Key Takeaways

- Raydium is the finest decentralized alternate on Solana. It aggregates liquidity from its hold liquidity pools and Serum’s orderbook.

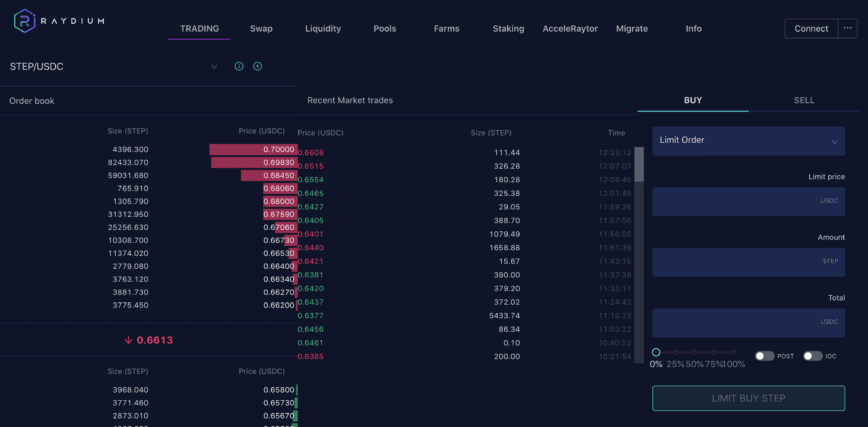

- Raydium is also the finest market maker on Serum and one of few DeFi exchanges with a constructed-in limit orders option.

- In open up to reduction develop the Solana ecosystem, Raydium constructed AcceleRaytor, a launchpad for new initiatives on Solana.

Raydium is a decentralized alternate on Solana that functions unlike any varied alternate. It makes employ of liquidity pools nonetheless also acts as the finest market maker on Solana’s advise guide-based mostly alternate, Serum.

Raydium Explained

Raydium Protocol is Solana’s prime automated market maker.

On the other hand, it in actual fact works in a different way from varied decentralized exchanges in that it acts as a market maker for Serum.

To cherish why Raydium functions the fashion it does, it’s worth pondering the project’s crew. The team had worked together for diverse years sooner than launching the decentralized alternate in early 2021. The crew worked together in a quant trading algorithmic market-making agency on a pair of of the tip crypto exchanges.

Raydium’s yarn has parallels with the yarn of Sam Bankman-Fried, the billionaire founding father of the FTX alternate and Alameda Compare and a astronomical supporter of the Solana ecosystem. Both Bankman-Fried and the Raydium crew had been merchants, which shines by in the exchanges they contrivance. Alpha Ray, the founding father of Raydium, affirms that Bankman-Fried has been a astronomical help to Raydium. They advise:

“Sam is a astronomical investor in every Solana and Serum, and to present these work he wants a thriving ecosystem on Solana so he’s very invaluable. He devotes reasonably a range of his time, and FTX’s resources to reduction the ecosystem.”

One amongst the principle benefits to centralized exchanges when when put next with their decentralized counterparts is the flexibility to present limit orders (though limit orders agree with been made imaginable on Uniswap V3 by following a positive methodology). Orders want an advise guide rather then a liquidity pool. Merchants choose to specify the worth at which they’d choose to alternate their resources, which isn’t imaginable with liquidity pools.

Raydium’s alternate was as soon as constructed on the philosophy of allowing the ultimate of every worlds. When a user enters a alternate, this would presumably either be made the employ of Raydium’s hold liquidity pools or routed to the decentralized advise guide Serum reckoning on where the ultimate trace could presumably even be stumbled on. Alpha Ray explains:

“Serum has an advise guide system, and Raydium has its hold liquidity pools. When customers produce transactions on our platform, the protocol aggregates liquidity from these two sources, a bit of fancy 1inch on Ethereum.”

Raydium is the finest market maker on Serum, routing trades from their hold customers 24/7, making them one of many appropriate DeFi exchanges to agree with a constructed-in option for limit orders. The crew also has a stop relationship with Serum, which formula it’ll hasty troubleshoot any points that come up.

One other Raydium crew member going by the name Gamma Ray says that Raydium and Serum portion their liquidity, which makes the Solana ecosystem extra efficient. They advise:

“In DeFi, liquidity is on the general sioled between varied platforms fancy Sushiswap and Uniswap, which within reason inefficient. Raydium and Serum see to portion their liquidity with the general ecosystem. It’s about rising the general pie for the Solana ecosystem.”

