Cycling On-Chain is a month-to-month series that uses on-chain and value-related data to estimate where we are in bitcoin’s market cycle. It at the start began as a month-to-month Twitter thread that became later adopted by Bitcoin Magazine. On this fundamental edition of Cycling On-Chain, we’ll survey aid on the first leg up in the 2020–2021 bull escape and the conditions that grew to change into out to be fertile soil for a firm downward correction that introduced terror into the market. The 2nd segment will try to survey forward by constructing a case for why we would no longer accumulate considered the head of this market cycle, as properly as some of its vulnerabilities.

The January Turnaround

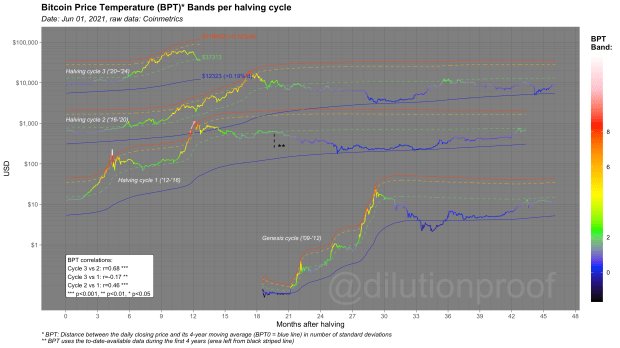

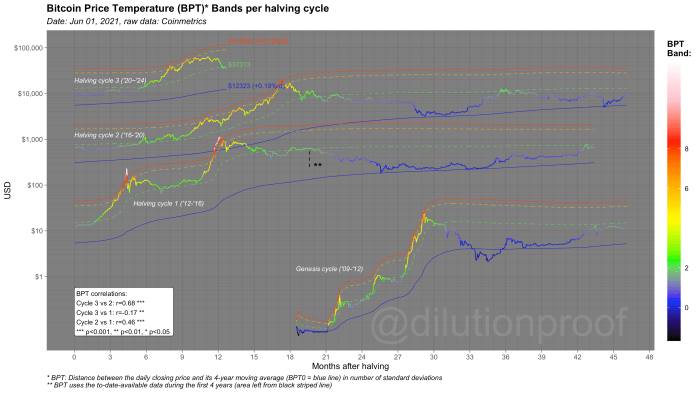

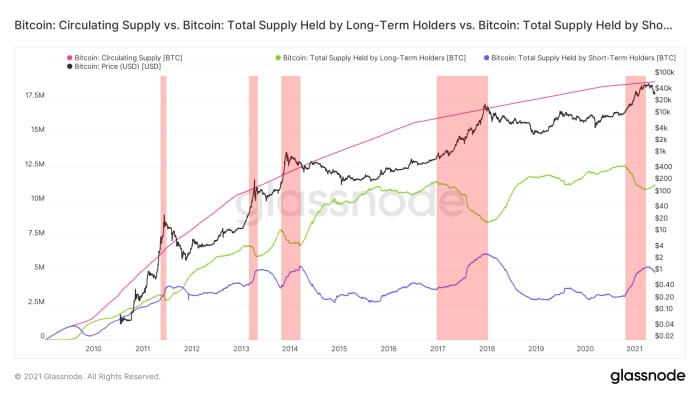

Finest accumulate the old two variations, 2020’s halving created a provide shock that precipitated an exponential label fetch bigger. However, when put next with the old (2016) halving cycle, this cycle heated up powerful faster (figure 1).

