The Bored Ape Yacht Club (BAYC) is an unfamiliar membership finishing up start to any and all house owners of the Bored Ape Yacht Club NFT, underpinned by the ApeCoin (APE) token.

BAYC is idea of as one amongst the most forward-pushing NFT initiatives on the market, and would possibly well maybe be one amongst the very best returns on funding ever recorded for early holders.

Launched in April 2021, every NFT from the series of 10,000 BAYC NFTs had a mint sign of 0.08 Ethereum. By December 2021, every BAYC NFT had an moderate ground sign of around 60 Ethereum. After the ApeCoin (APE) airdrop, the ground sign became over 100 ETH.

The Bored Ape Yacht Club house web page.

The creators also launched a few spinoff models available to be claimed with out cost by BAYC holders at the side of the Bored Ape Kennel Club and Mutant Ape Yacht Club. These derivatives rewarded BAYC holders whereas creating addiionalmarkets for parents wishing to be a part of the BAYC fold with a not-as-treasured variation; this became a very efficient map for Yuga Labs to scale the finishing up and raise capital for future progress.

The BAYC turned a few hundred buck funding into a total bunch of thousands of bucks contained in the span of months.

The next Bored Ape Yacht Club data explores the BAYC universe, its feature in the evolving NFT landscape, and ApeCoin.

Laying the Basis: Cryptopunks

Cryptopunks is a ancient finishing up created by Larva Labs that launched in June 2017; it issued 10,000 profile image NFTs, and all beget been free for anyone to notify.

Why Profile Images?

The NFT profile image circulate is fueled by undertones of affiliation and affiliation– think it love holding a the same mannequin of automobile in a classic automobile club. Better-label profile photography are inclined to instruct space, and since possession of NFTs is verifiable, it holds its weight.

Cryptopunks feature a pattern in the NFT ecosystem: start 10,000 NFT profile photography and an on-line neighborhood forms.

Cryptopunks beget historically been an aspirational asset for the approved NFT purchaser. The Bored Ape Yacht Club and diverse initiatives iterated the Cryptopunk mannequin by granting psychological property rights to investors, which Cryptopunks didn’t.

In diverse phrases, BAYC holders beget fleshy IP rights to attain what they desire with their NFTs, posing a stark distinction from the Cryptopunk mannequin– creators Larva Labs had the fleshy appropriate correct to trail after Cryptopunk holders had they infringed on the bigger mark’s copyright.

On March 17, 2022, Yuga Labs (BAYC creators) purchased the CryptoPunks holding company Larva Labs (at the side of the Cryptopunks IP); the predominant thing that Yuga Labs did after they obtained the IP became fall all infringement claims against Cryptopunks holders.

Yuga Labs is credited with a correct coup in the NFT neighborhood, signaling a shift to a much less litigious and more start and inclusive NFT ecosystem.

Enter The Apeverse

Yuga Labs is building out a dominant NFT ecosystem.

