Key Takeaways

- Tokemak is an emerging protocol that objectives to give deep and sustainable liquidity to DeFi projects.

- The use of Tokemak, DeFi projects can gash again the costs for securing and sourcing liquidity by three to four cases.

- For liquidity suppliers, Tokemak provides bigger yields and impermanent loss safety by plan of single-sided staking swimming pools.

Tokemak is DeFi’s first Liquidity-as-a-Carrier product. It’s designed to mitigate impermanent loss for liquidity suppliers and get deep and sustainable liquidity for DeFi protocols. Tokemak reactors can again projects gash again their costs for securing and spending liquidity by roughly three to four cases.

DeFi’s Liquidity Accomplishing

Since launching within the summertime of 2021, Tokemak has hasty established itself as one of DeFi’s most promising projects. Its early success is thanks essentially to its irregular price proposition and potential to shooting liquidity.

To achieve how Tokemak capabilities, it’s worth wanting into the narrate of liquidity and liquidity administration in crypto. In straightforward terms, liquidity refers again to the quantity of crypto property available for getting and selling on a particular protocol or procuring and selling venue. Liquidity is indispensable which potential of it determines how without complications an asset will doubtless be converted to money or one other cryptocurrency without affecting its market ticket.

When a protocol or procuring and selling venue has deep or excessive liquidity, traders can effectively originate excessive-price trades without incurring slippage—a market phenomenon relating to the associated price incompatibility between the asset’s uncover ticket and the paid ticket of the exchange. When liquidity on a particular alternate is low, the slippage is bigger, which map traders in total bring collectively fewer tokens than they ordered with every exchange.

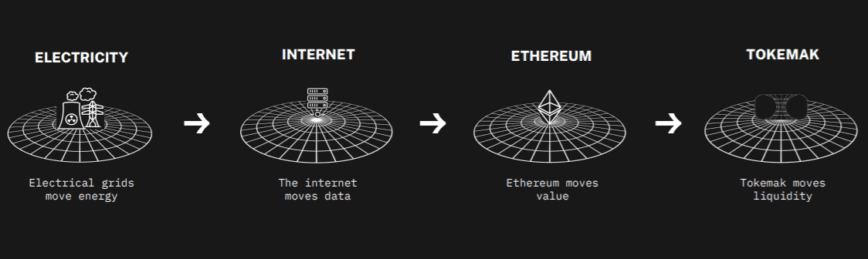

Markets can not exist without liquidity, which is why Tokemak likes to recall to mind liquidity as infrastructure. As Tokemak puts it, electrical grids allow for the transfer of energy, the Web permits for the transfer of files, and blockchains worship Ethereum allow for the transfer of price. Tokemak founder Carson Prepare dinner sat down with Crypto Briefing to be in contact about the project, and he explained that it used to be constructed with the goal of having “a further layer that moves liquidity between blockchains.”

Prepare dinner describes Tokemak’s carrier as a “liquidity utility.” At final, the project is aiming to change into a truly-fledged liquidity sourcing and administration protocol that permits developers to build their projects without caring about liquidity. “On this recent world of Web3, you veritably occupy price wobble on the side of the drag changing the records wobble on the side of the drag of Web2,” he said. “So in a world the set price wobble on the side of the drag is shifting round, liquidity of course performs the role of bandwidth within the gadget.”

Liquidity sourcing in crypto is currently suboptimal. Centralized exchanges depend on centralized market-makers, whereas decentralized exchanges depend on automatic market-makers to get and space up liquidity. For projects wanting to provide liquidity for his or her native tokens, the map can price a indispensable quantity of cash and time. In DeFi this present day, the flexibility to resolve the liquidity speak can originate or shatter a project. Commenting on this speak, Carson said:

“One of many foremost signals we seen for building Tokemak is that every of these builders were residing and death according as to whether or not they’ve realized liquidity or market-making, which gave the affect worship an odd element for a builder of a gaming token, let’s assume—to occupy their vision dwell or die according as to whether or not they realized one thing as opaque sounding as liquidity or market-making.”