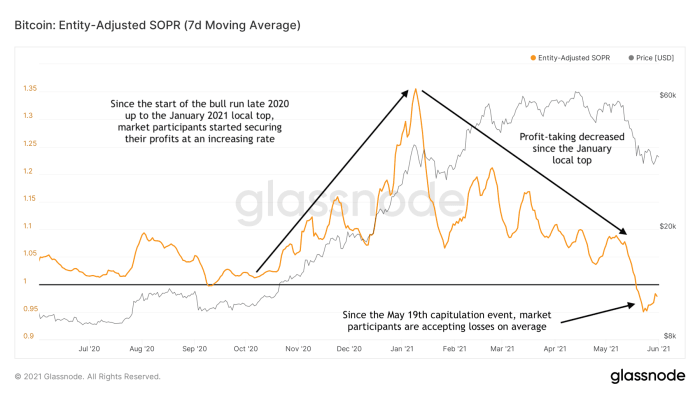

What on the total happens all the best device by these exponential label increases (figure 3), is that long-term bitcoin holders (inexperienced) begin up to step by step sell, while fresh market contributors (crimson) begin up constructing their positions — till the market cycle reaches a top and both events switch roles.

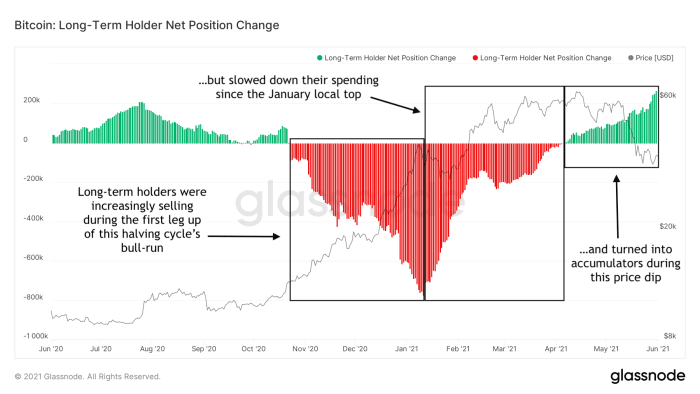

If we zoom in on the accumulate set commerce of the long-term bitcoin holders (figure 4), we glance that long-term holders accumulate been basically selling up to the January 2021 local top, slowed down their spending in a while and accumulate grew to change into into accumulate accumulators all the best device by this label dip.

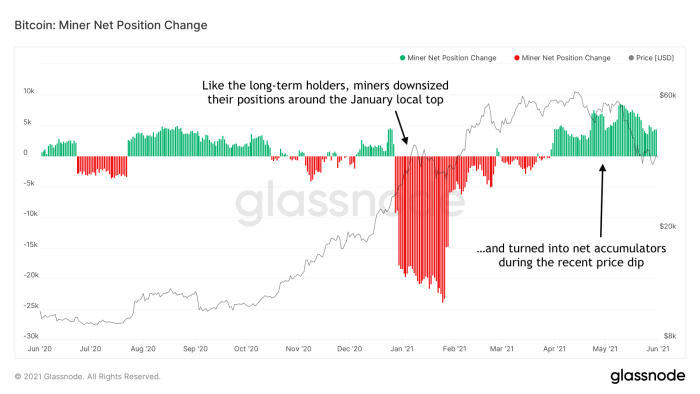

A an identical vogue may even be witnessed in the accumulate set commerce of miners (figure 5), one other class of market contributors with decided long-term market experience and exposure.

Levering It Up

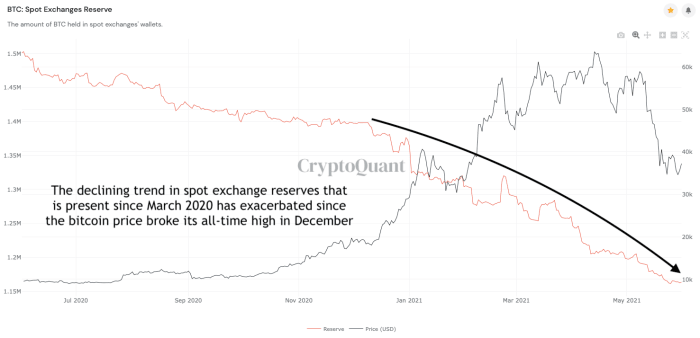

In March 2020, a gorgeous macro-pushed label rupture cleared the bitcoin market from all leverage and created more organic market stipulations that grew to change into out to lay the groundwork for this 2020–2021 bull escape. Since then, a transparent vogue of lowering bitcoin reserves on exchanges became witnessed, suggesting that a gorgeous provide shock became forming. After the bitcoin label broke its 2017 all-time high, this vogue has accelerated on pure space exchanges that don’t offer derivatives buying and selling (figure 6).

