The first time we interviewed Alex Mashinsky turned into in July 2018 within the guts of a undergo market. Bitcoin turned into about $6,500. The Celsius app turned into about to open.

The 2d time turned into in Would possibly perhaps well 2020. Bitcoin turned into silent below $10,000, but by this time, Celsius had disregarded a billion greenbacks in resources.

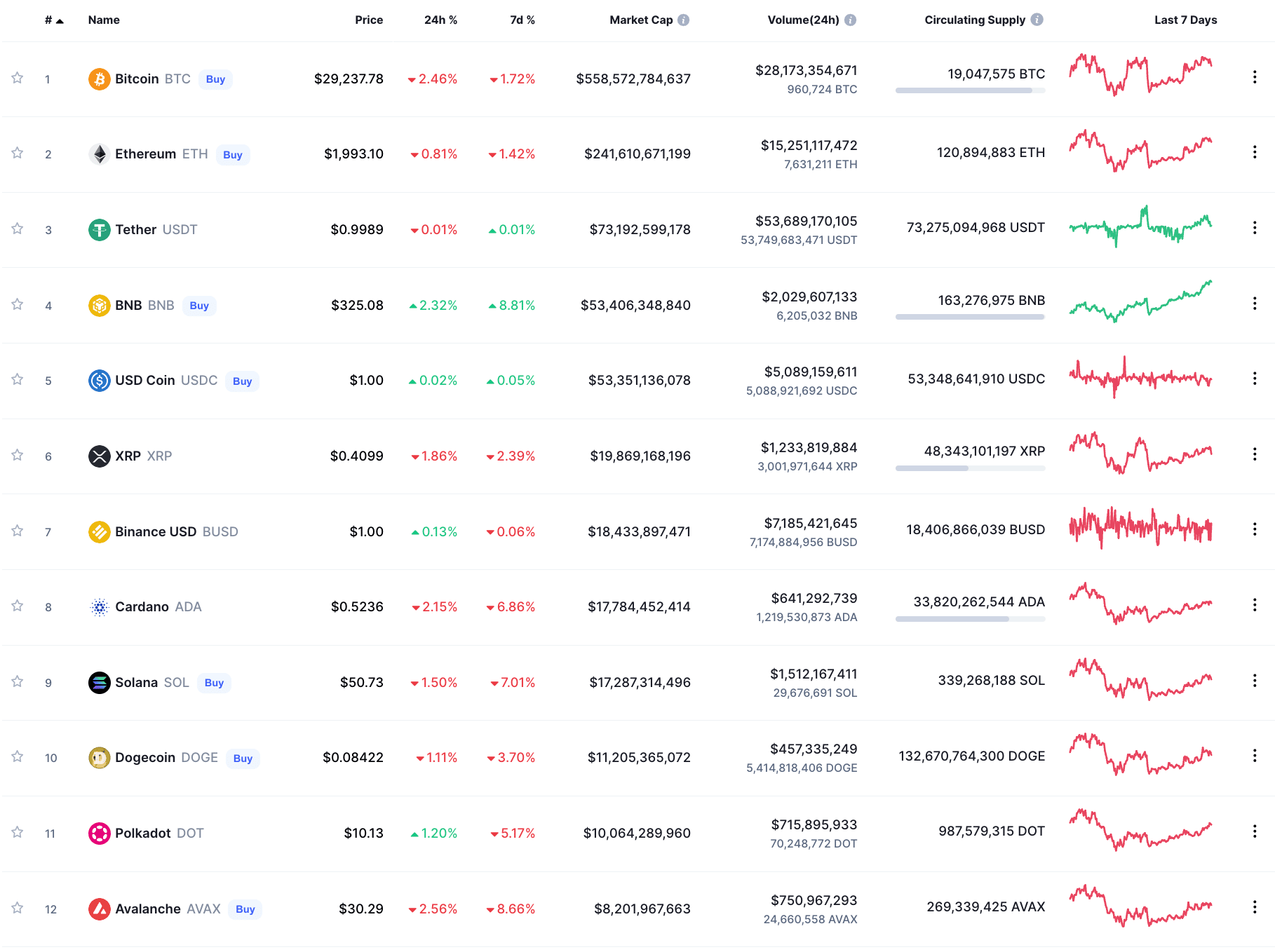

These days, we’re within the middle of 1 other undergo market. Bitcoin is down by over 50% from its all-time excessive, and it’s getting off provocative with out problems compared with completely different initiatives.

Celsius is believed of 1 of the high cryptocurrency curiosity accounts and is the eighth startup firm as a founder for Alex. Two of Alex’s prior corporations, Arbinet and Transit Wireless are two of Novel York’s largest endeavor-backed exits ever ($750M and $1.2B respectively.)