Constructing on Solana

Solana-based mostly initiatives fancy Raydium lift perfect thing about the low worth of the employ of the network. The experience of trading on advise books is terribly varied from the employ of liquidity pools. Merchants will continually enter a limit advise, assassinate it, adjust a pair of parameters, and reenter. In a decentralized ambiance, all of these actions are interactions with the blockchain that advise a price.

Solana benefits from low prices—every transaction on Serum charges not up to 1 cent. An identical transactions could presumably affirm customers reduction $50 a time on Ethereum mainnet. Serum is currently not available on Ethereum, nonetheless the emergence of Layer 2 alternate suggestions fancy Arbitrum and Optimism could presumably trade that.

Solana’s low worth prices had been a key part at the help of Raydium’s decision to contrivance on the network. Whereas many DeFi initiatives started flocking to Ethereum in the summertime of 2020, the need for extraordinarily low gas prices forced Raydium to scrutinize for imaginable choices. Solana’s technical prowess managed to persuade the crew. Speaking of the decision to contrivance on Solana, Alpha Ray says:

“We wanted a blockchain with high transaction throughput, high tempo, and low prices. After we started building on Solana there wasn’t powerful there. We had been afraid that if Solana wasn’t ready to contrivance up, it wouldn’t topic how perfect our platform was as soon as. Now, we’re obviously very happy to agree with taken that probability.”

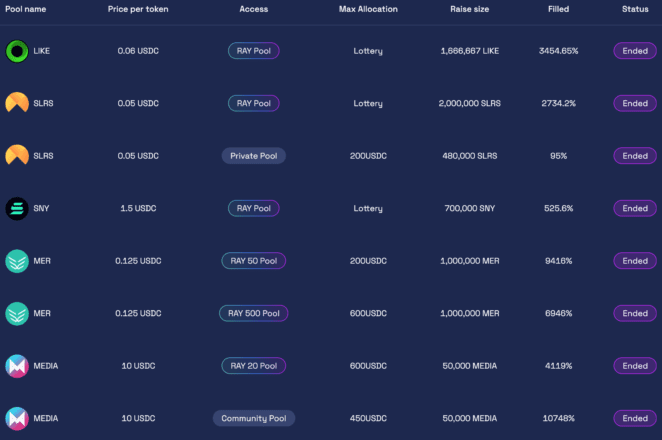

Now, one of Raydium’s key desires is to develop the Solana ecosystem by attracting extra initiatives, skills, and customers. For that, the crew created AcceleRaytor, a launchpad for new initiatives that facilitates neighborhood investment into new Solana initiatives.

Many initiatives on AcceleRaytor are very neatly-liked. Most of them had oversubscribed launches, which resulted in random attracts between all alive to investors to reach to a call who would obtain a token allocation. Alpha Ray notes that Raydium identified the necessity to scheme prime-quality initiatives early on. He says:

“For Raydium to be astronomical, we would like reasonably a range of tokens to alternate. We desire active trading on many stable initiatives and a thriving ecosystem so as that people will movement their DeFi industry to Solana. We tried to title what we wanted after we launched and give that to these initiatives. A stable marketing push, enough funding, a liquid trading market, and finally a fusion pool that distributes rewards to early investors.”

Raydium meticulously research any project that goes by AcceleRaytor to introduce solid initiatives to investors and contrivance a stable relationship constructed on have confidence.

NFTs are yet another astronomical set apart that Raydium is monitoring, though plans for an NFT marketplace are probably to be not a precedence. Making improvements to the hot product offering is currently Raydium’s important aim. Alpha Ray explains:

“NFTs are mountainous stunning now, and they devise reasonably a range of folks to Solana as correctly. This forces customers to move centralized exchanges, and at that point, they strive Raydium. NFTs are key to bringing new customers to DeFi, and Solana’s lower prices could presumably carry powerful extra folks.”

The Risks for Raydium

Whereas Raydium has a promising future, there are some ability dangers. The crew has identified three key areas that will presumably negatively impression the project: safety dangers, competition, and dependency on Solana’s ecosystem relate.

In the case of safety, the crew admits that there’s a possibility that anyone could presumably exploit an unexpected vulnerability of their orderly contracts, which is why protocol safety is a first-rate precedence. Alpha Ray explains:

“Hacks and orderly contract exploits in DeFi are going on daily now. It’s stunning the nature of the alternate—something we must reach to phrases with. While you occur to’ve bought originate source code custodying hundreds and hundreds, there’ll repeatedly be anyone searching to interrupt it. Every time there’s a unusual orderly contract exploit in DeFi, we’re going reduction and reviewing our code to ascertain whether we’re at probability of the a similar assault vector.”

