Boston Federal Reserve president Eric Rosengren talked about stablecoins in a recent presentation on June 25. Rosengren confused out that stablecoins will doubtless be a “disruptor” to high cash market funds and the Boston Fed president remarked that the exponential development of stablecoins is concerning.

Rosengren: ‘We Can like to silent Be a Bit Concerned About Stablecoin Markets Growing Very With out observe’

Members of the Federal Reserve are moderately responsive to stablecoins and the extensive market these pegged-sources like created. Right this moment time statistics repeat there’s $111 billion in stablecoin capitalization amongst the prolonged checklist of all these tokens.

Out of all that cash, on Sunday, June 27, there’s $63 billion in reported stablecoin change volume out of the $96 billion in crypto swaps recorded globally. Boston Fed president Eric Rosengren has seen the expansion and the banker thinks it may perhaps pose a matter to short-length of time cash markets.

At some level of the presentation dubbed “Monetary Steadiness,” Rosengren highlighted stablecoin markets as a “periodic disruption to short-length of time credit score markets.” The Boston Fed president additional talked about inflation and the U.S. valid property market.

Rosengren talked about the topic of stablecoins and talked about tether (USDT) with Yahoo Finance reporter Brian Cheung. After the presentation, Cheung asked the Boston Fed president: “Isn’t the monetary balance chance of those stablecoins like tether entirely as enormous of a chance because the Fed will allow given its historic characteristic as a reduction stopper?”

“The cause I talked about tether and [stablecoins] is that if you happen to explore at their portfolio, it in overall appears like a portfolio of a high cash market fund but maybe riskier,” Rosengren responded to Cheung’s inquire. “We in actual fact had a stablecoin that bumped into monetary difficulties final week. Tether, as you highlighted, has a different of sources that, all the way by the pandemic, the spread obtained moderately huge on those sources. The Fed intervened in notify to make certain that short-length of time credit score markets continued to characteristic,” Rosengren added. The Boston Fed president continued:

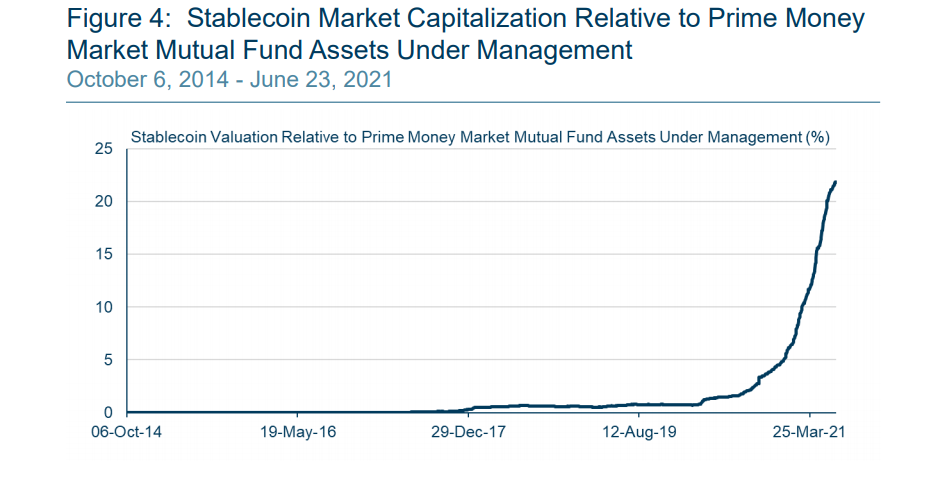

And the cause we must the least bit times be a puny bit infected by stablecoin [markets] is that it’s rising very with out observe so there’s exponential development in stablecoins. The high cash market funds were slowly happening as of us like regarded for a much less dangerous formulation to lift their transactions accounts and a form of them like moved to authorities cash market funds.

Rosengren Highlights the Favor to Initiate Thinking In moderation About What Happens to Things Like Stablecoins

Rosengren says the central monetary institution and regulators have to “divulge more broadly” about what kinds of things may perhaps unsettle short-length of time credit score markets. “Surely stablecoins are one ingredient,” the Boston Fed president remarked.

Cheung additional asked “if the Fed is going to backstop those markets within the occasion that they win expertise stress, then wouldn’t there no longer be as enormous of a monetary balance chance from those kinds of products? Rosengren replied that he thinks rules have to change more progressively, so officials don’t have to return to such issues every decade.

“I win concern that the stablecoin market that is currently, magnificent significant unregulated as it grows and becomes a more main sector of our financial system,” Rosengren emphasised. “That we want to capture severely what occurs when of us lumber from all these instruments very snappy,” he added. Rosengren additional stated:

Fair correct like the cash market funds introduced about a inferior disruption in credit score markets, I contain a future monetary balance area will doubtless be going down if we don’t initiate pondering fastidiously about what occurs to things like stablecoins next time we like a inferior market recount.

Tether (USDT) is by far the largest stablecoin in existence nowadays and has a $62 billion valuation. Behind tether, is usd coin (USDC), a stablecoin issued and maintained by the company Circle. USDC has a $25.8 billion capitalization and between both USDT and USDC mixed, the 2 stablecoins signify 79% of all of the $111 billion stablecoin market cap.