BlockFi and Gemini Make are two stellar merchandise to judge while you’re taking a look to impact ardour for your cryptocurrency. For these original to the cryptocurrency ardour yarn home, it appears to be indubitably one of many industry’s handiest-saved secrets; by conserving digital sources take care of BTC, ETH, and USDC on a platform take care of BlockFi or Gemini will robotically impact you between 4% and 8.6% APY.

On the present time, we’ll be evaluating two main platforms: BlockFi vs. Gemini. Both is a correct fit for the day after day Joe taking a look to generate some profits from slothful money or traders diversifying their portfolios, but there are just a few nuances price brooding about.

A crypto ragged, Gemini launched in 2015 and is founded by the Winklevoss brothers. It gives its users a few merchandise, including yet every other take care of minded with 40+ cryptocurrencies, its crypto ardour yarn, Gemini Make, and its USD-backed stablecoin, GUSD.

With industry-main security certifications, Gemini is indubitably one of many safest places to alternate or correct let you money slothful and accrue ardour. Gemini recently surpassed $30bn of cryptocurrency below their custody, almost tripling their crypto-below-custody since 2021 began.

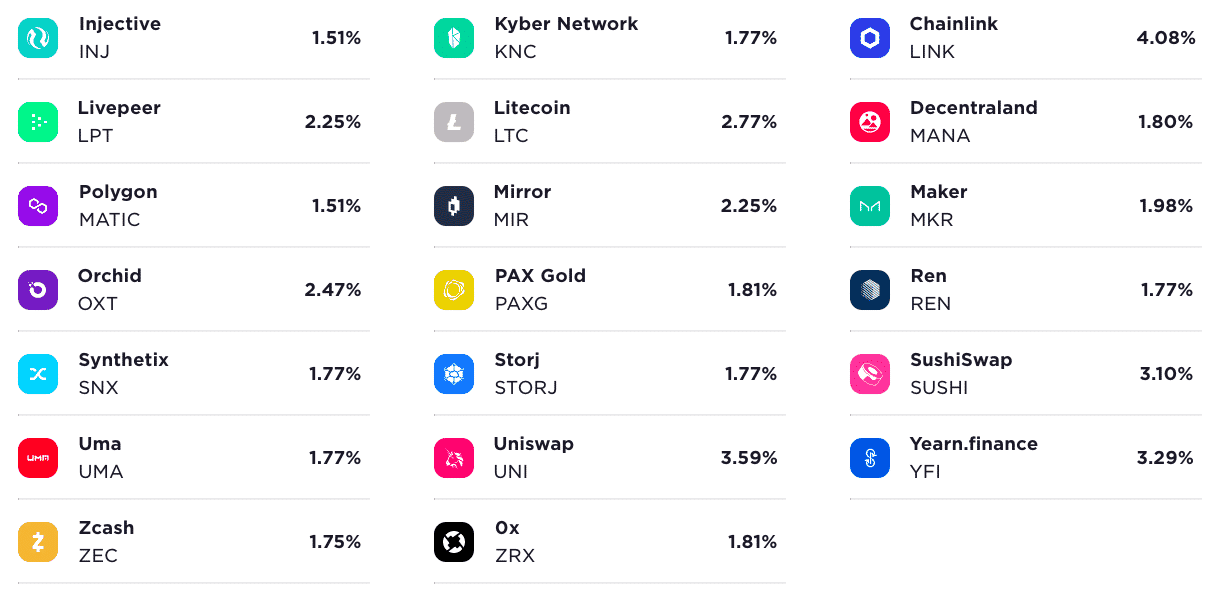

BlockFi launched in 2017 and has grown to alter into indubitably one of many perfect crypto ardour yarn services. BlockFi also gives crypto-backed loans, the put users can borrow USD-backed stablecoins at as low as 4.5% APY, a trading yarn, and a recently-launched cryptocurrency credit card.

BlockFi would be youthful in firm founding, but it undoubtedly precedes Gemini Make. It has over 225,000 users on its crypto ardour platform, and it’s undoubtedly no longer an underdog to its ragged counterpart. It raised $350 million in a Series D and is valued at $3 billion. BlockFi and Gemini are interlinked in a few concepts– BlockFi’s predominant custodian is the Winklevoss-owned Gemini Belief Co. LLC.

