On-chain recordsdata reveals the Ethereum netflows are sharply turning definite, a mark that would maybe perchance expose to be bearish for the crypto.

Ethereum Alternate Reserve Rises As Netflows Change into Obvious

As pointed out by an analyst in a CryptoQuant post, exchanges have seen opt up ETH inflows currently, swelling up their reserves.

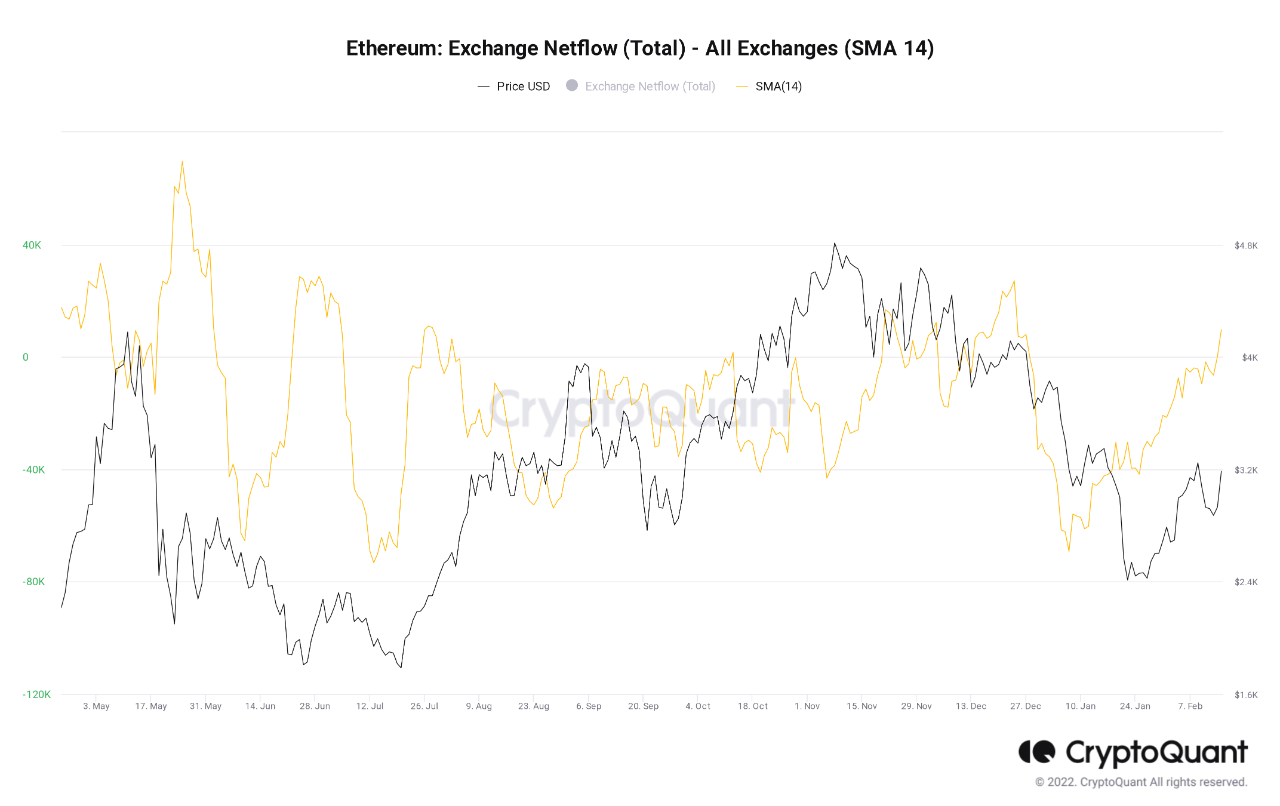

The “all exchanges netflow” is a trademark that measures the opt up amount of Ethereum shifting into or out of wallets of all exchanges. The metric’s price is calculated by taking the adaptation between the inflows and the outflows.

When the price of the indicator is definite, it formulation exchanges are getting extra inflows proper now than outflows. The sort of model will doubtless be bearish for the price of the coin as traders most regularly deposit their ETH to exchanges for selling capabilities.

On the quite loads of hand, detrimental netflow values point out that outflows are in the intervening time overwhelming the inflows. Sustained such values will doubtless be bullish for Ethereum because it’ll be a mark of accumulation.

Linked Studying | Right here Are Two Eventualities For Bitcoin A Month Prior To FED Asserting That you just will doubtless be in a snarl to think Hobby Rate Hike

Now, right here’s a chart that reveals the model in the ETH netflows over the past year:

Looks devour the indicator's price has currently risen above zero | Source: CryptoQuant

As you will be in a snarl to search in the above graph, the Ethereum netflows have sharply elevated to definite values in the past couple of weeks.

