The below is from a most in style model of the Deep Dive, Bitcoin Journal’s top rate markets newsletter. To be amongst the first to win these insights and other on-chain bitcoin market prognosis straight to your inbox, subscribe now.

In this day’s Day-to-day Dive, we’re masking some visuals to illustrate bitcoin’s attach and derivatives market dynamics. We can kind this by taking a leer at two key metrics compared with attach: the futures perpetual funding rate and the lengthy-time interval holder win space commerce.

As a refresher, the futures perpetual funding rate used to be lined extra in-depth in The Day-to-day Dive #097 – Derivatives Market Breakdown. It’s a key rate to gawk, particularly when the market is overleveraged to 1 aspect with the derivatives market having extra have an effect on over the transient attach.

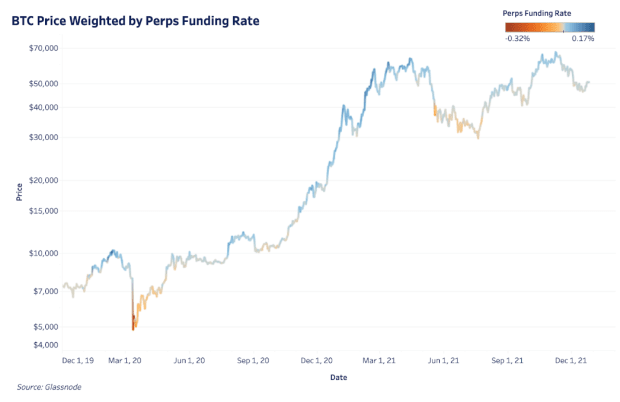

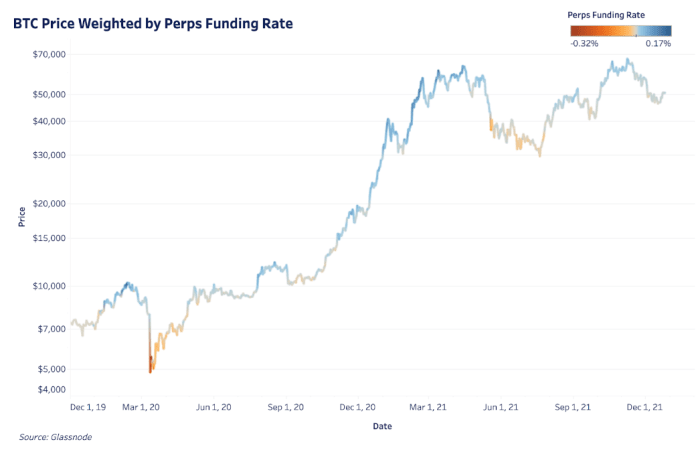

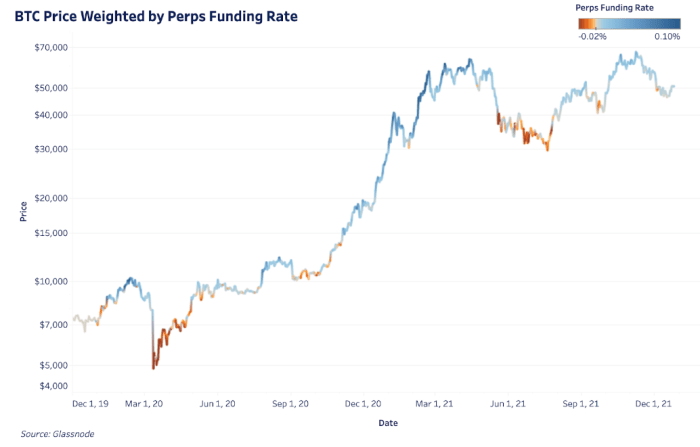

The two charts below current bitcoin attach overlaid with the perpetual funding rate. For the reason that market is historically biased lengthy, the colour thresholds are reduced in the second chart to raised emphasize sessions of any unfavourable funding. Overall, the charts current when the derivatives market is both inflating or suppressing attach.

The darkish blue areas current when the market used to be overleveraged to the lengthy aspect and the darkish red areas current the reverse. Every of these low sessions comprise subsequent, explosive moves in attach as positions are wiped out.

The darkish blue areas current when the market used to be overleveraged to the lengthy aspect and the darkish red areas current the reverse.

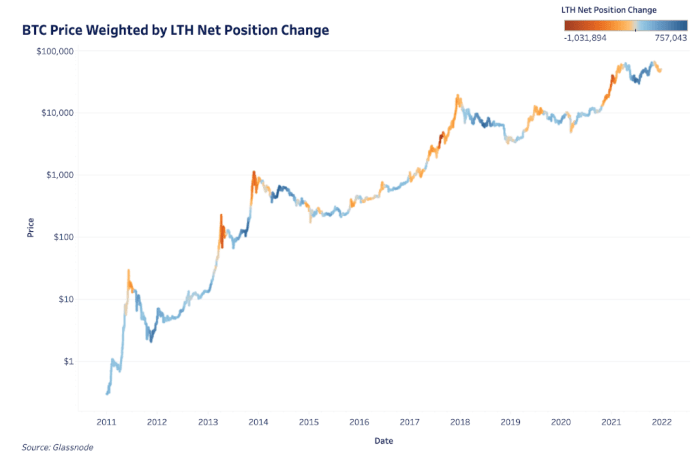

The derivatives market influences attach in the quick time interval however lengthy-time interval attach is driven by adoption, sustained attach demand and the behavior of lengthy-time interval holders. The lengthy-time interval holder win space commerce is one technique to uncover this behavior as it’s the 30-day commerce in present held by lengthy-time interval holders.

As we’ve lined sooner than, every bitcoin attach all-time excessive comes with a valuable distribution of coins from lengthy-time interval holders to fresh market entrants. Sessions of darkish red current this in the below chart while sessions of darkish blue current somewhat heavy accumulation sessions over bitcoin’s lifetime.