Celsius vs. Nexo is a comparability it’s main to construct whereas you happen to’re taking a look to carry out rather passive APY for your cryptocurrency property. Celsius and Nexo are both UK-basically based entirely mostly companies and are both actively competing for their reduce of the worldwide market of cryptocurrency holders.

The next Celsius vs. Nexo overview examines the nuances of every platform, standout aspects, interest offerings, security, and community belief.

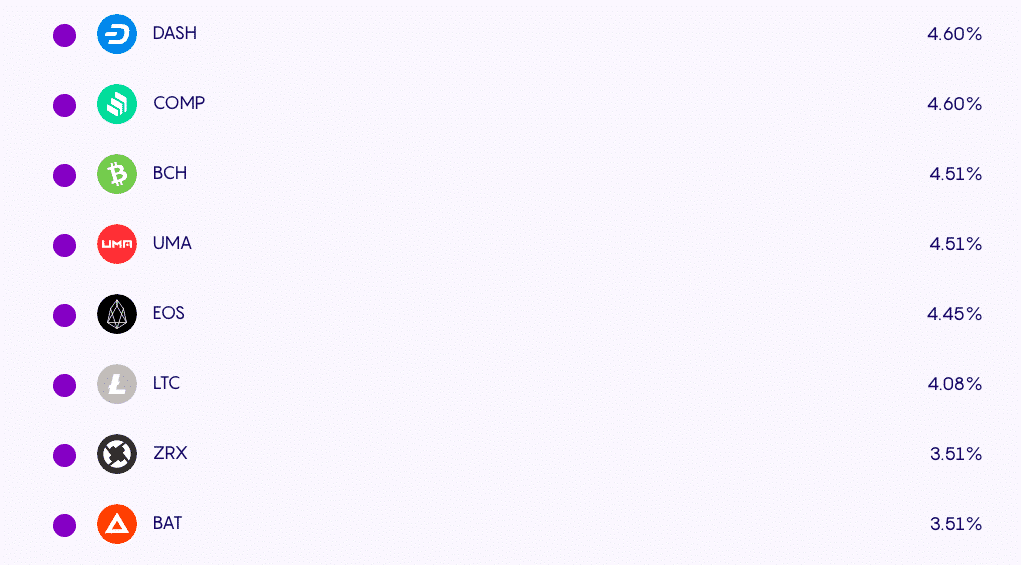

Founded in 2017, Celsius is a London-basically based entirely mostly company with $20.6B+ in property below administration from 1M+ customers. Celsius customers within the US can carry out 6.20% APY on up to 1 BTC and 3.51% on deposits above that. The company presents 5.35% APY on up to 100 ETH, then 5.05%. Celsius customers might well perchance carry out 3% on LINK, 4.08% on LTC, 8.88% on GUSD and USDC, and 5.50% on PAXG.

Celsius customers exterior the US can carry out APY extra across the board if they retain to get their interest earnings in Celsius’ native token, CEL.

