- Cboe has submitted a 19b-4 filing to be allowed to checklist and exchange alternatives on location Ethereum ETFs

- The proposal follows excessive search recordsdata from for Ethereum ETFs

- NYSE American has made a same proposal, however it completely’s but to obtain SEC approval

The Chicago Board Alternate suggestions Alternate (Cboe) has officially submitted a 19b-4 filing to the US Securities and Alternate Commission (SEC), making an try to procure approval to checklist and exchange alternatives on location Ethereum alternate-traded funds (ETFs).

This circulate signifies a pivotal step for Cboe towards rising investor entry to Ethereum, mirroring the rising search recordsdata from internal the cryptocurrency market.

Cboe seeks to elongate its funding tools

Cboe’s filing goals to broaden the spectrum of funding tools available to market contributors. By permitting alternatives trading on Ethereum ETFs, investors would favor an accessible technique to have interaction with Ethereum’s worth movements.

The 19b-4 filing comprises funds equivalent to those managed by Bitwise and Grayscale, particularly the Grayscale Ethereum Belief and Grayscale Ethereum Mini Belief, which withhold Ethereum as their main asset.

The alternate posits that these alternatives would perhaps perchance perhaps lend a hand no longer handiest as one other avenue for investors to amass exposure to Ethereum, however additionally as a the largest hedging instrument towards the inherent volatility of the cryptocurrency market.

Particularly, Cboe’s filling follows on the heels of a same proposal by NYSE American, which has but to obtain SEC approval, with the regulator citing issues over market manipulation, investor safety, and ensuring an even trading ambiance.

The SEC’s hesitance is rooted in Fragment 6(b)(5) of the Securities Alternate Act of 1934, which emphasizes the safety of investors and the maintenance of comely and honest correct-making an try markets.

No topic these challenges, Cboe’s proposal is framed as a aggressive response to NYSE’s initiative, suggesting a doable market eagerness to take into legend these monetary merchandise come to fruition.

Cboe’s manner within the filing underscores that Ethereum ETF alternatives would be governed by the identical stringent suggestions as other fund part alternatives on its platform. This comprises listing requirements, margin suggestions, and trading halts.

This regulatory alignment goals to reassure the SEC of the proposal’s adherence to existing frameworks, equivalent to those utilized to Bitcoin ETF alternatives, which were licensed below same regulatory scrutiny.

The surge in investor hobby in Ethereum ETFs

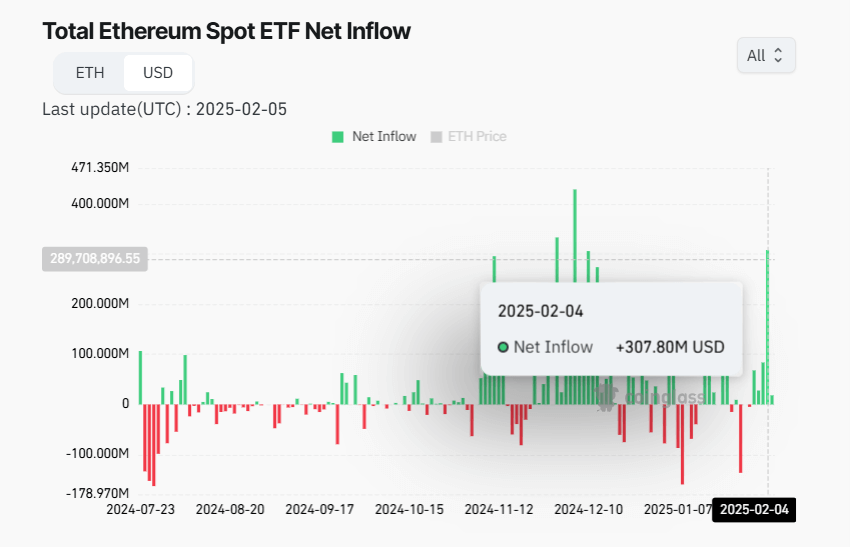

The timing of the Cboe filing coincides with a surge in investor hobby in Ethereum ETFs. No longer too long within the past, these funds bear considered unheard of trading volumes and catch inflows.

As an instance, on February 4, 2025, Ethereum ETFs recorded catch inflows of $307.77 million, the final word single-day influx of the year, demonstrating sturdy investor self belief.

This performance no longer handiest supports the explanation within the lend a hand of introducing alternatives trading, however additionally highlights the market’s readiness for such monetary innovations.

The introduction of alternatives on Ethereum ETFs would perhaps perchance perhaps doubtlessly stabilize Ethereum’s worth by bettering market liquidity.

Alternate suggestions provide sophisticated probability administration tools for institutional investors, permitting them to hedge towards worth fluctuations. Retail traders would perhaps perchance perhaps leverage these alternatives for speculative positive aspects.

This would perchance perhaps lead to a more outmoded and precise market ambiance for Ethereum, fostering better institutional adoption and contributing to the cryptocurrency’s mainstream monetary integration.

Business experts, cherish Nate Geraci from The ETF Store, bear indicated that the approval job would perhaps perchance perhaps note a timeline equivalent to that of location Bitcoin ETFs, which took about eight to 9 months from starting up to alternatives trading approval.

If this precedent holds, we would take into legend alternatives on Ethereum ETFs changing true into a fact within the advance future, doubtlessly as quickly as subsequent month, assuming regulatory hurdles are cleared.