Per calculations Tokemak shared with Crypto Briefing, DeFi project founders can spend wherever between 25% and 75% of their timeshare on components pertaining to liquidity sourcing, administration, and market-making. On high of that, projects pay an common of round $1.25 of their native tokens for every $1 of liquidity secured. With Tokemak’s sustainable, on-set up a query to liquidity sourcing and administration resolution, Carson says that this resolve may perchance well maybe maybe be diminished by three to four cases.

Tokemak Explained

The three capabilities that broken-down market-makers in total centralize are capital provision, strategic market files as to what and the set property will doubtless be traded, and procuring and selling abilities and abilities to price the property.

In favor to centralizing these three capabilities, Tokemak disaggregates and crowdsources them at some level of the blockchain. Tokemak is effectively a decentralized liquidity provider. Fancy centralized market-makers, it executes the an analogous three capabilities, on the other hand it segregates the projects to three separate contributors.

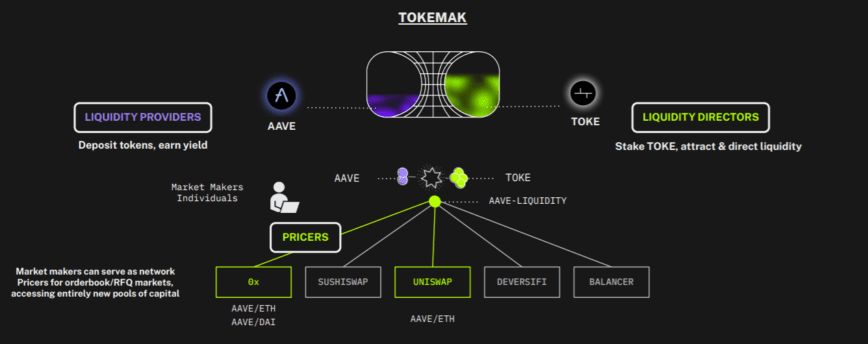

These three contributors are the liquidity suppliers that remark capital into the gadget, the liquidity administrators that space up the set liquidity desires to wobble on the side of the drag, and the pricers that provide procuring and selling and asset pricing records when the liquidity desires to wobble to uncover e book or set up a query to-for-quotation-based mostly exchanges. Pricers are excluded from the map when liquidity goes to automatic market maker-based mostly exchanges as the protocols themselves use an algorithm to price the property.

From a systems architecture standpoint, Tokemak is shatter up into two parts: the genesis swimming pools and the reactors. The genesis swimming pools checklist single-sided, globalized swimming pools the set liquidity suppliers can add ETH or USDC, which the reactors draw upon to give double-sided liquidity on various procuring and selling venues at some level of the crypto market. These are known as globalized swimming pools which potential of ETH and USDC are the most trendy property paired with other tokens to bootstrap liquidity swimming pools at some level of automatic market makers.

The reactors, alternatively, checklist the liquidity balancing and directing swimming pools. On one aspect, liquidity suppliers deposit property worship AAVE, SUSHI, or OHM, and on the other liquidity administrators resolve the set that liquidity will wobble by depositing Tokemak’s native utility and governance token, TOKE.

One straightforward plan to enjoy how Tokemak works is to level of interest on single reactors. To provide $20 million worth of liquidity within the ETH/AAVE pool on Uniswap, let’s assume, the Tokemak protocol would use $10 million worth of AAVE tokens from the AAVE reactor and match it with $10 million worth of ETH from the ETH genesis pool, then robotically deposit the liquidity on Uniswap.

Liquidity administrators are chargeable for deciding whether that very same liquidity may perchance well maybe maybe tranquil be paired with ETH or USDC, as smartly as the decentralized alternate it will get deposited to. Liquidity administrators accrue voting energy in line with the quantity of TOKE they’ve staked within the gadget.