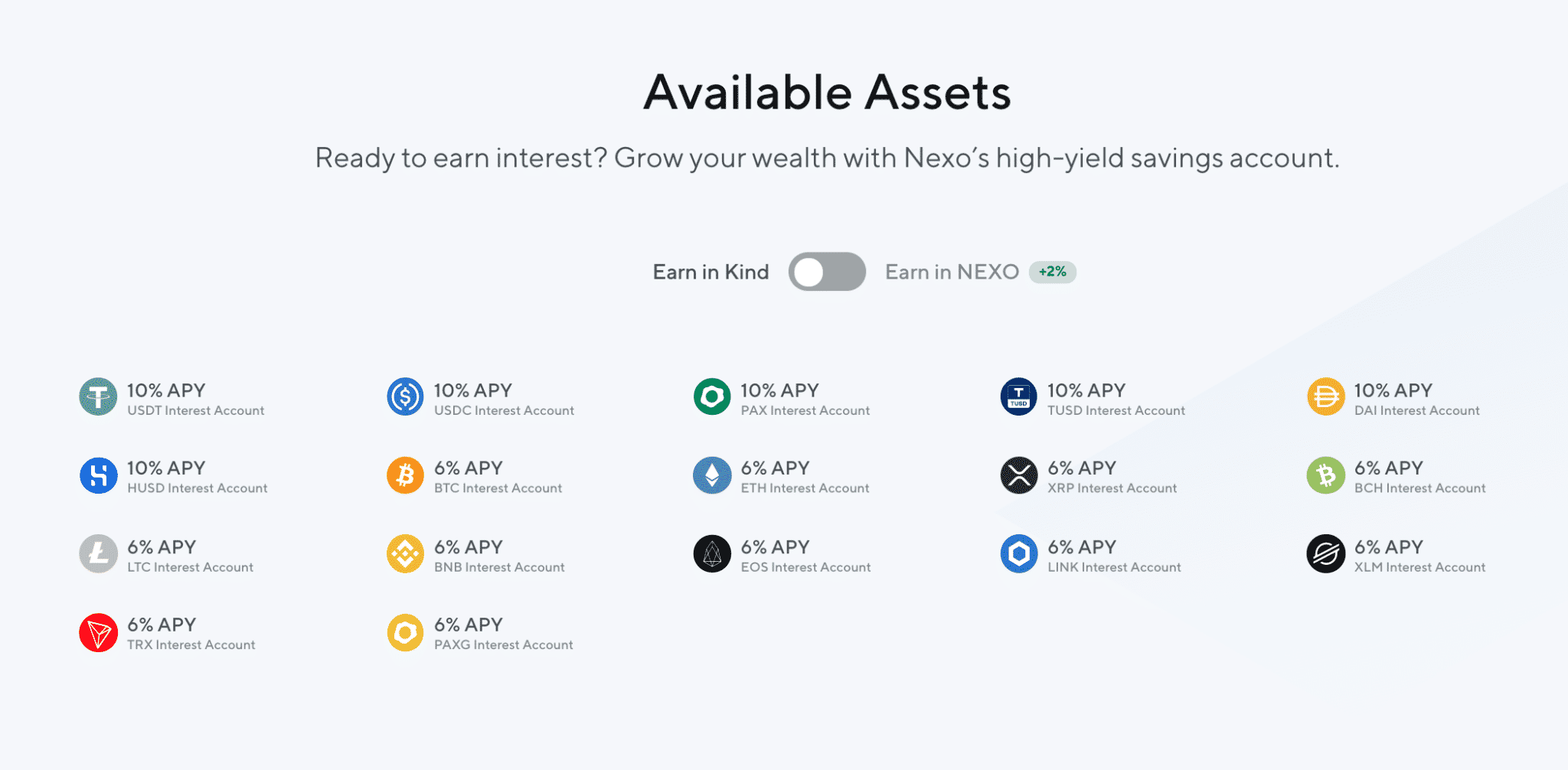

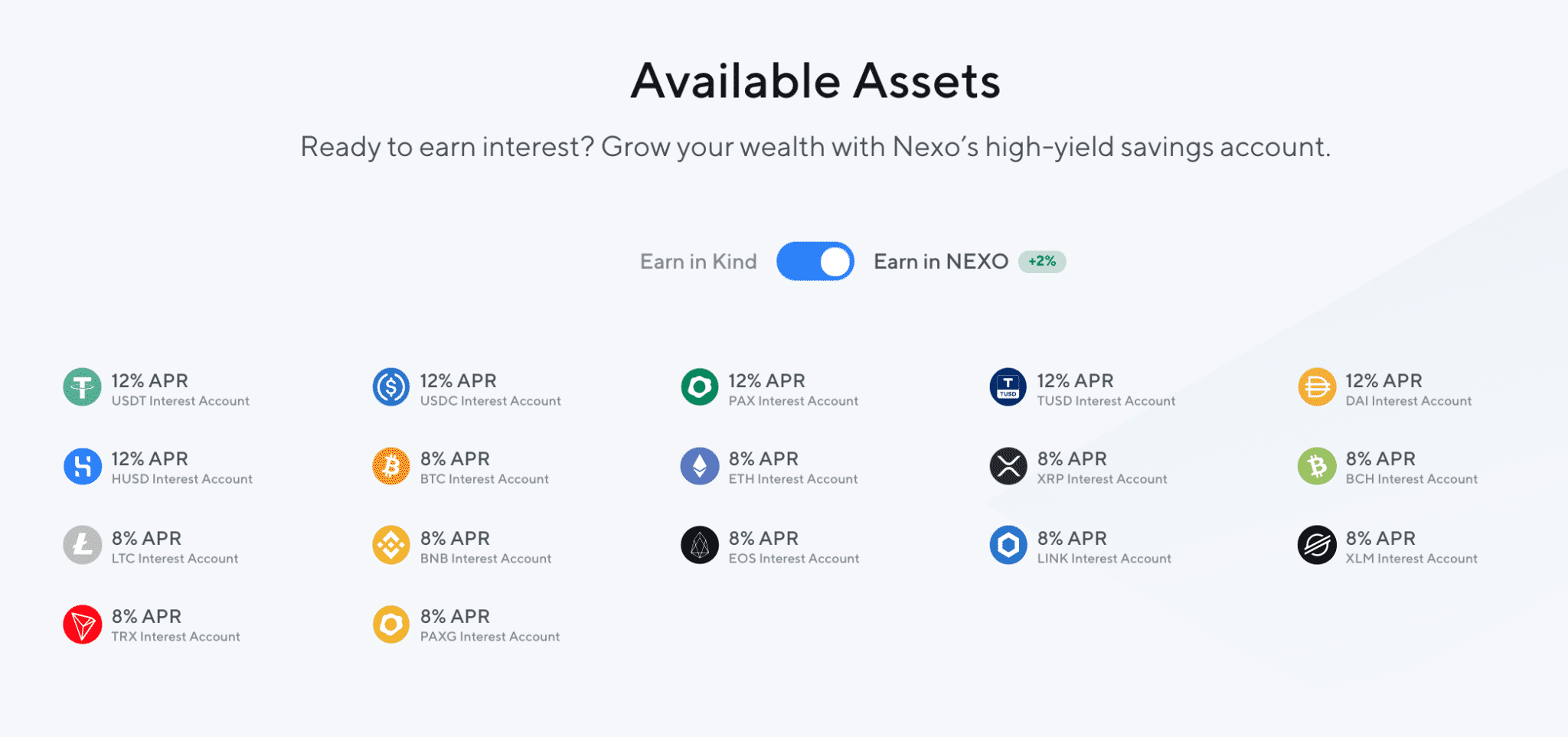

Nexo is also basically based entirely mostly in London and used to be basically based in 2017. It has over $15 billion in AUM from 2M+ customers, who carry out 6% APY on BTC, ETH, LINK, and LTC. The company also presents 10% on DAI and USDC and 6% on PAXG.

Nexo customers can carry out 2% extra in APY across the board if they retain to get interest in Nexo’s native token, NEXO.

Both Celsius and Nexo are accessible via web and cell apps.

So, both platforms have strikingly identical charge propositions, nonetheless there are some distinctions value pondering.

Celsius vs. Nexo?– which one is correct for you? Let’s dig in.

Celsius vs. Nexo Key Files

Merchandise |

Celsius |

Nexo |

| Space | London, UK | London, UK |

| Beginner-Pleasant | Yes | Yes |

| Mobile App | Yes, on Android and iOS | Yes, on Android and iOS |

| Readily accessible Cryptocurrencies | 40+ cash including BTC, ETH, LTC, GUSD and USDC | 20+ cash including BTC, ETH, LTC, DAI, and USDC; 40+ fiat currencies including EUR, USD |

| Company Originate | 2017 | 2017 |

| Community Belief | Gigantic | Upright |

| Safety | Gigantic | Gigantic |

| Buyer Red meat up | Gigantic | Upright |

| Bills | Low | Low |

| Opinions | Be taught our Celsius overview | Be taught our Nexo Review |

| Popularity/Promotions and Signup Bonuses | Device up to $50 in BTC | None. |

Feature #1: Passion Rates — Who Has Better APY, Celsius or Nexo?

Bitcoin

Celsius presents tiered charges on BTC. Customers can carry out:

- 6.20% on 0 – 1 BTC

- 3.51% on >1 BTC

Nexo’s Bitcoin charges are a flat 6% APY for customers within the US, and eight% for worldwide customers who get their interest in NEXO.

Ethereum

Celsius presents:

- 5.35% on 0 – 100 ETH

- 3.05% on 100+ ETH

Nexo’s APY charges are 6% for US customers, and eight% for worldwide customers incomes in Nexo.

Stablecoins

Celsius presents 8.8% APY on TUSD, GUSD, PAX, USDC, USDT ERC20, TGBP, TAUD, THKD, TCAD, BUSD, ZUSD, and 4.60% on MCDAI.

