Propelled by space Bitcoin ETFs traded within the US, crypto funding products survey enhance in assets below administration.

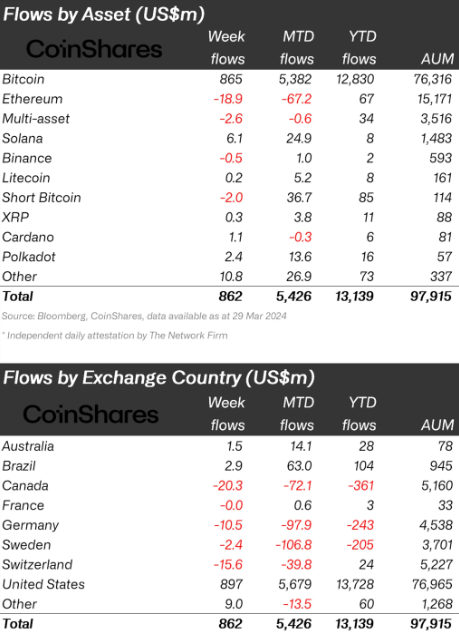

Crypto funding products saw $862 million in weekly inflows in March final week, according to asset administration firm CoinShares’ head of study James Butterfill. The circulate comes one week after a represent of practically $1 billion in outflows used to be registered by the the same products.

Funds with publicity to Bitcoin (BTC), largely space trade-traded funds (ETF) traded within the US, registered $865 million in inflows and dominated the duration. Meanwhile, crypto products going instant on BTC price confirmed a $2 million outflow.

Traders confirmed less urge for food for Ethereum (ETH) publicity through funds, with $19 million in outflows considered from these products. ETH funds suffered basically the most intelligent outflows in March, with over $67 million being moved out by investors.

Solana-associated funds saw $6 million in inflows final week, and $25 million final month, with SOL being the altcoin with basically the most attention in March. Polkadot (DOT) additionally captured weekly curiosity, as its $2.4 million in inflows show.

Locally, the US registered $897 million in inflows final week, and over $5.6 billion in March. Brazil and Australia registered $2.9 million and $1.5 million in weekly inflows, respectively, whereas the leisure of the worldwide locations tracked by CoinShares went the exchange formulation.

Crypto products traded in Canada registered $20 million in weekly outflows, whereas Switzerland funds gotten smaller by $15.6 million in assets below administration within the the same duration.

The records on or accessed through this net living is received from just sources we reveal to be fair correct and legitimate, but Decentral Media, Inc. makes no representation or guarantee as to the timeliness, completeness, or accuracy of any records on or accessed through this net living. Decentral Media, Inc. is now not an funding manual. We develop now not give customized funding advice or thoroughly different financial advice. The records on this net living is field to trade with out stare. Some or the total records on this net living could well become older-common, or it goes to be or become incomplete or erroneous. We are able to also, but are now not obligated to, exchange any old-common, incomplete, or erroneous records.

Crypto Briefing could well augment articles with AI-generated direct created by Crypto Briefing’s bask in proprietary AI platform. We consume AI as a instrument to bring snappily, well-known and actionable records with out shedding the insight – and oversight – of experienced crypto natives. All AI augmented direct is fastidiously reviewed, in conjunction with for factural accuracy, by our editors and writers, and repeatedly attracts from more than one predominant and secondary sources when on hand to make our experiences and articles.

That that it is probably going you’ll perhaps also tranquil by no formulation discover an funding resolution on an ICO, IEO, or thoroughly different funding per the records on this net living, and likewise that it is probably going you’ll also tranquil by no formulation define or in any other case depend upon any of the records on this net living as funding advice. We strongly indicate that you simply consult a certified funding manual or thoroughly different certified financial skilled whenever you’re looking out for funding advice on an ICO, IEO, or thoroughly different funding. We develop now not gather compensation in any develop for inspecting or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.