Key Takeaways

- The chair of the Commodities Futures Procuring and selling Price has stated his belief that Bitcoin and Ethereum are clearly commodities.

- He claimed that the digital asset dwelling contained both commodities and securities, and properly regulating them would require separating them out.

- The remarks attain in a watershed twelve months for crypto regulation, with governments across the world acting to realize new guidelines to suit the industry.

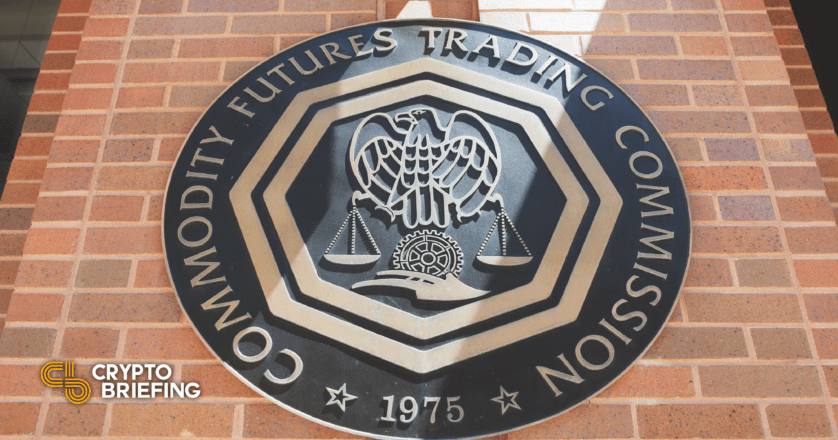

Commodity Futures Procuring and selling Price (CFTC) Chair Rostin Behnam has expressed his belief that Bitcoin and Ethereum are commodities, though the digital asset market contains commodities and securities alike. He therefore argued that separating out which is which will be a mandatory step toward factual regulation.

Digital Commodities

Bitcoin and Ethereum are both commodities, in step with the chair of the CFTC.

Rostin Behnam, Chair of the Commodities Futures Procuring and selling Price, stated this day in an interview with CNBC that he turned into as soon as “sure” that both Bitcoin and Ethereum are commodities. He did so all over the context of arguing that the colossal array of digital property entails both securities and commodities, and that it turned into as soon as the job of regulators to parse out that are which:

“Within the sphere of digital property and the money which come up hundreds of hundreds, they’re naturally going to be some commodities and securities. In my glance, it is miles sparkling to form of parse thru the 2 and determine the set apart we are able to set apart every.

Staunch oversight of the crypto industry, if it is miles to be performed correctly, can’t skip this essential step, no topic its scenario:

It’s going to be complicated from a legislative standpoint, and given the novelties of all these cash and the technology, we going to delight in to determine what’s going to picture the protection below the broken-down securities regulation and what would picture more of a commodity in tell that we are able to manage correctly, given the 2 diverse suitable buildings.”

Most notably, per chance, turned into as soon as Behnam’s stance on Bitcoin and Ethereum, that are with out predicament the dominant crypto property by market capitalization. Without hesitation, he stated unequivocally that he even handed both to be commodities:

“I’m able to claim for sure Bitcoin, which is the greatest of the money and has consistently been the greatest no topic the total market cap of the total digital asset market capitalization, is a commodity. Ether as smartly. I if truth be told delight in argued this forward of, my predecessors as smartly stated it is miles a commodity. There may maybe maybe be, if truth be told, a total bunch, if not hundreds of safety cash, however there are quite quite a bit of commodity cash that I have confidence it is miles sparkling, as we’ve performed historically, to net sure that every company has jurisdiction over commodities and securities, respectively.”

When asked just a few bill pending in the Senate that will maybe maybe set apart the bulk of digital asset regulation below the purview of the Securities and Alternate Price, Behnam stated that the 2 companies delight in a “mountainous relationship historically,” and they proceed to work closely collectively; however, he emphasized his belief that the CFTC should always level-headed adjust commodities and SEC should always level-headed adjust securities.

Quiet, he emphasized the need for regulation and implied it’d be a boon for the industry, arguing that sturdy particular person protections were the very reason in the abet of the success of American commodities and securities markets. Further, he bemoaned the lack of particular person protection all over the crypto industry in recount and pointed to its detrimental consequences:

“Closing week, quite quite a bit of folks purchased harm, quite quite a bit of imprint turned into as soon as misplaced in the market, and there if truth be told don’t seem like any customer protections accurate now. We delight in got a range of affirm-level guidelines and oversights however when it involves market oversight, when it involves disclosures, we don’t if truth be told delight in essential accurate now as it pertains to broken-down monetary markets… We would like to avoid losing forward a regulatory framework that will defend customers, net acceptable disclosures and sooner or later, for these that reinforce the industry, reinforce its order and maturity over the next couple of years.”

2022 is anticipated to be a watershed twelve months in crypto regulation, with growing indicators that a range of authorities bodies across the world taking circulate to net sure the nascent enviornment is introduced below more total and industry-explicit guidelines. Closing week, one senior global securities legit predicted the commence of an legit, world cryptocurrency regulatory body all over the next twelve months, and earlier this twelve months President Joe Biden signed an executive expose instructing federal companies in the USA to blueprint a total framework for cryptocurrency regulation.

Disclosure: On the time of writing, the writer of this portion owned BTC, ETH, and several other cryptocurrencies.

The understanding on or accessed thru this net goal is purchased from fair sources we predict about to be accurate and respectable, however Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any knowledge on or accessed thru this net goal. Decentral Media, Inc. is just not an funding advertising consultant. We attain not give personalized funding advice or other monetary advice. The understanding on this net goal is field to interchange with out peek. Some or the total understanding on this net goal also can develop into out of date, or it may maybe maybe maybe maybe be or develop into incomplete or unsuitable. We also can, however are not obligated to, update any out of date, incomplete, or unsuitable knowledge.

You’ll want to level-headed by no formulation net an funding choice on an ICO, IEO, or other funding in step with the understanding on this net goal, and also it’s worthwhile to always level-headed by no formulation interpret or otherwise rely upon any of the understanding on this net goal as funding advice. We strongly imply that you seek the advice of a certified funding advertising consultant or other certified monetary reliable if you happen to are searching for funding advice on an ICO, IEO, or other funding. We attain not settle for compensation in any net for inspecting or reporting on any ICO, IEO, cryptocurrency, foreign money, tokenized gross sales, securities, or commodities.

“To blame Pattern of Digital Property”: Biden’s…

The Biden administration has issued an executive expose that will support decide the U.S. authorities’s crypto policy in the months forward. Bellow Will Salvage New Insurance policies Early this day, President Joe…

Biden Will Title Gary Gensler as SEC Chairman

President-elect Joe Biden has confirmed that he’ll title Gary Gensler as the next chairman of the U.S. Securities and Alternate Price (SEC) in a brand new announcement. Gensler Will Become…

CFTC Chairman Who Declared ETH a Commodity to Resign

Heath P. Tarbert announced his plans to step down as the Commodity Futures Procuring and selling Price (CFTC) chairman in early 2021. “On the present time, I am asserting that I intend to resign my…