Whenever you’re attracted to the moderately passive profits that can reach with crypto interest accounts, BlockFi vs. Linus makes for an very wonderful comparability.

Linus is a relative newcomer and BlockFi is among the most prominent avid gamers within the interest repute. Every company has a various spot of professionals and cons that allure to various types of patrons.

BlockFi is a primitive cryptocurrency interest narrative supplier. You deposit BTC, ETH, USDC, or other digital assets, and invent interest paid in-kind.

Linus, on the opposite hand, only enables users to deposit fiat (USD) and invent in fiat; it offers its users rep accurate of entry to to crypto interest-incomes opportunities without buying or conserving any crypto.

It’s value noting that crypto interest accounts are unlike savings accounts; they pose uncommon dangers equivalent to now not being FDIC insured. This overview will duvet the intellectual details of each and each companies and provide you with all of the knowledge you’ll want to settle whether BlockFi or Linus is fitter for you.

BlockFi vs Linus: Key Recordsdata

| BlockFi | Linus | |

| Stories | BlockFi Evaluate | Linus Evaluate (Added rapidly!) |

| Predicament Sort | Cryptocurrency Curiosity Story + Classic Commerce | Blockchain-essentially essentially essentially based high yield savings narrative |

| Beginner Pleasant | Yes | Yes |

| Cell App | Yes | In constructing |

| Steal/Deposit Potential | ACH, Wire Transfers, Crypto Deposits | Checking narrative transfer or debit card |

| Promote/Withdrawal Potential | Exterior Crypto Pockets, Financial institution Story | Checking narrative transfer |

| On hand Cryptocurrencies | Bitcoin, Ethereum, Litecoin, Link + Stablecoins | None |

| Firm Birth | 2017 | 2019 |

| Plan | Jersey City, NJ, USA | Brooklyn, NY, USA |

| Neighborhood Belief | Colossal | Aloof organising |

| Security | Colossal | Okay |

| Customer Help | Perfect | Perfect |

| Verification Required | Yes | Yes |

| Costs | Medium | Colossal |

| Predicament | Seek recommendation from BlockFi | Seek recommendation from Linus |

Firm Bios: How Form BlockFi and Linus Compare?

BlockFi changed into launched in 2017 by Zac Prince and Flori Marquez. The corporate has got investments from grand names love SoFi, Winklevoss Capital, Pomp Investments, and ConsenSys Ventures.

BlockFi for the time being has around 225,000 users with $15 billion assets below administration. The corporate got a $3 billion valuation when it performed its closing spherical of funding, which took insist in March 2021.

Linus is composed a pretty recent company. It performed a public beta and is for the time being preparing for a corpulent open. Linus changed into essentially based in 2019 by Matt Nemer and Matt Hamilton. Nemer beforehand labored at BTC Inc, whereas Hamilton beforehand labored at IBM.

The corporate doesn’t for the time being possess any investors. It’s composed within the pre-seed piece of its hiss and hasn’t disclosed how many of us participated in its public beta.

Feature #1: Crypto Curiosity Charges: BlockFi vs. Linus APY?

We possess now to open this piece by announcing that Linus doesn’t provide interest in crypto. Its focal point is to give users who don’t desire to recall and withhold crypto rep accurate of entry to to crypto-essentially essentially essentially based interest-incomes opportunities. As a replace, Linus offers its users a tiered APY structure on their USD. Beneath, we’ve supplied BlockFi’s crypto APY and Linus’ tiered APY rates.

Bitcoin

BlockFi makes teach of a tiered interest-rate machine for Bitcoin, in which the APY you invent relies on how many bitcoin you store with the corporate.

