The below is an excerpt from a contemporary edition of Bitcoin Magazine Skilled, Bitcoin Magazine’s premium markets newsletter. To be among the main to receive these insights and a bunch of on-chain bitcoin market prognosis straight to your inbox, subscribe now.

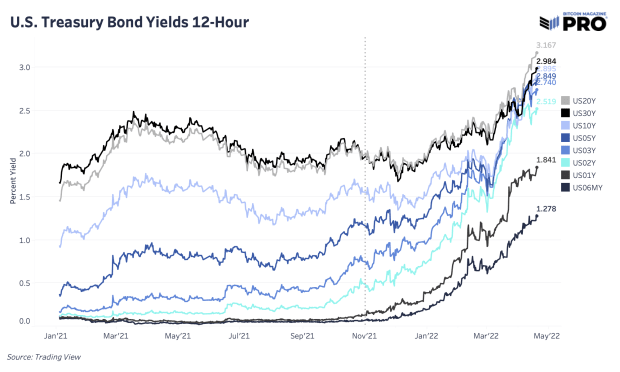

U.S. 30-Year Treasury Yield Hits 3%

Now not too long ago, the U.S. 30-year Treasury bond yield hit over 3% because the Treasury bond market across durations and broader credit markets proceed promoting off.

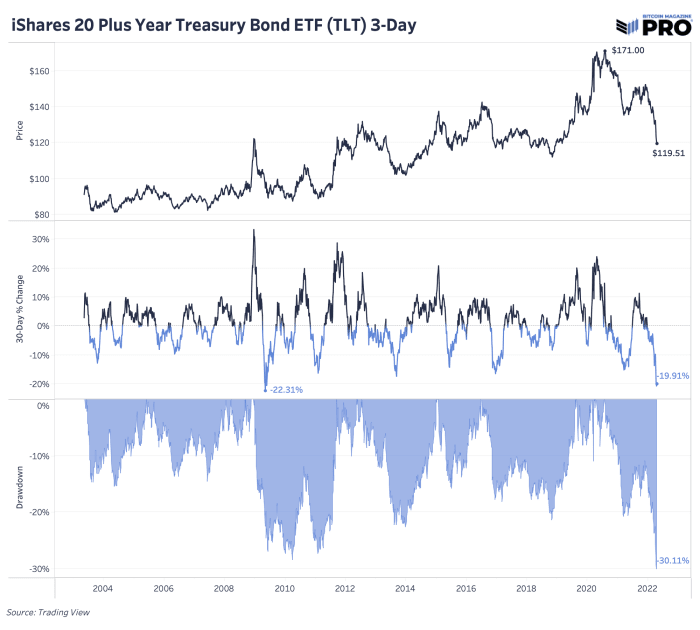

The upward thrust in yields has resulted in great increased bond market volatility and nerve-racking drawdowns for merchants. The iShares 20-year Treasury Bond ETF, TLT, which tracks an index of long duration maturities, is now down over 30% from the all-time excessive attend in July 2020. Essentially the most original drawdown is the fastest deceleration across a 30-day percentage alternate since Could 2009.

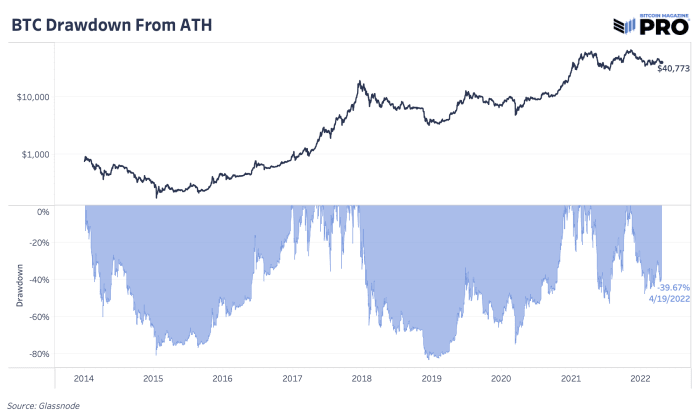

For context, bitcoin is greater down roughly 39% from the all-time excessive. So great for long-dated U.S. Treasuries providing low volatility, portfolio hedging efficiency and “possibility-free” charges.

It’s vital to earn into story the long-term outlook of the global monetary contrivance when evaluating the efficiency of bitcoin and debt securities.

Attributable to of the realities of a historic debt burden that worsened post COVID-19 financial lockdowns, followed by the historic stimulus that followed, debt as an asset class was once a promise of return-free possibility. Debt is no longer merely an settlement between borrower and lender, nonetheless in the global economy it underpins the total monetary contrivance as a liquid asset class (the most interesting one at that).

Attributable to of the truth of roughly $100 trillion price of credit promising return-free possibility (nevermind the assets which are priced off of the historically detrimental precise charges: equities, precise property, and so on.), our case has many cases been that the supreme asset in belief to spend at this stage of a long-term debt cycle is one with out a counterparty possibility and nil dilution possibility.

Theory met truth with the introduction of the Bitcoin network in 2009.

Now, because the total investing world is working to work out the plot in which to outpace the historic inflation regime we are confronted with right this moment, there stands bitcoin, which continues to leer remarkably low-impress in opposition to the market valuation of every a bunch of asset on the earth.