Discussing when and simple techniques to promote Bitcoin will also be controversial, but whilst you’re planning to protect shut earnings this cycle, it’s vital to attain it strategically. Whereas conserving Bitcoin indefinitely is an choice for some, many investors aim to capture beneficial properties, quilt dwelling prices, or reinvest at lower prices. Historic traits demonstrate that Bitcoin most steadily experiences drawdowns of 70-80%, providing opportunities to reaccumulate at diminished valuations.

For a extra in-depth undercover agent into this topic, take a look at out a contemporary YouTube video right here: Confirmed Contrivance To Sell The Bitcoin Impress Top

Why Promoting Isn’t Consistently Taboo

Whereas some, esteem Michael Saylor, recommend by no arrangement selling Bitcoin, this stance doesn’t consistently swimsuit particular person investors. For those now not managing billions, taking partial earnings can offer flexibility and peace of tips. If Bitcoin peaks at, inform, $250,000 and faces a fairly conservative 60% correction, it would possibly possibly presumably revisit $100,000, constructing a gamble to reenter at lower stages than we’ve already viewed.

The purpose isn’t to promote the complete lot but to strategically scale out of positions, maximizing returns and managing dangers. Reaching this requires pragmatic, recordsdata-pushed choices, now not emotional reactions. However again, whilst you by no arrangement want to promote, then don’t! Pause whatever works most efficient for you.

Key Timing Instruments

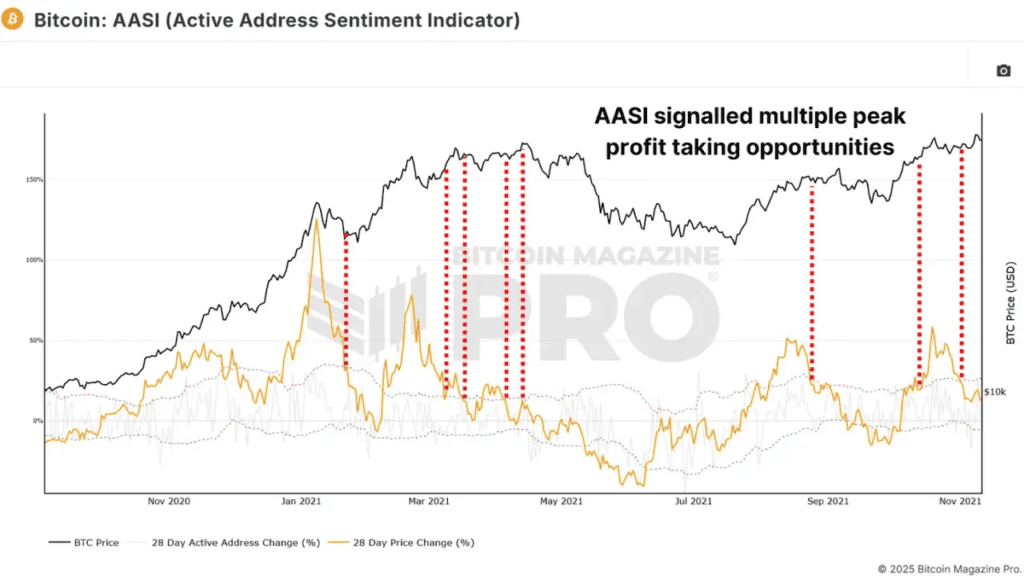

This Full of life Tackle Sentiment Indicator (AASI) compares changes in network assignment to Bitcoin’s trace motion. It measures deviations between trace (orange line) and network assignment, shown by green and crimson deviation bands.

As an illustration, at some level of the 2021 bull hotfoot, indicators emerged when the value substitute exceeded the crimson band. Sell indicators looked at $40,000, $52,000, $58,000, and $63,000. Every equipped an opportunity to scale out because the market overheated.