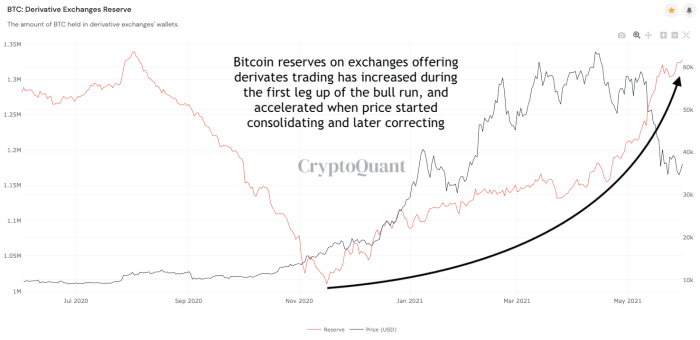

However, the alternative is actual when taking a survey at exchanges that assemble offer derivatives merchandise (figure 7). These derivatives exchanges accumulate considered their bitcoin reserves fetch bigger, especially after the label began consolidating and correcting.

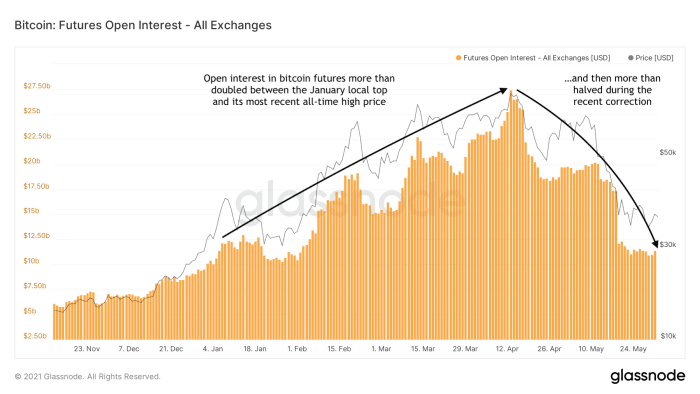

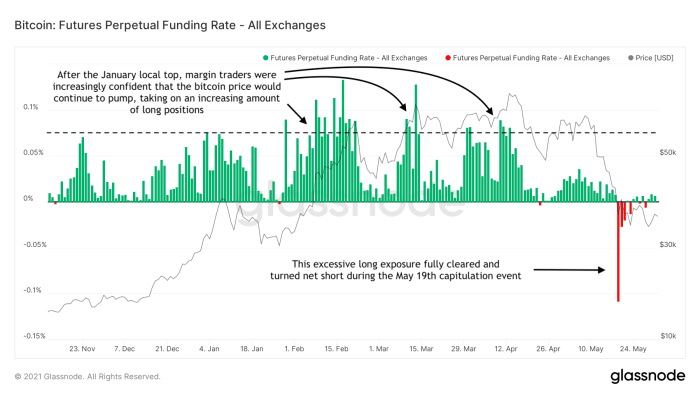

The bitcoin reserves on derivatives exchanges are (on the very least partly) held as collateral for (high) leveraged buying and selling. In the months following the January 2021 local top, the amount of open curiosity on bitcoin futures more than doubled (figure 8), suggesting that market contributors accumulate been an increasing selection of chuffed taking risks — a imaginable label of market euphoria.

