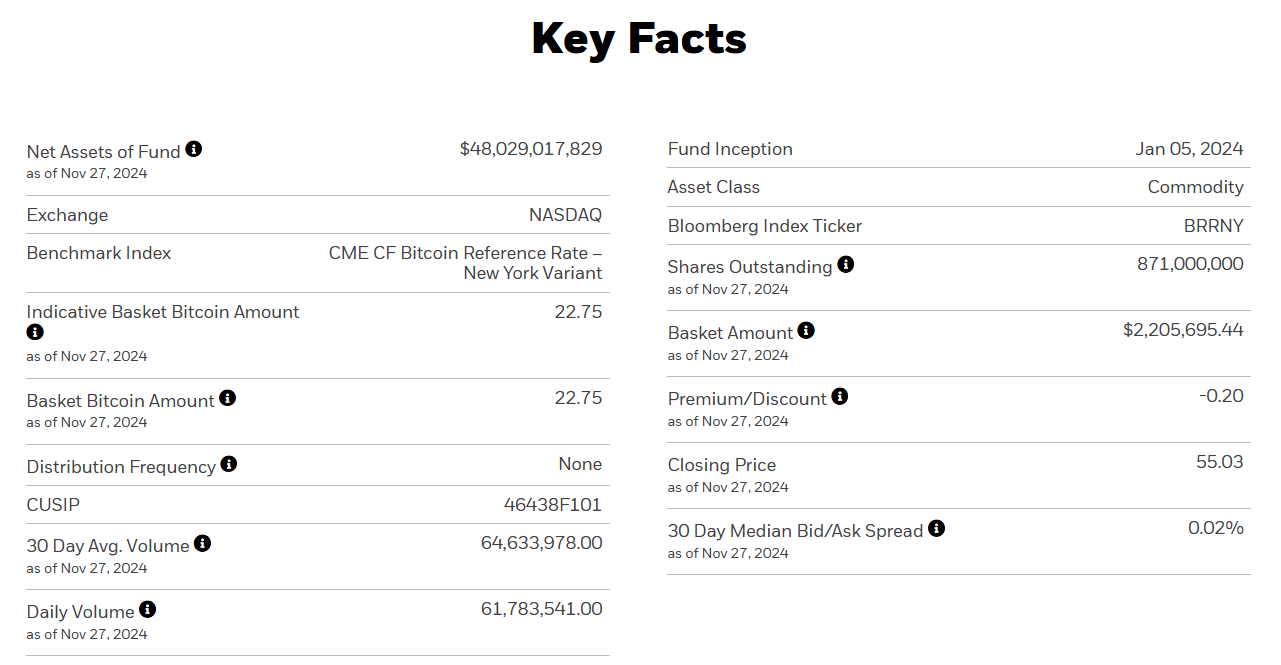

IBIT has considered quick boost because it started buying and selling in January, with roughly $forty eight billion in sources below administration as of November 27. The fund has surpassed its gold-focused counterpart, the iShares Gold Belief (IAU), which holds roughly $33 billion.

IBIT has attracted investments from diverse groups of merchants, in conjunction with hedge funds, pension funds, and institutional merchants.

In presumably the most popular 13F filings, Millennium Management topped the listing with round $848 million in IBIT shares, followed by Goldman Sachs with $461 million and Capula Management with $308 million.

The Bitcoin ETF has maintained recent day-to-day efficiency metrics, in conjunction with buying and selling volumes and capital flows, with over $30 million poured into the fund, in accordance to data from Farside Patrons.

Part this article