Duvet artwork: Photography by Bloomberg, Shutterstock; background by Mix and Match Studio (edited by Mariia Kozyr)

Key Takeaways

- Su Zhu, Have Kwon, and Kyle Davies bear reemerged to criticize the latest member of the failed founders’ club.

- Sam Bankman-Fried’s fraud arguably dwarfs that of most other crypto scammers combined.

- On the different hand, the crypto residence is no longer searching on either of the three pariahs any extra favorably.

2022 has considered bigger than a few once-revered industry figures plunge from grace, nonetheless none has blazed out extra spectacularly than Sam Bankman-Fried. The sheer extent of his financial woes—and certain drawing end handsome perils—appear to bear impressed a few past offenders to weigh in.

Historical Fraud

The industry is reeling from its ideal scam to this level, a multi-billion greenback fraud orchestrated by Sam Bankman-Fried and his end mates at FTX and Alameda Research. As a minimal $9.5 billion is identified to be misplaced outright, nonetheless FTX’s shoddy epic-keeping methodology millions extra (if no longer billions) might well be unaccounted for. This week, the contagion has continued spreading for the length of the markets; dozens of companies did industry with FTX, and the whole aftermath of its give diagram is silent unfolding as we focus on.

In an industry that has revealed itself to be stuffed with obnoxious actors, Bankman-Fried’s swift and monumental downfall has dwarfed these earlier than it. This capability that, one of the crucial residence’s stale guests (and now pariahs) bear felt gratified exposing themselves on social media to weigh in.

There modified into once once a time when of us that had been suspected of wrongdoing saved their mouths shut on the advice of counsel. In crypto, on the different hand, suspected obnoxious actors bear glean entry to to Twitter, and it would seem that their attorneys lack the upper physique energy required to pry their phones from their hands.

SBF, for his segment, has spent the greater segment of this week tweeting out nonsense of diversified forms, from single-letter tweets forming acronyms to implausible denials that he even is conscious of what’s going on. He’s likely no longer done himself any favors with this behavior, and his statements regarding searching for new capital bear left onlookers timorous and infuriated.

Now that the industry has a new Public Enemy Number One, some of its stale antagonists bear approach out of the woodwork to comment.

Among the many most critical to focus on up modified into once Three Arrows Capital (3AC) co-founder Su Zhu, who disappeared alongside with fellow co-founder Kyle Davies this summer season after it grew to turn into positive that 3AC modified into once going bust within the wake of Terra’s give diagram in Can also. Successfully-known for his frequent, cryptic tweets, Zhu went largely silent on Twitter on his firm’s give diagram in June, appearing simplest instant in July to criticize 3AC’s liquidators. On the time, the firm owed $3 billion after defaulting on a assortment of loans.

Now Zhu looks to be to be in increased spirits. On November 8, the identical day that FTX’s freefall began in earnest, Zhu reemerged on Twitter after a months-long hiatus. While many bear demanded that Zhu himself face accountability for shedding investor money, he has it sounds as if been engaged on his psychological effectively being and playing time browsing.

So what bear I been doing?

Catching up w long misplaced guests

Redeveloping spirituality, psychological effectively being. Extremely counsel Sam Harris’s Waking Up app

Browsing

Studying new languages

Praying for these that obtained wound with me, these that deserve to wound me, and these hurting in frequent— Zhu Su 🔺 (@zhusu) November 9, 2022

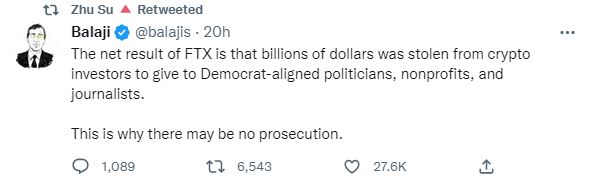

Zhu has additionally ancient his return to spread bigger than a few conspiracy theories surrounding the alternate’s give diagram, various which approach the total sort down to the premise that the Democratic Occasion is actively working with Bankman-Fried for depraved causes. While Bankman-Fried is a identified donor to Democratic campaigns, there is currently no evidence of unlawful collusion beyond hypothesis.

Provide: Twitter

In the interim, Davies looked on CNBC’s Snort Field at the present time to discuss FTX, accusing the failed alternate of colluding with Alameda to alternate against 3AC shoppers, claiming that the general public nature of the implosion has allowed him to focus on extra freely.

