A BlockFi vs. Hodlnaut comparability is one of a smartly-funded, respectable “blue chip” crypto ardour memoir staple versus an up-and-coming scrappy startup that has arguably held its weight with many top contenders within the dwelling.

BlockFi and Hodlnaut are every relatively attention-grabbing cryptocurrency ardour accounts; they offer merchandise that enable token holders to gain passive ardour on their crypto assets.

The next BlockFi vs. Hodlnaut evaluation will camouflage the differences between the APY differences, platform security, usability, customer carrier, and strange points of every platforms.

Enter BlockFi, a Original Jersey-based mostly company founded in 2017 that has quick grown to market chief. With over $15 billion assets beneath administration, BlockFi presents customers up to 7.40% APY on DAI and GUSD and up to 4% APY on BTC and ETH. BlockFi has over 265,000 customers.

After a Sequence D in March 2021, the company is valued at $3 billion, having raised over $508.7M from over 45 traders.

In inequity, Hodlnaut is a puny bit more contemporary to the crypto ardour block. The Singapore-based mostly company used to be founded in 2019 and raised about $100,000 in funding from a single pre-seed funding round (it raised the funds from Antler, a venture capital and early-stage accelerator firm. Hodlnaut has over $500M in AUM from about 5,000 customers.

Hodlnaut customers can gain up to 7.46% APY on BTC and ETH, up to 8.32% on DAI, and up to 12.73% APY on USDT and USDC. It helps six cryptocurrencies and has indicated it plans to add enhance for more within the long term.

So, BlockFi vs. Hodlnaut? Let’s explore.

BlockFi vs. Holdnaut: Key Files

Item |

BlockFi |

Hodlnaut |

| Situation | Original Jersey | Singapore |

| Newbie-Friendly | Certain | Certain |

| Mobile App | Certain, on Android and iOS | Certain, on iOS |

| Within the market Cryptocurrencies | BTC, ETH, LINK, LTC, GUSD, PAX, PAXG, USDT, BUSD, DAI, UNI, BAT | BTC, ETH, DAI, USDT, USDC, WBTC |

| Company Open | 2017 | 2019 |

| Community Trust | Immense | Sexy |

| Security | Immense | Immense |

| Customer Enhance | Sexy | Immense |

| Fees | Low | Low |

| Studies | Read our BlockFi evaluation | Read our Hodlnaut Evaluate |

| Situation/Promotions and Signup Bonuses | Discover up to $250 by signing up for and depositing up to $100,000+ into a BlockFi memoir. | Discover up to $20 by signing up for and depositing up to $100 into a Hodlnaut memoir. Customers can then gain up to $300 by making referrals. |

Characteristic #1: Passion Charges — Who Has Better APY, BlockFi or Hodlnaut?

Bitcoin

Both BlockFi and Hodlnaut offer tiered rates on BTC. On BlockFi, customers can gain:

- 4% on <0.25 BTC

- 1.5% on <5 BTC

- 0.25% on >5 BTC

Holdnaut presents vastly more competitive rates:

- 7.46% on <2 BTC

- 4.08% on <8 BTC

- 2.02% on <90 BTC

- 1% on 100+ BTC

Ethereum

BlockFi offers:

- 4% on 0 – 5 ETH

- 1.5% on 5 – 50 ETH

- 0.25% on >50 ETH

Again, Hodlnaut’s APY choices are vastly better. Customers gain:

- 7.46% on <20 BTC

- 4.08% on <80 BTC

- 2.02% on 100+ BTC

Stablecoins

BlockFi customers can gain on six stablecoins: GUSD, DAI, USDT, BUSD, and USDC at up to 7.5% APY, and PAXG at up to 2% APY.

On Hodlnaut, customers can gain up to 12.73% APY on USDC and USDT and up to 8.32% APY on DAI.

Holdnaut customers can moreover gain up to 7.43% on WBTC, while BlockFi customers can gain on LTC, LINK, UNI, and BAT.

General, Hodlnaut delivers elevated rates across the board, even supposing BlockFI helps more tokens. When you happen to were taking a survey to gain to your LTC, to illustrate, you’d be better served taking a survey at BlockFi. It’s moreover crucial to expose that these ardour rates could fluctuate due to the persona of cryptocurrencies.