Alex and Celsius secure needed to navigate a slew of issues to navigate in recent months:

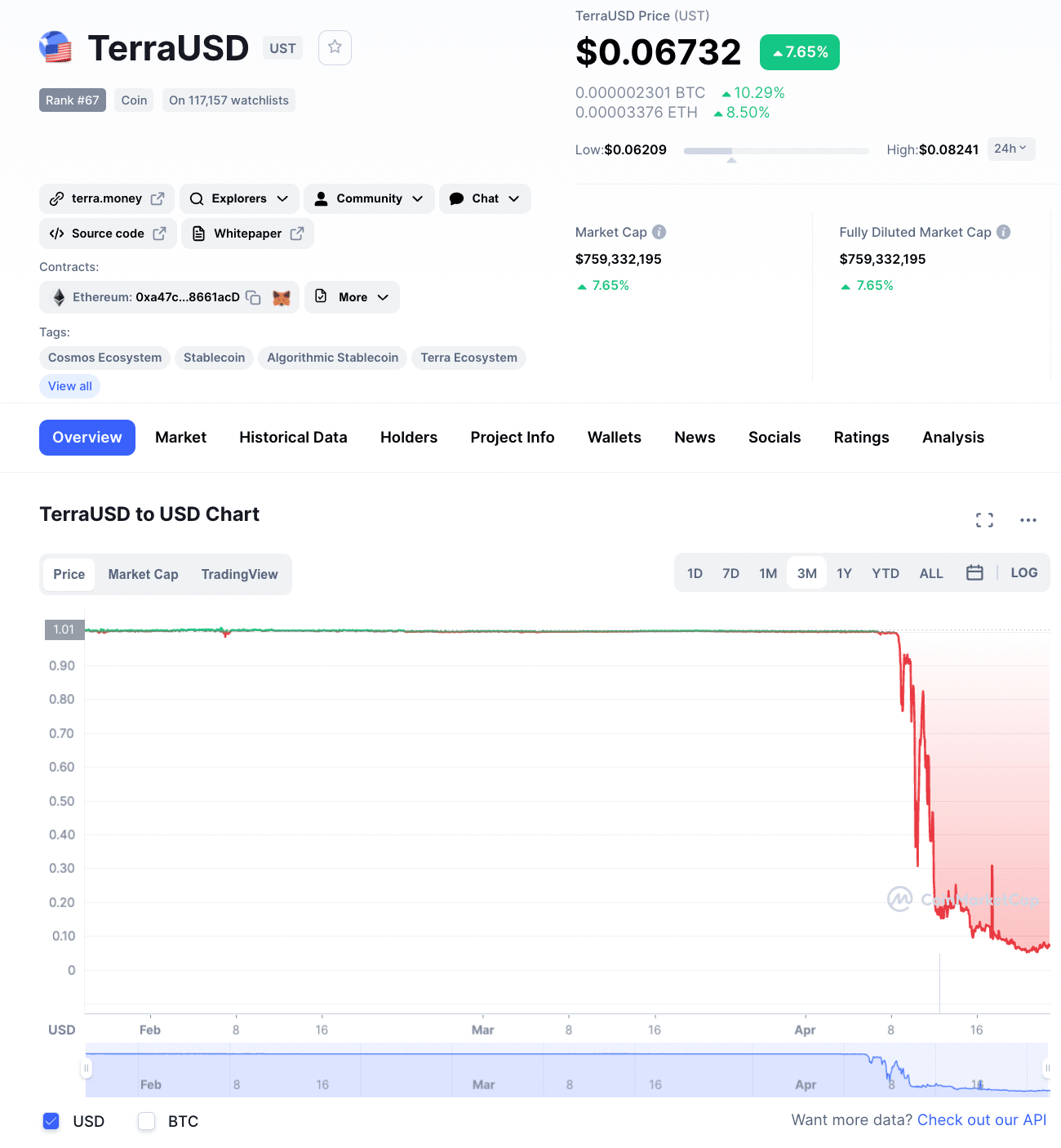

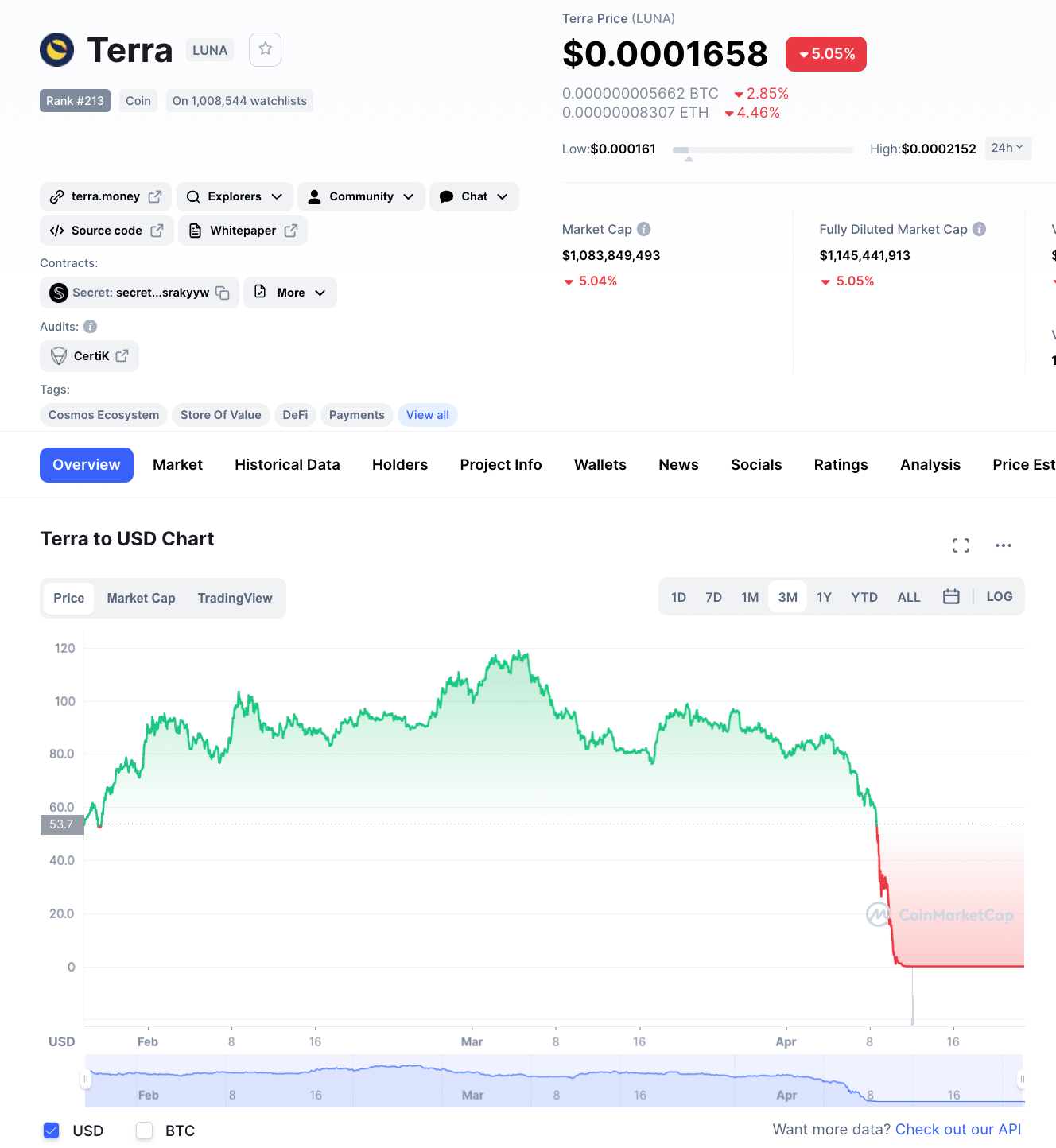

- The UST depeg and subsequent shatter of UST and Luna. What many regarded with no consideration dollar-pegged coin ended up imploding, wiping out billions of greenbacks of market price and causing a flood of customers to sell their crypto.

- The $100 million SEC and roar fines on BlockFi, sending a shockwave all the draw by the cryptocurrency curiosity story self-discipline.

- The motion in direction of DAOs and decentralized yield skills merchandise has enlivened the discourse of DeFi vs. CeFi all over again.

Alex Mashinsky joins CoinCentral to discover how Celsius is facing the challenges forward, and how today’s undergo market is completely different from the ones within the previous.

How is These days’s Endure Market Various?

Each and each undergo market tends to secure increased highs and lower lows. Even supposing we’re going by these corrections, we’re silent transferring upward. Bitcoin did completely must you role a Bitcoin versus the S&P 500 at some level of the final 10 years.

The cryptocurrency market on the time of interview.

Of us must brand that no topic the volatility, the direction is apparent and that they must care for excellent thing about these drawdowns to boost their publicity to this asset class.

But obviously, it’s upsetting that the terror index is at an all-time low. I deem it’s nine it’s below 10. I haven’t seen it below 10, so we are at max terror.

But, we’ve examined all eventualities, and I deem there’s a amount of reinforce for these stages.