As may even be considered in figure 9, most of this open curiosity became representing long positions. When the market is hugely (over)leveraged into one route, there is a transparent incentive for horny market contributors to push the label the flawed method. When the bitcoin label drops under a protracted set’s liquidation label, exchanges can power-sell the set, constructing even more downward label stress, potentially forming a cascading assemble of long liquidations that’s blended with a steep label decline, which is precisely what we seen on Can also 19, 2021.

A Switch Of Surroundings

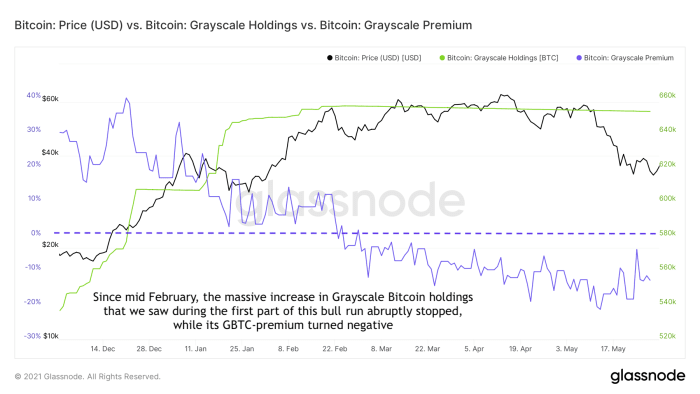

A commerce of surroundings is also witnessed in different other metrics all the best device by the first quarter of 2021. To illustrate, the bitcoin holdings of the Grayscale Bitcoin Have faith that had considered steep increases basically based mostly on institutional place a query to stopped rising in February 2021 (figure 10), while the top rate on its (GBTC) shares in actuality grew to change into deeply detrimental.

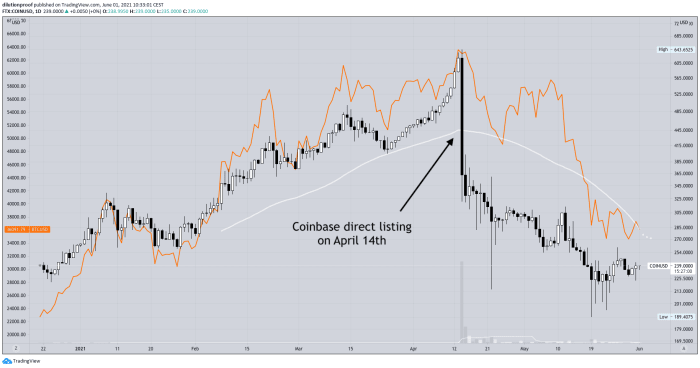

All around the first quarter of 2021, the anticipation of Coinbase’s inform itemizing (once in some time veritably known as their initial public providing or IPO) became one other tale that alternative market contributors accumulate been following. Both the bitcoin label (orange) and COIN label (gloomy and white) accumulate been creeping up all the best device by the months up to this tournament, and stumbled on their all-time highs round their inform itemizing date on April 14, 2021 (figure 11). The inform itemizing became accompanied with horny sell stress from Coinbase executives that accumulate been selling segment of their positions, constructing a steep downward label motion in the label of their shares.

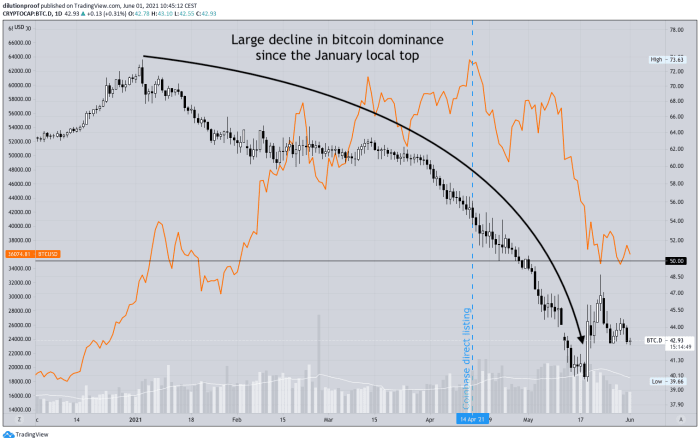

But any other decided vogue commerce that came about after the January 2021 local top became the immediate decline in bitcoin dominance that we accumulate now got considered since then (figure 12). This declining bitcoin dominance device that altcoin label appreciation became outperforming that of bitcoin, which is frequently attributed to retail market contributors getting into the scene en masse.

