Home » Markets » Crypto bloodbath sees $19B in leveraged positions erased

Oct. 10, 2025

The match represents the ultimate leverage reset.

Key Takeaways

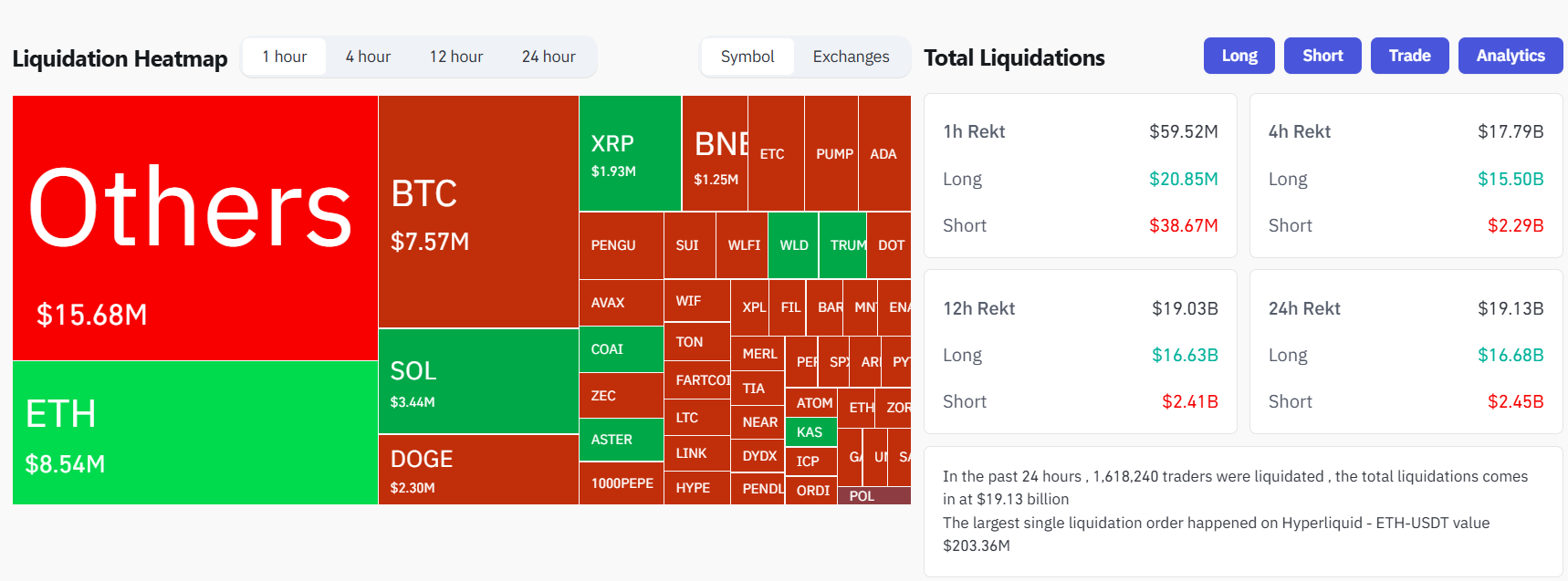

- Over $19 billion in leveraged crypto positions were liquidated in 24 hours, marking a a good deal single-day wipeout in digital asset history.

- Bitcoin and Ethereum long positions were hardest hit, with over 1.6 million traders affected across main exchanges.

Fraction this article

Roughly $19 billion in leveraged crypto positions were liquidated following a brutal sell-off that despatched Bitcoin tumbling to $102,000. It used to be a a good deal single-day wipeout ever recorded in digital asset markets, based entirely on CoinGlass files.

Many of the liquidations came from long positions, which totaled $16.6 billion in losses, when put next with $2.4 billion for shorts.

Over 1.6 million crypto traders were liquidated across main exchanges, with Bitcoin and Ethereum long positions severely impacted all over Friday’s US procuring and selling sessions.

The liquidation cascade used to be triggered after President Donald Trump proposed a large tariff expand on Chinese imports, adopted quickly by an announcement of a 100% tariff on Chinese goods based entirely on China’s planned export restrictions on uncommon earth minerals.

Bitcoin plunged from above $122,000 to spherical $102,000 on the facts. Ethereum dropped below $3,500, whereas smaller-cap altcoins noticed double-digit losses amid evaporating liquidity.

At the time of writing, Bitcoin traded above $113,000 after making improvements to from earlier lows nonetheless remained below its day after day high of $122,500, based entirely on CoinGecko files.