Winner: Hodlnaut. With solid rates across the board, Hodlnaut presents elevated APY at elevated margins to its customers. On the replacement hand, BlockFi presents a wider fluctuate of supported assets, even supposing its choices are soundless much less than these of Celsius and Gemini.

How Attain BlockFi and Hodlnaut Fabricate Money?

BlockFi makes money by offering institutional and consumer loans, while Hodlnaut makes loans to corporate entities. This works by taking loans from customers (the fervour rates they offer) after which using person assets as collateral to develop debtors with loans at elevated ardour.

BlockFi and Hodlnaut gain from the variation between the fervour they pay customers and the fervour they quiz from their debtors.

It’s helpful to expose that as crypto can now not be FDIC insured, crypto ardour accounts have a strange dwelling of risks. Earning ardour on crypto is now not the identical as maintaining fiat in a savings memoir.

Most crypto ardour accounts require collectors to stake collateral to fight the likelihood of borrower defaults. BlockFi is one such platform, requiring 50% loan-to-fee on all crypto-backed loans. Whereas managing over $15 billion in crypto, BlockFi has 0% losses across its lending portfolio and is regarded for safer lending practices.

In an interview with CoinCentral, Hodlnaut CEO, Juntao Zhu commented the following concerning the company’s lending habits:

Furthermore, the company puny print its task within the tournament that a borrower defaults:

Winner: BlockFi. Whereas it makes money the identical as Hodlnaut (even supposing the company does now not loan to customers) it moreover requires loans to be collateralized at now not much less than 50% LTV and has a history of practising protected lending systems.

Characteristic #2: Payouts and Withdrawals

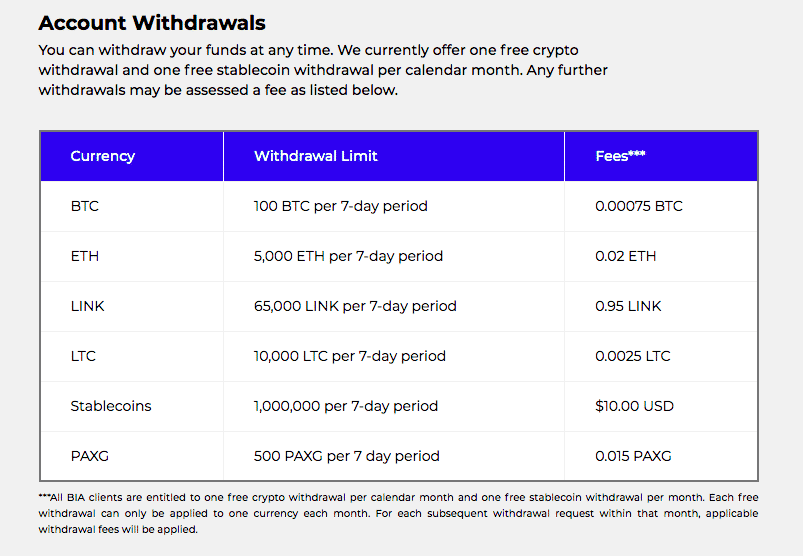

BlockFi customers receive ardour payouts every month, with one free stablecoin withdrawal and one free cryptocurrency withdrawal monthly. This withdrawal can simplest be utilized to 1 coin, and extra withdrawals entice a withdrawal price. BlockFi has withdrawal caps for every cryptocurrency. Right here’s what that appears to be like like:

BlockFi’s withdrawal limits. Source: BlockFi

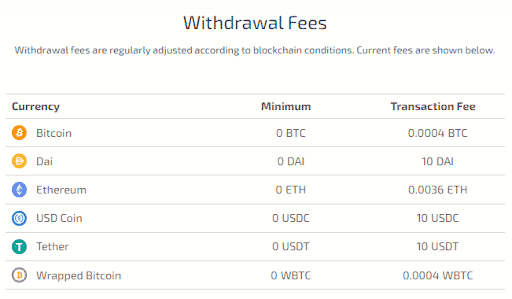

Hodlnaut customers can withdraw their crypto earnings (for a price) at any time, with a day-to-day cap of 100 BTC for accounts which had been verified thru finishing KYC requirements. When you’ve funded your memoir, you’ll delivery up incomes ardour directly. This ardour is paid every Monday.

