Biking On-Chain is a month-to-month column that makes utilize of on-chain and designate-linked records to better realize fresh bitcoin market movements. This eighth edition affords a yr in analysis for 2021 after which assesses what most well liked inclinations check take care of going into 2022.

A Year Of Modest Development

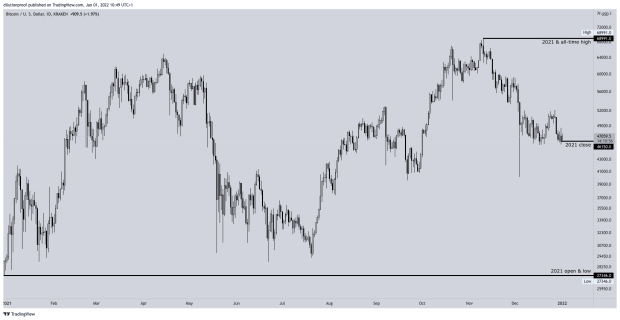

The bitcoin designate opened the yr at $27,346 (on Kraken) and in actuality by no methodology regarded relief. Hopes own been very excessive, which used to be largely driven by the institutional distress of lacking out (FOMO) that Michael Saylor and MicroStrategy triggered, along with PlanB’s Stock-to-Hotfoot (S2F) and S2F Atrocious Asset (S2FX) fashions that predicted a designate of spherical $100,000 and $288,000, respectively.

Bitcoin by no methodology seen these prices in 2021 but did situation a brand unique all-time excessive at $68,991 (on Kraken) in November. It closed the yr at a designate of $46,150, which is a $18,804 (68.8%) extend for the explanation that birth of the yr. Bitoin’s paunchy 2021 designate history (on Kraken) is displayed in figure 1.

Figure 1: Bitcoin (XBT) designate in United States dollars (USD) on Kraken (Provide).

Grayscale Inflows Stop In February

In January 2021, the bitcoin designate reached its first local top of its bull cycle, throughout which loads of on-chain inclinations changed. Most significantly, sell tension of lengthy-interval of time holders and miners began to fall off. For the interval of that time, there used to be serene massive institutional FOMO going on, seemingly triggered by the mix of MicroStrategy and NYDIG’s institutional onboarding event that used to be rumored to be very successful, apart from to Tesla procuring for $1.5 billion worth of bitcoin in early February and accepting it for automobile gross sales.