Younger Whales Crashing The Birthday party

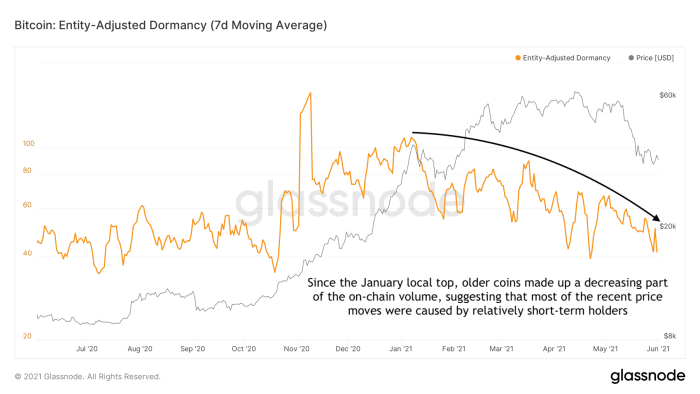

For the rationale that January 2021 local top, a transparent downward vogue may even be witnessed in the degree in which older coins are to blame for the on-chain volume (figure 13). This means that fresh label actions can an increasing selection of be attributed to rather young market contributors.

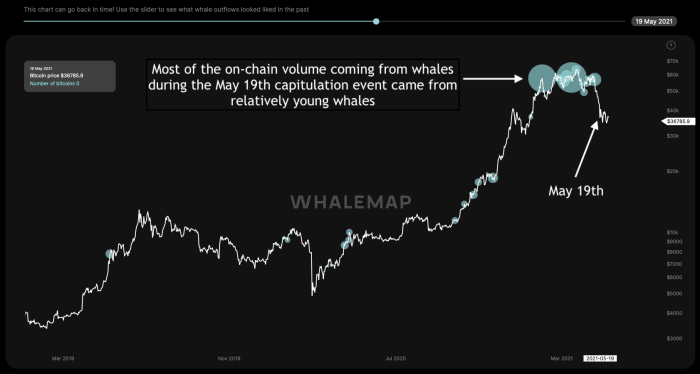

When zooming in on the on-chain actions of the best players in the bitcoin market (“whales”), it’s miles moreover decided that most of the on-chain actions accumulate been made by young whales. An example of that is visualized in figure 14, where the inexperienced circles highlight the (magnitude of) whale addresses that transacted on-chain all the best device by the Can also 19, 2021, capitulation tournament. These on-chain actions are doubtless a combination of these young whales (1) triggering the label rupture itself, (2) selling out of dread, (3) getting liquidated from their long positions and (4) procuring for aid at a decrease label for tax benefits (“tax harvesting”).

A Mountain Without A Top

The good ask that remains — is that this celebration over now…?

It is most no longer prone to predict the longer term basically based mostly on historical data for the rationale that context of that data consistently changes and future events can simply win a varied route. However, comparing fresh and historical on-chain data structures may even be helpful to gauge to what extent (cyclical) investor behavior rhymes in phrases of market psychology.