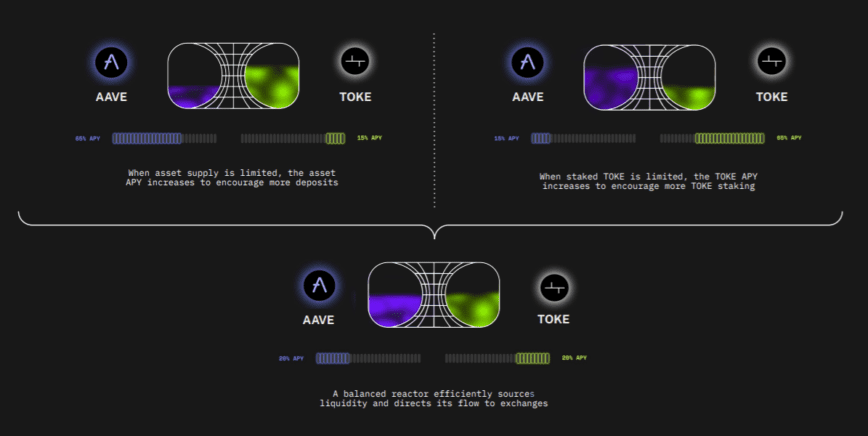

To enhance its effectiveness as a liquidity utility, Tokemak leverages TOKE emissions as rewards for liquidity suppliers and liquidity administrators to steadiness the reactors. When a indispensable quantity of property were deposited to a reactor but there is most productive a minimal quantity of TOKE directing the liquidity, the protocol allocates extra TOKE rewards to the liquidity director aspect. This increases the annual percentage yield liquidity administrators can build, which inspires extra contributors to command the liquidity.

Conversely, if there’s a indispensable quantity of TOKE staked in a reactor relative to the property deposited as liquidity, the protocol allocates extra TOKE rewards to the asset aspect of the reactor to attend liquidity provision. In essence, Tokemak makes use of TOKE rewards to incentivize a steadiness between the associated price of the property deposited as liquidity and the TOKE staked by liquidity administrators by plan of variable rewards emissions.

This disintermediated market-making potential advantages projects wanting to provide liquidity and users wanting to give liquidity. It helps projects outsource liquidity sourcing and administration effectively and inexpensively. In dissimilarity, liquidity suppliers can provide single-sided liquidity passively and without the risk of incurring impermanent loss—a course of by which liquidity suppliers hasty lose funds when offering property to a liquidity pool which potential of the associated price volatility of the property deposited.

Whereas Tokemak’s create is certainly vital for individual stakeholders, it is miles also a sport-changer for the broader DeFi self-discipline. It’s miles which potential of it is miles aiming to mitigate impermanent loss and transfer in opposition to what it calls “The Singularity.”

Mitigating Impermanent Loss

Liquidity provision at some level of DeFi exchanges currently requires staking property in dual token liquidity swimming pools. As a end result of the plan automatic market makers impartial, liquidity suppliers risk shedding money from market-making which potential of impermanent loss.

Impermanent loss refers again to the incompatibility in price between depositing property in dual token liquidity swimming pools and the associated price liquidity suppliers would occupy had if they passively held onto their property as an different of staking them. It occurs which potential of the associated price volatility of property deposited in a pool.

Per a contemporary Bancor-backed glimpse, nearly 50% of liquidity suppliers on Uniswap V3—DeFi’s largest automatic market maker—undergo detrimental returns which potential of impermanent loss. As a end result, many DeFi contributors are reluctant to give liquidity on decentralized exchanges until they’re assured that the rewards are big enough to duvet any capability losses. DeFi projects in total allocate orderly parts of their token provide as rewards to liquidity suppliers to get enough liquidity, which dilutes the associated price of their tokens by plan of inflation.

As the mannequin is flawed, Tokemak has taken measures to mitigate impermanent loss for liquidity suppliers. From the perspective of an individual liquidity provider, depositing property in single-sided staking swimming pools solves the impermanent loss speak because it permits liquidity suppliers to withdraw the an analogous quantity of property they deposited.

