Cardano develop into once conception to be one of primarily the most hyped Layer 1 chains in 2021 and develop into once anticipated to turn out to be home to about a of the topmost DeFi Dapps, however the events that unfolded soon after its launch failed to put Cardano in the equal league as Ethereum and Binance Neat Chain. So then, how arrive Charles Hoskinson believes that Cardano’s TVL is over $19 billion? Let’s stumble on.

Is Cardano’s DeFi Indubitably Value $19 Billion?

The founder of Cardano and co-founder of Ethereum, Charles Hoskinson’s opinions and feedback withhold hundreds of weight in the crypto alternate. As such, in conception to be one of his tweets the outdated day, Hoskinson mentioned,

“Fun Truth, would possibly perchance perchance appreciate to you counted the staked Ada, cardano’s TVL would possibly perchance perchance be over 19 billion greenbacks. Why don’t we count it? Because you don’t appreciate to lock your Ada to stake it. (sic)”

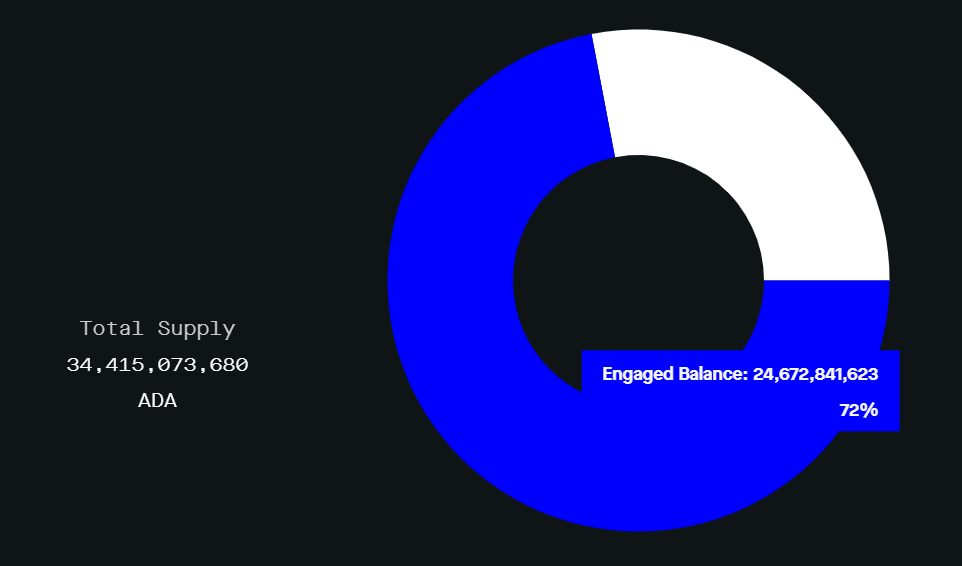

His claim is factually excellent since 24.6 billion ADA, which makes up 72% of ADA’s provide, is staked.

And while excellent, his comment came at a time when Cardano’s stablecoin Djed’s public testnet went live. Djed being a decentralized, algorithmically backed stablecoin, falls in the equal league as TerraUSD (UST) and DAI.

The arrangement Djed would work is that it will withhold stability thru a combination of collateral and a reserve token.

Cardano’s high DeFi protocols, SundaeSwap, Minswap, and WingRiders, are also starting up to verify the stablecoin thru test pools on their platforms to behold its that it is possible you’ll perchance perchance possibly imagine exact-world capabilities.

Now the motive here’s a sizable deal is that Djed is serious in reigniting the hype that investors in the crypto home had for Cardano’s excellent contracts.