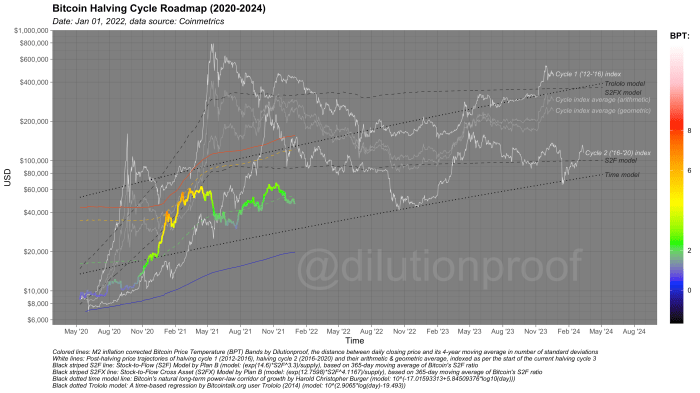

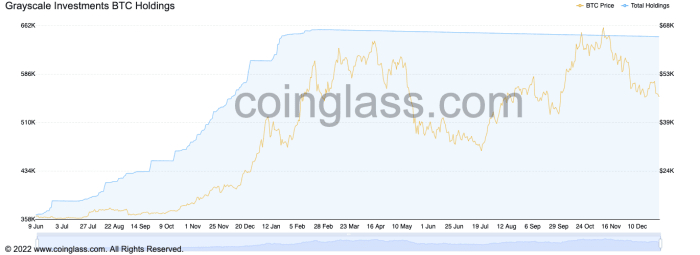

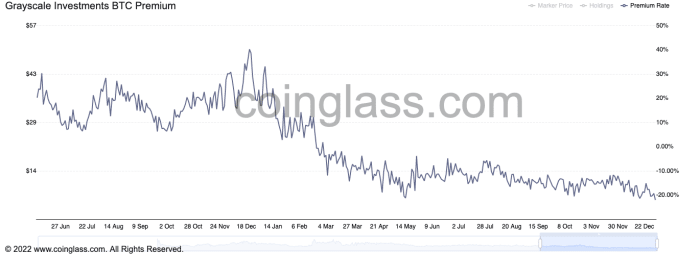

On the different hand, in February, one in all the largest drivers of the value speed-up into unique highs also stopped doing so. Grayscale Investments, which is a fund where largely institutional investors (81–84%) can bewitch shares that Grayscale would relief with bitcoin (GBTC) and promise to by no methodology sell, with exception of their annually deducted price. For the interval of 2020, Grayscale Investments’ BTC holdings seen a enormous rise, topping at exact over 650,000 bitcoin in February (figure 2).

Figure 2: Grayscale Investment BTC Holdings (Provide).

As a result of repute of the GBTC shares for entities that is now not going to own been willing to self-custody massive amounts of bitcoin themselves, the value of GBTC shares traded at a enormous premium over the situation bitcoin designate. This provided an arbitrage or “money-and-raise commerce” different, where investors that will perchance maybe well simultaneously ride quick GBTC by the usage of futures markets and lengthy GBTC by truly procuring for shares, and closing every positions when the GBTC shares could perchance maybe well be unlocked to be traded on secondary markets six months later. By doing so, investors could perchance maybe additionally snatch a “threat-free” spread between the value of GBTC shares and the situation bitcoin designate, which peaked at a whopping 40.2% in December 2020 (figure 3).

Figure 3: Grayscale Investments BTC premium (Provide).

Expressionless February 2021, this GBTC premium dropped to detrimental ranges, closing the window for this arbitrage different that took so mighty bitcoin off the market. In hindsight, this change seemingly performed a key feature in the inability of vigor in subsequent months to confidently defend bursting to unique all-time highs, take care of it did throughout the 2017 bull speed.

Capital An increasing form of Flows Into Altcoins And NFTs In Q1 And Q2

On myth of the birth of 2021, an increasing amount of capital has began flowing into other crypto belongings take care of altcoins and non-fungible tokens (NFTs). Around that very same time, the GameStop inventory frenzy used to be going on, where retail investors colluded on platforms take care of Reddit and Robinhood to pump the costs of certain shares that hedge funds own been vastly shorting. A massive portion of the market used to be clearly having a seek belongings with unheard of upsides, no matter the threat profile that used to be hooked up to them.

Inner the broader crypto markets, anticipation of an upcoming Coinbase “IPO” used to be emerging. On April 14, Coinbase used to be indeed instantly listed on Nasdaq. This event coincided with a series of executives promoting their inventory, inflicting a enormous dump in the value of its shares that day. The bitcoin designate also situation a brand unique all-time excessive that day but, after that, went down alongside Coinbase’s inventory designate.

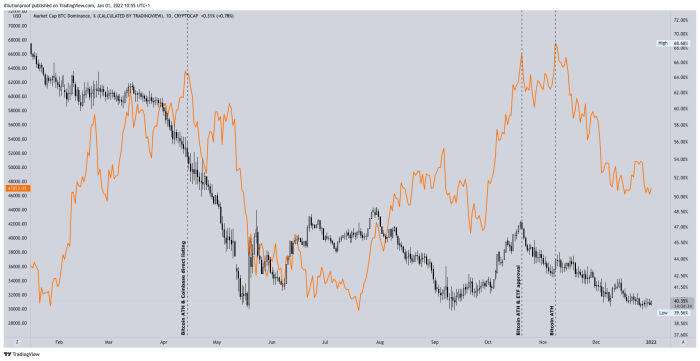

For altcoin merchants, Coinbase’s say checklist meant that a enormous series of tokens own been now accessible on a platform that operates on a bigger stage, sending their designate expectations for these tokens upward. Around the Coinbase say checklist, altcoin prices outperformed bitcoin by massive margins, sending the Bitcoin Dominance Index, which is the proportion of the total crypto market cap that includes bitcoin, downward (figure 4).

Figure 4: Bitcoin designate (orange) and market dominance (sunless/white) (Provide).