Hodlnaut’s prices as of August 2021. Source: Hodlnaut.

Winner: BlockFi’s free stablecoin and mounted coin withdrawals, as smartly as their lower prices for withdrawing BTC, are all positives. On the replacement hand, with limitless withdrawals, no caps, and much lower withdrawal rates on ETH, Hodlnaut wins over BlockFi on this category.

Characteristic #3: BlockFi vs. Hodlnaut Security

Your assets held in BlockFi are simplest as protected as BlockFi’s predominant custodian, Gemini Trust. Gemini secures 95% of BlockFi’s AUM in chilly storage wallets insured by Aon and 5% in insured hot wallets. Furthermore, US greenbacks in Gemini Trust are FDIC-insured up to $250,000 per particular person.

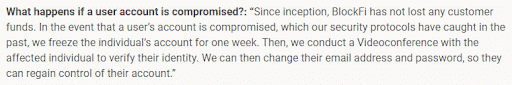

What happens within the future of a hack? BlockFi presented a security breach on its platform in Could most doubtless 2020. Purchasers misplaced no funds, and the hacker used to be ready to impact gain admission to to an employee’s phone and credentials, bypassing their two-narrate authentication thru a sim-swapping assault.

In an uncommon interview with CoinCentral, a BlockFi representative mentioned the following about its systems within the tournament of a security breach:

Holdnaut makes utilize of commerce-fashioned encryption and requires customers to dwelling up 2FA sooner than making withdrawals. Hodlnaut’s predominant custodian is Fireblocks, which holds assets in a combination of offline chilly storage and insured hot wallets, claiming that the full lot of a given person’s deposit is rarely within the identical space correct away.

Uniquely, Hodlnaut moreover presents customers the choice to have interaction insurance protection on their crypto thru a partnership with Nexus Mutual. This is notable as most platforms within the cryptocurrency ardour dwelling don’t offer insurance protection alternatives for person assets after being deployed (loaned.)

Since these ardour platforms are consistently lending and receiving deposits, funds are in constant motion, making them anxious to insure. Hodlnaut’s insurance protection with Nexus currently caps at $22M and is anticipated to develop because the companies impact traction.

Hodlnaut is certified by the Singapore Fintech Affiliation, which the Monetary Authority of Singapore recognizes. As of this writing, Hodlnaut is undergoing a license application to turn into the predominant regulated entity in Singapore’s crypto borrowing and lending dwelling.

Winner: BlockFi. A U.S. based mostly company with in depth security protocols every on its platforms and courtesy of its custodian, BlockFi has made many moves to securing its platform. On the replacement hand, its price noting that Hodlnaut’s now not mandatory Nexus Mutual insurance protection protection can present an additional level of security to Hodlnaut customers attracted to it.

Characteristic #4: BlockFi vs. Hodlnaut Ease of Spend

BlockFi is on the market by strategy of web and a mobile app that is directly available on Android and iOS.

Holdnaut is currently readily available by strategy of web and an iOS app released in mid-2021.

Winner: BlockFi. The platform is on the market by strategy of Android and iOS apps for customers who expend to manage their stack on the plod, and a web app for customers who expend a broad survey the least bit their assets. Even supposing Hodlnat’s iOS app has been launched, Android customers can simplest gain admission to the platform by strategy of its web app.

BlockFi vs. Hodlnaut: Bonuses/Standout Aspects

BlockFi moreover presents a trading memoir and a crypto bank card that customers can utilize to gain an infinite 1.5% cashback on every transaction, 3.5% aid in BTC within a customers’ first three months, and more rewards.

Hodlnaut’s Token Swap lets customers alternate currencies directly within the app. The platform helps WBTC, so customers can utilize the token swap feature to wrap and unwrap their BTC.

CoinCentral readers can gain up to $250 by signing up for and depositing up to $100,000+ into a BlockFi memoir, and up to $20 when they signup to Hodlnaut and deposit up to $100. When you happen to refer a buddy, they’ll receive a $20 signup bonus after making a deposit equal to $1000.