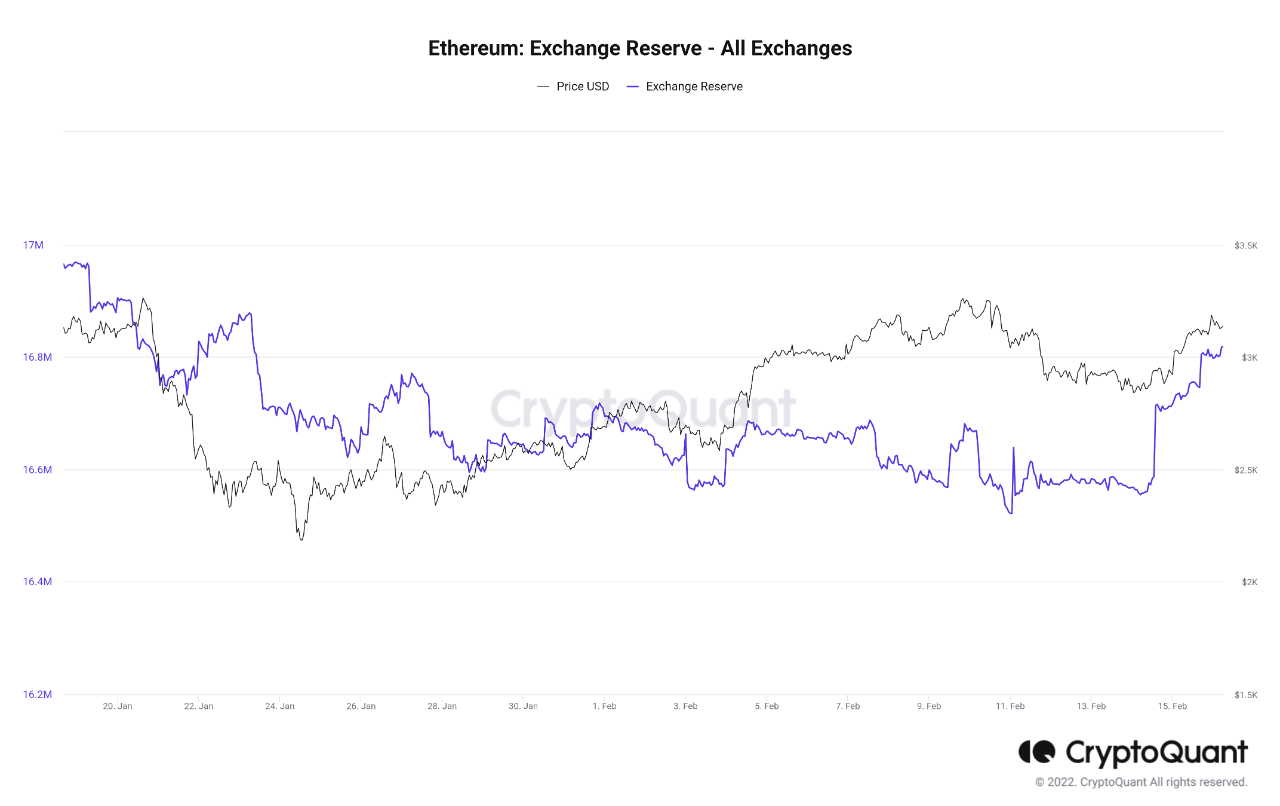

The construct of these opt up inflows will doubtless be considered thru the alternate reserve indicator, which measures the total amount of ETH sitting on exchanges. Underneath is the chart for it.

The indicator appears to be like to be to have surged up currently | Source: CryptoQuant

As the graph reveals, the Ethereum alternate reserve has sharply elevated in price in the past week. Which is anticipated, as the netflows were definite currently.

Linked Studying | Bitcoin Choice Traders Seem Uncertain At Entering Directional Trades

The alternate reserve is mostly known as the “sell offer” of the crypto. If the model continues and the reserve retains on going up, the terminate to term outlook will doubtless be bearish for the price of the coin.

ETH Tag

On the time of writing, Ethereum’s heed floats around $3k, down 6% in the final seven days. All around the final month, the coin has parted with 8% in price.

The under chart reveals the model in the price of the crypto over the final five days.

The cost of ETH appears to be like to be to have dipped down over the past twenty-four hours | Source: ETHUSD on TradingView

Ethereum’s heed had surged as much as almost $3.2k a couple of days serve, but has since attain serve down a bit to the current ranges. For the time being, it’s unclear when the coin would maybe demonstrate additional restoration.

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com