Elon And China Region off A Market Capitulation In Might well additionally honest

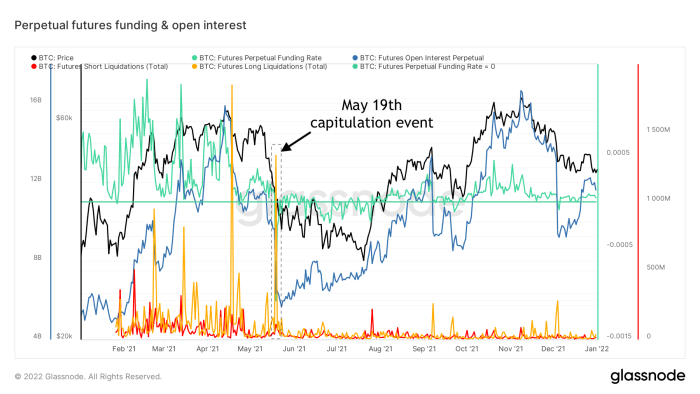

On myth of the Coinbase say checklist mid-April, an increasing amount of bitcoin used to be being deposited on exchanges and the value saved making sideways actions. On Might well additionally honest 12, Tesla CEO Elon Musk all straight away tweeted that Tesla would end accepting bitcoin for payments due to environmental concerns. A week later, on Might well additionally honest 18, China banned its financial institutions from offering bitcoin services and products, exacerbating this distress, uncertainty and doubt (FUD) that created alarm in a fairly overheated market.

This combination of events sent the bitcoin designate down quick. Many previously illiquid bitcoin grew to turn into liquid yet again and own been sent to exchanges. This market capitulation event ended with a bang on Might well additionally honest 19, because the downward designate movements sent the value of many bitcoin-margined futures contracts under their liquidation prices (figure 5), triggering the automatic promoting of the underlying bitcoin collateral of these contracts, sending the value down even extra. The following cascade of liquidations painted bitcoin’s first day-to-day candle with a $10,000 intraday designate fluctuate — unfortunately to the diagram back.

Figure 5: Bitcoin designate (sunless), futures birth curiosity (blue), perpetual futures funding rate (inexperienced), quick- (crimson) and lengthy-liquidations (orange) (Provide).

China Cracks Down Against Bitcoin Mining In Might well additionally honest And June

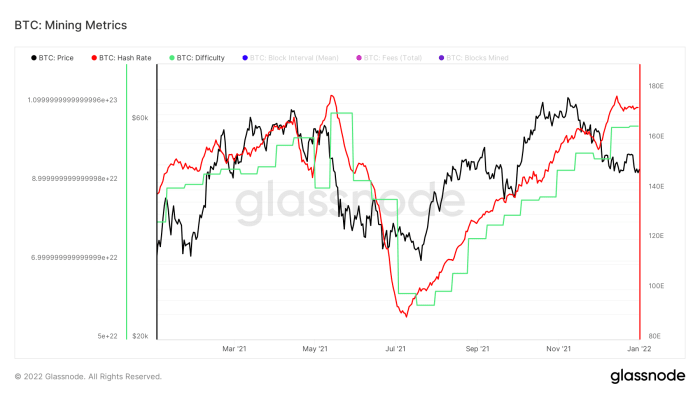

For China, the crackdowns on Bitcoin didn’t end there. Skilled Bitcoiners own considered China ban and unban Bitcoin dozens of times since 2013, but this time truly used to be different. A massive portion of the bitcoin mining has historically been completed in China, but all over Might well additionally honest and June 2021, the Chinese language government truly banned bitcoin mining, which resulted in a hash rate fall of spherical 50% all over that interval (figure 6).

Figure 6: Bitcoin designate (sunless), hash rate (crimson) and affirm (inexperienced) (Provide).

This interval truly used to be one in all the most unsure times in Bitcoin throughout up-to-the-minute years. Had been we witnessing an staunch nation-allege attack on Bitcoin, or used to be China making a name here that has the ability to pass down in history because the worst geopolitical decision linked to Bitcoin? On June 1, I wrote the next in COC#2:

“If the Bitcoin network does indeed remain solid, China’s crackdowns in opposition to it will truly ride down as a gigantic instance of Bitcoin’s anti-fragility. The total point of a truly decentralized diagram is that you simply’ll want to perchance maybe now not ban that diagram — you can additionally only ban your self from the usage of it. Hash rate transferring faraway from China also lowers the impression of future habitual China FUD (Terror, Uncertainty and Doubt), as their ability adjust over the diagram will own truly diminished.”