Hodlnaut customers can moreover gain up to $300 if their referrals register using Hodlnaut’s iOS app, and gain 10% price on their referrals’ ardour. Hodlnaut bonus payouts are within the identical asset deposited.

The Court docket of Public Realizing: BlockFi vs. Hodlnaut Reddit / Customer Enhance

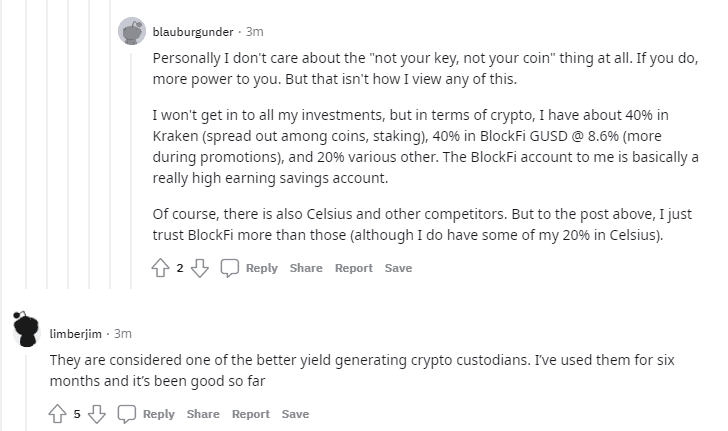

BlockFi has an above-moderate customer enhance and is appreciated in many Reddit opinions for its security procedures, stablecoin rates, and 50% LTV protection. BlockFi customer carrier can even be reached at [email protected].

Reddit opinions of Hodlnaut customer enhance are in general positive, and feedback on its APY choices are supportive across the board. You could contact Hodlnaut enhance by strategy of a enhance price or at [email protected].

Hodlnaut opinions on Reddit

Both companies retain FAQ pages.

BlockFi vs. Hodlnaut: Which is the Better Crypto Passion Fable?

BlockFi has been across the crypto ardour block. With a bigger target market, an over $3bn valuation, and 15bn AUM, it undoubtedly appears to be like prior to Hodlnaut relating to customer belief and company profile.

BlockFi presents a broader fluctuate of supported assets than Hodlnaut, which is soundless much less than the 40+ assets supported by competitors like Celsius and Gemini.

Despite this, Hodlnaut wins within the cryptocurrency ardour offering department, with up to 7.46% APY on BTC and ETH, as adverse to BlockFi’s 4%. Hodlnaut moreover wins with stablecoins, offering up to 12.73% APY on USDC, USDT, and BUSD.

Hodlnaut moreover has elevated rates on DAI (up to 8.32%) as towards BlockFi’s up to 7.5%, nonetheless doesn’t enhance GUSD, for which BlockFi presents 7.5% APY.

Hodlnaut boasts an spectacular fee proposition for its measurement: its customer carrier is impressively quick, and its insurance protection option is an quick strive to mitigate a couple of of the dangers that reach with cryptocurrency ardour accounts.

CoinCentral readers can gain up to $250 when signing up for BlockFi, and up to $20 when signing up for Hodlnaut.

BlockFi takes the lead within the BlockFi vs. Hodlnaut comparability for a couple of causes:

- BlockFi is a U.S.-based mostly company and is forced to work within the future of the confines of U.S. regulations, whereas Hodlnaut is primarily based in Singapore and must work within the future of the confines of its respective government. This is a subject of need, nonetheless must you’re one of our readers situated within the United States, BlockFi can be a better option.

- BlockFi has raised more venture capital money to make investments in a better product trip.

On the replacement hand, BlockFi must proceed to innovate its product to retain stagger with a snappy evolving crypto ardour memoir ecosystem.

As Hodlnaut grows, we can doubtless peep the product originate to enhance more assets and enhance points. On the replacement hand, Hodlnaut has worthy much less funding and, with over $500M in AUM, will inevitably must indicate more teach certifications to be responsible with person funds.

For a more detailed dive, we recommend studying our BlockFi Evaluate and Hodlnaut Evaluate.