Cryptocurrency hobby accounts receive it that you might per chance also take into consideration to originate slightly passive earnings on digital resources fancy Bitcoin, Ethereum, and stablecoins fancy USDC and GUSD, and BlockFi vs. Coinbase is a frequent point of comparison.

BlockFi is considered a staple in the cryptocurrency hobby tale trade, whereas Coinbase boasts possible the loudest and strongest repute of the cryptocurrency exchanges.

Both platforms dabble in what the opposite specializes in– BlockFi provides the procuring for & selling of cryptocurrency, whereas Coinbase provides some modest hobby-producing suggestions for digital resources.

All things regarded as, which platform is more healthy particularly for your cryptocurrency hobby tale desires? The next BlockFi vs. Coinbase comparison evaluate will duvet hobby charges, payouts, and security.

By the stop of it, you’ll better understand BlockFi and Coinbase as companies, the cryptocurrency hobby tale niche, and which suggestions would perhaps well also simply or would perhaps well also simply no longer be factual for you.

For a fat person breakdown, investigate cross-test our BlockFi evaluate, Coinbase evaluate, and a high level thought of the correct cryptocurrency hobby accounts.

| BlockFi | Coinbase | |

| Reviews | BlockFi Review | Coinbase Review |

| Attach Form | Cryptocurrency Passion Memoir + Frequent Substitute | Cryptocurrency Substitute + Frequent Crypto Passion Memoir |

| Newbie Pleasant? | Yes | Yes |

| Cellular App? | Yes | Yes |

| Place shut/Deposit Programs | ACH, Wire Transfers, Crypto Deposits | Credit Card, Debit Card, Bank Switch, Crypto Deposits |

| Promote/Withdrawal Programs | Exterior Crypto Pockets, Bank Memoir | PayPal, Bank Switch, Withdrawal to Exterior Crypto Pockets |

| Readily accessible Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Link + Stablecoins | Bitcoin, Ethereum, Litecoin, and 58 extra |

| Firm Delivery | 2017 | 2012 |

| Web space | Discuss over with BlockFi | Discuss over with Coinbase |

Corporations Bios: How Place BlockFi and Coinbase Overview?

Coinbase used to be founded in 2012 by Brian Armstrong and Fred Ehrsam. The company depends in San Francisco, CA, and is truly the most popular cryptocurrency change in the US; it has about 56 million registered users and has over $200 billion resources below administration.

It no longer too long in the past IPOd on the Original York Stock Substitute and has a few $45 billion market cap, shopping and selling below $COIN.

BlockFi used to be founded by Zac Prince and Flori Marquez in 2017. The company purchased seed investments from ConsenSys Ventures and SoFi in 2018. BlockFi used to be valued at $3 billion all thru its closing round of funding, which used to be carried out in March 2021.

BlockFi has around 225,000 users and roughly $15 billion in resources below administration. Loads of vital names appreciate invested in the company, reminiscent of:

- Winklevoss Capital

- Bain Capital Ventures

- Pomp Investments

- Tiger Global

- CMT Digital

- Kenetic Capital

Feature #1: Crypto Passion Rates: BlockFi vs Coinbase APY?

Let’s preface this piece with a caveat and spoiler– BlockFi blows Coinbase out of the water for many APY since it used to be particularly created to be a cryptocurrency lending and borrowing platform. Coinbase began as an change, but appears to be extra and extra heat, but has yet to confirm, to the premise of launching its appreciate cryptocurrency hobby tale product. We are able to replace this piece as necessary in the long term.