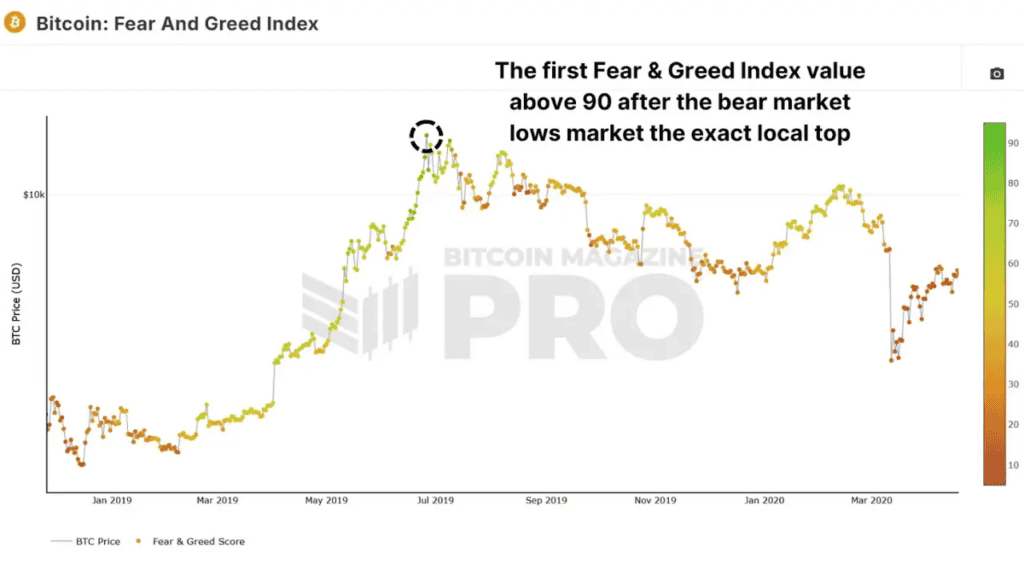

The Fear and Greed Index is a straightforward but efficient sentiment tool that quantifies market euphoria or anguish. Values above 90 counsel crude greed, most steadily previous corrections, equivalent to in 2021, when Bitcoin rallied from $3,000 to $14,000, the index hit 95, signaling a neighborhood peak.

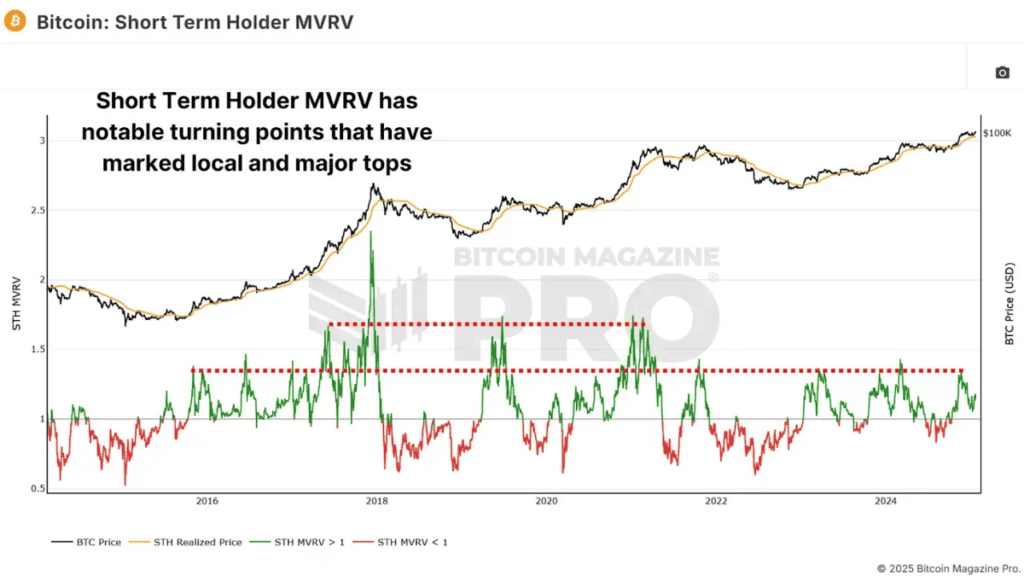

The Short-Timeframe Holder MVRV measures the frequent unrealized income or lack of unique market participants by comparing their cost basis to newest prices. Round 33% income stages most steadily trace reversals and native intracycle peaks, and when unrealized earnings exceed around 66%, markets are most steadily overheated and would possibly be shut to major cycle peaks.

