- BlockFi: A Rapid Company Bio

- Why Did BlockFi Plug Bankrupt?

- BlockFi and SEC Fines:

- The BlockFi Team

- How Mighty Cash has BlockFi Raised?

- How Does BlockFi Salvage Cash?

- Where Did Issues Plug Inaccurate for BlockFi?

- How fabricate I salvage in contact with BlockFi Buyer Carrier?

- Is BlockFi insured?

- Final Thoughts: What’s Subsequent for BlockFi

BlockFi became once a cryptocurrency-centered wealth technology platform that equipped a chain of products, such because the BlockFi bank card, a BlockFi custodial wallet, and a cryptocurrency hobby fable.

The firm at first assign launched with a cryptocurrency hobby fable product, offering round 4.5% APY on BTC and as a lot as 9.5% on stablecoins. They save apart this offering on ice in February 2022. Upon paying $100 million in fines to the SEC and 32 states, BlockFi ceased all BlockFi Hobby Tale offers to lift its industry internal the Investment Company Act of 1940.

As modified into sure after BlockFi declared monetary catastrophe in November 2022, BlockFi had embroiled itself in an superior interdependent monetary relationship with now-bankrupt FTX earlier in the 365 days. It became once one of many cryptocurrency hobby accounts to elaborate bankrupcy.

BlockFi: A Rapid Company Bio

BlockFi became once a privately-held NYC-primarily based lending platform based in 2017. BlockFi’s flagship product became once the BlockFi Hobby Tale (BIA), which allowed customers to carry out compound hobby on cryptocurrencies corresponding to BTC, ETH, LTC, USDC, USDT, GUSD, and PAXG.

All the intention throughout the BIA’s operation from 2017 to 2022, halted by the above-mentioned settlement with the SEC, BlockFi kept cryptocurrency deposits stable and consistently generated yield for its depositors, step by step shedding its charges in the approach. It also launched a slew of newest products, including the BlockFi bank card.

BlockFi garnered a popularity as one of many main and most-trusted cryptocurrency hobby accounts, namely, accepted amongst those focused on generating passive revenue.

BlockFi deposits weren’t FDIC-insured. These accounts weren’t speculated to be regarded as financial savings accounts they had been investment accounts with a explicit dangers.

Why Did BlockFi Plug Bankrupt?

Although BlockFi paused all customer deposits into its hobby-bearing fable, it persisted lending operations.

In Can also simply 2022, BlockFi loaned $680 million to Alameda Analysis, FTX’s affiliated hedge fund.

Following subsequent the cryptocurrency shatter, one of BlockFi’s largest debtors, Three Arrows Capital, collapsed– 3AC had taken a virtually $200 million loss in the Luna debacle.

BlockFi, in dire straits, managed to carry out a $400 credit facility from FTX in July 2022, which also integrated an possibility for FTX to aquire the firm in due direction for as a lot as $240 million.

BlockFi rapidly stumbled on itself in an superior incestuous relationship with being owed money by Alameda Analysis (FTX’s affiliate hedge fund) and owing FTX $275 million from the July bailout.

BlockFi became once also using the FTX alternate to alternate cryptocurrencies– and had $355 million of its crypto (i.e., particular person funds) locked up when FTX filed for monetary catastrophe in November 2022.

In November 2022, BlockFi filed monetary catastrophe, claiming it owes money to over 100,000 creditors; it also sold half of its cryptocurrency resources, entering monetary catastrophe with $256.5 million money on hand.

As well to the over 100,000 customers with funds locked in BlockFi, some of BlockFi’s largest creditors encompass:

- West Realm Shires Inc., (the correct title for FTX US): $275 million unsecured verbalize,

- the Securities and Exchange Commission (SEC): $30 million unsecured verbalize.

- Ankura Have confidence Company: a $730 million unsecured verbalize.

BlockFi and SEC Fines:

The gripe with BlockFi’s Hobby Tale largely revolved round:

- The consensus is that the BIA’s are actually securities, and the firm hadn’t registered them.

- An inadequate disclosure of threat in scheme and advertising reproduction

- BlockFi issuing securities to boot to retaining more than 40% of its total resources in investment securities (corresponding to loans of cryptocurrency resources to institutional debtors).