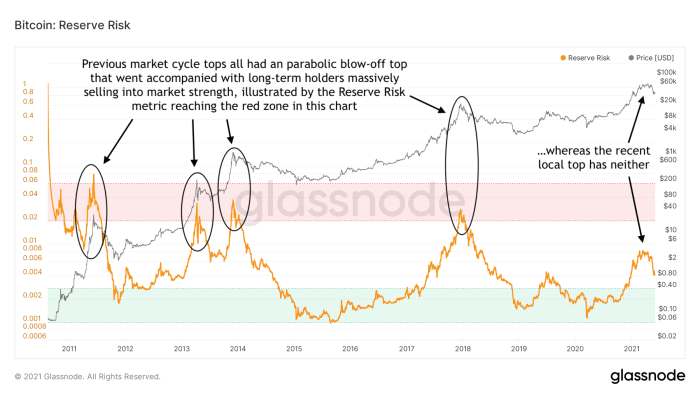

One example of that is illustrated in figure 15. Unlike the old market cycles, whose tops accumulate been all marked by an exponential blow-off top that became blended with long-term holders hugely selling into market energy, this cycle (to this point) has had neither. Without a doubt, this cycle would now not accumulate to be related to the old ones, but this does illustrate that it may be somewhat odd if the sizzling cycle indeed ends with a dud.

A Unique Hope(?)

As correct identified, we can no longer predict the longer term basically based mostly on on-chain data; but we can display screen traits in its flows to aid us understand fresh market actions and more substantially speculate where the market may scramble subsequent. Despite the steep label drop, some definite on-chain signals is also witnessed.

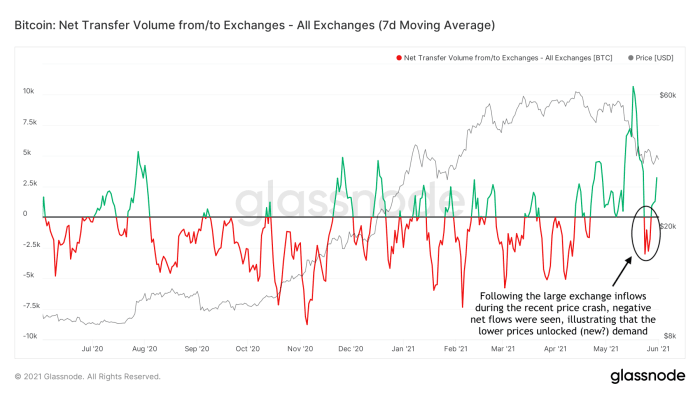

All around the sizzling market correction, exchanges seen horny accumulate inflows of the short holders that accumulate been getting out of their positions (figure 16). As label declined, so did the accumulate switch volume from/to exchanges, even turning accumulate detrimental once more shut to the tip of the label dip. This means that the decrease prices precipitated (fresh?) place a query to, rising self assurance that investors will continue to step in all the best device by dips.

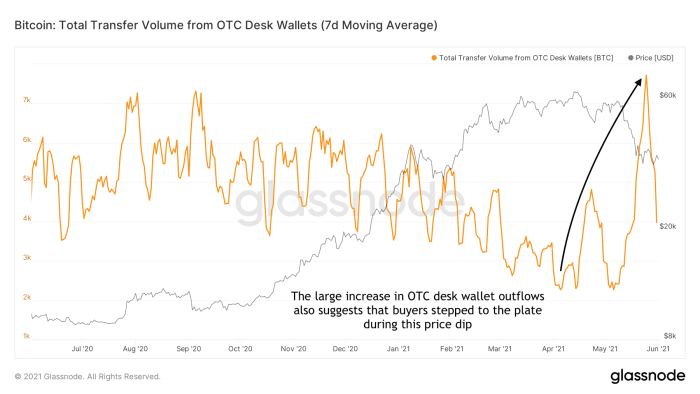

All over this dip, there moreover accumulate been horny outflows in over-the-counter (OTC) commerce desks (figure 17). These OTC desks facilitate buying and selling between bigger entities that wish to rob or sell bitcoin with out transferring markets.