The crew isn’t in particular nervous about competition. They are saying it’s “segment of the game,” and whenever you occur to’re the tip project in your niche, there’s repeatedly anyone gunning to lift your dwelling. There’s hundreds of room to develop the pie for all people on Solana, so as that’s what the crew is concentrated on. The crew says its product line is the same to Sushi, nonetheless its formula to relate is closer to Uniswap. In varied words, it’s hoping to onboard as many customers to the Solana ecosystem as imaginable without demanding too powerful about competition.

The correct final grief is whether Solana succeeds in rising valid into a thriving, self-sustaining ecosystem, identical to Ethereum recently. Each project building on newer or “replacement” orderly contract blockchains faces this jam, especially when the Layer 1 protocol isn’t neatly suited with the Ethereum Virtual Machine (Solana was as soon as not EVM-neatly suited when Raydium started building on it, though alternate suggestions are rising). Alpha Ray unearths that the crew spent a prolonged time pondering which Layer 1 protocol to contrivance on. He says:

“Our finest grief at the origin was as soon as whether we made the beautiful solution to contrivance on Solana. It was as soon as undoubtedly the superior protocol from a technical viewpoint, nonetheless by the ecosystem, there was as soon as nothing powerful on it besides Serum. It was as soon as a tricky and unstable decision to present, nonetheless we made it and it now appears to be like to be fancy it ended up in our decide.”

The success of Layer 1 protocols is heavily dependent on every network and Lindy effects, which formula the bigger they develop and the longer they continue to exist, the bigger the probability that they’ll thrive. Whereas Solana’s success will not be assured, the most fresh ecosystem relate bodes correctly for Raydium’s future.

The Future for Raydium

Approaching plans on Raydium’s roadmap encompass plans for stableswap pools, which wants to be out by the ruin of August. The pools are optimized for minimal slippage, high capital efficiency, and low prices on swaps between tokens with solid trace correlations, including stablecoins fancy USDC-USDT or varied synthetics representing the a similar underlying asset fancy renBTC-wBTC.

On condition that Solana affords low transaction prices, Raydium’s stableswap pools will primarily attend customers by reduced trace slippage for huge trades the employ of stablecoins or synthetics. The aim is to present Raydium the alternate of preference for tiny and astronomical merchants alike.

After that, Raydium wants to start its developed advise routing protocol and mix Wormhole. The advise routing protocol will allow customers to seamlessly swap between all resources on Solana, in spite of the available pools. Shall we embrace, if a user wants to alternate USDT for FTT nonetheless can’t obtain a pair, Raydium will obtain the ultimate route between varied pools to facilitate the alternate at the ultimate trace for the swap.

Wormhole, in the intervening time, is a decentralized bridge allowing customers to port their resources between Solana and Ethereum. Shall we embrace, this would presumably let customers transfer Ethereum-native Uniswap tokens to Solana to attend from the protocol’s low worth and superior efficiency. Wormhole will enhance Solana’s interoperability with varied blockchains and thus enhance the natural relate of its ecosystem.

Raydium also has plans for governance. The crew promised to decentralize and roll out governance within six months, nonetheless that has proven to be an subject so a ways. Alpha Ray elaborates:

“Governance has been on our thoughts, and it’s very crucial to us, nonetheless the topic is Solana currently lacks the good infrastructure. Shall we embrace, there’s no gasless DAO balloting plan fancy Snapshot, which is considerable for governance. We desire to reduction if anybody wants to contrivance it, nonetheless if no person steps up, we’ll agree with to contrivance it ourselves.”

Raydium is an intrepid project, central to the enchancment of the Solana ecosystem. Up to now, Solana has few initiatives that will presumably be classified as “blue chips” which agree with been central to the ecosystem’s relate. From a technical point of watch, Raydium’s hybrid model of trading between advise books and liquidity pools is already noteworthy of consideration.

The exact kicker lies in its AcceleRaytor feature and in the protocol’s holistic formula to serving to initiatives develop on Solana. Raising money is infrequently ever the finest venture for crypto initiatives—gathering early customers is much tougher. Raydium’s help in sparkling the highlight on noteworthy initiatives is one of its most positive contributions to Solana’s DeFi set apart, and it could presumably help it flourish over the arriving years.