The Rise and the Drop of Cardano

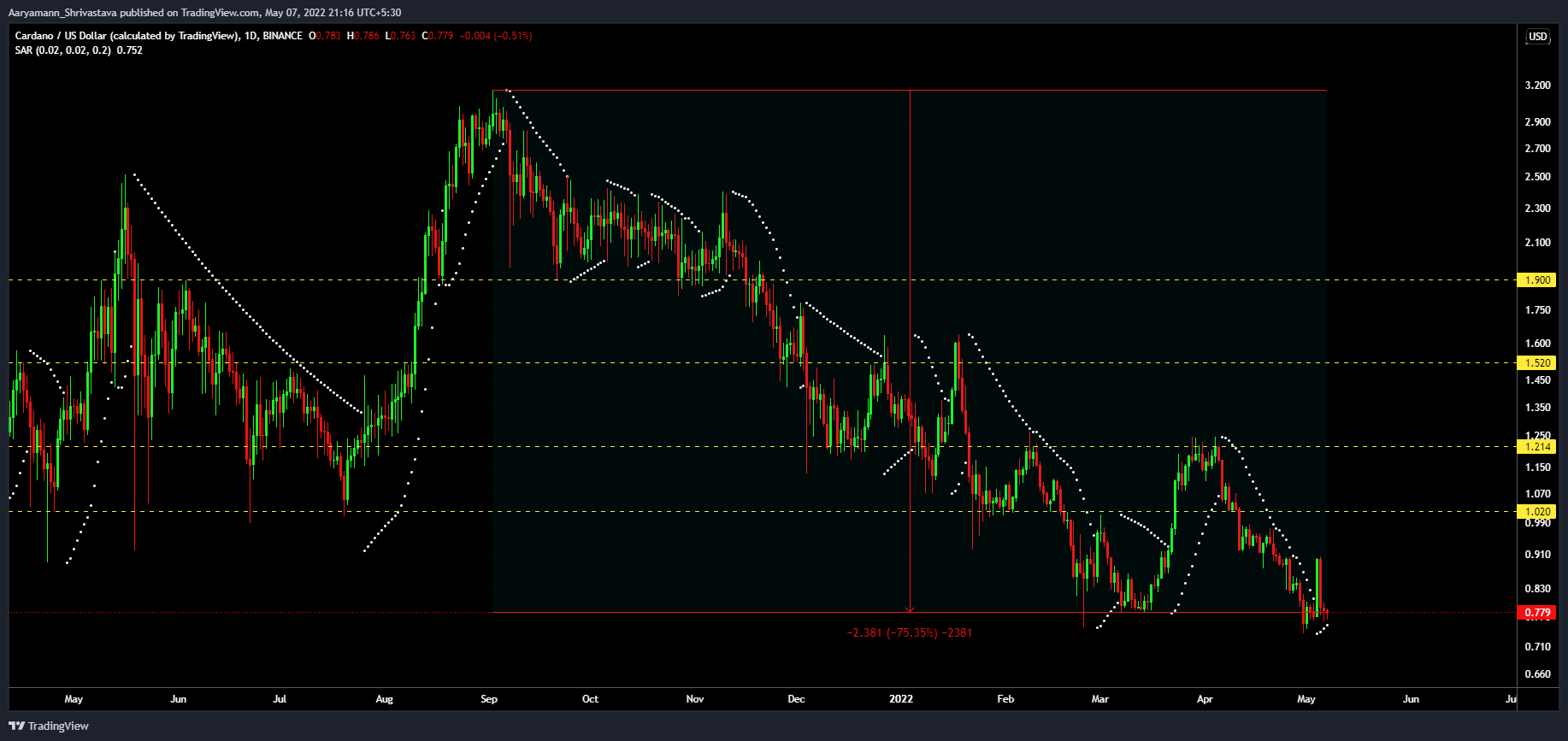

The anticipation for the launch of excellent contracts in August 2021 pushed Cardano’s native coin ADA’s value to $2.96, making it the third supreme cryptocurrency on the earth.

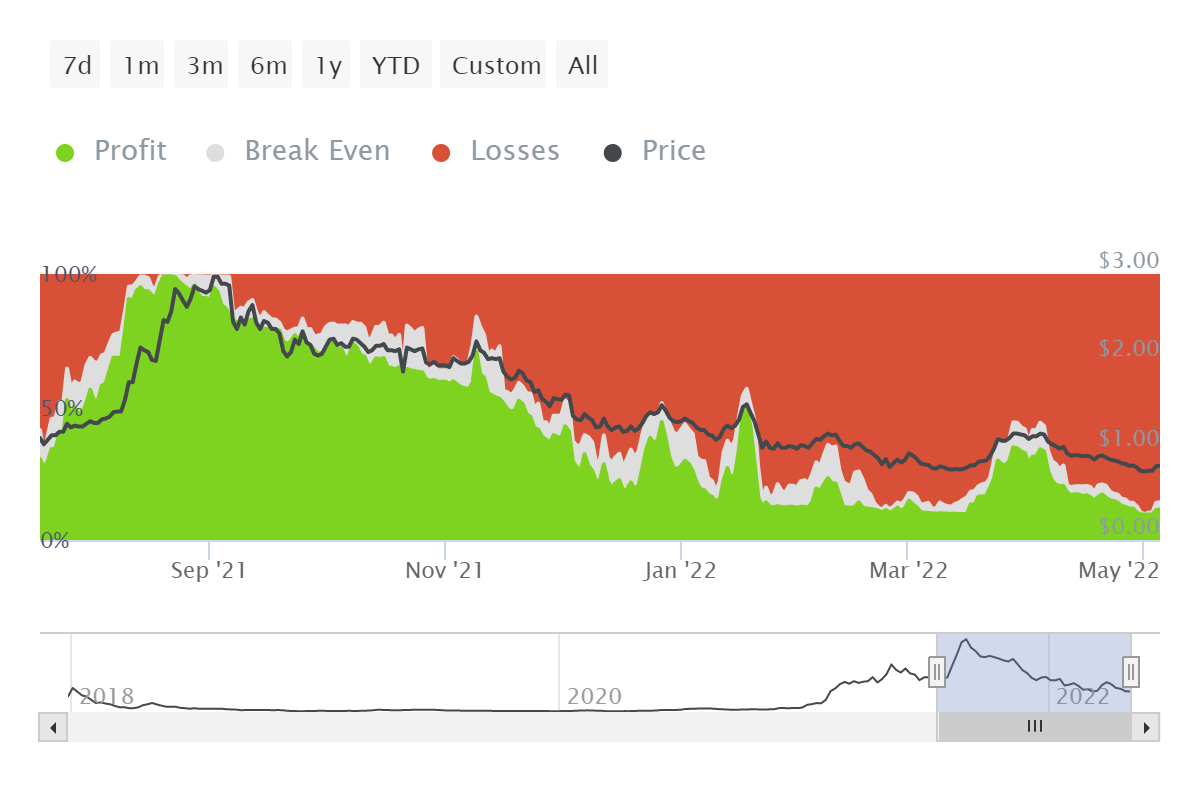

Cardano investors carried out their easiest point in the equal duration as community-huge provide observed primarily the most ADA in profit.