Fortunately, here is precisely what performed out in the next months. Many Chinese language Bitcoin miners reportedly moved to more mining-pleasant jurisdictions, and Bitcoin’s hash rate and affirm fully recovered to its old all-time highs. Bitcoin yet again showed off its resilience, as markets regained confidence throughout the 2d half of 2021.

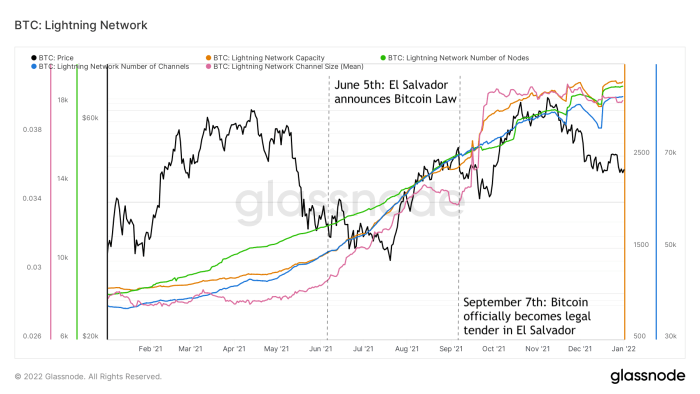

El Salvador Adopts Bitcoin For the interval of The Summer

On the the same time when China cracked down laborious in opposition to Bitcoin, El Salvador opened its fingers to it and announced that it could perchance perchance maybe well rating bitcoin exact soft in their nation. El Salvador’s Bitcoin technique would depend carefully on Lightning Network adoption as a strategy of day-to-day payments and situation an unbelievable precedent for the particular usability of Bitcoin as a medium of alternate, doubtlessly clearing every other habitual provide of FUD from the desk. Even though we don’t know to what extent El Salvador’s announcement triggered this, all over 2021, Lightning Network adoption soared on all accounts (figure 7).

Figure 7: Bitcoin designate (sunless) and Lightning Network ability (orange), series of nodes (inexperienced), series of channels (blue) and mean channel dimension (crimson) (Provide).

As hash rate used to be recovering and El Salvador’s “Bitcoin Day,” where it could perchance perchance maybe well officially turn into exact soft and your complete nation’s inhabitants would rating $30 worth of bitcoin if they downloaded the government’s Chivo app, changed Bitcoin’s story to a more particular tone. Bitcoin Day itself (September 7) ended up functioning as a “sell the news event,” triggering every other fierce unload that sent the value down in subsequent weeks. This unique local top used to be then followed up by a brand unique better low, suggesting that the total pattern in the bitcoin designate had indeed flipped from bearish to bullish in all places in the summer season.

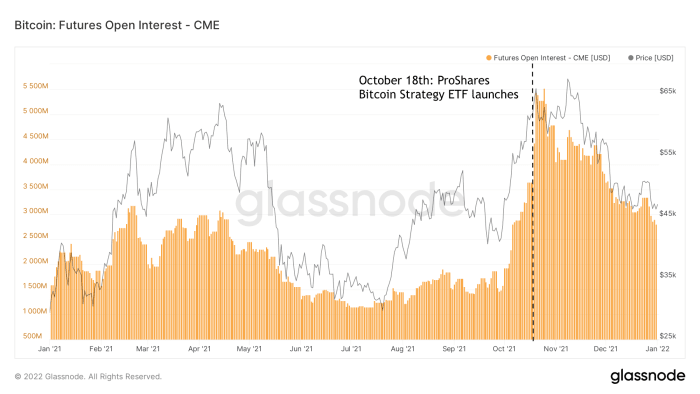

Bitcoin Futures Etfs Originate In October

For the interval of the summer season, on-chain capital flows became bullish yet again, as some huge cash own been being moved off exchanges, into the fingers of lengthy-interval of time holders and illiquid entities. This coincided with the hash rate recovery and El Salvador’s Bitcoin adoption, which used to be then followed up by every other massive fable that bitcoin market contributors own anticipated for a really lengthy time: the formal acceptance of a bitcoin alternate traded fund (ETF).

For the interval of 2021, the U.S. Securities and Alternate Commission (SEC) appointed Gary Gensler as their unique chairman. Gensler had a history of having a more particular perspective in the direction of Bitcoin, and all over 2021 gave hints that a futures-essentially based fully bitcoin ETF could perchance maybe additionally honest be current. On October 1h, the ProShares Bitcoin Strategy ETF grew to turn into the most major bitcoin ETF to be current, which used to be followed by a couple of other futures-essentially based fully ETFs. The ProShares ETF would predominantly utilize CME futures, which ended in a enormous extend in the amount of birth curiosity in these (figure 8).