So. BlockFi vs. Gemini Make? Let’s detect.

BlockFi vs. Gemini Make: Key Data

| Item | BlockFi (Order BlockFi Review) | Gemini (Order Gemini Review) |

| Discipline | Sleek Jersey | Sleek York |

| Newbie-Pleasant | Yes | Yes |

| Cellular App | Yes | Yes |

| Accessible Cryptocurrencies | Bitcoin, Ether, 8 others | Bitcoin, Ether, 30+ others |

| Firm Beginning | 2017 | 2015 |

| Neighborhood Belief | Huge | Huge |

| Security | Huge | Huge |

| Buyer Toughen | Perfect | Huge |

| Costs | Low | Very Low |

Feature #1: Passion Rates: BlockFi Will pay Larger, Gemini Has Extra Range

First off, APY. BlockFi gives a tiered ardour constructing on predominant money take care of BTC and ETH. BlockFi gives 8.6% APY for the Gemini buck, GUSD, and the same stablecoins, capping at 9.6% APY for Tether’s USDT.

Right here’s what BlockFi ardour fee offerings look take care of.

| Forex | Quantity | APY |

| BTC (Tier 1) | 0 – 0.5 | 5% |

| BTC (Tier 2) | > 0.5 to 20 BTC | 2% |

| BTC (Tier 3) | > 20 BTC and above | 0.5% |

| LINK | > 0 | 4.5% |

| ETH (Tier 1) | 0 to 15 ETH | 4.5% |

| ETH (Tier 2) | > 15 to 1000 ETH | 2% |

| ETH (Tier 3) | > 1,000 ETH and above | 0.5% |

| LTC | > 0 | 5.5% |

| USDC | > 0 | 8.6% |

| GUSD | > 0 | 8.6% |

| PAX | > 0 | 8.6% |

| PAXG | > 0 | 4% |

| USDT | > 0 | 9.3% |

| BUSD | > 0 | 8.6% |

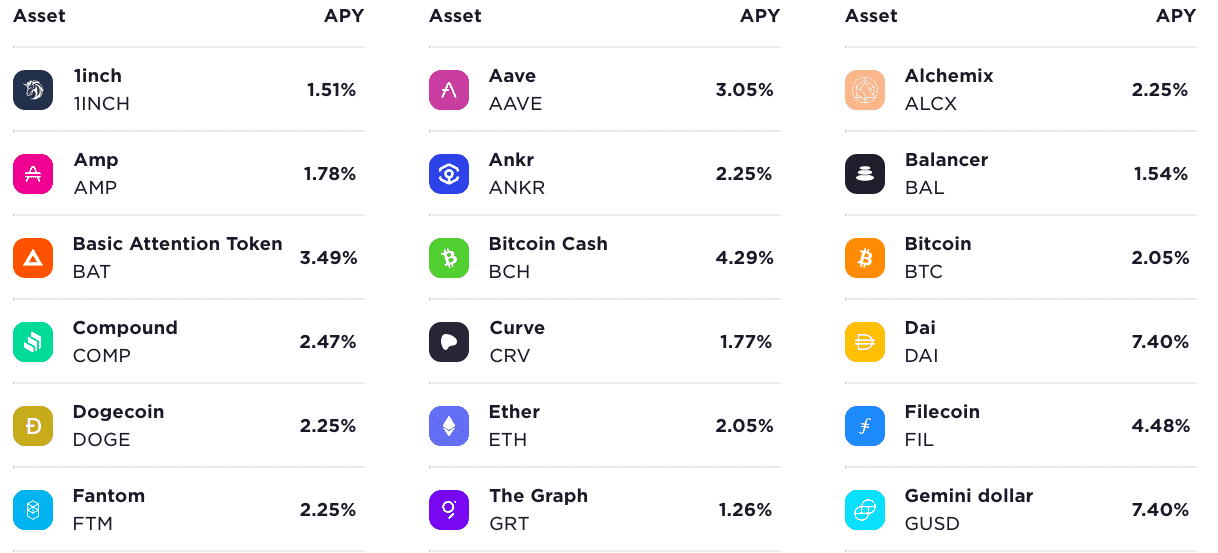

On Gemini, you impact a mounted 2.05% APY for BTC and ETH and ranging ardour rates for 30+ altcoins and stablecoins.