BlockFi’s parent firm settled, agreeing to pay a $50 million penalty to the SEC, quit its offers and sales of the unregistered BlockFi Hobby Tale, and strive to lift its industry internal the provisions of the Investment Company Act internal 60 days. BlockFi currently owes the SEC $30 million.

BlockFi paid an further $50 million in fines to 32 states.

BlockFi also presented it intends to register the provide and sale of a brand contemporary lending product beneath the Securities Act of 1933. The contemporary product has no longer but been registered nor disclosed.

The elephantine press birth from the SEC could maybe even be stumbled on right here.

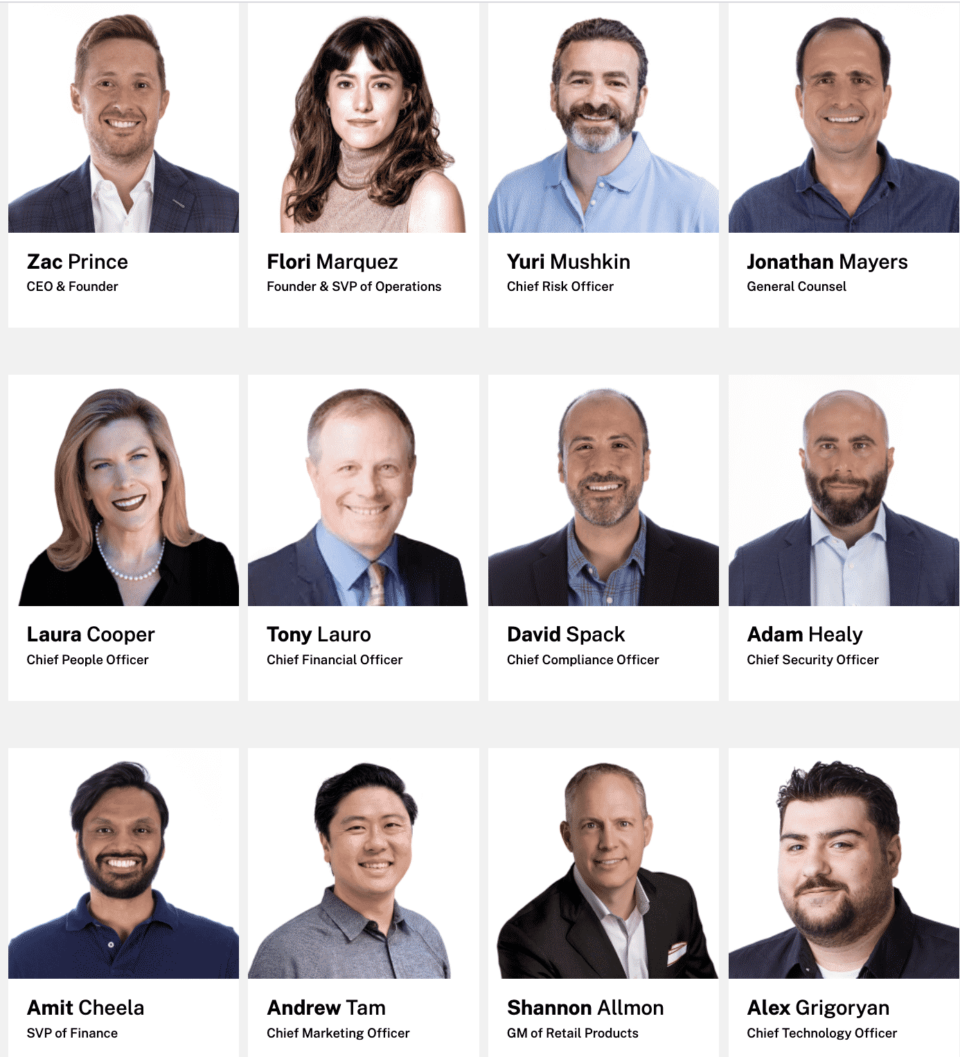

The BlockFi Team

BlockFi’s management crew has many years of abilities in the faded monetary providers and products and banking world. The firm claims to elevate a conservative approach to regulation that can assign of abode it for sustainable long-time frame boost and growth.

Founder & CEO, Zac Prince has management abilities at more than one a hit tech corporations. Before starting up BlockFi, he led industry pattern groups at Orchard Platform, a dealer-vendor and RIA in the safe lending sector, and Zibby, an net particular person lender.