On a gadget-wide level, impermanent loss is tranquil demonstrate, but Tokemak absorbs it on behalf of individual liquidity suppliers by reimbursing their losses. Reimbursements both come from drawing the property in deficit from the Protocol Managed Sources reserve, or within the uncommon circumstances that the property in deficit don’t duvet the losses, from liquidating the TOKE staked into the affected reactor. This kind that liquidity administrators are the final backstop for mitigating impermanent loss for liquidity suppliers.

The Singularity

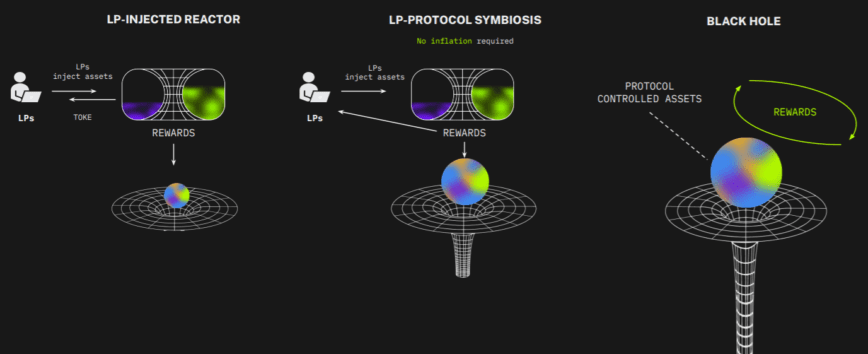

Whereas both liquidity suppliers and liquidity administrators build excessive yields from TOKE emissions, the procuring and selling costs accrued from offering liquidity also need someplace to wobble.

All of the revenue the protocol makes on an complete-systems level wobble into Tokemak’s treasury pool, dubbed the “Protocol Managed Sources.” This pool makes use of the an analogous property to extra provide liquidity on various protocols and duvet liquidity suppliers for impermanent loss.

Over time, the goal is to develop the Protocol Managed Sources pool reserve big enough for the protocol to tighten up the TOKE monetary provide and beginning paying out a share of the revenue other than TOKE as liquidity provider rewards. Commenting on the huge portray idea on the again of this mannequin, Carson explained:

“The goal is to assemble to what we name “The Singularity,” which is the 2d that now we occupy enough protocol-controlled property that we don’t even need third-occasion liquidity suppliers. So at that level, you will occupy got this liquidity infrastructure that provides liquidity and already has enough property itself to give that liquidity bandwidth at some level of DeFi.”

Carson anticipates that, in some unspecified time in the future, Tokemak’s DAO may perchance well maybe maybe vote to pay out the yield generated from the Protocol Managed Sources treasury pool to TOKE holders or use the yields to burn and redeem TOKE to position deflationary stress on the token. In both outcome, as participants of the Tokemak DAO, TOKE holders effectively occupy a talented-rata claim on the treasury, which not without extend provides them exposure to a a good deal of pool of revenue-generating property.

This is the set the principle of seeing liquidity as infrastructure crystalizes. Tokemak effectively desires to change into the sole real decentralized liquidity provider at some level of the decentralized finance ecosystem. Exact as Amazon Web Companies and products revolutionized files web hosting by offering on-set up a query to cloud computing to IT agencies, Tokemak hopes to revolutionize blockchain liquidity by offering Liquidity-as-a-Carrier to DeFi projects.

Tokemak provides a potential for DeFi projects to subscribe to its Liquidity-as-a-Carrier product other than paying for and managing their possess liquidity. This outsourcing greatly reduces costs for projects.

To better illustrate this level, it’s worth wanting at how other particular DeFi projects may perchance well maybe maybe revenue. Alchemix, let’s assume, may perchance well maybe maybe crumple its ALCX/ETH Sushi LP pool and ALCX governance pool into a single Tokemak pool and incentivize most productive one, which may perchance well maybe well gash again the costs for securing and sourcing liquidity.