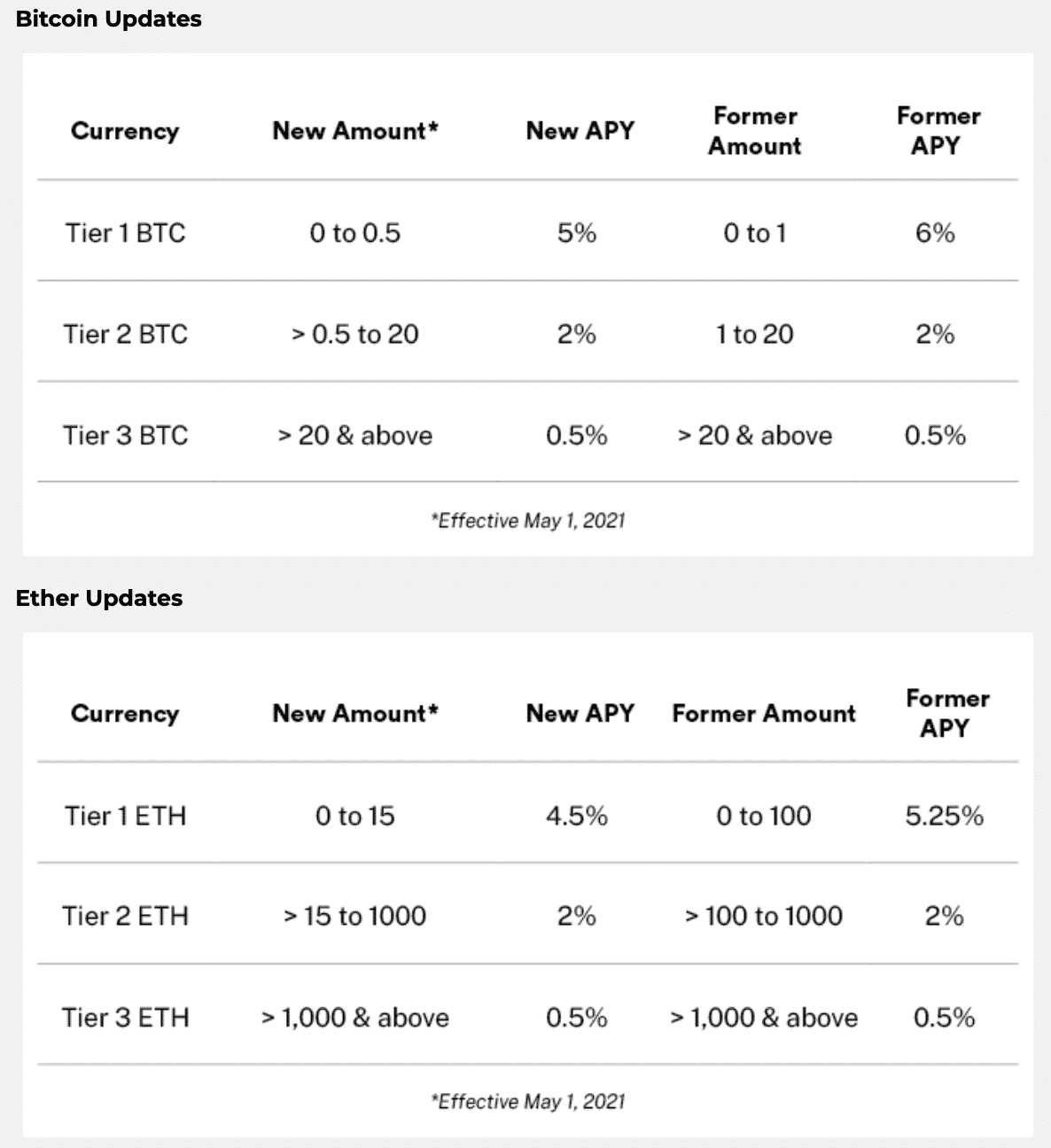

Bitcoin

BlockFi uses a tiered hobby system for bitcoin. Customers with between 0 and nil.5 BTC originate 5% APY. Folks who appreciate between 0.5 and 20 BTC originate 2% APY. And these with better than 20 BTC originate 0.5% APY.

BlockFi’s charges June 2021

Coinbase doesn’t supply any hobby for BTC saved on its platform as of the time of writing.