Because of this, August became the final time ADA holders had been most winning as lower than 0.8% of investors had been in loss.

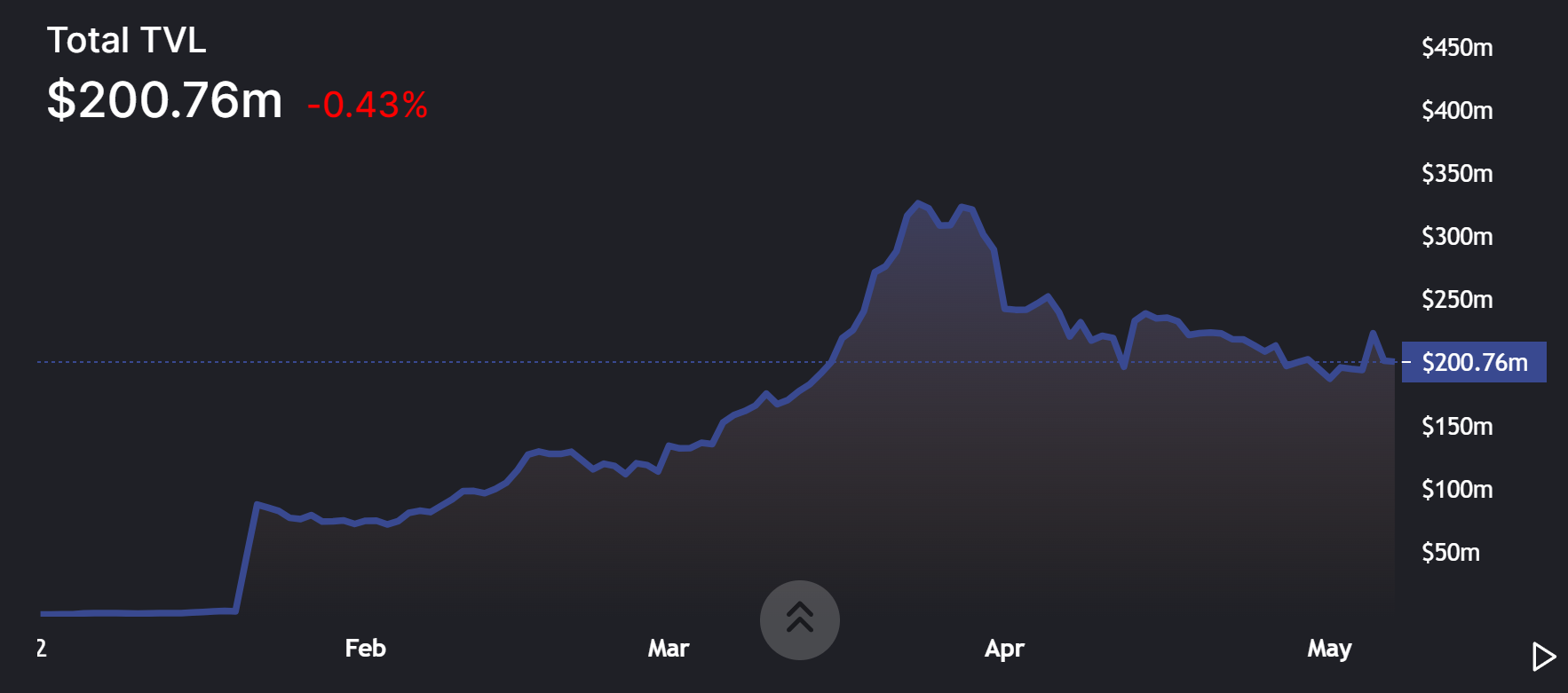

Because of this, Cardano handiest has $200 million locked in total value, but it does appreciate beef up from the alternate, which believes that the chain has the prospect of changing into a worthy elevated DeFi blockchain.

The evidence of the equal is the ‘Wave ADA Yield Fund‘ launched by Wave Monetary LLC. This fund has been designed to present liquidity for mark new DeFi protocols launched in the Cardano ecosystem. The identical Wave has committed an initial sum of $100 Million to beef up and extend Cardano’s DeFi home.

In conclusion, while for the time being, Cardano would possibly perchance also no longer appear treasure a lucrative DeFi blockchain, the continuing trends and aforementioned beef up would possibly perchance also give it the reduction significant to turn out to be a predominant player in the crypto home.