Co-Founder & VP of Operations Flori Marquez has abilities managing substitute lending products. She helped form and scale a $125MM portfolio for Bond Boulevard (got by Goldman Sachs) as Head of Portfolio Administration. She managed all operations, including point of origination, default, and litigation.

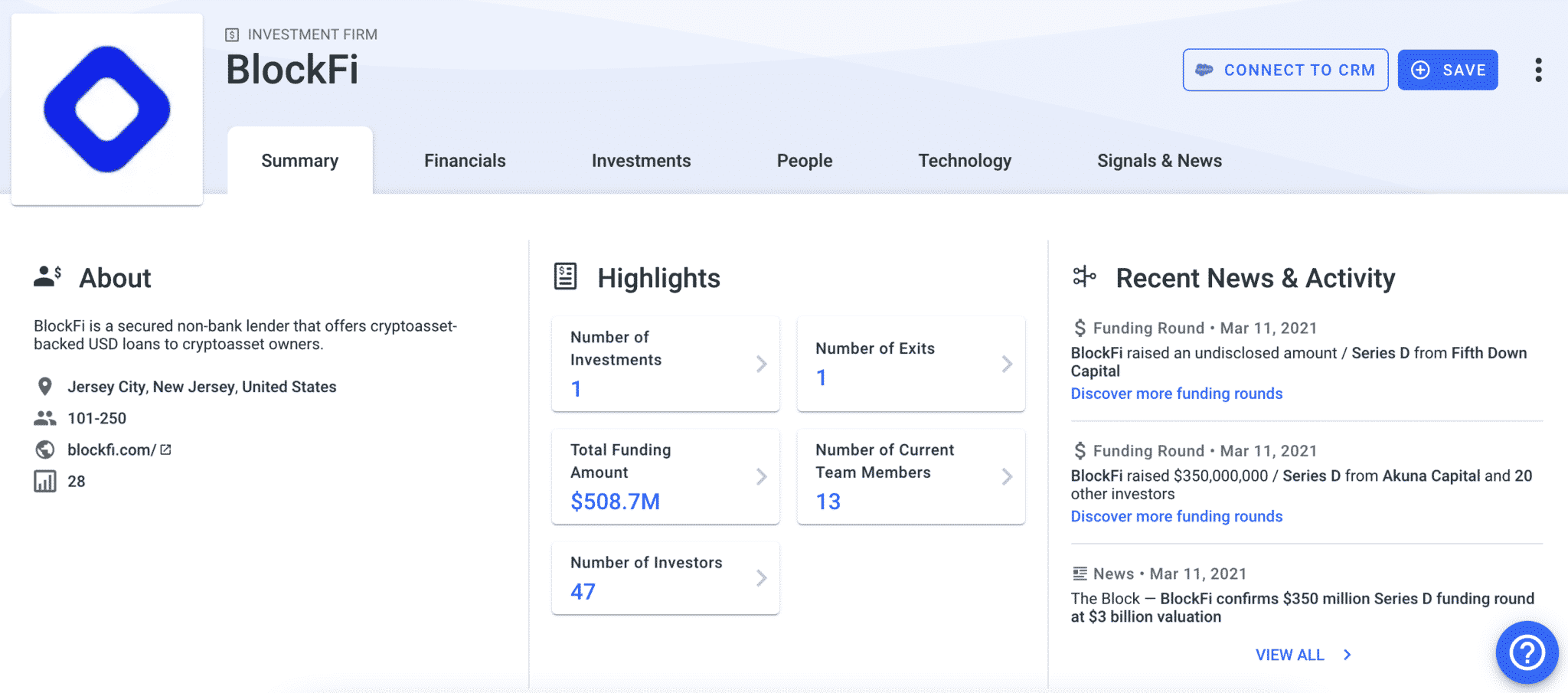

How Mighty Cash has BlockFi Raised?

BlockFi raised a total of $508.7M, valuing the younger firm at $3 billion. BlockFi’s revenue has grown 10x all over the last 365 days, inserting it heading in the correct path to attain $100M in revenue over the following 365 days. With over $1.5B in resources on the platform, and a 0% loss fee correct through its lending portfolio, BlockFi has made a solid case for organising itself as a dominant entity in the overarching rising FinTech space.

