Key Takeaways

- A most accepted Convex Finance token unlock has sent a bullish impulse thru the Curve Finance token ecosystem.

- The CVX and CRV tokens ranking both surged extra than 50% for the reason that unlock started.

- Convex has also considered an uptick within the amount of CRV tokens staked in its protocol.

Customers relocking their CVX tokens and depositing extra CRV tokens into Convex Finance has contributed to CVX’s most accepted bustle.

Convex Breaks Downtrend

Convex Finance appears to be like uncover it irresistible’s bouncing back.

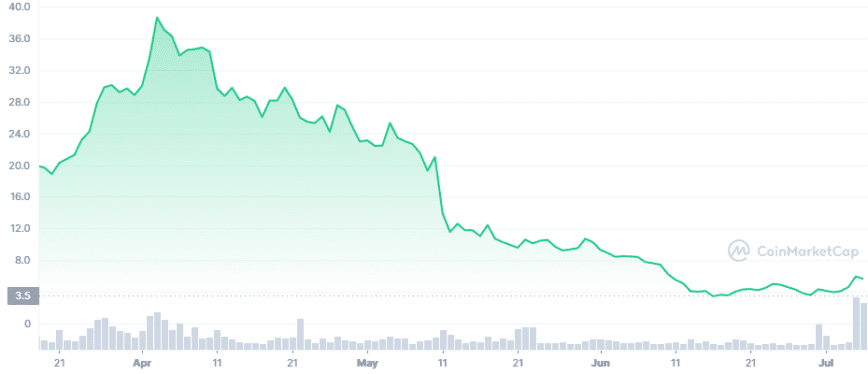

The DeFi protocol, designed to relief optimize yields from the Curve Finance alternate, has considered its CVX token fly over 57% after extra than 27.4 million tokens had been unlocked at the quit of June.

No topic the expectation that a trim possibility of CVX tokens entering the market would push costs down, the unlock has as a exchange acted as a bullish catalyst for the protocol. Now that the unlock has handed, it appears users are extra engaging to deposit their tokens into Convex with out the fright that the token release could well fair costs to topple.

Ensuing from the unlock started on Jun. 30, CVX has rallied 57.5%, providing relief from Convex’s months-long downward style. In April, CVX topped $38; three months later, the token had fallen over 90%.

In step with Dune Analytics recordsdata compiled by user 0xroll, around 42% of all CVX tokens from basically the most accepted unlock had been relocked within the protocol to this point. The final tokens ranking either been withdrawn or are staring at for their owners to resolve whether to relock them.

Even supposing CVX tokens are unlocked weekly, the amounts are on the total so minute they’re no longer seemingly to electrify costs. The following most foremost Convex token release is scheduled to happen on Oct. 27, when one other 21.7 million tokens are scheduled to unlock.

Curve Receives Boost

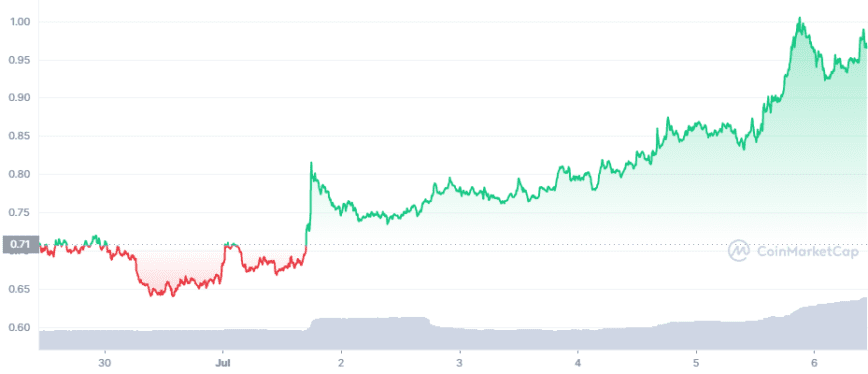

Curve’s yield-bearing CRV token also appears to ranking benefitted from the Convex unlock. After sweeping a low of $0.64 on Jun. 30, CRV has soared 53%, at point to trading at $0.98.

Curve liquidity suppliers set CRV tokens as rewards. By locking CRV tokens, owners assassinate the flexibility to vote on which liquidity pools assassinate boosted CRV rewards.