Figure 8: Bitcoin designate (sunless) and CME futures birth curiosity (orange) (Provide).

The speed-up to the ETF originate sent Bitcoin into unique all-time highs, but the ETF approval itself also functioned as a sell the news event. In subsequent weeks, the bitcoin designate yet again recovered and created unique highs but has been in a downtrend since.

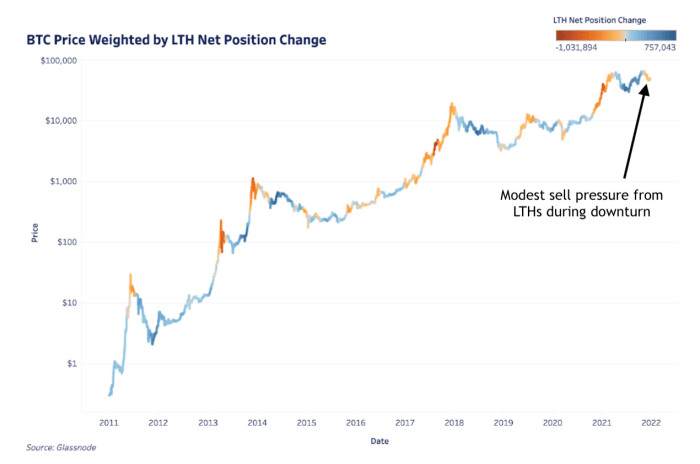

Prolonged-Term Holders (LTH) Only in the near past Offered Soundless Resistance

For the interval of this most well liked downtrend, something attention-grabbing came about. Traditionally, lengthy-interval of time holders (LTH), which are Glassnode-labeled entities which own held the massive majority of their bitcoin for now not now not up to 155 days, have a tendency to sell a few of their money throughout market energy and particularly throughout designate discovery. This also came about throughout the most well liked ~$69,000 all-time excessive, but even continued for fairly bit on the methodology down, which is more unheard of.

In a fresh Bitcoin Journal article by Sam Rule, which highlighted a portion of a linked Deep Dive newsletter, the bitcoin designate used to be overlaid by the LTH salvage situation change (figure 10). This figure reveals that more “heated” colours usually seem throughout uptrends in designate and generally quickly depart as quickly as designate moves down yet again. This closing downtrend since touching the ~$69,000 all-time excessive is an exception to that rule, as LTHs on combination truly provided a modest portion of their situation on the methodology down.

Figure 9: Bitcoin designate overlaid by the salvage situation change of lengthy-interval of time holders (LTH), which are entities which own held the massive majority of their bitcoin for 155 days or more (Provide).

The cause on the help of here is seemingly linked to the broader macroeconomic circumstances and concerns relating to the industrial impression of protection choices linked to the emergence of the unique Omicron COVID-19 variant that own been pointed out closing month in COC#7.

Even though there own been particular signals coming out that suggest that the Omicron variant is now not going to own as mighty of an impression on environment up complications than the previously dominant Delta variant, protection choices in some countries own been extreme (e.g., lockdowns). Similarly, the most well liked Federal Reserve meeting appears to be like to own calmed down financial markets (inventory prices rose into unique all-time highs since then), but a certain quantity of distress and uncertainty remains stuffed with life in markets. From that perspective, the inclinations described in COC#7 are serene linked on the present time.

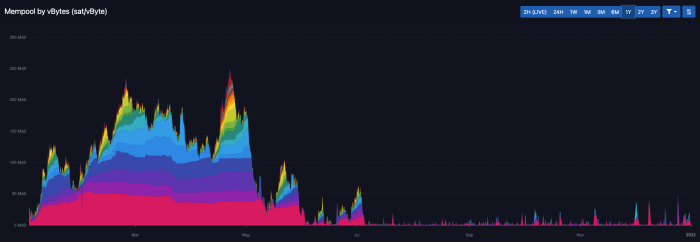

The Bitcoin Market Lacks Momentum

A cause that the market could perchance maybe additionally now not take care of the modest sell tension of LTHs after passing all-time highs used to be that a lot of the momentum that used to be most well liked throughout the most major half of 2021 is now long past. On myth of the Might well additionally honest capitulation event, on-chain boom has been in a downtrend, as used to be also pointed out in COC#4 on the starting of September. For the interval of the 2d half of 2020 and first half of 2021, the bitcoin mempool, which represents how many transactions are lined up, waiting to be included in the next block, used to be constantly filled. Since then, the mempool most continuously clears, sending most transaction charges relief to the backside rate of 1 satoshi per vByte (figure 10).