BlockFi raised its lion’s half of funding in a $350M Sequence D, led by contemporary customers corresponding to Bain Capital Ventures, Pomp Investments, Tiger Worldwide, and partners of DST Worldwide. In an announcement, BlockFi basic it plans to use the influx of capital to explore further innovation in its product suite, flee contemporary market growth, and potentially fund contemporary acquisition opportunities.

BlockFi raised $50 million in its Sequence C led by Morgan Creek Digital, with collaborating customers corresponding to Valar Ventures, Winklevoss Capital, Kenetic Capital, CMT Digital, Fortress Island Ventures, SCB 10X, HashKey, Avon Ventures, Purple Arch Ventures, Michael Antonov, NBA player Matthew Dellavedova, and two college endowments.

Before its newest Sequence C, BlockFi raised $18.3 million in Sequence A funding led by the Peter Thiel-backed Valar Ventures with participation from Winklevoss Capital, Galaxy Digital, ConsenSys Ventures, Akuna Capital, Avon Ventures, Susquehanna, CMT Digital, Morgan Creek, and PJC.

BlockFi has also raised earlier rounds by SoFi and Purple Arch Ventures.

The crew notes that they predict raising further capital in due direction to facilitate persisted product pattern and immediate boost.

As of March 2021, the platform has over 265,000 retail and 200,000 institutional purchasers, with reported month-to-month revenue of $50m in 2021, in contrast to $1.5m month-to-month revenue in 2020.

How Does BlockFi Salvage Cash?

BlockFi’s former Hobby Tale became once a selection industry that makes money by borrowing capital at a obvious fee (the hobby charges it pays to customers) and lends it a increased fee (the hobby charges it offers for BTC/ETH/GUSD loans). A BlockFi weblog post notes that the firm primarily works with institutional counter-parties to offer them liquidity. These debtors consist of:

- Merchants and investment funds seeking arbitrage buying and selling opportunities in a fragmented market. They borrow cryptocurrency to conclude mispricing gaps between exchanges or dispersed markets. Margin merchants will borrow to fuel their buying and selling strategies.

- Over-the-counter (OTC) market makers that join customers and sellers that prefer no longer to transact over public exchanges, usually at a steep mark-up. These parties fill to lift cryptocurrency stock on hand to meet ask. Since proudly owning the cryptocurrency is very capital intensive and bears the dangers of impress volatility, OTC market makers will borrow from lenders corresponding to BlockFi to facilitate their desires.

- Diverse corporations that want an stock of cryptocurrency to offer their purchasers with liquidity. This class involves corporations corresponding to cryptocurrency ATMs that protect the bulk of their cryptocurrency resources in chilly storage and want some diploma of liquidity to feature on a each day foundation.

All the intention throughout the bulk of its operations, BlockFi became once regarded as a high-tier product, no no longer as a lot as in the cryptocurrency industry; it became once regarded as to be safe, and its govt crew pledged to lift particular person funds safe.

On the factitious hand, as rubber met the road, BlockFi had no selection nonetheless to block all potentialities from withdrawing their resources. A BlockFi book went as a ways as to name BlockFi “the antithesis of FTX,” citing its passe, fixed management, knowledgeable workers, and beautiful protocols and procedures, despite their firm’s involvement with FTX.

As of writing, all particular person deposits are silent locked on the platform.

When we at first printed this article in 2019, we interviewed a member of the BlockFi crew referring to numerous scenarios referring to the firm’s safety and industry model. The responses are kept in their accepted carry out below.

What happens if BlockFi will get hacked?: “Gemini is BlockFi’s predominant custodian and BlockFi doesn’t abet deepest keys straight. Gemini keeps the massive majority of its resources in chilly storage and is insured by Aon. Gemini is a licensed custodian and controlled by the NYDFS. They no longer too long prior to now obtained SOC2 Form 1 compliance audit from Deloitte for his or her custody solution. We assist customers to read more about Gemini’s security. “

What happens if a particular person fable is compromised?: “Since inception, BlockFi has no longer lost any customer funds. Within the event that a particular person’s fable is compromised, which our security protocols fill caught prior to now, we freeze the actual person’s fable for one week. Then, we behavior a Videoconference with the affected particular person to look at their identification. We are able to then trade their electronic mail address and password, so that they are able to gather management of their fable.”