Ethereum

BlockFi provides 4.5% APY for an person’s first 15 ETH, 2% on an person’s first 1,000 ETH, and nil.5% APY on the relaxation beyond 1,000 ETH.

Coinbase provides ETH2 staking with an hobby charge of 6% APY. Then again, this requires users to lock their ETH precise into a natty contract. Customers can’t get entry to any ETH deposited into this contract except ETH strikes to its Proof of Stake model and the natty contract ends or Coinbase provides functionality to the contract that permits users to trade staked ETH for other resources.

Stable Coins

BlockFi provides 8.6% APY on USDC, GUSD, PAX, and BUSD, and 9.3% APY on USDT.

Coinbase is undoubtedly the creator of the stablecoin USDC, but it absolutely ultimate provides 0.15% on USDC. *unhappy trumpet sound*

Alt Coins

BlockFi provides 5.5% APY on LTC and 4.5% on LINK.

Coinbase provides staking for Cosmos and Tezos. The charge for these varies but would perhaps well also furthermore be as excessive as 7.5% APY.

How Place BlockFi and Coinbase Create Money?

BlockFi makes its money by borrowing funds for lower than it lends them out.

As an illustration, a BlockFi person can originate a maximum of 5% APY on Bitcoin that they deposit to the platform, however the company charges users around 9.75% for a USD loan.

BlockFi is a cryptocurrency lending platform– concentrate on it roughly fancy a aged bank. BlockFi’s loans are secured by the cryptocurrency that users appreciate deposited to the platform. It’s usually essential to build up a 50% loan-to-worth (LTV) ratio to build up a loan in factual standing. As an illustration, if you want out a loan of $10,000 with BlockFi, it is main to preserve a minimal of $20,000 in crypto on the platform to build up a 50% LTV ratio.

The menace here is that a sudden fall in crypto prices would perhaps well motive the LTV ratio to fall below 50%, and you might per chance possible must deposit extra crypto to come serve the loan to factual standing. Whenever you might per chance also’t make that, the company will liquidate your crypto at a time when the market is low, that would perhaps be an inconvenient loss for your cryptocurrency holdings.

Coinbase is an change, and it essentially makes its money by charging transaction prices at any time when users carry, promote, or trade cryptocurrency in its platform.

To get a better belief of how Coinbase makes money, we suggest taking a learn about its SEC Accumulate S-1, a file required of companies wanting for to be listed on a nationwide change by plan of IPO. This file alone provides a wealth of data on how Coinbase runs as a industry. BlockFi, on the opposite hand, is privately held and its revenue streams are extra opaque.

Feature #2: BlockFi vs. Coinbase Payouts and Withdrawals

Passion on BlockFi accrues day after day and is paid out monthly. The company provides one free crypto and one free, stable coin withdrawal monthly. It charges prices for every and every subsequent withdrawal in the same month.

Coinbase’s staking providers and products accrue hobby day after day. Then again, potentialities must wait an preliminary interval of 35 to 40 days sooner than withdrawing any of that hobby. After that interval is over, an person can receive withdrawals each and every three days.

Feature #3: Security: BlockFi vs. Coinbase

95% of BlockFi’s funds are held in frigid storage by its mother or father company, The Gemini Have faith Firm, which is regulated by the Original York Division of Monetary Products and providers. The Gemini Have faith Firm furthermore no longer too long in the past purchased recognition from Deloitte for its solid crypto storage practices.

Coinbase retail outlets about 98% of its potentialities’ resources in frigid storage as neatly. BlockFi provides FDIC insurance coverage for any USD funds up to $250,000, a federal security equipped to the immense majority of banks that build U.S. Greenbacks.

Then again, neither BlockFi nor Coinbase supply FDIC insurance coverage on their cryptocurrency resources, which is what you might per chance possible must deposit to be ready to attain basically the most of their hobby accounts. While each and every platforms dart to substantial lengths to give protection to person funds, your deposits are no longer assured or protected by federal insurance coverage.

