The below is from a most current version of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the principle to derive these insights and other on-chain bitcoin market diagnosis straight to your inbox, subscribe now.

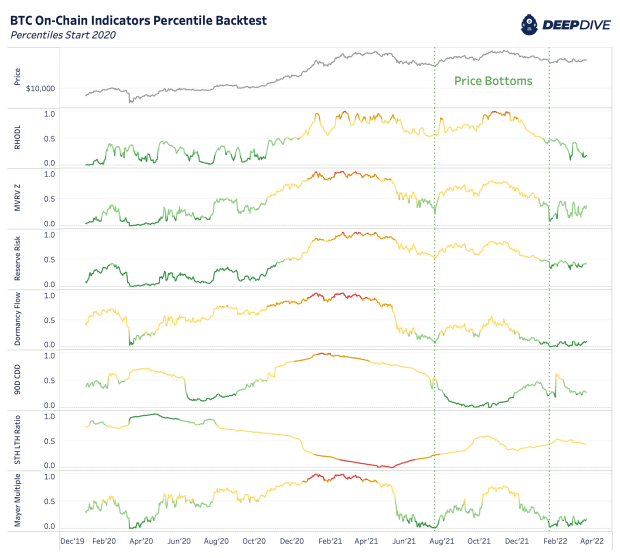

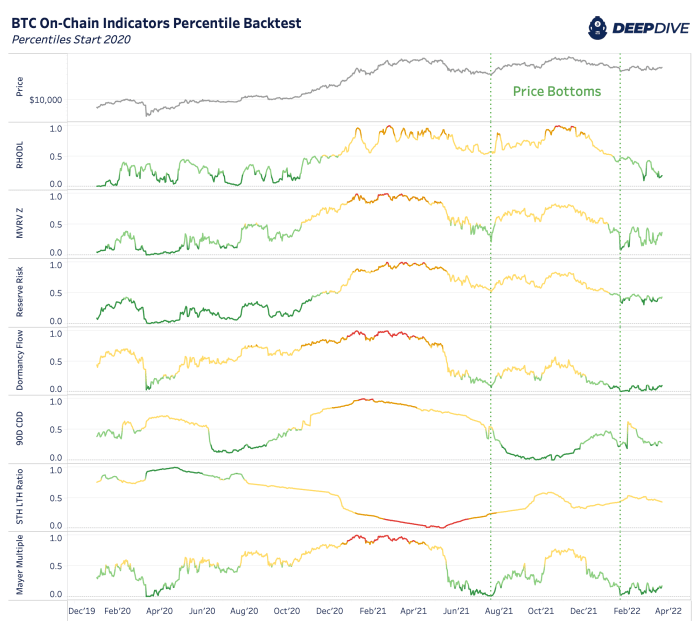

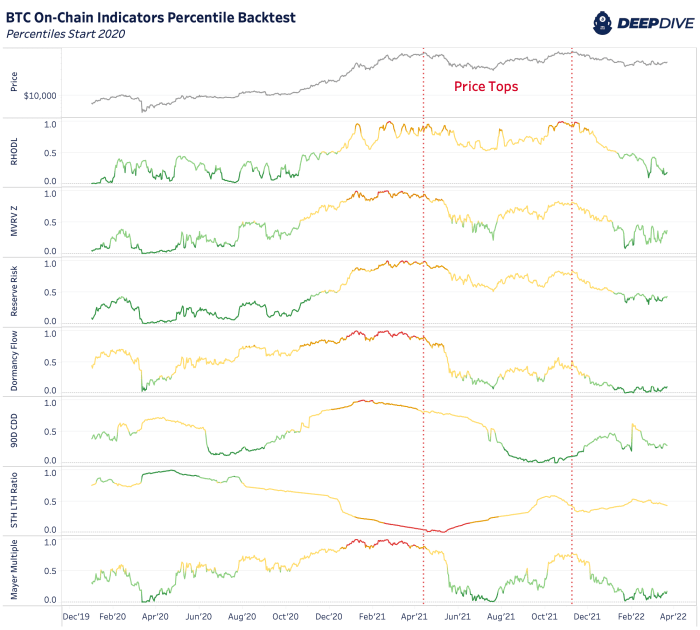

In old Daily Dives and analyses, we’ve highlighted the importance and traits of fundamental on-chain cyclical indicators across the realized HODL ratio, market-rate-to-realized-rate z-rating, reserve risk, dormancy drag, 90-days coin days destroyed and the ratio between non eternal holders and lengthy-time interval holders. The diagnosis this present day covers these metrics in aggregate at the side of the Mayer Multiple.

By no manner are these metrics splendid at predicting the market within the short time interval but they invent out provide us with precious insights on when the market will be at a secular or cyclical turning point. We resolve to make spend of these metrics together to salvage confluence round lengthy-time interval signals and altering behaviors within the market.

One approach to defend out that’s to drag attempting at these high on-chain metrics across their historical percentile distributions in varied time classes. To provide sense of the percentile details for every metric, we phase the percentiles into 5 varied groups and colours ranging from sad inexperienced to inexperienced, yellow, orange and red. Lower percentiles correspond to the greens whereas bigger percentiles correspond to orange and red.

Below you would possibly perchance peek how just a few of the splendid on-chain indicators did smartly at figuring out the March 2020 bottom and the April 2021 high.

As for the April 2021 high, every indicator in this diagnosis turned into exhibiting overheated indicators appropriate before or all the way by the price height.

The caveat here is that as bitcoin matures and volatility falls, comparing on-chain indicators to the total historical past can also unprejudiced no longer give the splendid results for his or her predictive vitality within the kill. If we’re to continue to drag attempting less blow-off-high events in value then that will even be reflected in quite a lot of indicators.

Final Screen

There are key on-chain indicators that are precious in determining lengthy-time interval cycle tops and bottoms. But as Bitcoin matures and changes, so lift out the analytical predictive vitality of these metrics.