Figure 10: The Bitcoin mempool essentially based fully on mempool.discipline (Provide).

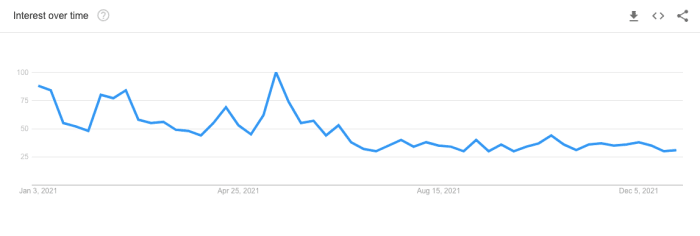

Similarly, Google search inclinations for the discover “Bitcoin” that constantly stare an uptick throughout bull runs are suspiciously serene for the explanation that summer season (figure 11). From this perspective, it is truly fairly valuable that the bitcoin designate honest lately situation unique all-time highs, because the retail portion of the market used to be either distracted by different belongings or simply exact absent.

Figure 11: Worldwide Google search inclinations for “Bitcoin” (Provide).

In Absence Of Retail, Increased Market Participants Dominate

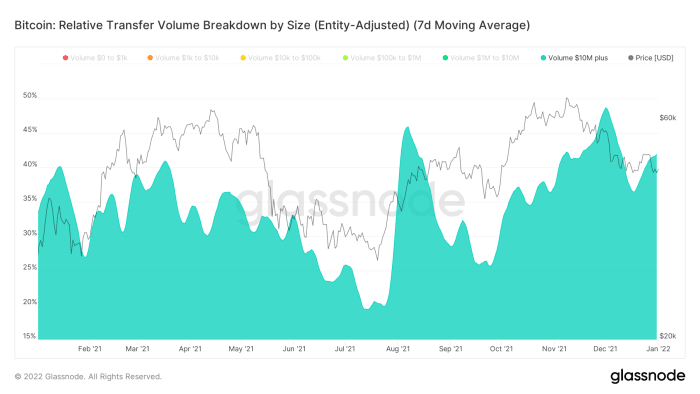

In the initiating of November, COC#6 pointed out that “trim money” used to be now frontrunning retail. Since then, it has gotten an increasing form of more certain that here is indeed the case. As an instance, when having a check on the proportion of the transfer quantity that includes more prosperous on-chain entities (e.g., worth more than $10 million) has been fairly excessive when put next with the most major half of 2021 (figure 12).

Figure 12: The bitcoin designate (grey) and a seven-day transferring moderate of the proportion of the on-chain transfer quantity that includes entities with an on-chain wealth of $10 million or more (Provide).

On-Chain Provide Flows Remain Neutral To Bullish

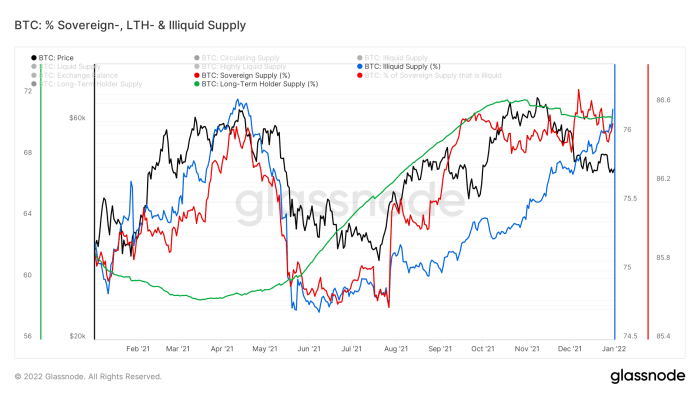

The modest promoting tension by LTHs that used to be mentioned with figure 9 could perchance maybe additionally additionally be seen in the downtrend in the inexperienced line in figure 13. Furthermore, the crimson line reveals that throughout the most well liked designate downtrend (sunless line), the sovereign provide, which is the total bitcoin provide that’s now not held on exchanges, didn’t stare a the same downturn take care of it did after the mid-April 2021 market top (Coinbase say checklist) and subsequent Elon and China FUD. The illiquid provide (blue), which is the total bitcoin provide that’s in the fingers of entities that Glassnode identified as having little or no history of promoting, has truly risen and is relief on the same values as throughout the mid-April 2021 market top.

