Reason to trust

Strict editorial policy that specializes in accuracy, relevance, and impartiality

Created by industry consultants and meticulously reviewed

The best standards in reporting and publishing

How Our News is Made

Strict editorial policy that specializes in accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper ecu odio.

The cryptocurrency market flourishes on pivotal originate-or-fracture moments at clear stamp ranges where assets either collapse or catapult elevated. For BNB, the $531 reinforce stage has confirmed to be a turning point. After a duration of uncertainty, BNB has held this wanted zone and ignited a highly efficient rebound, confirming a shift in market structure from cautious consolidation to bullish momentum.

This resurgence is bigger than honest a technical soar. It reflects growing self belief among traders, resilient attach a matter to at key ranges, and a broader market appetite for altcoins as Bitcoin stabilizes. With solid volume, reclaiming key racy averages, and breaking advance-duration of time resistance, BNB is signaling that the correction segment is at risk of be over.

BNB Chart Pattern Signaling Sustained Momentum

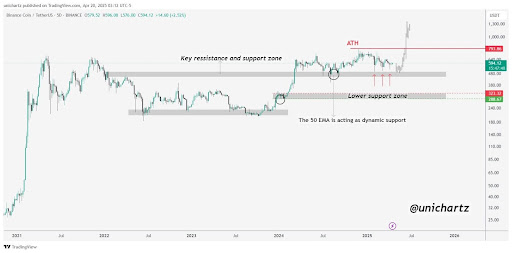

In a original post shared on X, UniChartz highlighted that BNB is within the imply time showing solid bullish momentum after rebounding from a key zone. This stage, which as soon as served as a predominant resistance barrier, has now flipped into solid reinforce, a fundamental bullish price that assuredly reinforces the strength of an ongoing uptrend.

Primarily primarily based on the diagnosis, the a hit retest of this zone validates the breakout and means that traders are stepping in. With momentum constructing and worth structure aligning in prefer of the bulls, BNB is at risk of be primed for extra climb if this reinforce continues to support company.

He extra famed that as lengthy as BNB maintains its region above this key reinforce zone, the general bullish structure remains intact, holding the momentum firmly in prefer of the bulls. This sustained strength reinforces the chance of a endured climb, with the trot in direction of a peculiar all-time high (ATH) advance the $794 stage taking a stamp more and more viable.

This outlook is supported by the 50-day Exponential Transferring Realistic (EMA), which continues to wait on as dynamic reinforce, carefully monitoring stamp action and cushioning minor pullbacks. The alignment of stamp above this racy common extra solidifies the original uptrend, suggesting that BNB is at risk of be gearing up for a sustained rally if broader market sentiment remains favorable.

Breaking Barriers: Key Resistance Ranges To Judge

Today, BNB is on the verge of breaking above the wanted $605 resistance stage. This stage serves as a psychological barrier and aligns with a key technical home where selling tension has traditionally emerged. A decisive fracture above this resistance, especially if supported by a solid surge in trading volume, may possibly possibly well price a clear affirmation of purchaser dominance within the market.

This form of breakout would likely residence off a wave of unusual trying to fetch hobby from retail traders and institutional members. Extra importantly, clearing this stage may possibly possibly well birth the door for BNB to accommodate elevated resistance zones, including the $680, $724, and all-time highs. Till then, traders will contain to silent scrutinize this stage carefully because BNB’s response here may possibly possibly well shape the trajectory of its subsequent predominant switch.

Featured image from iStock, chart from Tradingview.com

Disclaimer: The data chanced on on NewsBTC is for tutorial functions

most appealing. It would now not scream the opinions of NewsBTC on whether to aquire, promote or reduction any

investments and naturally investing carries dangers. You are informed to conduct your contain

research earlier than making any funding decisions. Use recordsdata equipped on this website

fully at your contain risk.