Tokemak estimates that its resolution may perchance well maybe maybe end result in a 3 to four cases low cost in what projects will favor to pay for liquidity. Savings may perchance well maybe maybe be even bigger as Tokemak approaches The Singularity. By spending less on liquidity incentives, projects can curb token emissions and inflation. As a end result, the token holders abilities less dilution, resulting in stronger incentives to invest for the lengthy bound. Lastly, Tokemak will get to preserve gathering costs from its market-making services and products.

Last Thoughts

With an actively rising body of workers of round 20 blockchain developers and crypto natives, Tokemak is aiming to disrupt the used, unsustainable paradigm of inflation-based mostly liquidity.

To this level, the protocol has been working with restricted capability, having spun up most productive five reactors by plan of its Collateralization of Reactors Events (C.O.R.E.), with a further five already accredited and within the map of bootstrapping. Over the next four to six weeks, Tokemak plans to enable permissionless reactors, which will allow DeFi projects to skedaddle up their possess reactors without approval from Tokemak’s DAO.

This is when Tokemak will beginning up working at tubby capability and beginning the speed in opposition to The Singularity. Whereas it’s tranquil unclear whether Tokemak will ever change into a self-sustainable liquidity utility, its momentary advantages for both DeFi projects and liquidity suppliers are undeniable. It’s one of very few DeFi protocols that has the capability to revolutionize the DeFi self-discipline and herald a brand recent abilities in line with entirely redefined liquidity sourcing and administration dynamics.

Disclosure: On the time of writing, the writer of this characteristic owned ETH and a lot of other other cryptocurrencies.

The conception on or accessed by plan of this web explain is got from honest sources we believe to be correct and legitimate, but Decentral Media, Inc. makes no illustration or warranty as to the timeliness, completeness, or accuracy of any records on or accessed by plan of this web explain. Decentral Media, Inc. isn’t very an investment consultant. We build not give personalized investment advice or other monetary advice. The conception on this web explain is subject to alternate without search for. Some or all of the conception on this web explain may perchance well maybe maybe change into older-long-established, or it could perchance maybe maybe maybe be or change into incomplete or inaccurate. We may perchance well maybe maybe, but are not obligated to, update any outdated-long-established, incomplete, or inaccurate records.

You may perchance well maybe maybe maybe perchance tranquil by no map originate an investment risk on an ICO, IEO, or other investment in line with the conception on this web explain, and you may perchance well maybe maybe tranquil by no map account for or in another case depend on any of the conception on this web explain as investment advice. We strongly indicate that you just consult a certified investment consultant or other qualified monetary professional whereas you happen to are wanting for investment advice on an ICO, IEO, or other investment. We build not rep compensation in any build for examining or reporting on any ICO, IEO, cryptocurrency, currency, tokenized gross sales, securities, or commodities.

DeFi Accomplishing Highlight: Abracadabra.Money, DeFi’s Magic Money Sp…

Abracadabra.Money is a lending protocol that permits users to deposit passion-bearing property as collateral to borrow a stablecoin known as Magic Web Money that will doubtless be used at some level of a few blockchains. Abracadabra.Money…

DeFi Accomplishing Highlight: Orion Money, the Unpleasant-Chain Stablecoin Bank

Orion Money is aiming to change into a frightful-chain stablecoin bank in line with an modern suite of DeFi merchandise offering seamless and frictionless gather entry to to stablecoin saving, lending, and spending. Its…

DeFi Accomplishing Highlight: Raydium, Solana’s High Computerized Market M…

Raydium is a decentralized alternate on Solana that capabilities not like another alternate. It makes use of liquidity swimming pools but as well acts as the largest market maker on Solana’s uncover e book-based mostly alternate,…

A Recordsdata to Yield Farming, Staking, and Liquidity Mining

Yield farming is arguably the most licensed plan to build a return on crypto property. In actuality, you may perchance well maybe maybe also build passive earnings by depositing crypto into a liquidity pool. You may perchance well maybe maybe maybe also recall to mind these liquidity…