Perchance most aesthetic, on the different hand, modified into once the emergence of Have Kwon into the debate, who’s on the slither from South Korean authorities and is currently wanted in all 195 Interpol member states. The disgraced Terra co-founder made a surprise appearance on UpOnly final week as FTX collapsed to weigh in on Bankman-Fried’s downfall. As he has previously insisted, Kwon denied that he modified into once on the slither, nonetheless he didn’t show off his feature and left the name as mysteriously as he looked.

When requested if he had any disaster administration advice for Bankman-Fried, Kwon spoke back, “Successfully, I don’t say I did it in particular effectively, so I don’t say I’m the finest particular person to are awaiting for advice.”

Crypto Briefing’s Snatch

With limitless voices crying out for all four of these men to face justice, the audacity of the “lesser” fraudsters to reappear in converse to criticize the bigger one in all fairness prosperous. While some of their antics are no doubt a chortle, let’s no longer neglect that everyone in every of these of us did serious destroy on their arrangement out. Now it looks they’re trying to diminish their very possess mismanagement by evaluating it to SBF’s, and whereas they might well decide over a few impressionable hearts on Twitter, they are no longer helping their cases by giving public commentary.

Overall, although, the team wants cramped to manufacture with the erstwhile titans of the industry. Many bear accused them of wrongdoing themselves—if no longer blatant fraud, then no longer less than the mismanagement of funds. The outpouring of rage has been voluminous, and a transient glimpse round Crypto Twitter provides wonderful a glance of how offended of us are.

It’s a easy talking present relate that the crypto residence wants to weed out obnoxious actors, nonetheless if truth be told, there’s simplest so worthy we are able to manufacture as an industry to slither off these that might well snatch advantage of the residence. There are some regulations for which you fabricate need an enforcer, if for no other reason than to demonstrate to others that “asking forgiveness later” does no longer excuse outright criminal activity. Now and again, pronouncing “sorry” doesn’t decrease it.

Sam Bankman-Fried will very likely be severely punished for what he’s done, as he should always be. He might well well bear guests in high areas that he thinks can defend him, nonetheless he’s additionally shattered the trust of various the identical of us that might well bear helped him out. He’s harmless except confirmed responsible, positive—nonetheless proving SBF’s guilt looks discover it irresistible might well be as easy as proving 2 + 2 = 4.

Serene, the lesser fraudsters shouldn’t be comforted wonderful because there is a bigger obnoxious man within the room now. And somebody in actuality should always snatch their phones away.

Disclosure: On the time of writing, the creator of this share owned BTC, ETH, and various other other crypto property.

The facts on or accessed through this web residence is obtained from honest sources we say to be wonderful and legitimate, nonetheless Decentral Media, Inc. makes no illustration or guarantee as to the timeliness, completeness, or accuracy of any data on or accessed through this web residence. Decentral Media, Inc. is no longer an investment consultant. We fabricate no longer give personalized investment advice or other financial advice. The facts on this web residence is topic to interchange with out watch. Some or the total data on this web residence might well well turn into old sort, or it goes to be or turn into incomplete or inaccurate. We might well well, nonetheless are no longer obligated to, replace any earlier-fashioned, incomplete, or inaccurate data.

It’s best to never originate an investment determination on an ICO, IEO, or other investment in accordance to the data on this web residence, and also it is best to never clarify or otherwise rely on any of the data on this web residence as investment advice. We strongly counsel that you just consult a certified investment consultant or other qualified financial professional whenever you waste up searching for investment advice on an ICO, IEO, or other investment. We fabricate no longer settle for compensation in any develop for analyzing or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

Remembering 3AC’s Su Zhu in 10 Legendary Tweets

Chris Williams explains why crypto’s water cooler is a less bright set with out the Three Arrows Capital co-founder. Su Zhu on Crypto Twitter For honest about as long as crypto has…

The set Has Have Kwon Long past? Terra Chief Says He’s “No longer on the Bustle” a…

Kwon insisted that he modified into once “no longer ‘on the slither’” on Twitter Saturday. Authorities bear urged otherwise. Have Kwon Disappears Have Kwon might well well or is no longer going to be “on the slither,” relying…

SBF Scrambles to Duvet Tracks After FTX Blowup

Sooner than agreeing to promote FTX.com to Binance, Sam Bankman-Fried assured his Twitter followers that the alternate modified into once in factual financial standing in various since-deleted tweets. It looks, it wasn’t. SBF Goes…