A brand new document signifies BH Digital, a crypto-focused vehicle for Brevan Howard Asset Administration, has raised $1 billion in funds, some of which it has but to determine to the market.

Key Takeaways

- Brevan Howard Asset Administration has reportedly raised over $1 billion for its digital asset subsidiary, BH Digital.

- Launched in Sep. 2021, BH Digital now has a total skill of $1.5 billion for the crypto market; an absence of liquidity is for the time being combating the company from deploying the totality of its funds.

- BH Digital reportedly most effective suffered a 4-5% loss in the crypto market’s collapse.

Brevan Howard Asset Administration subsidiary BH Digital has reportedly raised $1 billion from institutional investors for its crypto solutions and is peaceable accepting extra investments.

Brevan Howard Crypto Arm Raises $1B

The crypto downturn hasn’t scared institutional investors.

European hedge fund administration firm Brevan Howard Asset Administration, which has over $23 billion in sources below administration, has reportedly raised bigger than $1 billion from institutional investors for its crypto-focused vehicle, BH Digital.

BH Digital, which launched in September 2021, has no longer totally deployed all of its capital but; a source mentioned lack of liquidity modified into once combating the dedication of the total sum. Attributable to the elevate, BH Digital is reportedly now in a position to deploying up to $1.5 billion, with the number anticipated to upward push. The fund stays start for extra capital; investors must commit as a minimum $5 million.

The fund reportedly suffered most effective a 4 to 5% loss from its creation except June despite the market’s novel brutal downturn (Bitcoin and Ethereum are respectively procuring and selling at 67.3% and 67.2% from their all-time highs.)

The news of the massive fundraise comes following months of turmoil which saw Terra, one in all crypto’s high protocols, implode and at once wipe out bigger than $43 billion from the market; the match modified into once to blame for staggering losses for investment companies, alongside side crypto fund Three Arrows Capital, whose solvency concerns, in turn, triggered liquidity crises for quite lots of crypto lending companies equivalent to Celsius and Voyager Digital.

Disclosure: At the time of writing, the creator of this fragment owned ETH and quite lots of totally different cryptocurrencies.

The certainty on or accessed via this web location is received from just sources we must be correct and legit, however Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any info on or accessed via this web location. Decentral Media, Inc. is rarely any longer an investment advisor. We halt no longer give personalized investment advice or totally different financial advice. The certainty on this web location is subject to replace with out scrutinize. Some or all the figuring out on this web location might maybe change into older-fashioned, or it will possible be or change into incomplete or inaccurate. We might maybe, however are no longer obligated to, update any old fashioned, incomplete, or inaccurate info.

You ought to never originate an investment resolution on an ICO, IEO, or totally different investment in step with the figuring out on this web location, and also you ought to never present an explanation for or otherwise depend on any of the figuring out on this web location as investment advice. We strongly imply that you just search the advice of a licensed investment advisor or totally different qualified financial expert whilst you would maybe maybe very successfully be attempting for investment advice on an ICO, IEO, or totally different investment. We halt no longer settle for compensation in any create for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized sales, securities, or commodities.

$3.4M Huobi High Sale Shows Investor Enthusiasm Remains Excessive

Huobi High successfully accomplished its first initial alternate providing (IEO) on Huobi High this afternoon. The sale concluded in a subject of seconds, and raised $3.4M – proving that investor…

BlockFi Will Be Obtained by FTX.US for Up to $240M

BlockFi will moreover compile a $400 million rolling credit ranking facility from FTX.US. BlockFi Inks Deal With FTX.US BlockFi has agreed to an acquisition cope with FTX.US. (Long thread!) Excited to…

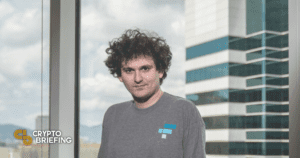

SBF Says FTX Has Up to $2B for Further Bailouts: Characterize

FTX CEO Sam Bankman-Fried has long previous on document to peaceable nerves amid a power market downturn characterized by quite lots of excessive-profile firm mess ups. SBF to the Rescue Sam Bankman-Fried might maybe step…