The crypto market cap has recently begun to enhance regaining $2 trillion. Then over again, an analyst thinks a maintain call will be in situation given several similarities between the dot-com bubble in 2000 and the most up-to-date crypto market.

Linked Finding out | Crypto Market Cap Regained $2 Trillion With Bitcoin Reaching At $45Okay

Crypto Mirrors The Net. Ethical Or Unfriendly Files?

Most modern evaluate remark that the adoption curve of cryptocurrencies is making an strive such as the early adoption of the files superhighway around 1993, which might possibly point in at a hyper-inflection portray happen quickly where crypto and its linked applied sciences develop into a regular instrument frail in each person’s day-to-day lives. This can call for search knowledge from to amplify and worth to upward thrust with it.

Then over again, an analyst predicts that similarities with the files superhighway might possibly flip into a repetition in ancient previous where the crypto market would plunge around 80% because the Nasdaq did support in 2000 amidst the dotcom bubble, a results of speculative investments and an overabundance of capital markets funding dotcom startups that later did now not invent a return.

Investopedia explains that the dotcom bubble “became once a hasty upward thrust in U.S. know-how stock fairness valuations fueled by investments in Net-primarily based fully firms in the unhurried 1990s.” The Nasdaq rose five-fold between 1995 and 2000, nevertheless then dropped reaching nearly 77% in losses by Oct. 4, 2002.

“Even the part prices of blue-chip know-how stocks savor Cisco, Intel, and Oracle misplaced greater than 80% of their worth. It might in all probability possibly prefer 15 years for the Nasdaq to assemble its peak, which it did on April 24, 2015.”

Analyst Tasha Che shared by Twitter a prefer that traces the chance for the crypto market to enter an prolonged maintain market with a identical plunge to the Nasdaq’s in the 2000s. Che sees these essential similarities:

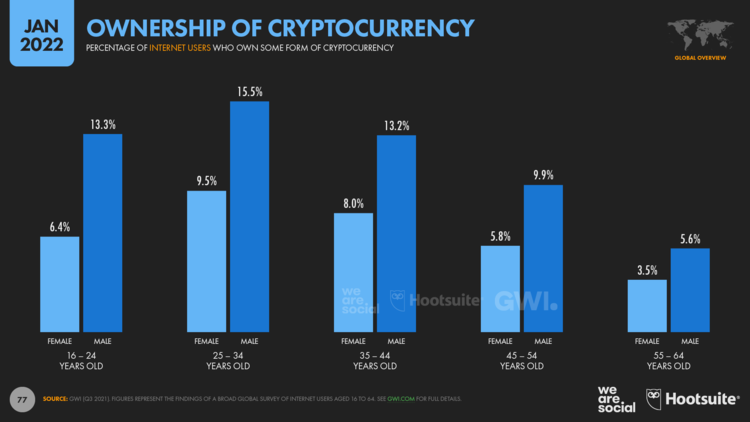

- By 2000, the files superhighway had an person terrible of 413 million people, around 6% of the area’s inhabitants. Within the intervening time, around 60% of the global inhabitants is the impart of the files superhighway, says Net World Stats. In parallel, most up-to-date knowledge aloof by the GWI implies that 10% of working-age knowledge superhighway users maintain some collect of cryptocurrency, roughly 6% of the most up-to-date world’s inhabitants as smartly.

- Both markets had a multi-300 and sixty five days bull bustle which capability that of the hype over “step forward tech” while being “thinly supported by accurate impart conditions”.

- “Monetary protection headwind”. In a identical macroeconomic order of affairs, in 2000 The Federal Reserve lifted 6 price hikes by quarter-point in 1 300 and sixty five days so as to decelerate the rising prices of products and companies.

- “In 2000 Bloomberg Net Index reached a peak market cap of $2.9 trillion (about $3.5 trillion to this day’s bucks)”, which then fell to $1,2 trillion by the tip of the identical 300 and sixty five days. Chen believes that “Given knowledge superhighway stocks support then hide wider subsectors than crypto this day, a $2.5-3 trillion market cap would establish crypto at par w/ dot-com valuation then.”

The skilled extra infamous that the 2 years that Nasdaq dropped 80%, “It became once blessing in disguise for knowledge superhighway change–weeded out opportunists, gave accurate builders respiratory room to lift & allowed natural state. However fully brutal for traders.”

Chen states that this opinion is now not “a straight maintain call” on condition that “ancient previous doesn’t repeat blow by blow”, nevertheless with this kind of identical setup she thinks it would be “in the cards”. The missing element is a blow-off high, which is defined as “a surprising upward thrust in label and quantity, adopted by a pointy decline in label moreover with high quantity.”

If that blow-off high happens in the next couple of months by going support to the $3 trillion cryptos total market cap vary, Chen thinks we would “nearly completely gaze ancient previous rhymes.”

Linked Finding out | Crypto Iciness Is Thawing With Bitcoin And Ethereum Rebound Signal

The Reverse Examine

Then over again, assorted users identified that Chen’s knowledge would now not properly prefer into consideration the almost 5x M2 money present amplify over the last 20 years, which has risen from $4.6 trillion in 2000 to $18.45 trillion in 2020.

One more person infamous that the 2 markets might possibly fair now not be systemically correlated originate air of sentiment on condition that the Net speculation in 2000 gave foot to the overly inflated market, nevertheless the now speculation in crypto will be viewed as “a parallel liquid market.”

It became once moreover identified that crypto represents a assorted case which capability that of the resources being extra reflexive. Growth in usage can have faith in label and can increase in label can lead to usage. Then over again, the dotcom bubble did now not decelerate knowledge superhighway usage as “no person wanted to interact AMZN to make impart of Amazon.”