What happens if with out note all americans defaults on their cryptocurrency loans?: “When we lend crypto resources to generate yield, now we fill an awfully thorough threat management and credit prognosis task. We finest primarily lend to sizable, properly-capitalized, institutional debtors, or to counter-parties inviting to post collateral and offer the flexibility to margin name them on a 24/7 foundation.”

“What that potential is, if we are lending $1M rate of BTC to Company XYZ, Company XYZ collateralizes the loan (on the total ~120%) by giving us ~$1.2M USD. If the loan had been to then enter margin name and the borrower became once unable to offer further collateral (default), we would use their USD collateral to aquire crypto.”

“Now we fill actively lent since January of 2018, including during more than one lessons of excessive volatility, with out any losses correct through our entire lending portfolio. BlockFi is sure by NDA’s to focus on terms of particular debtors/charges.”

How fabricate I salvage in contact with BlockFi Buyer Carrier?

For those that’d adore to contact customer support, you should attain them at [email protected].

Is BlockFi insured?

Is BlockFi FDIC insured? No. BlockFi claimed to use partner firm Gemini as its custodial service, and Gemini does fill its own insurance coverage for its deposits. When stated catastrophic even came about, zero customer funds had been reimbursed through any insurance coverage.

BlockFi Interview: How Did BlockFi Work?

Although the BlockFi Hobby Tale finest exists for prior potentialities, who even then aren’t ready with the design to add more funds, there are some lessons that could be received from the evolving cryptocurrency hobby fable area of interest. Excerpts are from our interview with the BlockFi crew, ahead of the SEC event mentioned above.

How is offering a 4.5% on BTC hobby fee sustainable?

“The hobby we are ready to pay is in response to the yield that we are ready to generate from lending, which straight correlates to the market ask in the space (I.e. what fee establishments are inviting to pay to borrow particular crypto resources, as it varies from asset to asset). We are sure by NDAs to focus on specifics (establishments, particular charges, and so forth).”

How about the 9% hobby fee on Stablecoins adore GUSD?

“We are ready to use stablecoin deposits to fund our particular person loans (moderate APR is ~10-13%) so we can fill ample money to pay increased hobby to GUSD / Stablecoin depositors.”

The BlockFi hobby fee is self-discipline to trade on a month-to-month foundation, could maybe you mask why right here is?

“Upcoming changes are presented on the total 1-2 weeks ahead of a brand contemporary month, giving purchasers huge be aware and time to prepare. The hobby we are ready to pay is a feature of the borrowing ask.

You can read more about why our charges are variable and the intention the lending market works right here and right here.”

What happens in the case of a BTC/ETH fork? Will a particular person’s steadiness be credited with the forked coin as properly?

“Gemini is our custodian and has all of the info about what happens in the case of a forked community. Please refer to their particular person settlement right here the assign you should read more about that.”

Final Thoughts: What’s Subsequent for BlockFi

In our preliminary evaluate, all of our indicators (history, crew, communication with give a boost to, and industry model evaluate) pointed to BlockFi being legit– which suggests it became once a legitimate firm and no longer a scam. On the factitious hand, despite no longer being an outright scam, its customers get themselves at a identical conclusion– with their funds out of attain. Some percentage of fund recovery is probably, nonetheless it unquestionably has silent been a disheartening endeavor for a complete lot of customers.

Any time your cryptocurrency leaves your laborious chilly wallets, it’s uncovered to a increased diploma of threat. If BlockFi or Gemini had been to abilities some catastrophic event, your cryptocurrency could maybe be at threat– and as evidenced above, these objects can occur to even the most seemingly legitimate corporations.

Editor’s Present/disclaimers: The above article isn’t investment advice. This evaluate is written for academic and leisure purposes. Enact no longer make investments the rest you should no longer fill ample money to lose, and talk with a licensed monetary advisor once you occur to’re drawn to cryptocurrency.

In no intention Leave out One other Change! Salvage hand chosen data & data from our Crypto Experts so that you should form skilled, knowledgeable choices that straight fill an label to your crypto profits. Subscribe to CoinCentral free newsletter now.