Algorithmic Stablecoins, the Luna & UST Depeg Fiasco, Celsius Network’s Involvement with Anchor Protocol

Excellent because any individual calls themselves a stablecoin would now not imply that they are a right coin.

Of us must brand that the right coin is available in three completely different formats:

- Fully backed by Fiat currencies fancy USBC, TUSD, and USDT. There would possibly perhaps be a dollar sitting in a bank within the US bank or have confidence firm. Somebody who reveals up with a token goes to bag a dollar.

- Over collateralized stablecoins, fancy DAI. For those, it be most well-known to spy at what is the collateral. DAI, to illustrate, has Bitcoin and Ethereum as collateral. They’ll additionally additionally be resources now not correlated to the crypto market. When crypto crashes, those completely different resources don’t lose their price.

- Algorithmic stablecoins. The topic with this community is that algorithmic stablecoins are backed by an asset that is even more unstable than Bitcoin and is in an instant correlated to the performance of the underlying stablecoin itself. So, this makes it inherently now not right.

Of us recall that UST turned into a right coin, that it goes to additionally now not ever depeg, and that they would possibly be able to constantly bag their a refund.

The UST depegging mark chart

That turned into confirmed now not to be the case. The dispute is now not referring to the algorithmic nature of the stablecoin; it’s with the collateral. Even a combination of Luna and Bitcoin wasn’t ample to aid the peg when Bitcoin started crashing.

Celsius has 55 completely different resources in our pockets, together with Luna and UST. And when other folks give us their tokens, we must stake it. When other folks give us Luna, we must fabricate one thing with it.

So I don’t realize why other folks are shocked that we are taking part in every DeFi protocol. We withhold these resources on behalf of our community, and we stake them or switch them spherical to maximize yield.

LUNA’s mark after the depeg

Celsius displays all of these markets 24/7. After we saw a risk of a depeg, we were one of many principle to pull out of these protocols whereas most other folks were either asleep, on the job, or searching at a movie.

Most other folks don’t secure the talents or the protection to switch searching to search out markets persistently. Celsius has over 800 employees, 50 of them are in our network security group, and almost 20 of them are in our risk group. They video display your complete markets so you don’t must, and that’s why Celsius now has almost 2 million clients and billions of greenbacks.

We pulled funds sooner than the crisis, now not at some level of the crisis.

We had a amount of withdrawals; we on a typical foundation take care of transfers in tons of of hundreds and hundreds of greenbacks on daily foundation. Our volume turned into increased [during the UST depeg week], but there isn’t someone who wanted to withdraw resources from Celsius who’s silent searching forward to their resources. Everybody who requested withdrawals got serviced very like a flash.

Generally the blockchain turned into dead, fancy Terra stopped operating its blockchain, and we are in a position to’t feature when the blockchain doesn’t feature. Despite the slowdowns, I maintain that we did an noteworthy job for our clients. We’re the completely guys within the alternate with an 800 amount. You’ll likely be in a position to be in a location to name us six days per week, at 1-866-HODL-NOW, and take a look at with any individual.

We had file calls [during the UST depeg week]; we had two or Thrice as many cellular telephone calls inbound with other folks asking questions or asking for us to aid. I’m very good enough with our 800 group that helped mark plug we helped our clients larger than I deem someone else at some level of this match.

How Does Celsius Take care of a Flood of Of us Attempting to Exit Concurrently?

We secure got sizable reserves. For those that’re planning for a day fancy this, then you don’t secure a be troubled. For those that aren’t planning for a day fancy this, then you’ll secure a be troubled. You’ll secure be troubled searching to secure your complete orders.

Essentially, we would ogle a amount of withdrawals of Bitcoin and Ethereum; this time it turned into essentially stablecoins. Of us were timid that after UST went below, Tether would possibly perhaps be subsequent, after which it can be one thing else. They were searching to de-risk and bag out of their stablecoins because they were timid. They weren’t fervent about Celsius; they were timid about these issuers now not being in a location to convert these stablecoins into greenbacks.

And so they were confirmed irascible, fancy other folks that equipped their USDT for 95 cents on exchanges. You equipped it to any individual who then took that very same token to Tether and got a hundred cents on the dollar. Tether didn’t depeg; the completely thing that depegged turned into the mark of Tether on exchanges.

USDC didn’t depeg either. Any one who went to Silver Gate or Circle got a hundred cents on a dollar on USDCjust fancy they got a hundred cents on the dollar from Tether.

Of us must brand that these are two completely different issues. They’ll bag nervous after they ogle the mark on an replacement, but the mark is splendid a interesting purchaser and a interesting vendor doing a transaction below the price of the resources. It doesn’t converse to the price of a right asset fancy USDC or USDT that has fiat reserves equal to the total price of the stables.

