In Bloomberg Intelligence’s most up-to-date document, bitcoin is setting apart itself from possibility resources with increasing HODL conduct and historical patterns counsel a lightweight down-turn.

In Bloomberg Intelligence’s most up-to-date document, bitcoin is setting apart itself from possibility resources with increasing HODL conduct and historical patterns counsel a lightweight down-turn.

- Bloomberg Intelligence talked about bitcoin and other cryptocurrencies because it pertains to adoption, markets and defining asset classes.

- The document explains how bitcoin is setting apart itself from customary possibility-resources and turning into a possibility-off asset.

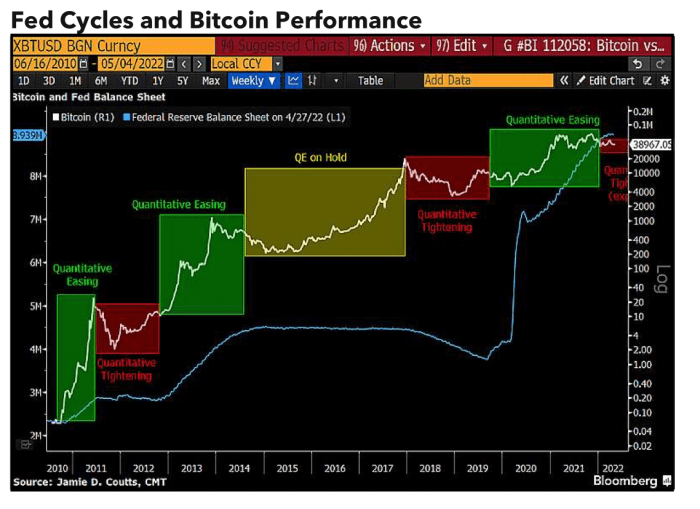

- Bloomberg Intelligence also discusses historical patterns of Federal Reserve coverage because it pertains to bitcoin and endure-markets, offering which that you would possibly perchance take into consideration outlooks.

Essentially the most up-to-date Bloomberg Intelligence document for Can also discusses the adoption of bitcoin and other cryptocurrencies, markets, and the unparalleled advances of enterprise technology.

The document acknowledged that Bloomberg Intelligence’s key takeaway from the Bitcoin 2022 convention in Miami change into that “what’s happening to attain money and finance into the 21st century is unstoppable.”

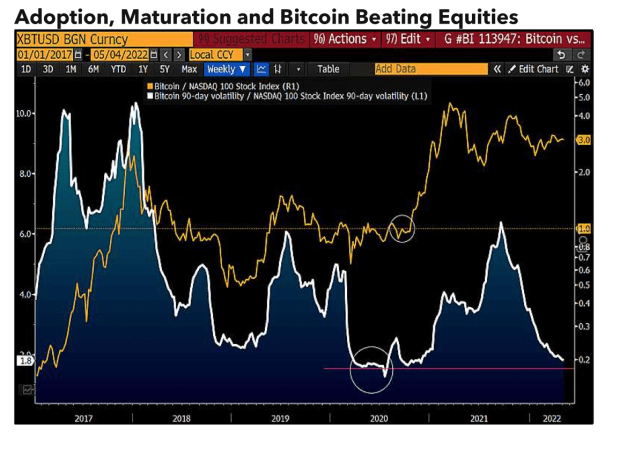

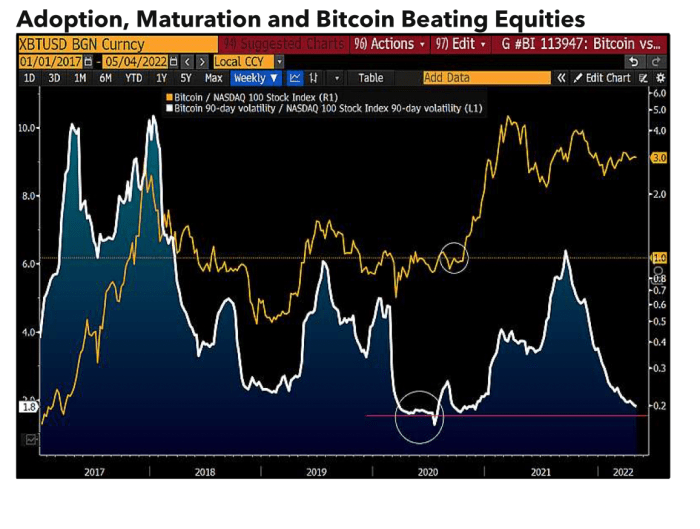

Early within the document, Bloomberg Intelligence notes institutional involvement and declining volatility in bitcoin versus frequent possibility resources appears to present off a truthful divergence in desire of bitcoin, allowing investors to turn into self sustaining from the final pitfalls of frequent resources. Bloomberg Intelligence states “our watch is now to not buck ‘the pattern is your buddy’ mantra”, explaining that investors who engage now to not as a minimal in part-allocate would possibly perchance well suffer the worst.

The document additional illustrates bitcoin’s divergence as an frequent possibility-asset by comparing it to the year-to-date (YTD) numbers to Can also 3 for the Nasdaq 100 Inventory Index. To that level. The Nasdaq 100 suffered a -20% downturn, whereas bitcoin handiest dipped -15%. Bloomberg Intelligence contends this to teach bitcoin turning into a possibility-off asset.

The separation from frequent resources turns into ever extra crucial as this day the enviornment awaits the most up-to-date Federal Launch Market Committee (FOMC) meeting. Because the Federal Reserve continues with quantitative tightening, Bloomberg Intelligence notes that bitcoin is wisely-positioned to overhaul a broader market cap in opposition to “potentially overextended equity costs.”

On the different hand, bitcoin appears to be deviating from the central banks coverage choices indicating a lightweight endure-market when put next to historical endure-markets. As would possibly perchance well also be considered under, within the course of previous tightening phases, bitcoin rises. With maintaining, the asset stays stage. For free easing practices, bitcoin historically rises.

Whereas the document does scream one other expected leg-down as the Federal Reserve has handiest supreme begun the tightening course of, Bloomberg Intelligence aspects to “HODL conduct,” which reveals extra addresses and recent addresses alike are maintaining their bitcoin. This HODL mentality presents upward push to the expectation of a principal milder down-turn than has beforehand been noticed within the face of negative financial impacts from the Federal Reserve.

“We watch giant possible for bitcoin to proceed doing what it has been doing for a lot of of its existence – outperforming most frequent asset classes,” the document said.