Their ardour constructing is as follows:

Gemini’s APY rates. Source: Gemini

BlockFi has the edge for below 0.5 BTC and mostly all other tokens, even beating out Gemini’s rates for its gather stablecoin, GUSD.

How attain BlockFi and Gemini Fabricate Cash?

BlockFi makes money by borrowing capital at a tell fee (the ardour it gives users) and then loaning that capital at a increased fee by offering BTC/ETH/stablecoin loans (at a increased ardour) to institutional debtors. This gives debtors liquidity without promoting their crypto sources.

The platform performs credit assessments of its debtors and is identified for more conservative lending concepts. It stores crypto reserves (which fund users’ withdrawals) with its predominant custodian, Gemini Belief. Courtesy of Gemini have faith, most funds are held in offline frigid storage moderately than sizzling wallets. Fiat funds are FDIC insured as a lot as $250,000.

BlockFi’s 50% Mortgage-to-Cost (LTV) requirement procedure that debtors have to comprise holdings of no longer decrease than 2x the amount they borrow, which BlockFi holds as collateral.

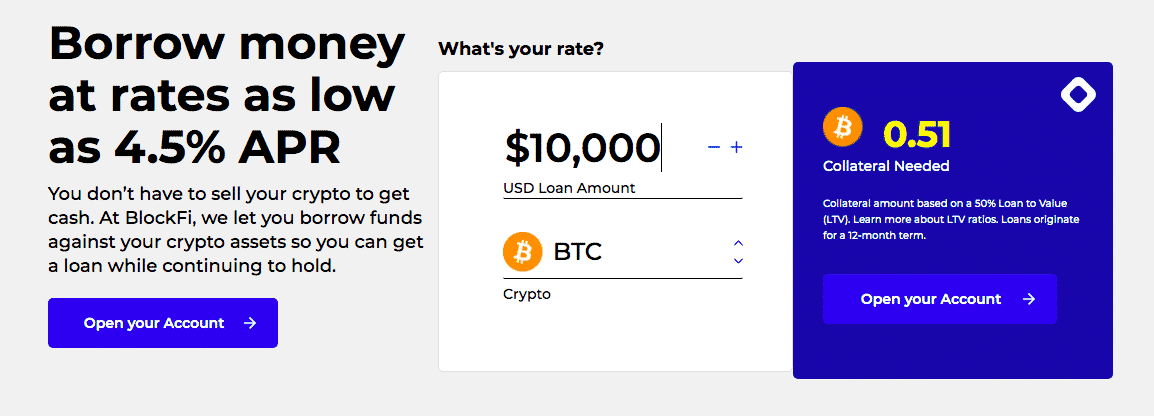

Like BlockFi, Gemini Make makes its money by loaning yours. The well-known contrast right here is that the put BlockFi has taken steps to be obvious it will return loaned sources, Gemini gives its loans collateral-free, selecting as a replacement to gather a threat review on its company creditors and shriek users to whom it lends their funds.

Gemini is certain on the dangers of this of their Terms.

Gemini’s pockets and alternate are just a few of the safest in the industry, and it gives over $200 million price of insurance coverage for person funds. Alternatively, this protection does no longer translate to Gemini Make. As clearly acknowledged above, Gemini does no longer insure sources no longer in its custody. So the 2d your satoshis leave Gemini to its creditors, they’re up in the air.

BlockFi’s LTV collateral diagram discourages loan defaults (defaulters can’t totally abscond without a longer decrease than 2x their loan held in BlockFi). Serene, Gemini has no longer disclosed any the same constructing for conserving their crypto loans.

That acknowledged, Gemini is moderately selective of the entities that borrow from it. It handiest loans to its accredited company debtors and performs complete background assessments, threat assessments, and original asset evaluations on them. It currently handiest one creditor—Genesis Global Capital.