The corporate’s recent rates are:

- 5% APY for 0 to 0.5 BTC

- 2% APY for 0.5 to 20 BTC

- 0.5% APY for 20+ BTC

Ethereum

BlockFi makes teach of the a similar tiered-essentially essentially essentially based capacity for the Ethereum APYs that it offers. The corporate’s users are for the time being incomes the following rates of interest on ETH:

- 4.5% APY for 0 to 15 ETH

- 2% APY for 15 to 1,000 ETH

- 0.5% APY for 1,000+ ETH

Stablecoins

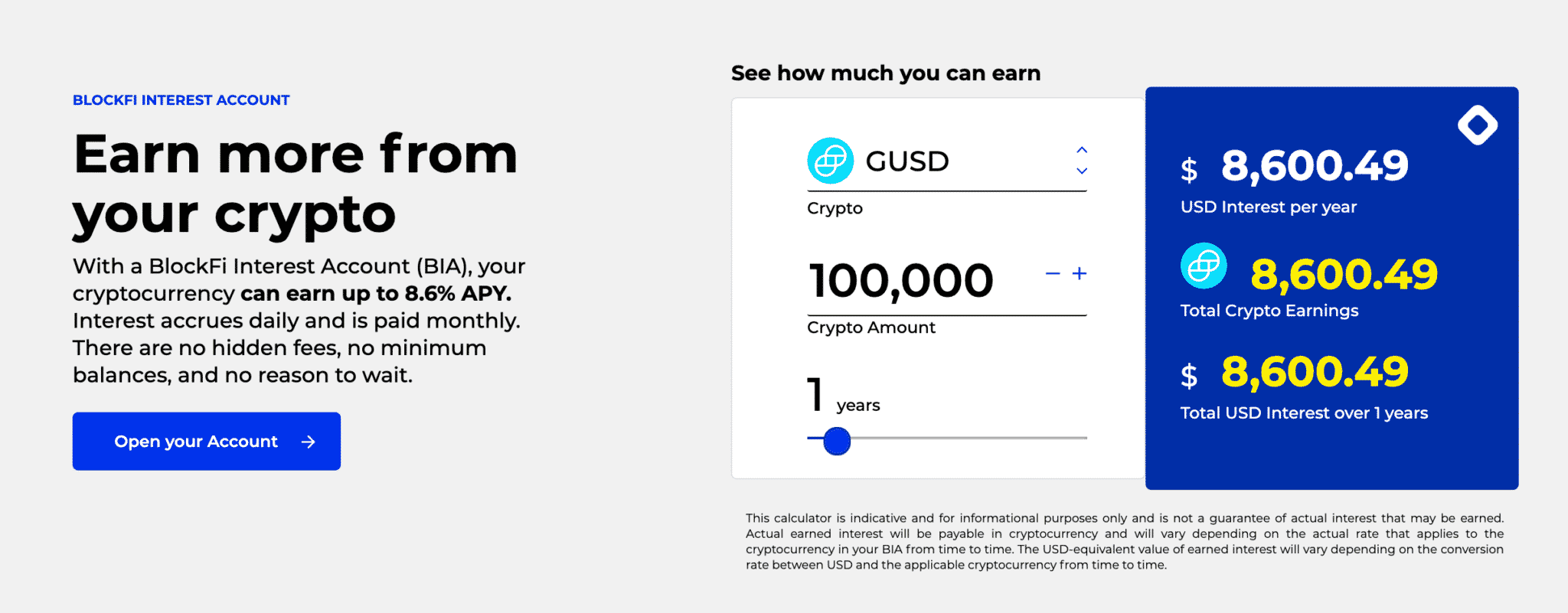

BlockFi’s only rates are reserved for stablecoins. The corporate offers 8.6% APY on PAX, BUSD, GUSD, and USDC. It offers 9.3% APY on USDT.

Altcoins

BlockFi also offers interest on a pair of altcoins. As an illustration, users can invent 5.5% APY on their LTC and 4.5% on their LINK.