Tips on DAOs, Would Celsius Ever Decentralize?

The mission of Celsius from Day One turned into to raise the following 100 million other folks into crypto.

We don’t factor in that you just decentralize; we predict about that you just’re making the roads and bridges.

For those that judge a two-span bridge the put one span goes to TradFi, and one span goes to DeFi, Celsius, as a CeFi firm, is to make those bridges. With Celsius X, and completely different products and companies launched, fancy we invented yield on the blockchain, we’ll continue to innovate in constructing and expanding these bridges.

Our job is to resolve the KYC AML, streak-chain, security, and key management concerns. It isn’t to bustle away from those concerns.

DAOs are fabulous; they encourage a plug feature, but no regulator will can provide abet to mark the feature that we mark for our clients if we splendid change into a DAO. You obtained’t be in a location to manufacture what we did at some level of the UST depeg, the put we equipped tons of of hundreds and hundreds of greenbacks in withdrawals. You splendid can’t manufacture that as a DAO.

We must provide A to Z products and companies to our community.

We splendid launched on-ramps in 40 states. We secure got swaps internationally, now not splendid within the US. We’re issuing a credit score card subsequent month. We secure got loans. We secure got a yield product. We secure got staking merchandise. You cannot manufacture these forms of issues as a DAO.

We secure got to preserve what we are and continue working with regulators and lawmakers to mark plug the laws act within the completely curiosity of the American other folks and the relaxation of the enviornment. We want to offer products and companies that offer protection to the consumers, offer protection to the corporate, offer protection to the institutions, and enable them to make exercise of the ability forward for finance as an quite loads of of counting on TradFi.

What Does Celsius Working with Regulators Entail?

Now not like many quite loads of corporations that can additionally perhaps be hiding offshore the put they don’t secure an address and you’re going to additionally’t search recommendation from their workplaces, our main place of work is within the US, and we secure workplaces in Israel, Serbia, London, and completely different locations.

We constantly take a look at with regulators, lawmakers, Senators, and Congresspeople. We’re a segment of many quite loads of organizations which are either lobbying organizations or non-profit communities that promote the exercise and the capabilities of crypto and the blockchain.

They manufacture an very excellent job instructing and pushing the agenda for all of us; it’s now not splendid for Celsius, unprejudiced. It’s an agenda that we are all searching to manufacture because otherwise, there are a range of the same other folks from the banks and from monetary institutions who don’t need crypto to be right here. They don’t need any competitors or innovation because they’re doing exceptionally neatly, now not paying you any yield, charging you 24% to your credit score card, price you to your ATM, charging you for inactiveness, overdraft fees, you name it.

We’re right here to swap all of that. For those that vote with us, vote with your pocket. It is miles a must to vote with your pocket. You’ll likely be in a position to be in a location to either creep for crypto and help the community grow, otherwise you’re caught with TradFi for the relaxation of your existence.

Birth air of that, there are several blockchain associations potentialities are you’ll perhaps additionally Google– some are blockchain-centric, some are crypto-centric. It is miles a must to capture what you deem in. You’ll likely be in a position to be in a location to also attain out to your Congressman or woman and insist your opinions.

These days, so as so that you just can bag elected as mayor, governor, or Congressman and you allege irascible issues about crypto, you’re now not going to bag elected. At the least a quarter of your constituency is conserving crypto resources. It’s already too late for crypto to vanish or be squashed, and even now not to switch forward.

What we truly want is for folks to bag educated on the advantages. Sure, there are some downturns fancy we’ve seen with Luna and UST. We must always silent help watch over spherical right money, but there’s a amount of doable for innovation.

The very final thing we want to happen to us, the US of The United States, is to spy China or some completely different country make all that innovation after which us be the final ones to the game because we were paralyzed to innovate. We’re the country that created the accumulate. We’re the country that created we created Web 1.0 and Web 2.0. We must always silent positively be the ones constructing Web 3.0