It’s price noting cryptocurrency ardour accounts pose a particular threat, making them very a few from faded savings accounts. By the utilization of a platform take care of BlockFi or Gemini, you is at possibility of be consenting to your sources to be loaned without the protection of fiat rules. Crypto deposits can’t be FDIC insured, and crypto ardour is no longer threat-free.

We give Gemini the edge on security attributable to it being incredibly selective to who it loans cryptocurrency.

Feature #2: Payouts and Withdrawals

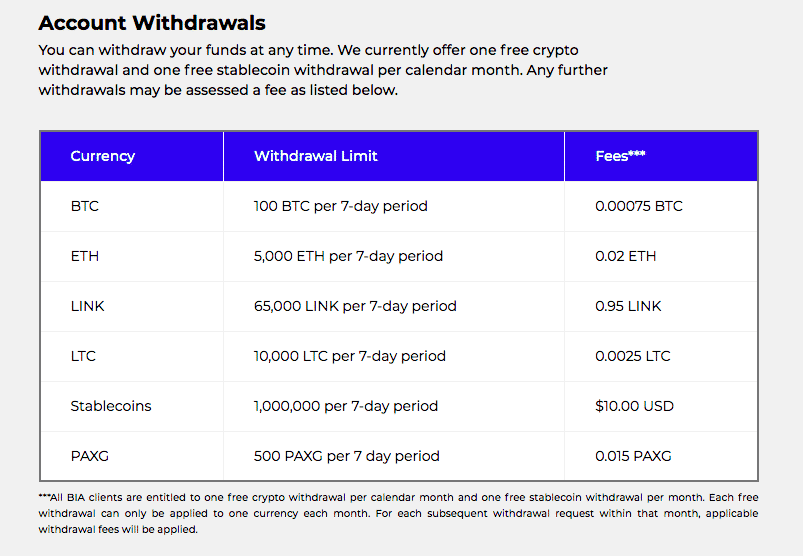

BlockFi gives one free withdrawal a month, after which withdrawals entice a rate and comprise a restrict. Right here’s what that appears take care of.

BlockFi’s withdrawal limits. Source: BlockFi

BlockFi ardour is paid before the entirety of every month.

In contrast, deposits you are making thru Gemini Make would be known as help at any time and can also simply amassed be readily accessible at this time at no withdrawal rate. Passion is compounded each day.

Gemini wins right here attributable to its flexibility.

Feature #3: Security

BlockFi’s funds are handiest as stable as Gemini Belief, and by industry requirements, that’s rather stable. Gemini holds 95% of BlockFi’s sources in frigid storage wallets insured by Aon and 5% in insured sizzling wallets. To boot to, US dollars on Gemini are FDIC-insured as a lot as 250,000 per particular person.

Alternatively, fund security isn’t the entirety. On Might perchance perchance additionally simply 19th, 2020, BlockFi offered, by strategy of an email to its customers, that a breach had happened the old week on Might perchance perchance additionally simply 14th. No shopper funds are believed to had been stolen. The breach happened when a hacker won gather right of entry to to an employee’s phone and credentials, bypassing their two-component authentication (2FA) thru a sim-swapping assault.

Despite the reality that risky, Gemini has taken rather masses of steps to be obvious the protection of its platform. It’s miles a Sleek York have faith firm, undergoes frequent bank assessments, and is self-discipline to the cybersecurity rules by the Sleek York Department of Financial Services and products (NYDFS). Gemini has carried out SOC 1 Form 2 and SOC 2 Form 2 assessments and earned an ISO 27001 certification.

