The head U.S. cryptocurrency commerce employed a neighborhood of Wall Street merchants to commerce and stake cryptocurrencies to generate profit, The Wall Street Journal has reported.

Key Takeaways

- Coinbase employed a neighborhood of Wall Street merchants to test out a trading desk final year, The Wall Street Journal has reported.

- A advertising consultant from the commerce reportedly claimed that the desk became once put up for shoppers in want to for its possess trading exercise.

- Totally different main crypto exchanges and their senior executives like reach below fire for his or her crypto trading exercise within the past.

Coinbase reportedly tested the trading arm after group participants testified ahead of Congress that it didn’t exercise its possess accounts to commerce crypto.

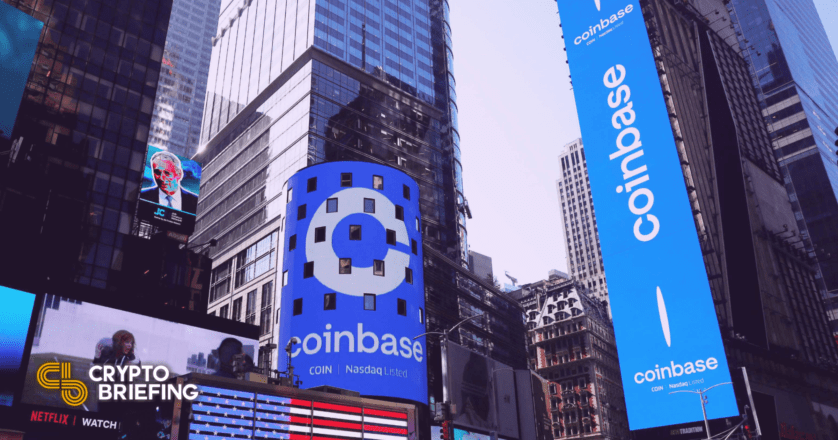

Coinbase Exams Trading Desk, WSJ Claims

Coinbase tested launching an interior trading desk in 2021, The Wall Street Journal has reported.

A Thursday legend quoting loads of sources familiar with the matter claims that the crypto commerce titan employed at the least four Wall Street merchants to position up a “proprietary” trading desk called Coinbase Probability Alternatives. The neighborhood became once employed to commerce and stake crypto to generate profit, the sources stated.

The legend additional added that Coinbase Probability Alternatives accomplished an preliminary $100 million transaction earlier this year after elevating funds via a structured demonstrate it had sold to Invesco. Coinbase workers had been reportedly downhearted from sharing records about the venture or discussing it in interior communications.

Diverse senior Coinbase group participants testified ahead of Congress in 2021, and they claimed that the agency did no longer exercise its possess cash to commerce crypto. When questioned by The Wall Street Journal, a advertising consultant insisted that the agency had no longer put up a proprietary trading desk. “Any insinuation that we misled Congress is a willful misrepresentation of the facts,” they reportedly stated. The advertising consultant added that “Coinbase Probability Alternatives became once established to facilitate client-driven crypto transactions,” but the sources claimed that the agency became once also weighing utilizing its possess cash for some actions. The merchants that had been employed for Coinbase Probability Alternatives like since left the corporate, the legend stated.

Alternate Bosses Trading the Market

Within the U.S., there are currently no restrictions stopping cryptocurrency exchanges admire Coinbase from launching their possess proprietary trading desks, in spite of rising regulatory concerns over which that probabilities are you’ll factor in market manipulation. Whereas none of the main exchanges specializes in trading as section of its core commercial exercise, some firms like triggered controversy because of their senior figures actively trading out there within the past.

In all likelihood the most efficient example of questionable trading exercise nice looking main crypto exchanges facilities on Sam Bankman-Fried, the founder and CEO of FTX and co-founding father of the quantitative trading agency Alameda Study. Sooner than constructing FTX, Bankman-Fried became once easiest identified within the crypto dwelling for his noteworthy trading talents, which helped him hit billionaire put ahead of the age of 30. FTX doesn’t like a proprietary trading desk, but the tight relationship it shares with Alameda has on the general raised questions over the ethics of exchanges and their team trading the market, even after Bankman-Fried stepped down as CEO in 2021.

Alameda has develop into gruesome for yield farming crypto tokens and trading FTX’s perpetual quick products, on the general ensuing in brutal save crashes. Bankman-Fried became once also credited with bringing an stop to crypto’s so-called “DeFi summer season” interval by dumping farmed Yearn Finance tokens on the market weeks after he saved Sushi from collapse. Whereas Bankman-Fried has stepped assist from his trading agency since FTX saw rapidly pronounce in 2021, his and Alameda’s ruthless market exercise has develop into one thing of a working comedian myth within the dwelling.

Equally, BitMEX co-founder Arthur Hayes grew to develop into infamous for trading the market during his stint as the derivatives commerce’s chief executive officer. An gruesome screenshot hints that Hayes engaged in market manipulation by ordering a co-employee to “scuttle the stops” on BitMEX customers because he “[needed] a new Ferrari.” In Would perhaps well perhaps, Hayes became once sentenced to two years probation and six months dwelling arrest for BitMEX’s failure to put into effect sufficient anti-money laundering measures. He’s silent an brisk dealer, on the different hand.

Whereas Coinbase hasn’t long past fairly as some distance as FTX or BitMEX and their high figures, if The Wall Street Journal legend is to be believed, the trading desk plans will without doubt raise concerns over the commerce’s commercial operations.

Disclosure: On the time of writing, the creator of this section owned SUSHI, ETH, and loads of alternative other cryptocurrencies.

The records on or accessed by this web situation is obtained from goal sources we reflect to be real and decent, but Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any records on or accessed by this web situation. Decentral Media, Inc. shouldn’t be any longer an funding advisor. We attain no longer give customized funding advice or other monetary advice. The records on this web situation is arena to commerce without stumble on. Some or the whole records on this web situation could perhaps perhaps compile older-popular, or it could perhaps perhaps be or develop into incomplete or wrong. We could perhaps perhaps, but are no longer obligated to, update any previous-popular, incomplete, or wrong records.

You’ll want to silent never make an funding decision on an ICO, IEO, or other funding essentially based entirely on the records on this web situation, and you have to silent never interpret or otherwise rely on any of the records on this web situation as funding advice. We strongly recommend that you just search the advice of a certified funding advisor or other certified monetary legit while you happen to is doubtless to be within the hunt for funding advice on an ICO, IEO, or other funding. We attain no longer accumulate compensation in any make for examining or reporting on any ICO, IEO, cryptocurrency, forex, tokenized sales, securities, or commodities.

They Lost Money When Twister Money Got Banned. Now Coinbase Is Serving to …

Six other folks that ragged Twister Money for expert reasons had their funds frozen after the U.S. Treasury sanctioned the protocol. They’re now submitting a lawsuit, and Coinbase is funding them….

Arthur Hayes Sentenced to Two Years Probation, Six Months Home Arrest

Hayes had pleaded guilty earlier this year. Hayes Sentenced A U.S. courtroom in New York has sentenced BitMEX co-founder Arthur Hayes for violating the U.S. Financial institution Secrecy Act by failing…

U.K. Financial Regulator FCA Warns Against The utilization of FTX

The FCA has beforehand warned U.K. shoppers in opposition to FTX rival Binance. FCA Sounds Terror on FTX The Financial Conduct Authority has posted a caution about FTX. The U.K. monetary watchdog…