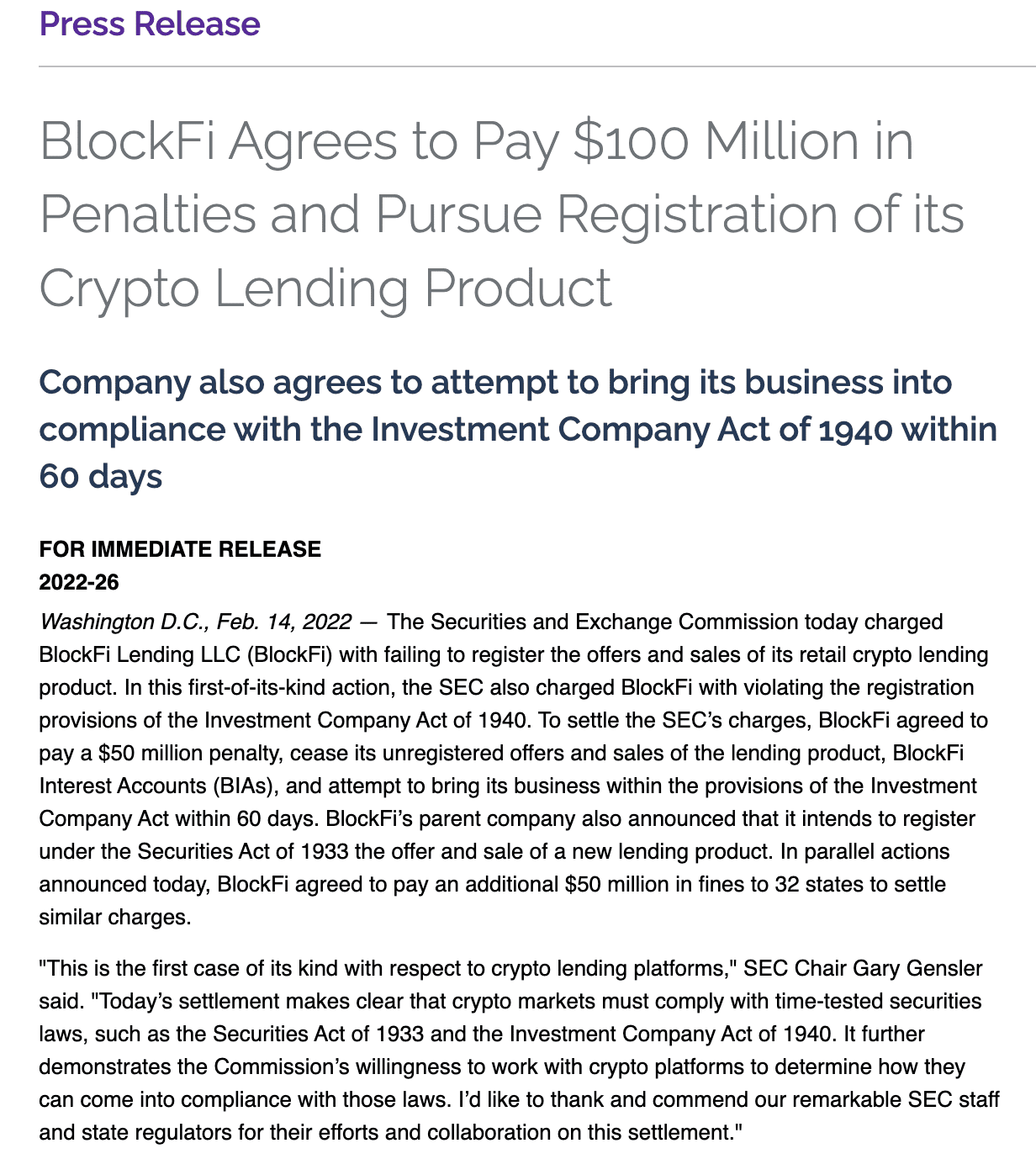

In February 2022, BlockFi got hit with a $50 million penalty to the SEC and one other 50 million in fines in 32 completely different states. How has that affected the cryptocurrency yield skills alternate? How has Celsus needed to handle the repercussions?

On April 15th, we segregated retail licensed and retail unaccredited. For those that’re unaccredited, you cannot make yield. But must you’re licensed, potentialities are you’ll perhaps additionally continue the exercise of your complete products and companies that we had sooner than.

An excerpt of the BlockFi SEC penalty

For the unaccredited, they would possibly be able to silent exercise loans, manufacture swaps, and exercise on-ramps. Every thing else is silent available; they splendid can’t make yield. In July, we’re going to be in a position to be introducing staking rewards. If any of you money are stackable, you are going to be in a location to stake them by Celsius and make staking rewards. But, must you’re unaccredited, you cannot make a yield on resources fancy BTC which are now not stackable.

Right here’s splendid what the regulators asked us to manufacture, and we adopted. We constantly phrase the regulatory regimes all around the enviornment, and we’re going to be in a position to continue to manufacture so

Editor’s existing: It sounds as if regulators mostly secure a be troubled with loaning resources to third events, therefore the safety for unaccredited merchants.

What Can We Request to Seek in Celsius’ Rates This one year?

There’s less competitors unprejudiced now. I deem most of the smaller players doubtlessly getting out.

Establishments will must pay more to care for loans, so I deem we needs as a draw to spy price will increase as an quite loads of of price reductions for depositors.

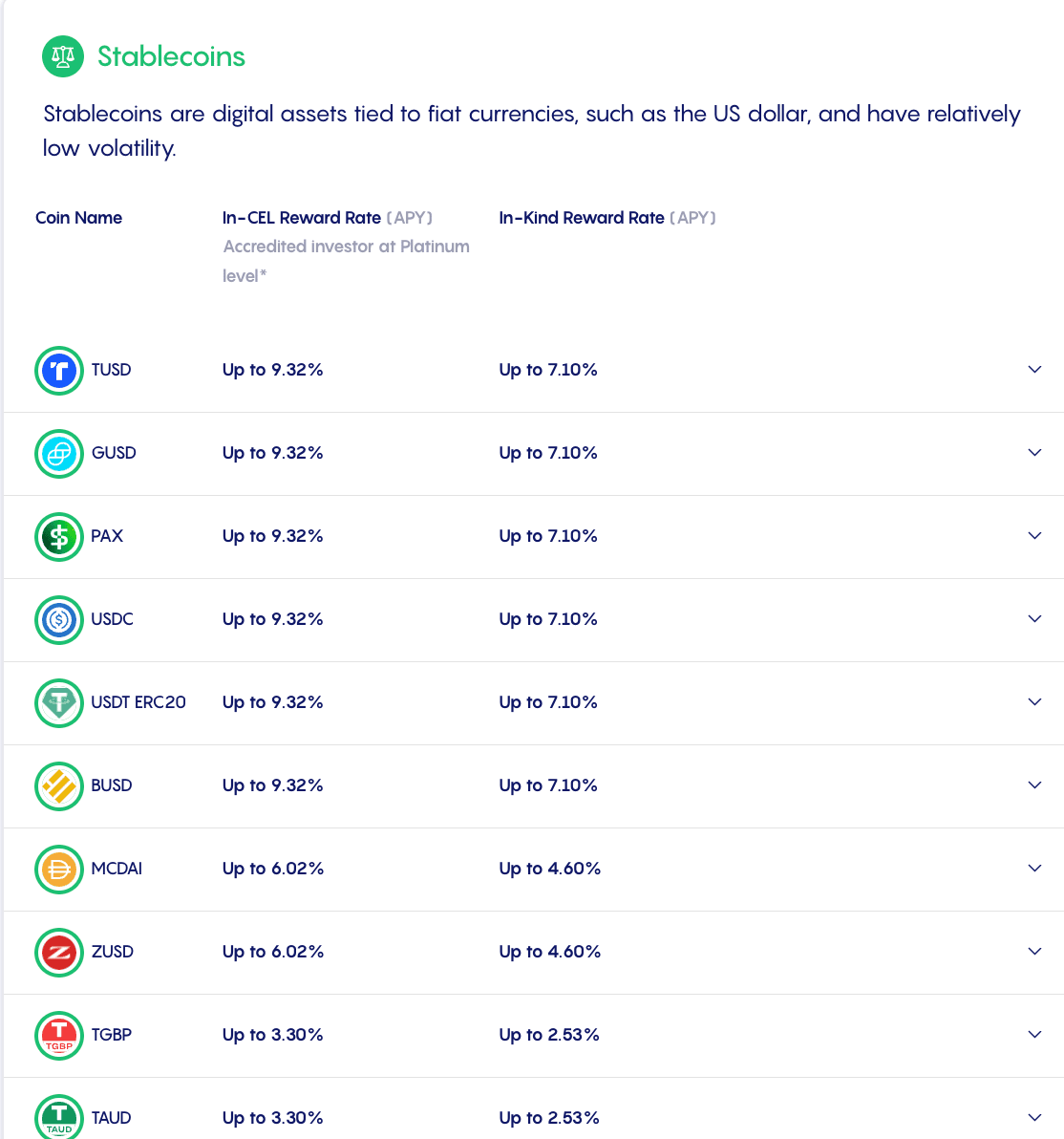

Celsius Network’s stablecoin charges (source: https://celsius.network/make)

What’s the Psychology of a HODLer?

It’s very sophisticated if this is your first winter and you’re down 50, 60%. For those that’re in alts and you’re down 80%, potentialities are you’ll perhaps additionally perhaps be feeling fancy an idiot; potentialities are you’ll perhaps additionally perhaps be feeling fancy oh my God, what turned into I taking into consideration? I FOMO’d in, I put too important money in, I wish I could perhaps additionally manufacture this, I wish I could perhaps additionally manufacture that.

None of that issues. You splendid must mark a dedication unprejudiced now.

Raise out you secure too important allocation taking into consideration your complete completely different resources?

My fleet measure for that, is how manufacture you sleep at evening?