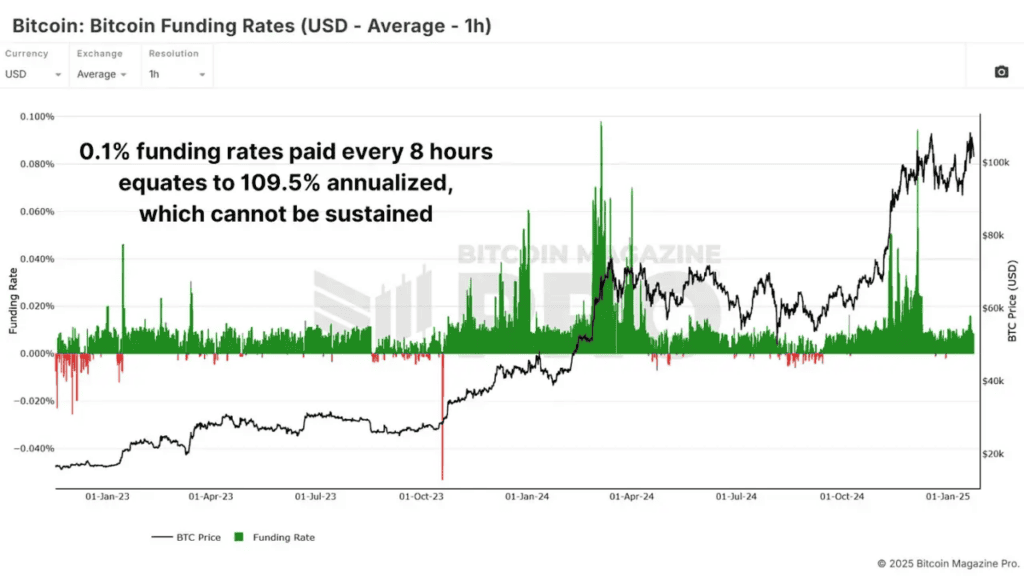

The Bitcoin Funding Rates replicate the premiums merchants pay to withhold leverage positions in futures markets. Extraordinarily excessive funding charges counsel crude bullishness, most steadily previous corrections. Cherish most metrics, we can sight that counter-shopping and selling an extraordinarily euphoric majority on the complete presents an edge.

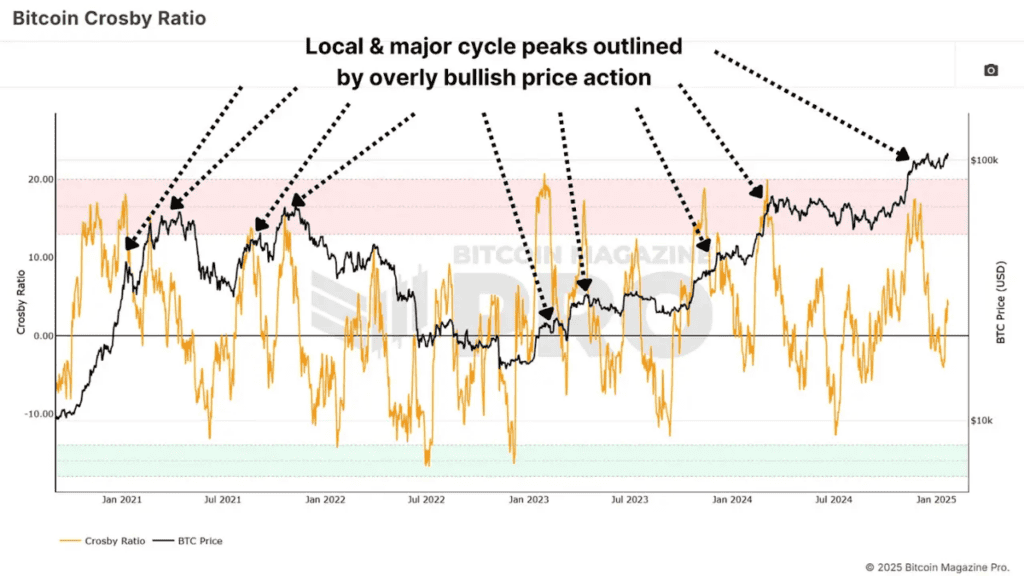

The Crosby Ratio is a momentum-primarily based mostly indicator that highlights overheated stipulations. When the ratio enters the crimson zone on the every single day chart, or even lower timeframes whilst you utilize our TradingView version of the indicator, market turning facets bear on the complete took place. When these indicators occur in confluence with other high-marking metrics, it solidifies the chance of the next-scale prediction.

Conclusion

Timing the true high is simply about impossible, and no single metric or approach is foolproof. Combine extra than one indicators for confluence and steer clear of marketing and marketing your complete location presently. As a replacement, scale out in increments as key indicators signal overheated stipulations, and protect in tips environment trailing stops tied to key stages or a share of trace motion to capture additional beneficial properties if trace rallies even higher.

For added detailed Bitcoin evaluation and to get right of entry to developed aspects esteem are dwelling charts, personalized indicator alerts, and in-depth substitute reports, take a look at out Bitcoin Journal Skilled.

Disclaimer: This article is for informational applications most efficient and is presumably now not regarded as monetary advice. Consistently attain your have study before making any funding choices.