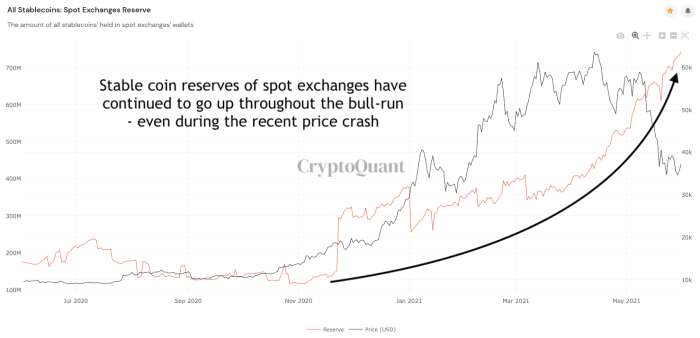

But any other imaginable label of continued place a query to for (space) exposure to bitcoin is the stablecoin reserves on space exchanges which accumulate continued to scramble up (figure 18).

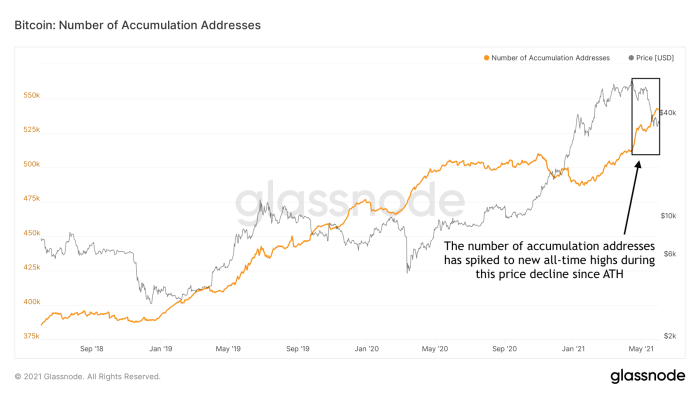

Consistent with the selection of accumulation addresses as of late peaking to fresh all-time highs, the label dip moreover appears to construct up precipitated market contributors to buck-label moderate (DCA) into a bitcoin set (figure 19).

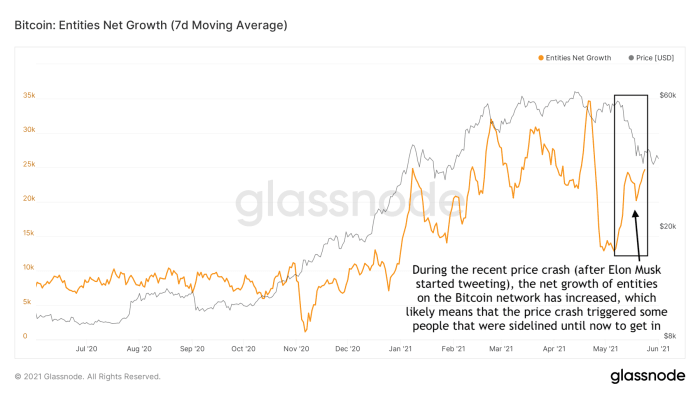

One way or the opposite, the sizzling spike in the accumulate reveal of entities on the Bitcoin network means that all the best device by the label rupture more entities joined than left, moreover suggesting that the decrease prices enticed some of us to rob into a gaggle (figure 20).