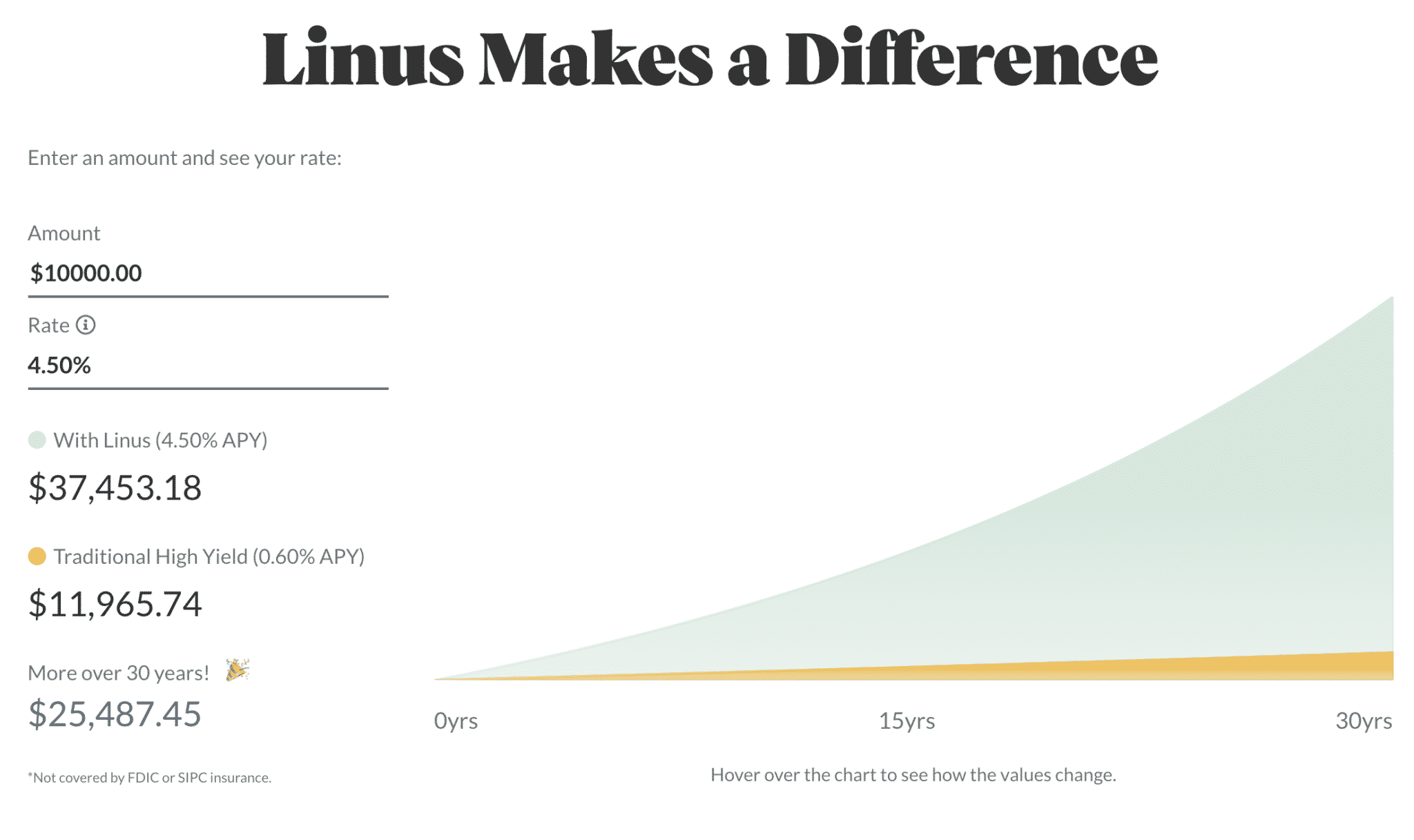

Linus APY Constructing

- 4.0% APY for $1.00 to $2,499.99

- 4.25% APY for $2,500 to $9,99.99

- 4.50% APY for $10,000+

How Form BlockFi and Linus Construct Cash?

BlockFi

BlockFi makes its money the a similar manner most primitive banks originate: it offers users lower rates of interest on their crypto than what it will get for lending it out.

As an illustration, BlockFi offers up to eight.6% APY on greenback-pegged stablecoins. Nonetheless users who desire a USD mortgage from the corporate have to regain an interest rate of 9.75%.