Customers desires to be very mindful of their very appreciate security whereas the verbalize of these platforms. A hacker alongside with your log-in info can verbalize it to get entry to your tale and potentially withdraw your funds. Since here’s crypto we’re facing, transactions are usually irreversible.

Then again, BlockFi and Coinbase make supply extra measures to terminate this from happening, reminiscent of 2-ingredient authentication. 2FA is a aged second layer of security; it requires users to put up a confirmation code from either a text message or an authentication app sooner than any logging in or withdrawals can favor space.

BlockFi furthermore enables you to “whitelist” clear cryptocurrency addresses, which plan your cryptocurrency can ultimate be sent to these addresses and no others, except you dart thru an wide direction of of adding a brand original contend with and identifying yourself.

Coinbase provides a vault characteristic where users can retailer cryptocurrency they don’t conception on shopping and selling in “vaults”. Cryptocurrency placed in a vault can’t be eliminated for 72 hours after a withdrawal is initiated. This provides users time to answer to an unauthorized withdrawal attach aside a query to and receive their funds if one had been to favor space.

Feature #4: Ease of Employ

Both BlockFi and Coinbase are easy ample for a beginner to verbalize. The platforms are easy and don’t require any specialised crypto info to the immense majority of worth.

Every carrier furthermore has a cell app, which enables users to examine on their accounts whereas on the dart.