Figure 13: Bitcoin designate (sunless) and the proportion of the circulating provide that Glassnode labels as “illiquid” (blue), in the fingers of lengthy-interval of time holders (LTH) (inexperienced) or now not to be on exchanges (crimson) (Provide).

Futures Markets Seek Extra Feeble And More healthy

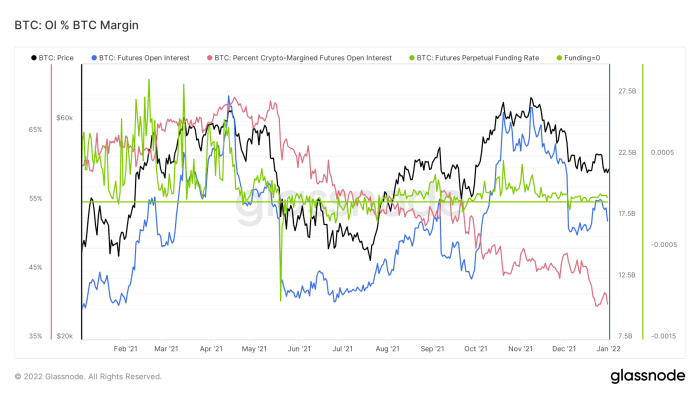

As used to be already mentioned in COC#7, the total allege of bitcoin futures markets now appears to be like, total, to be more aged and more healthy than throughout the most major piece of 2021. The total designate in futures contracts (birth curiosity) is on the same ranges as throughout the early-2021 highs, but at neutral funding charges and in step with more money-margined collateral that has less diagram back threat throughout lengthy liquidation cascades (figure 14).

Figure 14: Bitcoin designate (sunless), futures birth curiosity (blue), perpetual futures funding rate (inexperienced) and the proportion of birth curiosity that’s bitcoin-margined (crimson) (Provide).

Market Sentiment Is Extra Neutral

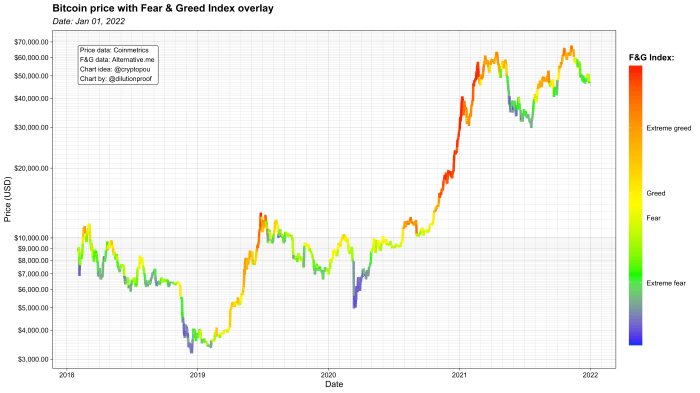

Similarly, the total market sentiment of bitcoin and cryptocurrency markets is now more neutral than throughout the most major piece of 2021. Figure 15 reveals that most well liked designate ranges that own been originally linked with “mistaken greed” are now accompanied by neutral or even haunted market sentiment, illustrating that most well liked prices are now thought to be to be mighty more “extraordinary” than they own been originally of the yr.

Figure 15: Bitcoin designate, overlaid by the phobia and greed index market sentiment ratings (Provide).