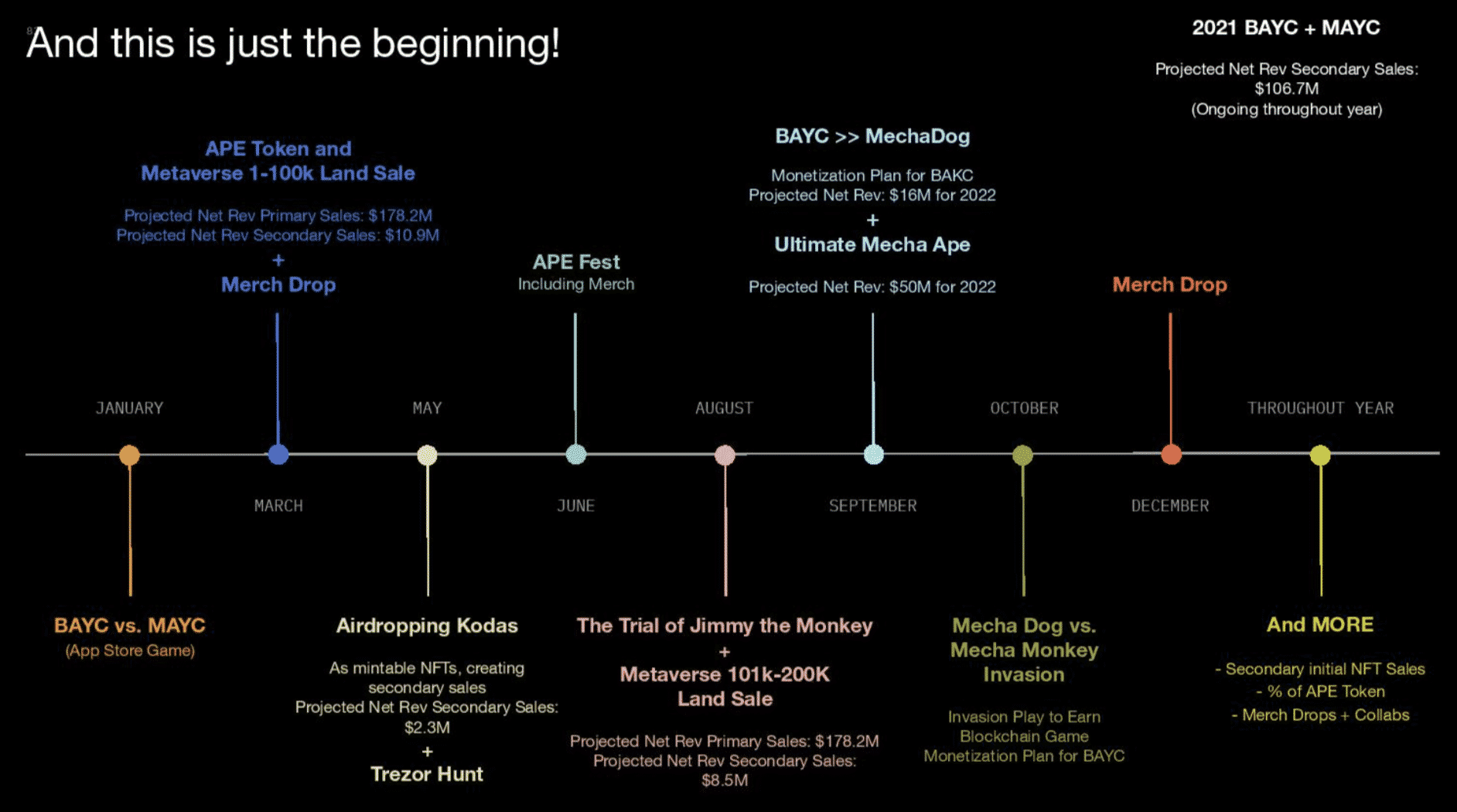

A leaked pitch deck shed a seek into the minds of the creators.

Yuga Labs pitch deck

Whereas pitching BAYC to a main finishing up capital company Andreesen Horowitz ( a16z) the Yuga Labs team published that it’s building a metaverse, video video games, launching additional NFTs, and going to be selling metaverse land.

Yuga Labs intends to present the strongest NFT mark we now beget ever viewed, and it’s an evolving case look on Web 2.0 versus Web 3.0.

Web 2.0 firms glimpse to extract cost out of their users in exchange for a product, service, or abilities, passing alongside the monetary cost to stakeholders (traditionally these stakeholders are finishing up capitalists, angel traders, or personal equity funds.)

Web 3.0 firms scheme to know the payment circling around their ecosystem of users– in Web 3, the impart stakeholders are the token holders.

Historically,early-stage investing in the US has been an opportunity reserved for approved traders.

Blockchain applied sciences produce the approved investing requirements demanding to implement– a web of crypto wallets, DAOs, and diverse crypto funding autos can pick any token or digital asset they please.