A person’s mortgage is backed by the market cost of the crypto that they’ve deposited into their BlockFi narrative. Due to this truth, users resolve on to withhold on the very least a 50% mortgage-to-cost (LTV) ratio to withhold their prominent loans in appropriate standing.

BlockFi stablecoin interest narrative

BlockFi stablecoin interest narrativeAs an illustration, an person that takes out a $10,000 mortgage with BlockFi needs to withhold $20,000 of crypto of their narrative to withhold the mortgage. If the complete cost of the person’s crypto drops below this point and they also don’t deposit extra, BlockFi will liquidate their holdings to pay attend the mortgage.

Crypto is an exceptionally volatile asset class; one would robotically desire to withhold an LTV of a lot increased than 50% to be on the protected aspect. On the opposite hand, chopping it too close may perhaps presumably also build you into a discipline where you’re compelled to liquidate your holdings for the length of a non permanent market dip.

Linus

Linus makes its money in essentially the a similar manner. The corporate’s users are given a spot interest rate on the money that they deposit into their accounts (above). Any excess APY that Linus can originate by providing liquidity in crypto protocols goes into its pockets.

Linus rates of interest over time

Linus rates of interest over timeLinus takes its users’ greenback funds, converts them into USDC, and then places these stablecoins into liquidity swimming pools on the Ethereum network. Crypto holders can borrow from these swimming pools by the teach of their crypto as collateral and paying an interest rate.

Offering liquidity in Ethereum clean contracts comes with uncommon dangers love impermanent loss.

Linus doesn’t provide detailed knowledge about its liquidity-providing practices or strategies to mitigate risk for its users, on the opposite hand it hasn’t disclosed its risk administration practices.

Both BlockFi and Linus invent their interest in moderately a similar strategies, however BlockFi will pay increased rates and is fitter established, so it wins on this category.

Feature #2: Payouts and Withdrawals

The crypto you deposit into a BlockFi narrative accrues interest day by day and may perhaps presumably pay interest monthly. As well, users rep one free crypto withdrawal and one free stablecoin withdrawal every month. Extra withdrawals incur a price.

The money you deposit into a Linus narrative accrues interest constantly and updates your narrative dashboard each and each six hours. Users are free to withdraw their funds and the interest that they’ve earned anytime they need, without any charges.

Linus supplies a higher buyer trip on this regard.

Feature #3: Security

BlockFi offers a pair of very wonderful security aspects for its users. The corporate stores 95% of its funds in wintry storage wallets managed by its dad or mum company, the Gemini Belief Firm. Gemini is SOC licensed by Deloitte.

BlockFi also offers a pair of security aspects to present protection to users from hacks. As an illustration, it supports 2-part authentication and enables users to whitelist explicit cryptocurrency addresses. These whitelisted addresses develop into the single addresses that users can withdraw their tokens to unless they fight through a detailed verification course of so as to add a brand recent one.

Linus, as a complete, is composed a work in growth and the corporate’s security provisions replicate this. Fancy BlockFi, the corporate supports 2-part authentication.

Linus claims that its users’ funds are backed by digital asset collateral and supported by third-celebration insurance protection protection, which supposedly protects against hacks, theft, and lack of funds. Unfortunately, it doesn’t provide any detailed knowledge on how it accomplishes this.

Feature #4: Promos and Bonuses

BlockFi and Linus each and each provide bonuses – BlockFi offers a tiered bonus to recent users, and Linus offers a referral bonus.

BlockFi Bonuses

- $15 for deposit totalling $100 to $1,499

- $20 for deposit totalling $1,500 to $19,999

- $40 for deposit totalling $20,000 to $39,999

- $75 for deposit totalling $40,000 to $74,999

- $100 for deposit totalling $75,000 to $99,999

- $250 for deposit totalling $100,000+

Register with this link to claim BlockFi’s bonus.

Linus Bonuses

From April to June 2021, all Linus users can invent a $20 bonus for making referrals. For users to receive this bonus, the referee have to originate a deposit totaling $100 or extra with a link love this– Register for Linus.

Feature #5: Ease of Use

Both BlockFi and Linus are if truth be told easy to teach. Every provider lets you deposit to your narrative with fiat from but another checking narrative or a debit card.

Ought to you deposit fiat into your BlockFi narrative, it’ll robotically convert into GUSD and open incomes an interest rate of 8.6% APY.

BlockFi has a cell app whereas Linus doesn’t, so it may perhaps well perhaps perhaps also very successfully be a higher resolution for folk that love to place an eye fixed on their funds on the walk.

Nonetheless, with Linus, you don’t have to take care of fiat-to-crypto conversions or recall any crypto at all. On narrative of of that, it’s likely a more uncomplicated different for folk that are recent to crypto.

Linus wins on the consolation entrance– half the work, however also half the rates.

Standout Aspects

BlockFi plans to liberate an interest-incomes cryptocurrency bank card within the on the subject of future. It’ll allow users to invent 1.5% interest, paid in Bitcoin, on each and each recall they originate.

Linus is composed very barebones since it hasn’t officially been launched to the final public but. On the opposite hand, one may perhaps presumably also keep in mind the provider itself a standout since Linus is among the few companies that offers users rep accurate of entry to to crypto-backed yield opportunities without proudly owning any crypto.

The Court of Public Understanding: BlockFi vs. Linus Reddit

Most Redditors discussing crypto interest accounts are inclined to love BlockFi, and there is minimal dialog about Linus.

Of us who originate are inclined to criticize the corporate, as self-assumed experienced merchants, bash the Linus 4.5% APY, claiming they’ll rep extra APY by providing their possess liquidity on Ethereum whereas composed taking roughly the a similar amount of risk.

On the opposite hand, these threads are likely created by experienced cryptocurrency fans with dabblings in DeFi products. Linus isn’t made for that inferior of patrons. As a replace, it’s intended for contributors who desire to rep increased APY on their fiat not directly by having access to DeFi and cryptocurrency incomes products with out a have to resolve out regain out how to originate all the pieces themselves.

Customer Help

It is seemingly you’ll perhaps be in a situation to rep answers to in vogue questions about BlockFi by visiting the corporate’s FAQ internet page. BlockFi also has an AI-powered chatbot and are residing cell phone give a boost to from 9: 30 AM – 5 PM ET Monday through Friday.

Linus has an on-line FAQ internet page as successfully. The corporate also has an on-line chat possibility on its internet utter and electronic mail give a boost to readily accessible at [email protected].

Can You Belief BlockFi and Linus?

BlockFi is backed by a pair of of the wonderful names within the cryptocurrency trade. As well, it has earned stamps of acclaim for its security practices from each and each Deloitte and the Fresh York Division of Financial Products and companies.

Linus also appears to be like devoted, however we would cherish extra details on how it protects its users’ funds from hacks, theft, and lack of funds with third-celebration insurance protection.

Linus is a extra most modern company and has but to fabricate its recognition but, which is comprehensible fascinated in regards to the corpulent version of its provider hasn’t launched.

Linus did total a public beta program without receiving any complaints about being a rip-off or dropping users’ funds. Thus, the early outcomes are optimistic, however cautious users may perhaps presumably also desire to present the corporate time beyond regulation to place itself before entrusting it with its funds.

BlockFi vs. Linus: Which is the Higher Crypto Curiosity Story?

BlockFi is the higher crypto interest narrative in case you’re taking a witness to invent interest on standard money love BTC, ETH, and LTC since Linus doesn’t provide these companies and products.

Essentially the most intelligent staunch point of comparability for BlockFi vs. Linus is for folk that desire to invent increased interest on their USD funds. Linus supplies a extra easy trip for this, however BlockFi composed has it beat– it robotically converts USD into GUSD, which earns 8.6%.

Linus only offers 4.5% APY on USD.

BlockFi has a cell app whereas Linus doesn’t.

On the opposite hand, Linus must composed be the higher possibility for these users that don’t desire the complications of proudly owning any cryptocurrency and wonderful desire to deposit USD and rep paid in USD.