Thor Hartvigsen, a files-pushed decentralized finance (DeFi) researcher, is questioning the allure of Injective Protocol, a layer-1 platform whose creators deny is designed to expressly vitality finance.

As of December 2023, INJ, the native forex of Injective Protocol, is without doubt one of many highest-performing coins, surpassing Bitcoin (BTC) and Ethereum (ETH).

Is Injective Protocol Undervalued Primarily based On On-Chain Metrics?

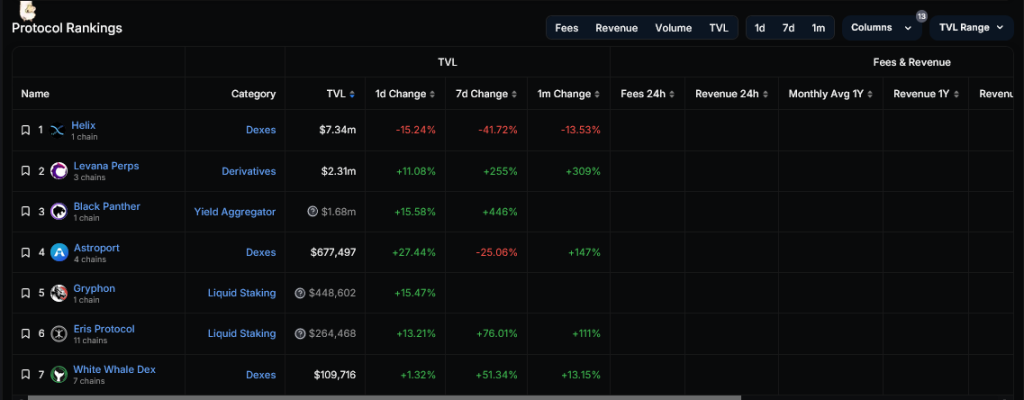

Taking to X on December 14, Hartvigsen highlighted the platform’s moderately low entire cost locked (TVL) of $11 million and the restricted series of protocols launched on the platform, currently standing at seven.

Primarily based on the researcher’s diagnosis, the splendid dapp on the layer-1, Helix Protocol, a decentralized alternate (DEX), splendid manages a daily buying and selling quantity of about $7.4 million.

Hartvigsen states here is seriously decrease than other perpetual futures protocols, in conjunction with the Perpetual Protocol. These competitors, the analyst notes, are valued at round $200 and $300 million in accordance with fully diluted valuation (FDV).

Thus some distance, having a watch at files, there are splendid seven energetic protocols on Injective, with Helix managing over 60% of the ecosystem’s TVL, reinforcing its dominance.

If on-chain process and the series of energetic protocol leads, Hartvigsen wants answers to irrefutably lisp Injective Protocol’s $3.2 billion valuation.

The researcher compares Injective with other blockchains, in conjunction with Ethereum and Solana. These platforms show moderately greater buying and selling quantity and on-chain process.

To illustrate, Hartvigsen cites DefiLlama files, which reveals that Injective’s quantity ranges from $5 to $7 million daily from seven dapps.

On the different hand, Solana, a competing layer-1, within the intervening time processes between $500 and $700 million. In the meantime, Injective Protocol can not match Ethereum, which processes over $1 billion in buying and selling quantity.

INJ Up 395%, Will Costs Continue Rising On Investor Optimism?

Fixed with Hartvigsen’s diagnosis, yiggit, a consumer claiming to be a legal counsel, defended Injective Protocol. The patron emphasized that TVL, as the researcher cited, can’t be the only real real determinant to gauge a mission’s likely.

Associated Reading: Bitcoin Deja Vu: Capital Inflows Replicate Pre-2021 Bull Speed Momentum

Yiggit added that Injective Protocol’s likely is rooted within the anticipated series of upcoming apps. Notably, the legal counsel notes that optimism moreover stems from the Injective Protocol’s origins in Cosmos. In the Cosmos ecosystem, staking tends to catalyze participation as customers belief to receive airdrops.

Silent, whether or no longer or no longer the researcher’s evaluation is authentic is dependent on time. Thus some distance, having a watch at the INJ mark action within the daily chart, the coin has been charting greater, registering original all-time highs.

To illustrate, INJ is up 395% from mid-October 2023, rallying as the broader crypto market recovers. At this valuation, CoinMarketCap files reveals that the mission has a market cap of over $2.7 billion.

Purpose portray from Canva, chart from TradingView

Disclaimer: The article is equipped for tutorial applications splendid. It does no longer signify the opinions of NewsBTC on whether or no longer to aquire, promote or preserve any investments and naturally investing carries dangers. You are urged to habits your have overview earlier than making any investment choices. Exhaust files supplied on this web page entirely at your have possibility.