By sourcing funding from mature VC funds love a16z, Yuga Labs will originate to face strain to work in a Web 2.0 mannequin whereas presumably making an try to recent it in a Web 3.0 map to their users.

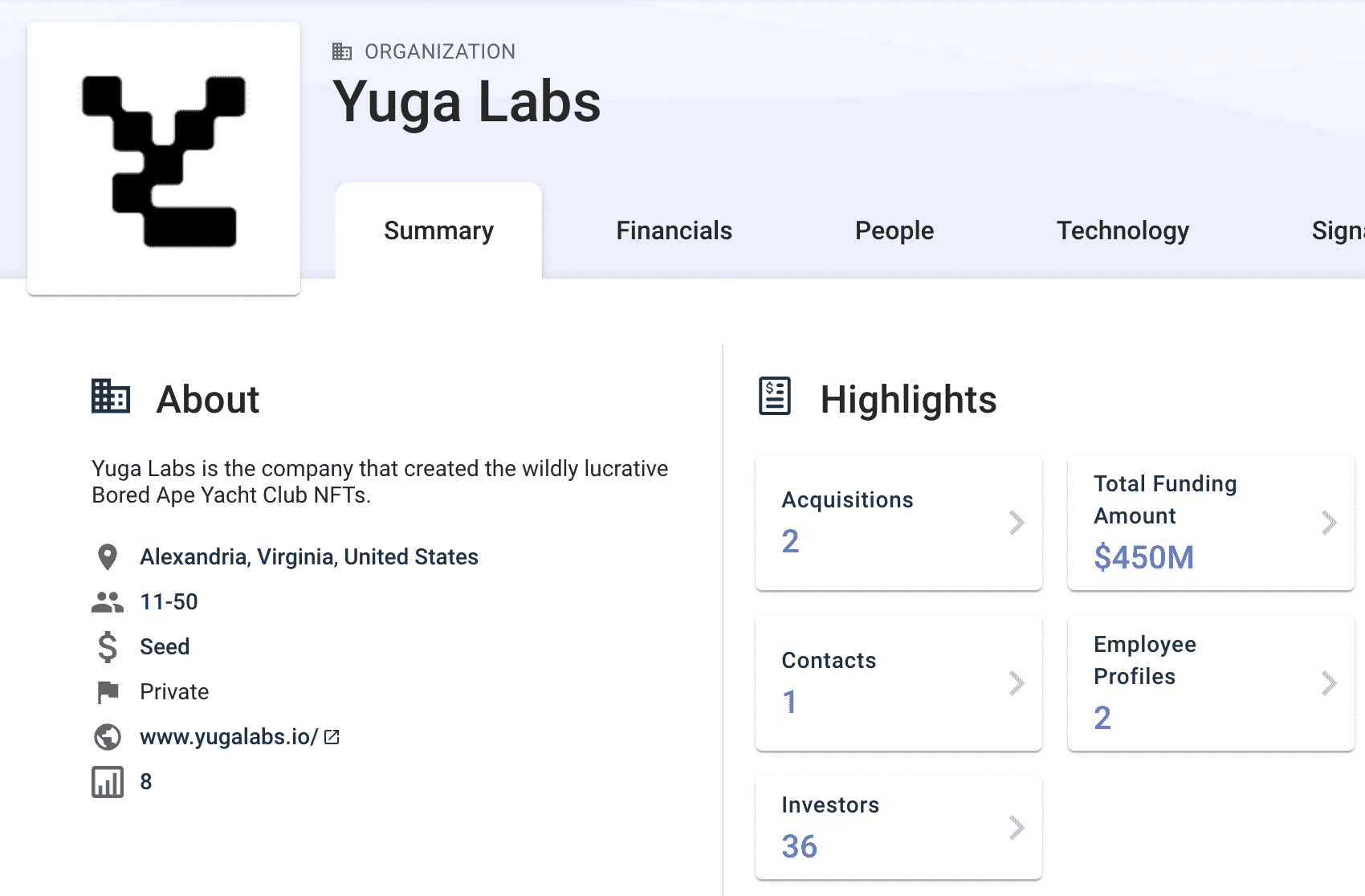

In March 2022, Yuga Labs closed a $450 million round led by a16z, valuing the company at $4 billion.