On the flip side, Nexo presents 10% APY on USDT, DAI, USDC, TUSD, GBPX, HUSD, and USDX, and 6% on PAXG.

Listed below are Celsius charges on cryptocurrencies;

How Attain Celsius and Nexo Bag Money?

Celsius makes money by offering loans to corporate institutions and exchanges. The company redistributes earnings to its customers via rewards searching on their loyalty tier (or the volume of CEL they choose) and has paid upwards of $508M in rewards to its customers within the previous Three hundred and sixty five days.

To stable these loans, Celsius requires customers to make a choice collateral of on the least 50% LTV (loan-to-charge). In utterly different phrases, to gain a loan, debtors need to make your mind up crypto property on the least twice the cost of the sum they’d make a choice to borrow inside a Celsius fable. This collateral can lumber up to 150% LTV.

Bask in Celsius, Nexo makes money from the distinction between what it can well perchance pay the customers it borrows from (or presents interest to) and what it payments debtors. The platform makes loans to both its patrons and institutional debtors.

Nexo shares 30% of earnings to NEXO holders as dividends. Since 2017, Nexo has paid out over $29.8M as dividends to its token holders.

Consumers can borrow from Nexo using credit score lines accessible thru a fiat switch or the Nexo card. These loans are collateralized at no longer much less than 50% LTV.

Feature #2: Payouts and Withdrawals

Celsius lets customers withdraw their funds at any time without payments. However, it has a subtle cap on withdrawals of $50,000+ inside 24 hours, and larger withdrawals can beget to 48 hours to activity. Celsius interest is compounded every Monday.

