In its 2023 Market Forecast, Blockware Solutions highlighted bullish metrics, slowing ASIC advances and the global energy crisis.

In its 2023 Market Forecast, Blockware Solutions highlighted bullish metrics, slowing ASIC advances and the global energy crisis.

Blockware Intelligence, the examine arm of Blockware Solutions, has launched its 2023 forecast, which indicated, amongst other things, that the bitcoin designate backside would be in rapidly.

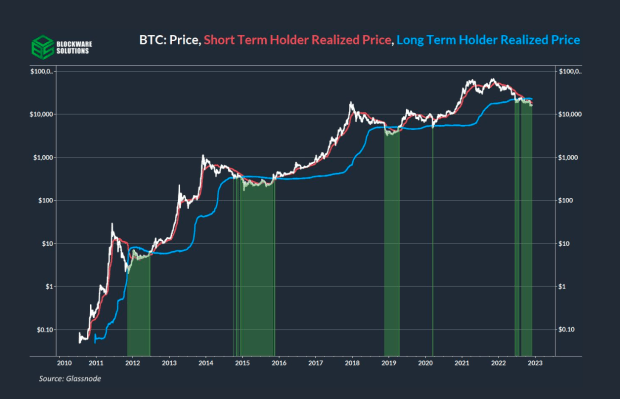

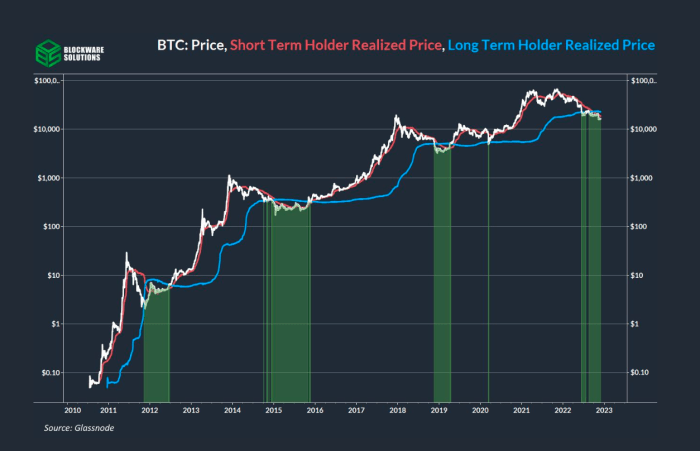

The file integrated the next macroeconomic overview and forecast, alongside bitcoin’s response as well to on-chain indicators that counsel seemingly future movements. Short-term holder realized designate (STH RP), as indicated by the file, is a more perilous, rapidly-to-pass metric obvious by the worth of cash moved during a obvious length, while long-term holder realized designate (LTH RP) is a much less perilous, more sticky metric obvious by the worth of cash held which had been unmoved for longer sessions. When designate dips under LTH RP, that manner that most long-term holders are underwater, it in most cases coincides with old endure market lows. The file means that the worth of bitcoin is inclined to flip each and every LTH RP and STH RP, which it’s currently under, which might per chance presumably presumably well signal the low of the endure market.

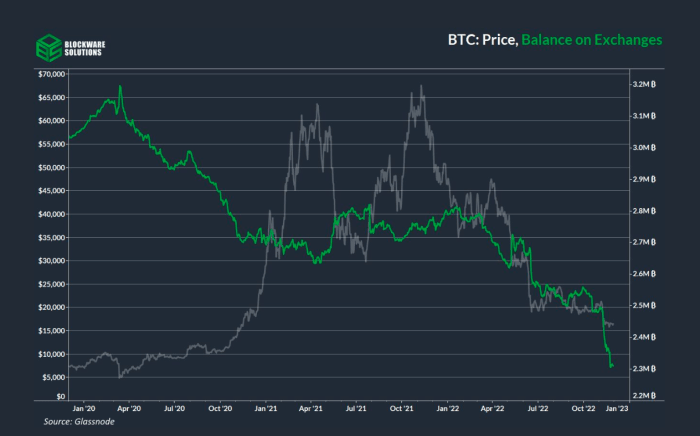

The file also famed the latest give diagram of several exchanges, namely Celsius, BlockFi and FTX, which has contributed to rising self-custody of BTC. Self-custodying of bitcoin has an inclination to amplify prices as the worth suppression seemingly created by exchanges is eliminated.

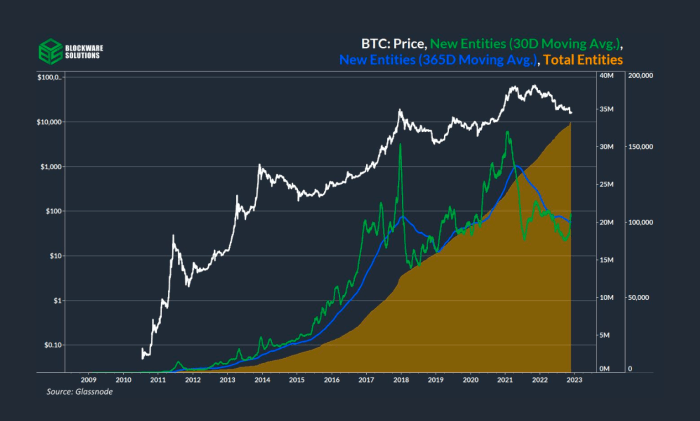

Additionally predicted is a serious amplify in the replace of on-chain users of bitcoin. Within the old 2018 cycle, the replace of on-chain users rising at an rising price indicated the commence of the bull speed. We now gaze over yet again that a obvious momentum shift in the replace of on-chain entities, suggesting rising adoption and seemingly seeds for the next bull market.

As well, it’s urged that latest cutting-edge ASICs, namely the S19XP, might per chance presumably presumably well retain their worth for longer than old generations of ASICs, as producers skill what is thermodynamically seemingly. This would own ramifications on the worth of the ASIC and plans for future money flows for miners.

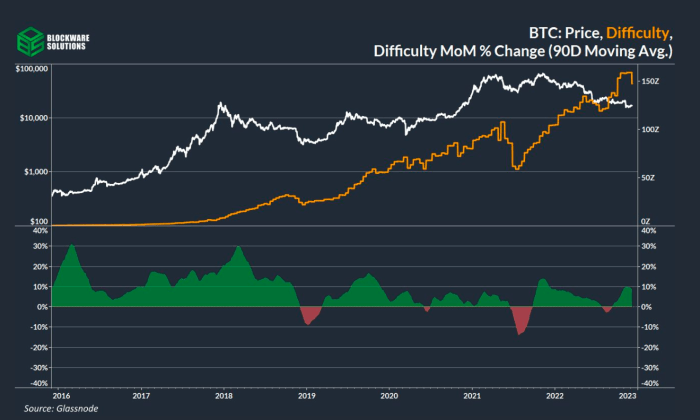

Right here is taken into myth as successfully in the next theory that Bitcoin hash price boost will leisurely progress in 2023, noting three factors:

“1. ASIC Commoditization

2. Lack of Mining Funding in 2022

3. International Vitality Crisis (lack of on hand cheap energy).”

The global energy crisis is additional detailed — as regulators put more strain on oil and hydrocarbon sources of energy, additional driving up the worth, miners with mounted energy buying agreements will seemingly be these insulated from this volatility.

The file finishes with the prediction that in 2023, the United States might per chance per chance be the preeminent destination for bitcoin mining on account of the energy of the buck, the soundness of energy prices here and the lesser impacts of inflation inside the country.