A conflict of crypto mega-personalities has save the final space on edge.

Duvet describe by Eva Marie Uzcategui/Bloomberg.

Key Takeaways

- Crypto Twitter became as soon as placed on excessive alert over the weekend as two giants of the enterprise publicly exchanged terse nevertheless noteworthy phrases.

- The alternate between Changpeng Zhao and Sam Bankman-Fried, respective CEOs of Binance and FTX, has inflamed rumors that the latter’s companies is seemingly to be in bother.

- Fears of a financial institution experience on FTX, the enviornment’s 2d-largest alternate, dangle save the space on edge.

On high of the midterm elections and coming near near CPI numbers on Thursday, the crypto world is contending with extra drama this week within the receive of two enterprise titans butting heads in a contrivance that places the final space on edge.

Conflict of the Titans

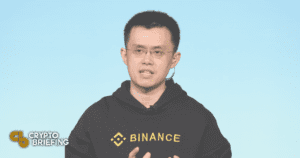

Binance CEO Chanpeng “CZ” Zhao made waves on Sunday by announcing on Twitter that the alternate would liquidate any FTT (FTX’s native token) it held resulting from “contemporary revelations.” Whereas he didn’t account for on what those revelations is seemingly to be, the rampant speculation is that the perpetrator could possibly effectively be a leaked steadiness sheet from Alameda Study, which has deep (though frankly unclear) ties to FTX.

FTX is the enviornment’s 2d-largest crypto alternate, lagging easiest on the aid of Binance. In a year that noticed several exchanges face liquidity crises and even give contrivance altogether, these two powerhouses dangle weathered the storm by staying reasonably dapper—they are most steadily ready to own excessive liquidity from the sheer measurement of their userbases and appear to portion a disinclination to overleverage themselves, à la Celsius or Three Arrows Capital.

Nonetheless, Alameda’s leaked steadiness sheet (which, you’ll want to show camouflage, could possibly no longer give a total describe of the firm’s funds) demonstrated that a pretty significant fragment of Alameda’s $7.4 billion in resources includes illiquid FTT and Solana-basically basically based mostly tokens. SBF’s history of make stronger for Solana renders the discovering considerably unsurprising, nevertheless Solana’s wretched efficiency over 2022 has introduced simply about all of its ecosystem’s tokens down with it.

As a consequence of this truth, no less than one amongst Sam’s companies is seemingly to be in accurate bother if any mass-withdrawal occasions had been to happen. Furthermore, Alameda’s shut ties to FTX is seemingly to be contributing to financial difficulties for the alternate as effectively—Twitter character 0xSisyphus pointed out

earlier this day that, for some cause, FTX has withdrawn 1,985 ETH (about $3 million) from Gearbox Protocol. Most steadily which will no longer draw any consideration, nevertheless provided that Gearbox is determined to pause its withdrawal fee subsequent week, it does lead one to surprise why the firm would sink higher than 30 mammoth into prices that it assign no longer want needed to pay if it had just correct waited about a extra days.

Silent, SBF insists that FTX is okay—that “resources are just correct-attempting.” Alameda CEO Caroline Ellison countered CZ’s preliminary tweet the day prior to this by offering to own all of Binance’s FTT over-the-counter for $22 a token. In his most steadily opaque capacity, CZ regarded as if it would be concerned with the deal earlier this afternoon, nevertheless it’s subtle to assess which implies his company will depart; meanwhile, FTT’s value still sits just correct about a cents above $22.

Whether or no longer the Alameda/FTX powerhouse is mostly just correct-attempting, nevertheless, stays to be viewed. If either had been to experience into insolvencies, it would be a just correct-attempting colossal sad note for Bankman-Fried, who has maintained a pretty definite public image to this level. However as we all know, things can substitute on a dime in this space; how FTX and Alameda address the subsequent few days could possibly describe us lots about their future within the enterprise.

Disclosure: At the time of writing, the author of this fragment owned BTC, ETH, BNB, SOL, and several varied digital resources.

Binance CEO Changpeng Zhao Criticizes Crypto Bailouts

Binance CEO Changpeng Zhao has issued a show camouflage summarizing his thought on bailouts and leverage within the crypto enterprise. His comments attain easiest about a days after experiences of the…

Binance and FTX Face Off—However Which Crypto Replace Will Come Out On …

A spat between Changpeng Zhao and Sam Bankman-Fried could possibly spark a crypto cool battle between the space’s two greatest exchanges. Binance Plans to Clear FTT Publicity War is brewing between…

Binance to Carry out FTX.com

The world’s largest crypto alternate has struck a deal to construct the enviornment’s 2d-largest alternate. Buyout After days of butting heads on Twitter amid rumors of enterprise troubles at FTX…