The Ongoing Battle Of The Bitcoin Pricing Objects

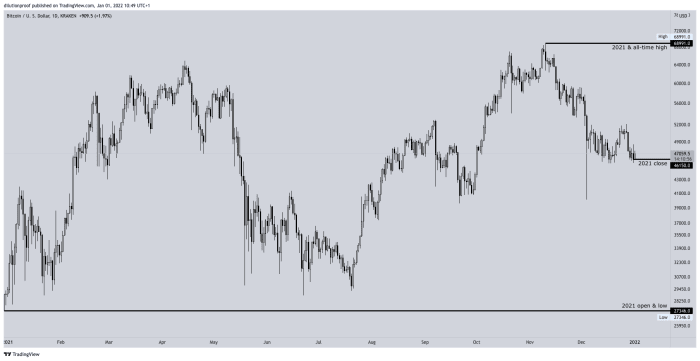

Traditionally, the bitcoin designate has moved in very distinct, halving-driven, four-yr cycles that can even be expected to at closing diminish. Many pricing fashions exist. Some simply extrapolate the value history of old halving cycles on top of the birth of the most well liked cycle (figure 17; white lines). Others are time-essentially based fully regression fashions (sunless dotted lines), or even modeled historical bitcoin prices with its disinflationary coin issuance time desk (sunless striped lines). Every of these fashions has their very maintain methodological boundaries that require a extremely nuanced interpretation, but collectively they diagram a rough image of what could perchance maybe additionally honest be expected if this most well liked cycle does pause up being considerably equivalent to the old ones.

Whether this cycle will truly be equivalent to the old ones has been carefully debated in 2021. The absence of a clear blow-off top take care of we seen on the same submit-halving dates in 2013 and 2017 convinced some that, from this point on, we’ll stare diminishing returns or even lengthening cycles. Others imagine that, in the interim, the coin issuance time desk and linked miner sell tension is exact now not as linked as it as soon as used to be, and that the bitcoin designate will seemingly be more of a random stroll with an upward waft, doubtlessly turning into less unstable over time. One thing is certain, following the final result of it will seemingly be engaging.

Summary And 2022 Outlook

In hindsight, the preliminary 2020–2021 bull speed used to be carefully driven by a combination of institutional FOMO and money-and-raise trades. As quickly as these arbitrage opportunities dried up and the story relating to institutional adoption changed, the market (which used to be carefully overextended in altcoins and NFTs) became spherical. The Chinese language crackdowns in opposition to bitcoin mining that continued in the next months suppressed any final bullish sentiment, driving speculators faraway from the market, as their dumped bitcoin gradually transferred into the fingers of investors with a better conviction and a decrease time want. The mix of the hash rate recovery, El Salvador adopting Bitcoin and the originate of the most major (futures-essentially based fully) bitcoin ETF fueled a brand unique speed-up in designate, but in relative absence of retail market contributors, the most well liked spherical of designate discovery lacked the endurance to enhance modest sell tension of lengthy-interval of time holders that provided into apparent market energy.

For the interval of 2021, two prominent historical anti-Bitcoin narratives own been disarmed: The “China controls Bitcoin” argument (miners left China) and the false impression that bitcoin can not be feeble for little payments (El Salvador makes utilize of bitcoin for payments by the usage of the Lightning Network). For the interval of 2021, many money moved from the fingers of speculators into these of lengthy-interval of time holders, as futures markets matured and $30,000 to $60,000 designate ranges grew to turn into the unique norm.

Doubtless 2021 didn’t raise the bitcoin designate ranges that many own been hoping for, but total, it positively used to be a extremely positive yr for Bitcoin. Going into 2022, Bitcoin would now not own the the same stage of bullish momentum as it did closing yr, but most well liked prices seem like at a mighty more balanced situation from a diagram back threat perspective. From that perspective, the bitcoin designate appears to be like to be primed for a continued interval of sideways to mildly upward designate action — till a structural change in either market sentiment or macroeconomic circumstances decide the destiny of the the relaxation of Bitcoin’s most well liked halving cycle.

Earlier editions of Biking On-Chain:

- #1 Unwinding Leverage (June 1, 2021)

- #2 Bitcoin Enters Geopolitics (July 1, 2021)

- #3 Squeezed Provide, Shorts And Bitcoin Lemonade (August 1, 2021)

- #4 On-Chain Silence Before The Storm (September 1, 2021)

- #5 How January’s On-Chain Footprint Bent The Bitcoin Tag Style Twice (October 1, 2021)

- #6 ‘Dapper Money’ Is Front-Running Retail (November 1, 2021)

- #7 The Bitcoin Market Hangs Between Hope and Terror (December 1, 2021)

Disclaimer: This column used to be written for academic and entertainment purposes only and could perchance maybe additionally honest now not be taken as investment advice.

That is a visitor submit by Dilution-proof. Opinions expressed are fully their very maintain and enact now not necessarily replicate these of BTC, Inc. or Bitcoin Journal.