Sam Bankman-Fried would possibly perchance likely additionally or would possibly perchance likely additionally no longer be including BlockFi to his growing crypto empire.

Key Takeaways

- BlockFi CEO Zac Prince “100%” denies that the firm is being offered for $25 million to FTX.

- A sale at this worth would keep a 99.5% decrease worth for the firm, which became valued at $4.8 billion in July 2021.

- FTX had previously extended BlockFi a $250 million loan.

BlockFi CEO Zac Prince denies that the firm is being offered for $25 million. The crypto lender had previously been valued at $4.8 billion.

99.5% Decrease worth?

Zac Prince says BlockFi isn’t being offered for $25 million.

The BlockFi CEO took to Twitter right this moment to “100% verify” that, opposite to CNBC’s latest reporting, the crypto lending firm became no longer being offered for $25 million. Prince chalked up the guidelines to “market rumors” and encouraged “everybody to belief fully crucial facets that you just hear at the moment from BlockFi.” He didn’t lisp the firm became being offered, nor did he point to FTX.

Fixed with CNBC, leading crypto change FTX is expected to raise BlockFi for roughly $25 million, a 99.5% decrease worth from a old valuation. Terms are allegedly peaceable subject to trade, though the deal is expected to be signed by Friday.

The cost impress would be famous brooding about BlockFi became valued at $4.8 billion in July 2021 and expected to in the waste walk public. Even after the Terra-led crypto market downturn, BlockFi became peaceable valued in early June 2022 at roughly $1 billion.

FTX has already extended a $250 million loan to BlockFi to insure that BlockFi potentialities would no longer suffer from the firm’s publicity to Three Arrows Capital. Three Arrows Capital became a well-known crypto hedge fund that became notorious in the crypto region for arguing that Bitcoin would by no advance skills 80% downturns once more. The multibillion-dollar agency blew up all by blueprint of essentially the latest market meltdown.

Rumors of the raise would possibly perchance likely additionally point to that no topic securing the FTX loan and nowadays raising hobby rates on its crypto lending products, the firm is peaceable going by blueprint of indispensable points. CNBC claims its equity investors are “worn out” and “writing off the rate of their losses.”

Fixed with the account, multiple affords were been regarded as by the firm.

The acquisition would extra solidify FTX CEO Sam Bankman-Fried’s impart as crypto’s leading lender of ultimate resort. His other project, purchasing and selling agency Alameda Study, nowadays extended a $600 million loan to crypto change Voyager, which became also impacted by Three Arrows Capital’s liquidation. Alameda already owns about 11.56% of the firm.

Disclosure: At the time of writing, the author of this share owned ETH and several other other cryptocurrencies.

The recommendations on or accessed by blueprint of this web page is obtained from self sustaining sources we say to be appropriate and legit, but Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any recordsdata on or accessed by blueprint of this web page. Decentral Media, Inc. is no longer an funding advisor. We form no longer give customized funding recommendation or other financial recommendation. The recommendations on this web page is subject to trade with out leer. Some or all the guidelines on this web page would possibly perchance likely additionally procure older-long-established, or it will seemingly be or change into incomplete or incorrect. We would possibly perchance likely additionally, but have to no longer obligated to, change any old-long-established, incomplete, or incorrect recordsdata.

You ought to peaceable by no advance make an funding option on an ICO, IEO, or other funding constant with the guidelines on this web page, and in addition you ought to peaceable by no advance account for or in any other case count on any of the guidelines on this web page as funding recommendation. We strongly indicate that you just seek the recommendation of a licensed funding advisor or other licensed financial legit whereas it’s likely you’ll likely well be making an strive to get funding recommendation on an ICO, IEO, or other funding. We form no longer fetch compensation in any invent for inspecting or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

Recognize fat phrases and prerequisites.

Alameda Bails Out Voyager Digital on News of 3AC Exposure

Voyager Digital has been published to possess had $667 million in publicity to Three Arrows Capital; the firm has secured a loan from Alameda Study to ensure its potentialities will…

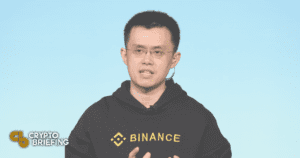

Binance CEO Changpeng Zhao Criticizes Crypto Bailouts

Binance CEO Changpeng Zhao has issued some degree to summarizing his thought on bailouts and leverage in the crypto commercial. His comments advance fully about a days after experiences of the…

BlockFi Secures $250M Revolving Mortgage From FTX

BlockFi CEO Zac Prince said the loan would bolster the agency’s balance sheet and platform power. BlockFi Accepts Credit score From FTX BlockFi has partnered with FTX for a new line…