Feature #4: Promos and Bonuses

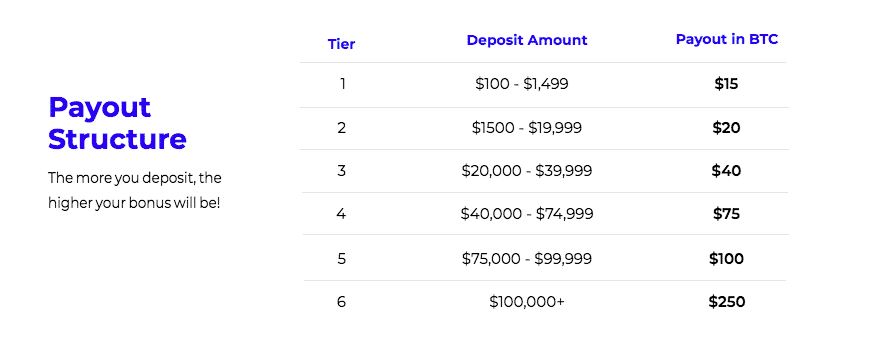

BlockFi gives original users between $15 to $250 when signing up with a accomplice link. Right here’s the tiered breakdown.

Gemini, on the opposite hand, gives original users $10 for signing up.

Winner: BlockFi: its promotion is more tantalizing but pays out more for every tier, but Gemini’s $10 bonus isn’t too shabby for the work tantalizing.

Standout Aspects: BlockFi and Gemini Both Magnify into Sleek Verticals

Both BlockFi and Gemini Make are beginner-friendly and accessible by strategy of internet and mobile apps.

BlockFi recently launched its BlockFi Credit ranking Card, which gives users 1.5% help in bitcoin on all purchases.

Gemini’s Gemini Pay allows users to pay the utilization of their cryptocurrencies in stores take care of Nordstrom, Bed Bathtub & Previous, Petco, and GameStop, amongst others. Gemini also offered its design to delivery a credit card in mid-2021.

The Court docket of Public Conception: BlockFi vs. Gemini Make Reddit

You would possibly perchance expend all day taking a look thru “BlockFi vs. Gemini” threads on Reddit, many skewing in either path. Despite the reality that most esteem its a few crypto offerings, Redditors are concerned that Gemini’s does no longer insure loans. Desire leans against BlockFi for its 50% LTV policy, and increased BTC APY.

Buyer Toughen

Both BlockFi and Gemini withhold a complete files scandalous that includes FAQs and the procedure in which-tos.

To this point, Gemini has stood out for above-life like customer provider; you would contact Gemini customer provider right here.

Our experiences with BlockFi customer pork as a lot as this level had been well above life like. You would possibly perchance contact them at [email protected].

Can You Belief BlockFi and Gemini Make?

Your funds are no longer as stable in BlockFi or Gemini Make as they’d be in a faded bank, which has FDIC insurance coverage. Regardless of this, BlockFi’s measures to guard your stacks are complete: from frigid storage and complete insurance coverage with Gemini Belief to its 50% LTV policy. It undoubtedly appears take care of BlockFi needs to withhold your funds as stable as that you just would believe.

Gemini has positioned itself at the forefront of crypto security with its platform regulated by NYDFS and licensed by Deloitte. Constant with concerns about fund security brooding referring to the ToS of Gemini Make, Gemini asserts that it vets its “relied on companions” thru a threat administration framework and consistently discloses them to users, so which institution has borrowed your funds.

Final Thoughts: Which is the Larger Crypto Passion Account– BlockFi vs. Gemini

BlockFi gives tiered trace-up bonuses, rather excessive APY (including that 5% APY on BTC and 8.6% on stablecoins), and it requires 50% LTV from its creditors.

Gemini is a paramount resolve in the cryptocurrency home and has performed a role in paving the methodology for pleasing regulation for cryptocurrency exchanges. The firm has labored with regulators in NYC, a city infamous for its demanding regulatory atmosphere. Its Gemini Make is a more fresh product, but it undoubtedly carries the load of the Gemini brand and group.

Indirectly, despite being a brand original firm, the BlockFi cryptocurrency ardour yarn is more ragged than that of Gemini. It has increased APYs, pleasing signup tier bonuses, insured offline frigid storage and sizzling wallets, and LTV safeguards for loans.

BlockFi and Gemini comprise parity of their security features, and with increased APYs, BlockFi is the easier cryptocurrency ardour yarn.

Alternatively, Gemini’s more in depth coin offerings attain give it a obvious inspire over BlockFi for holders of multiple and more imprecise digital sources. We recommend you researching additional into Gemini’s prospective creditors to search out out whether or no longer it’s price the threat.