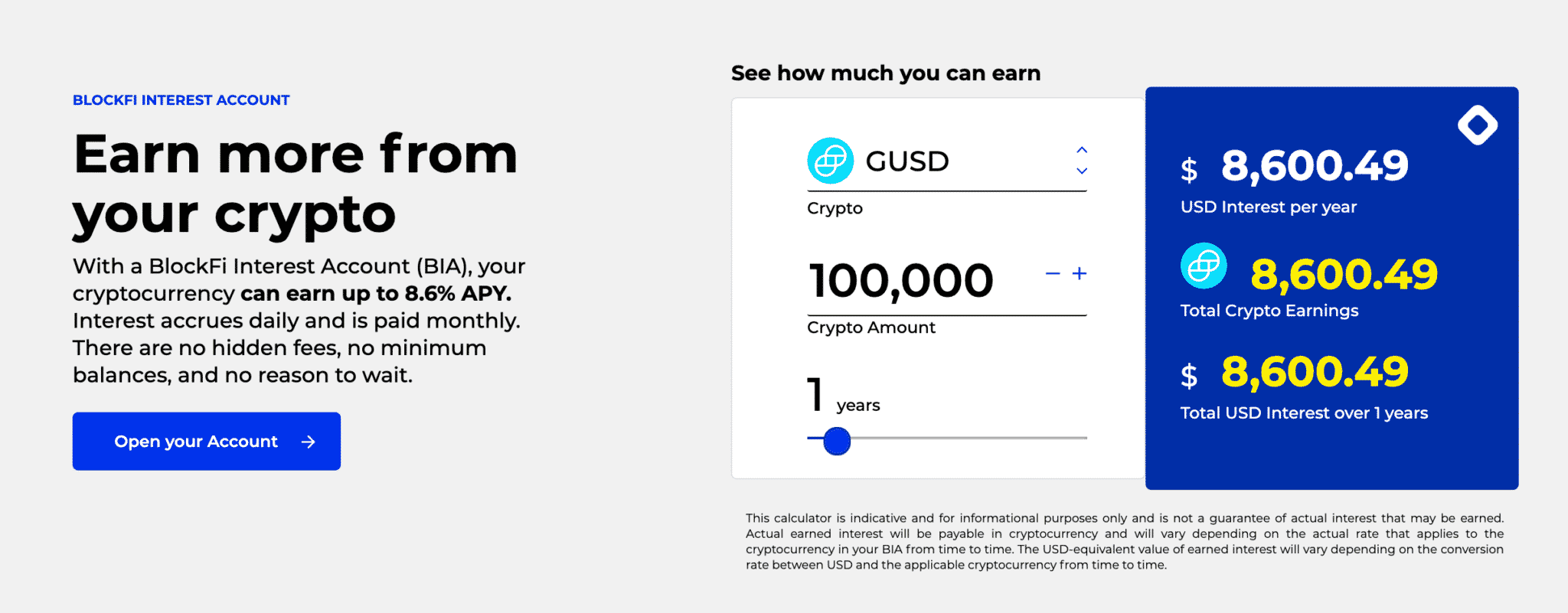

BlockFi stablecoin hobby tale

Both platforms enable for the depositing of fiat.

BlockFi would require any fiat deposits to be automatically transformed into GUSD, which straight begins accruing hobby at 8.6% APY per yr. There is not this sort of thing as a rate for this carrier. Customers can ACH deposit straight from fiat and claim up to a $250 bonus the verbalize of this hyperlink.

Coinbase enables you to deposit fiat, with which you might per chance also straight carry USDC with no rate. Bitcoin, Ethereum, and other cryptocurrency would perhaps well also furthermore be purchased with a transaction rate. Pro tip: verbalize Coinbase Pro (previously identified as GDAX) if you’re making are wanting at shopping other cryptocurrencies– simply receive an tale on Coinbase, deposit fiat, receive an tale on Coinbase Pro (it’s free), transfer the fiat, and carry a extra special broader diversity of crypto for extra special lower prices.

Feature #5: Standout Aspects

BlockFi’s standout characteristic is its upcoming cryptocurrency credit card. It has yet to be released, however the card will get users 1.5% serve, paid in bitcoin, on all purchases.

Coinbase’s standout characteristic is its companion carrier Coinbase Pro, which is supposed for additional experienced cryptocurrency traders. It provides lower prices on trades and provides users get entry to to extra cryptocurrency tokens.

The Court of Public Belief: BlockFi vs. Coinbase Reddit

Folks on Reddit are inclined to imprint BlockFi and Coinbase as complementary providers and products moderately than insist opponents.

It’s factual that BlockFi operates an change, but it absolutely ultimate enables users to carry a slight handful of cryptocurrencies and stablecoins. BlockFi’s main motive is to enable users to originate hobby on cryptocurrency and to borrow USD in opposition to their digital resources.

Coinbase, on the opposite hand, is essentially a platform that folks verbalize to carry cryptocurrency. It provides some staking opportunities but doesn’t present ample hobby for Bitcoin or stablecoins to compete with a platform fancy BlockFi– yet, a minimal of.

Many of us appreciate long past to Reddit for advice about whether they would well simply still verbalize Coinbase or BlockFi. Loads of the responses counsel that the person buys crypto on Coinbase and then transfers it to their BlockFi tale if they don’t conception on selling it or shopping and selling it anytime quickly.

Customer Help

BlockFi has an on-line FAQ page, an AI-powered chatbot, and live phone toughen from 9: 30 AM – 5 PM ET Monday thru Friday.

Coinbase furthermore has an on-line FAQ page. Then again, the company doesn’t at the moment supply live phone toughen. Instead, it provides users the chance to put up an e-mail attach aside a query to when they want aid with something.

Can You Have faith BlockFi and Coinbase?

BlockFi and Coinbase are two of basically the most relied on names in the cryptocurrency trade.

Both appreciate important rosters of neatly-known mission capital corporations, and Coinbase is the key cryptocurrency unicorn (worth over $1B) to IPO.

BlockFi’s security practices appreciate earned it a imprint of approval from Deloitte and the Original York Division of Monetary Products and providers.

Coinbase provides users up to $250,000 in FDIC insurance coverage on any USD funds that they retailer on the platform. The company furthermore says that it holds lower than 2% of its potentialities’ funds on-line with the relaxation being placed in frigid storage.