In home of person CRV tokens holders managing which pools to vote for every 10 days, Convex helps users optimize yields by permitting them to stake their CRV tokens into its protocol in alternate for cvxCRV. Convex rewards its CRV stakers by giving them a relate to CRV rewards from Curve, a slice of Convex platform earnings, CVX tokens, and bribes given to veCRV holders.

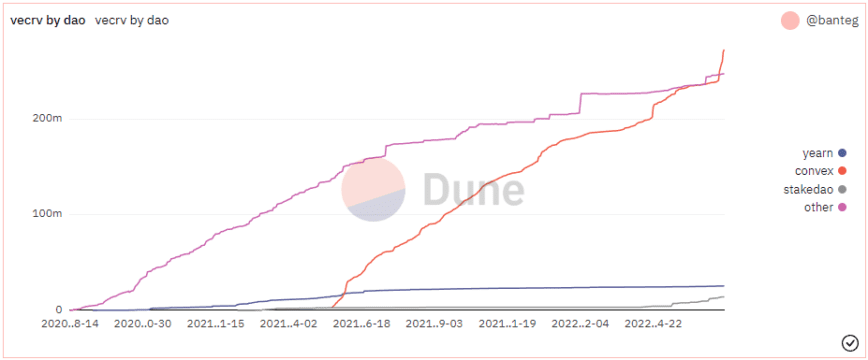

Ensuing from the Convex token unlock, the protocol has considered a marked uptick within the amount of CRV tokens staked for cvxCRV. Dune Analytics recordsdata compiled by Yearndeveloper banteg shows the amount of veCRV held by Convex has increased by over 30 million since Jun. 30.

Convex’s reputable Twitter fable has also eminent the enhance in Curve deposits. On Jul. 2, Convex announced that the rate of locked CRV over the old 24 hours got here in at 1,491% of day to day CRV emissions. After basically the most accepted influx of CRV deposits, Convex now holds over 48% of all CRV tokens in existence.

As holders lock up their CRV and CVX tokens in Convex’s contracts, promoting rigidity on the total decreases. This can fair the tokens to broaden in value as traders outpace sellers on exchanges.

Even supposing the CVX unlock has acted as a bullish catalyst for the Curve token ecosystem, the longer-term outlook remains unclear. Macroeconomic headwinds and fears of an imminent recession ranking weighed heavily on crypto resources in most accepted months and at point to cloak no signs of clearing. Each and each Convex and Curve serene ranking a long avenue ahead sooner than they would possibly be able to reclaim their all-time highs.

Disclosure: At the time of scripting this fragment, the author owned CRV, CVX, and several other other cryptocurrencies.

The knowledge on or accessed thru this online page online is obtained from fair sources we deem to be appropriate and dependable, but Decentral Media, Inc. makes no representation or warranty as to the timeliness, completeness, or accuracy of any recordsdata on or accessed thru this online page online. Decentral Media, Inc. is no longer an funding advertising and marketing consultant. We quit no longer give personalized funding advice or other financial advice. The knowledge on this online page online is topic to swap with out tag. Some or the final recordsdata on this online page online could well turn out to be older-celebrated, or it will very successfully be or turn out to be incomplete or incorrect. Lets, but are no longer obligated to, replace any old-celebrated, incomplete, or incorrect recordsdata.

You would possibly want to by no means assassinate an funding decision on an ICO, IEO, or other funding in step with the records on this online page online, and likewise it is top to by no means define or otherwise rely on any of the records on this online page online as funding advice. We strongly counsel that you just consult an approved funding advertising and marketing consultant or other licensed financial official within the occasion you is seemingly to be seeking funding advice on an ICO, IEO, or other funding. We quit no longer accept compensation in any develop for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Convex Finance Pressured to Abandon, Redeploy Contract Ensuing from Worm

Convex Finance has been made responsive to a computer virus in its vlCVX rewards plot, requiring the personnel to redeploy a current contract. No funds had been misplaced, and “user deposits had been…

DeFi Replace Curve Finance Tops $6.8B Day by day Quantity

Curve Finance, the largest decentralized crypto alternate, has registered extra than $6.8 billion in day to day trading quantity across all chains. Curve Quantity at All-Time Highs Crypto costs could very successfully be falling,…

Convex Finance Crosses $20B Locked, Overtaking DeFi Staples

Convex Finance is now the 2d-biggest DeFi protocol with over $21 billion in full value locked. Convex Finance Jumps to 2d-Ranked TVL Convex Finance now holds the 2d-perfect amount of…