A computer virus in a newly deployed Compound tidy contract has left $80 million worth of COMP at possibility of being misplaced.

Key Takeaways

- Compound is erroneously distributing COMP rewards attributable to an error in knowing to be one of its now not too long in the past deployed tidy contracts.

- Compound founder Robert Leshner mentioned that 280,000 COMP tokens are at threat.

- Transaction history reveals that extra promoting pressure could well moreover look for the asset wreck under $200.

Compound launched a original upgrade this week, but a computer virus in the code left $80 million worth of COMP at possibility of unfair distribution. The incident could well moreover lead to a COMP selloff.

$80 Million at Likelihood

Compound looks bearish.

The Ethereum-based DeFi blue chip launched Proposal 62 Wednesday, introducing two COMP distribution rates for protocol users. Alternatively, the original Comptroller contract became deployed with a computer virus that allows users to borrow definite property to pronounce more than their shapely piece of COMP.

Robert Leshner, the founder of Compound Labs, distinguished that “all equipped property, borrowed property, and positions” were unaffected by the computer virus. Aloof, he highlighted that 280,000 COMP tokens worth $80 million are at possibility of being misrewarded to users. He added that any alternate to the protocol requires per week-long governance process to compose it into manufacturing.

Though a transient patch for the distribution computer virus has been proposed, some users maintain already taken relieve of the exploit. Over 91,000 COMP tokens, worth $27.5 million, were claimed in a single transaction following the discovery. The wallet proprietor has since swapped quite lots of the tokens bought for USDC.

The surprising spike in downward pressure seen COMP dip under $290. Though the asset has shown signs of recovery in the old few hours, extra promoting around the original mark levels could well moreover lead to well-known losses.

Standing on Ragged Give a purchase to

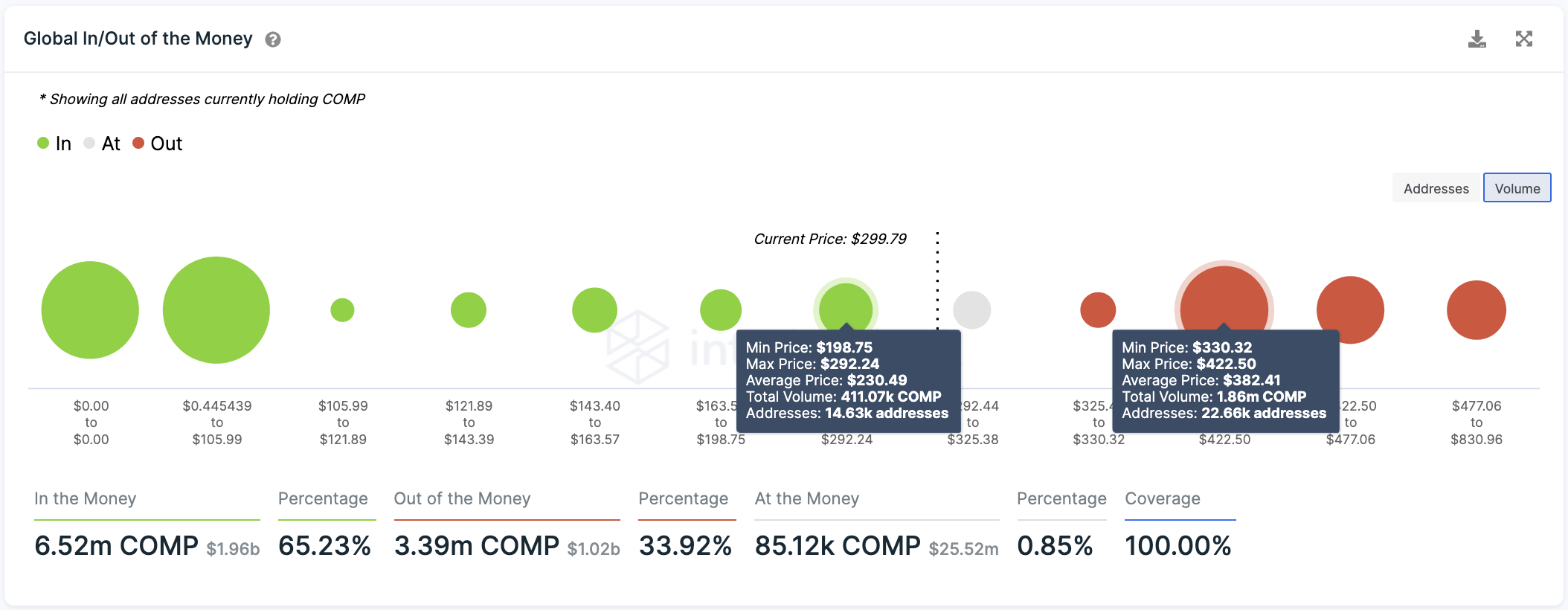

Transaction history reveals that Compound sits on top of a feeble request zone, while a well-known assortment of addresses are at this time underwater.

Such market dynamics counsel that a breach of the $292 give a purchase to diploma could well moreover result in a steep correction to $199. Bulls would then must quit COMP from breaching $199 since the following crucial ardour space sits at $100.

Alternatively, it must be complex for Compound to resume its uptrend. Roughly 22,700 addresses maintain beforehand purchased almost 1.9 million COMP at a median mark of $382. This gifts a tubby provide wall; COMP would want a decisive each day candlestick end above it to succeed in greater highs.