Ethereum (ETH) price has struggled amid but any other market shakeout. The 2d-ideal cryptocurrency by market capitalization fell beneath the $2,600 enhance zone for the third time within the past week, prompting crypto analysts to rob into consideration the next phases to inquire of out.

ETH’s Key Enhance Zone To Gape Out

The crypto market has viewed loads of retraces for the length of the cycle, with cryptocurrencies luxuriate in Ethereum severely lowering from its Q3 opening. Since July 1, the “king of altcoins” has viewed a 24% drop from the $3,400 enhance degree.

Following its descend beneath the $2,100 designate throughout the ‘Shaded Monday’ fracture, ETH has hovered between the $2,300 and $2,700 fluctuate. The cryptocurrency has recovered around 18% of its price whereas tries to reclaim the $2,600 degree.

On the other hand, the contemporary market shakeouts possess made the price retest the strength of the $2,500 enhance zone three times within the last two weeks, which grew to change into specialists cautious of ETH’s next step.

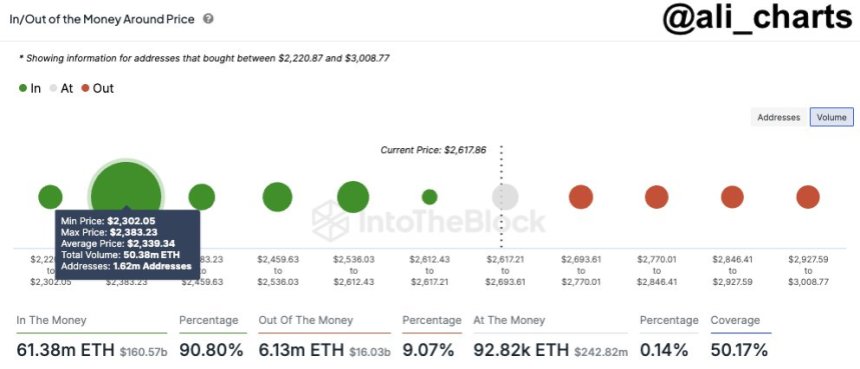

Eminent crypto analyst Ali Martinez said that investors must eavesdrop on a key enhance zone after Ethereum’s efficiency. To Martinez, the $2,300 and $2,380 price fluctuate must be watched if ETH continues its downward model.

Based mostly totally totally on the In/Out of the Cash Around Tag (IOMAP) chat shared by Martinez, 1.62 million addresses purchased over 50 million ETH at this zone, making it the next wall of enhance for Ethereum’s price. If the cryptocurrency fails to support this degree, its price may maybe presumably maybe drop to $2,200 and even phases no longer viewed since February.

Will Ethereum Tumble To $1,200 This Yr?

Assorted specialists possess suggested that the 2d-ideal cryptocurrency may maybe presumably maybe inquire of its price drop even lower, as “even giants will descend.” Prime analyst Benjamin Cowen said that the “collapse of ETH/BTC” is quite executed.

A 365 days within the past, Cowen forecasted that the collapse of the buying and selling pair would “designate the pause of the altcoin reckoning.” He explained that “altcoin reckoning” refers to the devaluation of the altcoins on their BTC pairs.

The analyst added that ETC/BTC turned into once the “last one to rise within the bull and it goes to even be the last to descend within the undergo.” To him, this buying and selling pair has four more months earlier than it goes up next 365 days.

Additionally, Cowen predicted that Ethereum’s price may maybe presumably maybe hit the $1,200 price fluctuate in December if its efficiency is analogous to the last two cycles.

Crypto investor Ted Pillows entreated investors to support on for the length of the waters, suggesting that a $10,000 is mute doubtless. To the vendor, the ‘King of altcoins’ is no longer any longer ineffective per diverse factors.

Ted highlighted that situation Ethereum alternate-traded funds (ETFs) inflows possess increased whereas Grayscale outflows possess gradually reduced in dimension, and Jump Shopping and selling has perfect around $60 million in ETH to sell.

Furthermore, ETH is “strongly defending its enhance degree,” which he deemed the ideal element. In a roundabout diagram, the investor Predicts that the consolidation breakout will happen between November and December, whereas the “parabolic mosey” will originate in Q1 2025.

Featured Image from Unsplash.com, Chart from TradingView.com

Disclaimer: The tips found on NewsBTC is for educational capabilities

perfect. It does no longer articulate the opinions of NewsBTC on whether or no longer to aquire, sell or support any

investments and naturally investing carries dangers. You are told to conduct your private

study earlier than making any funding choices. Utilize recordsdata equipped on this web sites

entirely at your private risk.