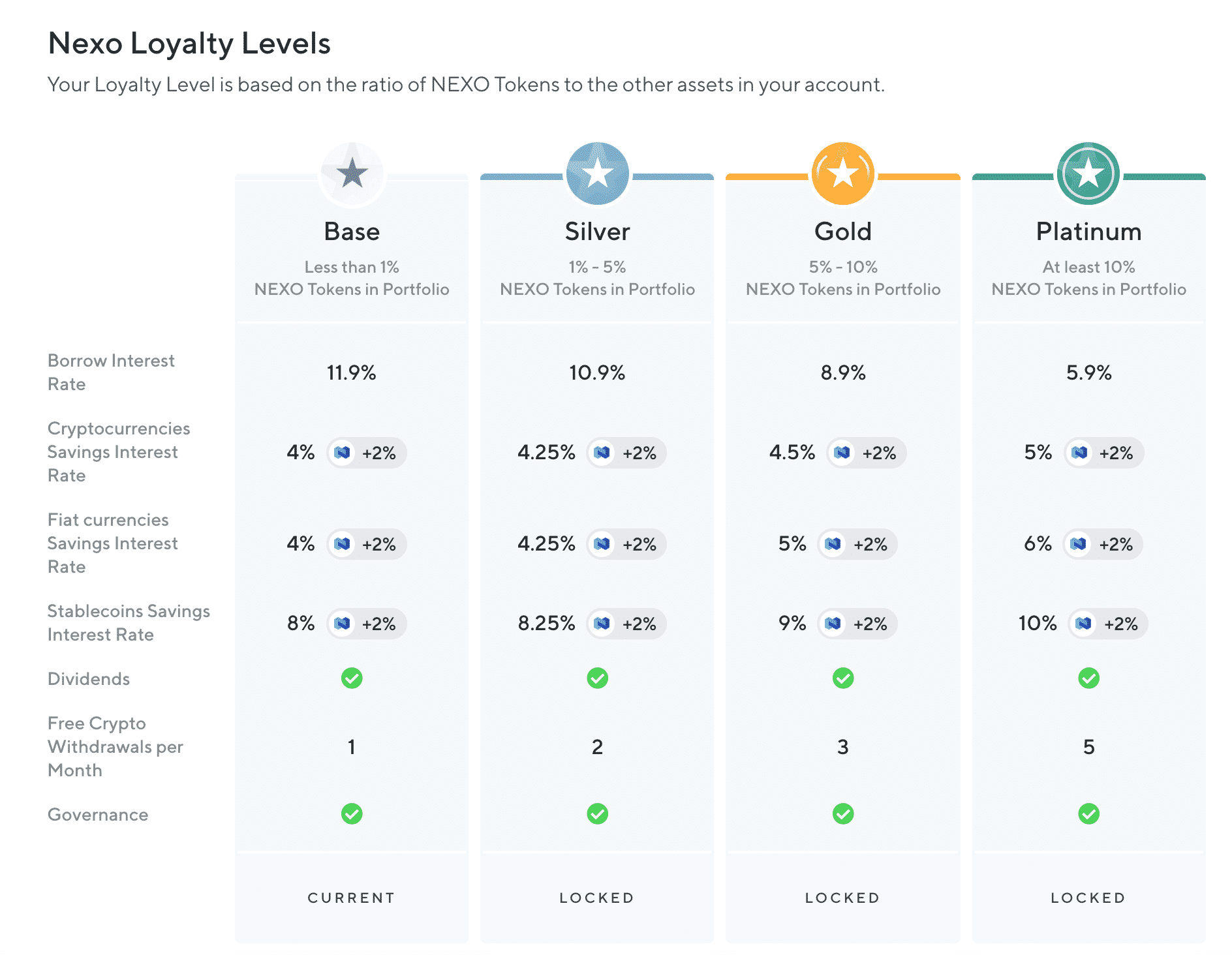

On Nexo, interest is compounded day after day, and customers can construct 1-5 free withdrawals searching on their loyalty tier or the volume of NEXO they choose. Nexo customers might well perchance construct limitless free fiat deposits, transfers, and withdrawals.

Winner: Celsius. Customers can construct limitless withdrawals and no longer pay any withdrawal, switch, transaction, or early termination payments.

Feature #3: Safety

Celsius and Nexo are both custodial platforms, which blueprint they choose possession of their customers’ deepest keys. Crypto loans and deposits can no longer be FDIC insured, and one should always adequately overview the hazards of using crypto interest merchandise.

However, both companies have demonstrated a excessive level of security regarding growing distinct deposits are by no blueprint nearby of prying hacker fingers.

Platform Safety

Celsius has a slew of user-facing security aspects, comparable to 2-aspect authentication, a pin, biometric security, and some confirmation aspects esteem e mail verification when altering your pockets contend with and manual verification when trying to withdraw property value over $150,000.

Celsius also has an inbuilt security characteristic called HODL mode. In HODL mode, customers need to full a 24-hour waiting length sooner than their withdrawals are confirmed, so there’s beyond regular time for you (and Celsius) to acknowledge if your fable has been hacked.

Nexo’s platform employs security procedures including 2FA, a password, biometric security, and e mail confirmation aspects.

Fund Safety

Celsius keeps user property in third-birthday celebration custodians Fireblocks and PrimeTrust.

Cryptocurrency property on platforms esteem Celsius are usually on the switch to be loaned and bought to generate interest; the above insurance protection doesn’t hide your property when they’re loaned to Celsius creditors to generate yield.

In April 2021, Celsius’ e mail distribution servers have been hacked, and the contact records of some performed an e mail and SMS phishing attack that resulted within the loss of some customers’ funds.

In a blog submit, CEO Alex Mashinsky stated, “ We have continually communicated to our possibilities and can continue to give a enhance to that Celsius will by no blueprint request for passwords, deepest keys, seed phrases, and utterly different confidential user credentials.”

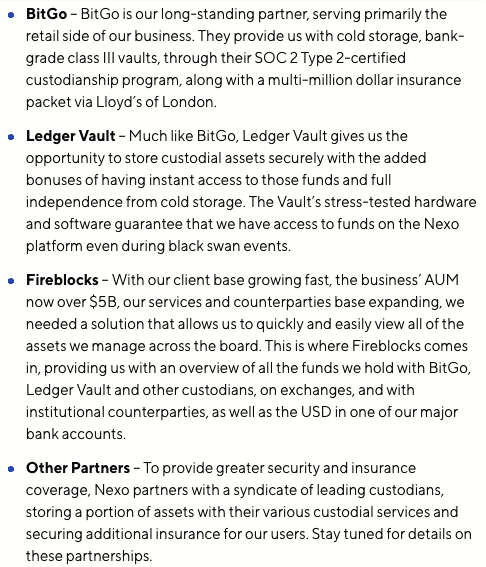

On the flip side, Nexo keeps user property safe in frosty wallets secured with multi-signatures, with deepest keys saved offline in Class III monetary institution vaults for physical protection. This substantial protection is attainable thru several custodians. Right here’s a breakdown;

As of this writing, Nexo has by no blueprint been hacked.