For those that sleep neatly at evening, that suggests you doubtlessly don’t secure ample allocation. For those that don’t sleep neatly at evening, that suggests you secure too important allocation and you’re going to additionally must sell more to bag yourself as a draw to sleep at evening.

That balance is completely different for every particular person because every particular person is interesting to care for completely different dangers and has a definite portfolio of resources.

I don’t provide investment recommendation, but this will be a thermometer with Celsius. It’s a splendid thermometer to measure your publicity to these completely different resources.

What’s the Slay Arrangement of HODLing? What are Of us Maintaining Crypto For?

We’re positively now not searching to make billionaires or help other folks change into the richest other folks within the enviornment. What we’re searching to manufacture is mark plug other folks which secure a hundred p.c of their resources within the dollar or fiat denominated savings, realize that they must detach. They secure to put five or 10% in one thing that is now not dollar-denominated because they’re printing greenbacks fancy loopy, unprejudiced? And it’s now not going to hand over.

We’re going to battle by a recession soon, and it is most life like to have to secure publicity to utterly different forms of resources which secure their very possess financial system and their very possess momentum, and bag to monetary freedom.

So, monetary freedom doesn’t imply that you just’re a millionaire. It ability you give you the money for incomes ample earnings to continue to exist that earnings. You don’t must depend to your kids or social security or issues which are doubtlessly now not going to give you the comfort you’d like.

Our route to success is all about making it all over that enact line.

For every particular person of us, we must secure a dream. We secure got to secure a thought of what our retirement looks fancy and mark plug we save ample so we are in a position to dwell off that money for the relaxation of our days.

How Can Crypto Hobby Accounts and Yield Generation Platforms Support Day after day Of us Brace for Inflation?

I don’t deem the banks will repair the inflation dispute anytime soon.

The completely yield story that I do know can pay 0.5%. This isn’t about crypto; this will be a be troubled that exists in TradFi.

Crypto is doing a considerably larger job of now not lower than making an try to resolve just a few of this topic. It’s providing you with a non-correlated asset that is confidently incomes several share aspects.

I deem inflation will scheme down. I don’t deem we’re going to be in a position to secure 15 to 20% inflation. I deem we’ve already seen it down from 8.5 to 8.3. Each and each we’re going to be in a position to ogle lower and lower inflation.

It is miles a must to brand that the crypto market is searching on the stock market, the stock market is searching on the fed, and the Fed is searching at inflation until inflation is tamed.

We is now not going to ogle the fed refocusing on helping the financial system. Upright now, they’re laser-centered on inflation. Inflation is fancy a three-headed dragon and we must abolish the dragon. Every month we bag a lower inflation amount; that’s us slaying one head. After we bag three months of lower inflation charges, the Fed can refocus on the financial system. They’ll manufacture all these items they’re asserting they’ll manufacture because they’re more entirely chuffed that inflation is now not raging out of regulate.

What Can We Request to Seek in Cryptocurrency 2022?

For those that spy on the final several crypto winters, Bitcoin turned into constantly the principle to soar back sooner than the stock market, the bond market, and commodities.

I search info from us to switch sideways for a whereas, perhaps even retest the lows. But then I search info from us to switch up.

After we creep up, we creep up 5x. As you talked about, with the final few stages in 2020 and 2017. It goes up important larger than the stock market or any completely different index when it goes up.

I don’t know the put we’re going, but I’m projecting the following bull bustle, [Bitcoin], will likely be over $100,000.

I don’t perceive how soon that’s going to happen. I do know that every particular person the money held by historic palms and vacationers were equipped and are going to the right palms. There’s now not that important selling. The complete leverage is out of the machine. Now the quiz is how many fresh other folks are we adding and how like a flash is that accumulation. There’s now not important Bitcoin being created.

What Novel Products Can We Request from Celsius?

Celsiusx.io is our DeFi initiative the put potentialities are you’ll perhaps additionally creep streak-chain and manufacture stuff with orderly contracts.

CelsiusX– the DeFi arm of Celsius

We’re also launching a credit score card subsequent month; our web pages has a ready checklist.

Assume our YouTube channel or Twitter, @Mashinsky or @CelsiusNetwork. Excellent accumulate the pockets, and care for a spy at it out. We also launched a web app, so potentialities are you’ll perhaps additionally try our products and companies on the accumulate.

Thank You, Alex!

———

You’ll likely be in a position to be in a location to phrase Alex Mashinsky on Twitter, the put he on a typical foundation feedback on happenings within the alternate. He also publishes market updates on his YouTube and Celsius newsletter, rain or shine.

You’ll likely be in a position to be in a location to also bag $50 upon signing up for Celsius and depositing $400 and conserving for 30 days with this code.