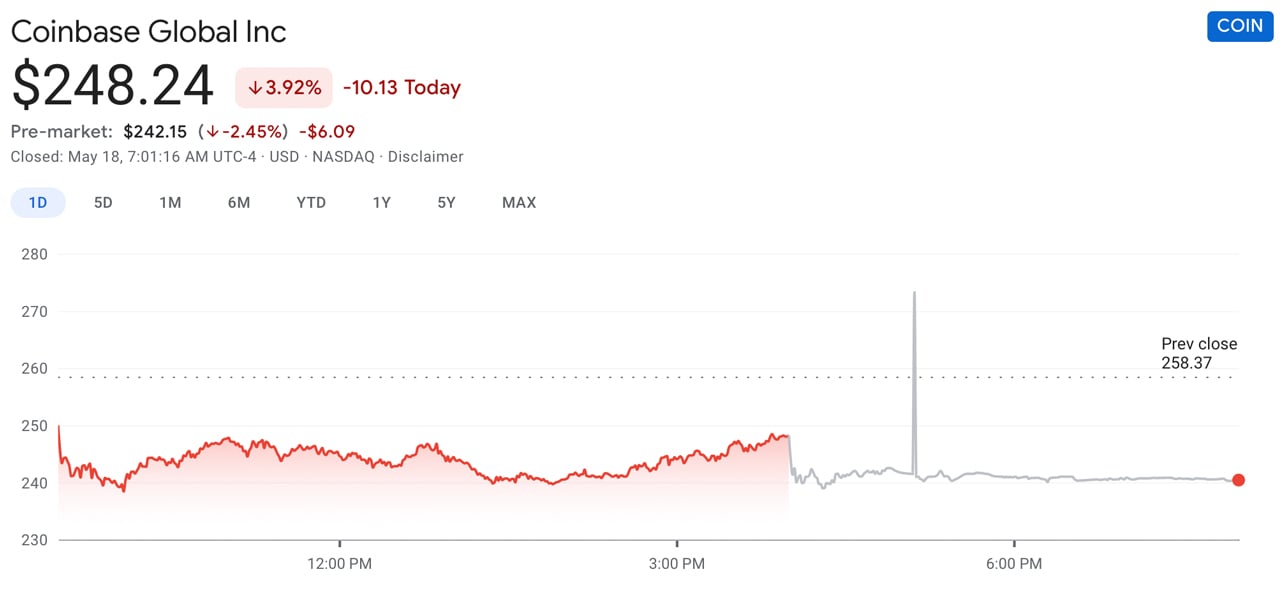

Coinbase shares own dropped in rate at some point of the closing month after opening at $342 per fragment. The company’s shares own dropped over 27% to $248 per fragment for the explanation that Nasdaq checklist in mid-April. On Monday, the firm extra launched intentions to sell $1.25 billion of convertible debt.

Coinbase Shares Tumble Below Reference Payment

Coinbase Global, Inc. (Nasdaq: COIN) launched on Monday that it intends to sell $1.25 billion of convertible debt looking out on market prerequisites. The company’s first shareholder letter printed four days ago explains the firm has seen tough competition within the digital forex industry.

“Despite our tough Q1 outcomes,” the Coinbase shareholder letter particulars. “The rapid expansion of the crypto economy moreover creates challenges for Coinbase. Competition is growing as unusual market entrants be part of the crypto economy every month.”

The announcement took arena while the company’s shares were dropping and closed below its $250 reference rate at $248 per fragment. Whereas the firm’s shares were losing rate at some point of the closing 30 days, COIN’s dip has moreover coincided with the market carnage affecting the crypto economy.

Within the identical trend, other tech shares with exposure to cryptocurrencies love bitcoin and the blockchain technology industry, in routine, own considered the same drops in rate.

Stocks love Canaan (CAN), Marathon Digital Holdings (MARA), Microstrategy (MSTR), and Revolt Blockchain (RIOT) own all considered losses. The Grayscale Bitcoin Have faith (GBTC) is moreover down in rate alongside a range of different digital asset trusts.

The announcement from Coinbase follows the sizzling revenue account printed on Thursday. The company acknowledged that it had earnings per fragment of $3.05 and gathered $1.80 billion of revenue in a Securities and Trade Price (SEC) submitting.

The company is up from $585 million in Q4 2020 and it expects monthly transacting customers of 5.5 million to grow 63% this 300 and sixty five days. After on the foundation atmosphere out in San Francisco, Coinbase extra launched this 300 and sixty five days that the firm operates remotely and not utilizing a bodily headquarters.

The $1.25 billion of convertible debt would possibly maybe well be weak to cushion the company’s holdings in line with the Have 8-Okay SEC submitting.

“This capital elevate represents an different to bolster Coinbase’s already tough balance sheet with low-rate capital that maintains running freedom and minimizes dilution for Coinbase’s stockholders,” the submitting notes.