Coinbase says that it maintains insurance coverage for the cryptocurrency that it holds on-line as neatly. So usually the company will either build your cryptocurrency in an offline wallet where on-line hackers will appreciate an incredibly refined time reaching it or your cryptocurrency shall be held on-line and insured. This makes Coinbase very honest.

BlockFi vs. Coinbase: Which is the Better Crypto Passion Memoir?

BlockFi is a better cryptocurrency hobby tale platform than Coinbase; It provides extra special better hobby on Bitcoin, Ethereum, stablecoins fancy USDC and GUSD, and a diversity of altcoins.

To be honest, Coinbase isn’t truly a cryptocurrency lending or hobby tale platform, which is why BlockFi is undoubtedly a fat head and shoulders better for this direct verbalize case. Coinbase simply has some parts that enable depositors to originate a chunk of passive earnings on their deposits.

We’d speculate that providing better hobby charges on cryptocurrency isn’t too a long way away in Coinbase’s future, but that is factual our educated, but wild guess. To Coinbase’s credit, it’s a extra special extra extra special shopping and selling platform than BlockFi– it has a extra special broader diversity of cryptocurrencies and trade-leading security practices.

Most of us will money in on the verbalize of every and every Coinbase and BlockFi moderately than factual one or the opposite– Coinbase Pro to carry the cryptocurrency (as described above) and then BlocKFi for its hobby tale.

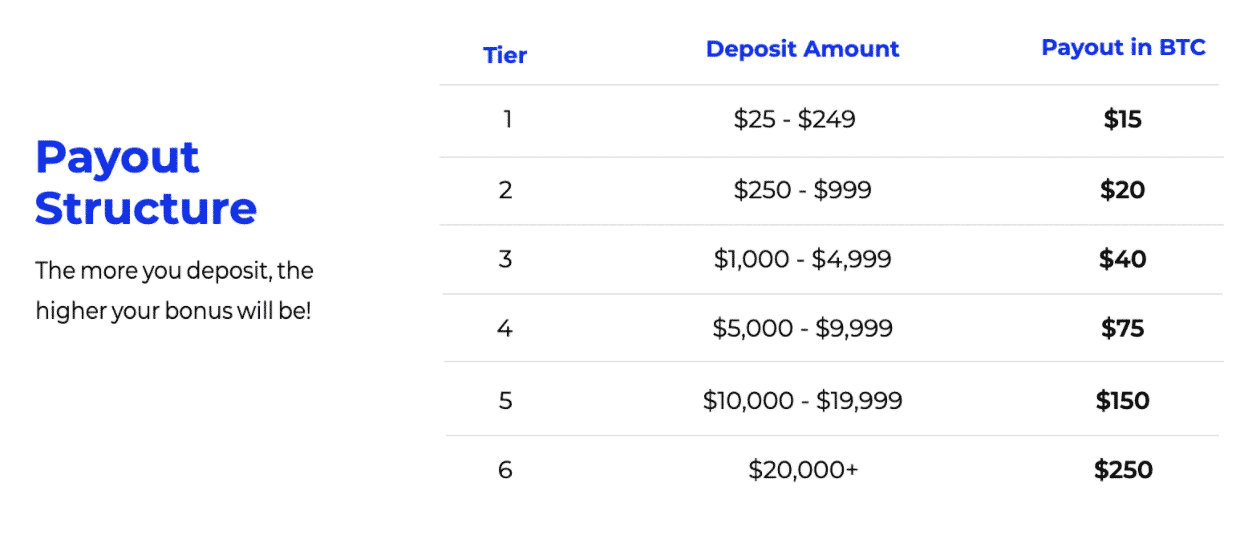

BlockFi and Coinbase appreciate signal-up bonuses:

- BlockFi’s signal-up bonuses are staggered by deposit amount: as minute as $25 will get you $15 in BTC, and $20,000+ will get $250.

- Coinbase provides a flat $10 if you carry or promote $100 on the platform.

BlockFI’s BIA signup incentives (source: BlockFi)

BlockFI’s BIA signup incentives (source: BlockFi)