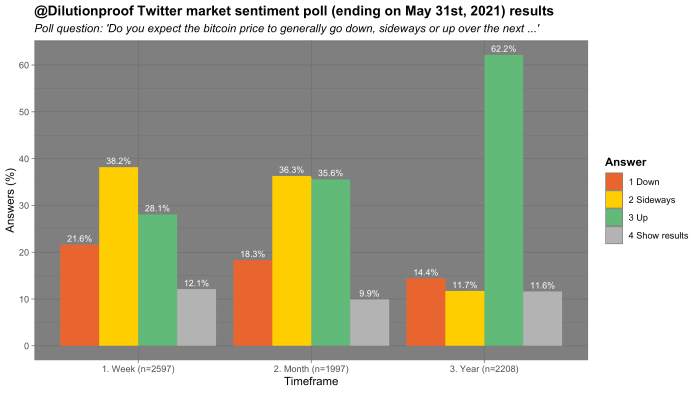

Even supposing Twitter polls constantly accumulate to be fascinated a pair of grain of salt, the outcomes of the polldisplayed in figure 21 provide one other signal that market contributors restful accumulate a definite mid- to long-term expectation for the bitcoin label. Respondents are neutral to mildly bullish on a weekly to month-to-month time-frame but clearly restful very bullish on a yearly time-frame.

Taproot

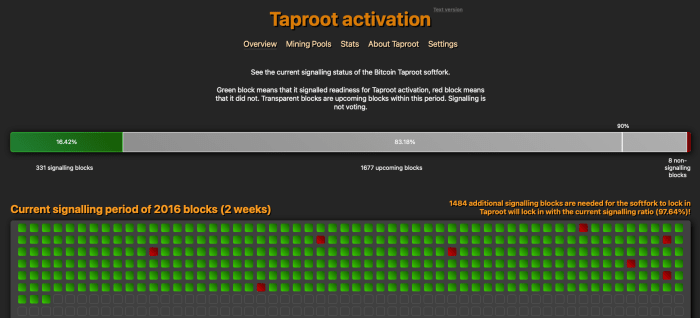

Along with label-related curiosity in bitcoin’s prospects, prospects about Bitcoin’s Taproot protocol upgrade may provide a more predominant driver for enthusiasm for the interval of the rest of 2021. Taproot improves some of Bitcoin’s on-chain privateness characteristics and unlocks fresh potentialities for scaling, dapper contracts and Lightning. The protocol upgrade is expected to be locked into activation internal the next two weeks and shall be activated in November 2021 if a hit.

A Present Of Caution

The fresh unwinding of leverage and commerce of surroundings supplied a name for caution, as properly as a warning that the bitcoin market has reached a truly unstable and vulnerable segment, no matter the route in which it moves subsequent.

All around the past year, bitcoin has matured into a macro-asset that’s an increasing selection of adopted by institutional investors, transferring the asset into a total fresh having fun with field. It goes to, therefore, glance regulatory headwinds that can spur dread into markets, even when these narratives are basically based mostly on flawed data.

But any other imaginable end result of the elevated institutional adoption is that its label developments may an increasing selection of begin up following these of the larger overall macro cycle. Like we seen in March 2020, its label route is also impacted if a macro-financial breakdown accumulate been to happen.

A Doable Outlook For 2021

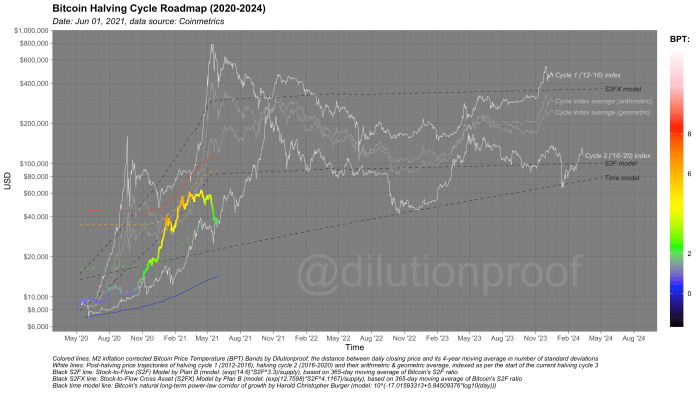

There are no ensures that the bitcoin label will basically mimic the trajectories of its old (halving) cycles. However, items accumulate the S2F and S2FX, time-basically based mostly items or much less difficult old cycle indexes that are displayed in figure 23 is also helpful for getting a rough notion of what’s also forward if bitcoin’s four-year cycle indeed rhymes on the very least one more time.