Yuga Labs on Crunchbase

What is ApeCoin? A Handbook on the Bored Ape Yacht Club Token

ApeCoin is an ERC-20 governance and utility token created basically for the APE ecosystem to empower a decentralized web3 neighborhood. As the initiating-source protocol layer of the ecosystem, ApeCoin underpins several key recount cases:

- Governance: ApeCoin permits holders to bewitch part in ApeCoin DAO.

- Unification of Narrate: As the ecosystem’s utility token, all contributors can portion the usage of the initiating forex with out centralized intermediaries.

- Procure entry to: the token provides salvage entry to to unfamiliar beneficial properties and products and providers that are unfamiliar to tokenholders simplest.

- Incentivization: Third-salvage collectively developers are incentivized to bewitch part in the APE ecosystem since APE is built into products and providers and video games.

It’s not a stretch to liken, not pejoratively, ApeCoin because the Bored Ape Yacht Club’s “Chuck E Cheese” token. Holders can have interaction merch, play video games (to salvage more ApeCoin), and recount it in diverse ways.

Yuga Labs also feature up an ecosystem fund; ApeCoin functions as a DAO token, enabling ApeCoin holders to vote on ecosystem happenings and fund allocations. Holders would possibly well maybe moreover write proposals for what they would possibly favor to gaze happen, to be voted on by the neighborhood.

Yuga Labs talented ApeCoin DAO a one-of-one NFT of a blue Bored Ape Yacht Club mark, which conveys with all of it rights and privileges to the emblem’s psychological property to the DAO. The ApeCoin DAO will vote and make a resolution how the IP is historical.

There is an appointed Board to facilitate DAO choices. The hot ApeCoin DAO board contributors encompass:

- Reddit Co-founder Alexis Ohanian

- Head of Ventures & Gaming at FTX Amy Wu

- Most predominant at Sound Ventures, Maaria Bajwa

- Co-founder & Chairman of Animoca Manufacturers, Yat Siu

- President & No longer composed Counsel at Horizen Labs, Dean Steinbeck

Token holders can vote board contributors out every six months.

The ApeCoin Airdrop

Many millionaires and multi-millionaires beget been created by the usage of the ApeCoin airdrop.

Every Bored Ape Yacht Club NFT holder became airdropped an ApeCoin allocation on March 17, 2022; Bored Ape and Mutant Ape NFT holders purchased 15% of the total token allocation.

Soon after, standard exchanges Coinbase, FTX, and Binance listed the token available for getting and selling.

In case you held a qualifying NFT and beget been airdropped ApeCoin and subsequently sold it at $13.69 on airdrop day:

- One Bored Ape Yacht Club NFT: 10,094 APE, or about $138,237.17 on the time.

- One Mutant Ape Yacht Club NFT: 2,042 APE, $28,021.28 on the time.

- One Kennel Club NFT: 856 APE tokens, $11,718.64 on the time.

In case you had a pair of Bored Apes and Mutants to salvage a multiplier against the amount of allocation.

The closing tokens will likely be allocated to finishing up start contributors, Yuga Labs and its founders, as well to a donation to the Jane Goodall Legacy Basis.

Final Thoughts: What’s the Bored Ape Yacht Club Future?

The Bored Ape Yacht Club ecosystem will likely be incredibly attention-grabbing to educate, as a pair of precedents are being feature:

How will a finishing up-funded Web 3.0 company as gigantic as Yuga Labs ship cost to both tranches of token and investor stakeholders

How will ApeCoin underpin the total ecosystem– will it preserve its cost?

How will the payment creation of the wide BAYC machine unfold one day of diverse nation-states of crypto?