Winner: Celsius affords its customers many alternate choices to make a choice their accounts safe. Its intensive user-side protection towards hacks affords it the seize in this fragment, even though Nexo’s mammoth protection towards custodial hacks is value noting.

Feature #4: Promos and Bonuses

CoinCentral readers can carry out up to $50 in BTC by signing up for a Celsius fable and making a deposit of up to $100,000. The company also presents up to $50 on every a success referral.

As of this writing, Nexo does no longer provide any promos or signup bonuses.

Winner: Celsius.

Feature #5: Ease of Allege

Both Celsius and Nexo are newbie-pleasant and accessible via web, iOS, and Android apps.

Celsius vs. Nexo: Standout Aspects

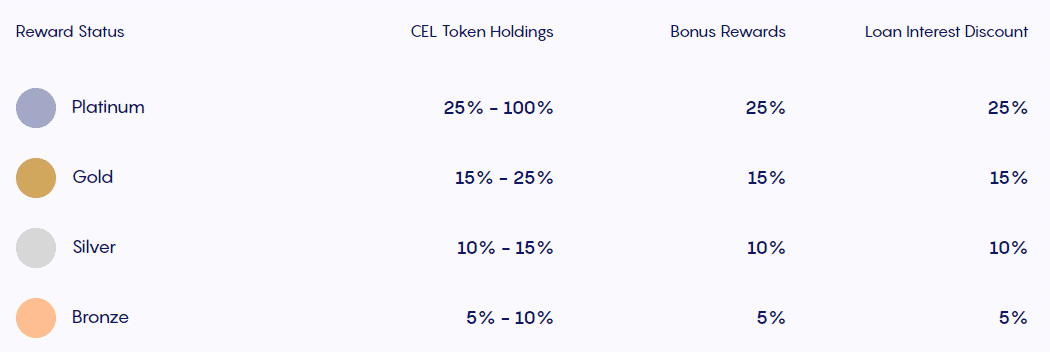

Celsius’ main standout aspects embody its token CEL. Customers who preserve to carry out interest with CEL can qualify for up to 25% reductions on loan interest payments.

Nexo’s standout aspects embody its change, which lets customers swap seamlessly between 100+ crypto and fiat pairs. Its card is approved by over 40M merchants worldwide and lets customers get instantaneous 2% cashback without a month-to-month or annual payments.

Holders of the Nexo token also carry out some treasured perks, esteem larger APY charges and diminished charges on crypto loans.

Buyer Service

Celsius has a devoted Support Center containing FAQs on deposits, withdrawals, and security. Customers might well perchance submit a help demand and get give a enhance to via e mail.

Nexo also maintains detailed FAQs in its Support Center, and customers can entry 24/7 give a enhance to.

The Court docket of Public Opinion: Celsius vs. Nexo Reddit

Red meat up for both Nexo and Celsius is suddenly obvious on Reddit. Customers favor both companies for their interest charges, nonetheless give a enhance to leans towards Celsius for its perceived transparency and openness. On the total, most Redditors command that customers diversify by utilizing both platforms.

Celsius vs. Nexo Last Ideas: Which is the Best Crypto Passion Fable?

It’s a in point of fact terminate bustle between Celsius and Nexo for the supreme cryptocurrency interest fable.

Celsius lets customers carry out on 40+ cryptocurrencies, with up to 6.20% APY on Bitcoin, up to 5.35% APY on Ether, and eight.8% APY on most stablecoins, including USDC, USDT, and GUSD.

On the flip side, Nexo customers can carry out 6% on Bitcoin and Ether and 10% APY on stablecoins esteem USDT, BUSD, USDC, and additional.

Celsius takes several user-side precautions comparable to HODL mode.

Nexo’s substantial fund safety features mean that property saved in its custody seem rather stable from hacks.

Nexo’s 24/7 customer give a enhance to and larger charges on cryptocurrencies (critically thru its loyalty program) might well perchance appeal to skill customers.

However, Celsius wins in this overview with better promos, a broader quantity of supported property, and successfully-thought-out user-side protection aspects.

1 comment

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers